With the COVID spending spree on PCs at an end and consumers spooked by inflation and a worsening economy, Intel’s profit and revenue plunged in the second quarter, the chipmaker said Thursday.

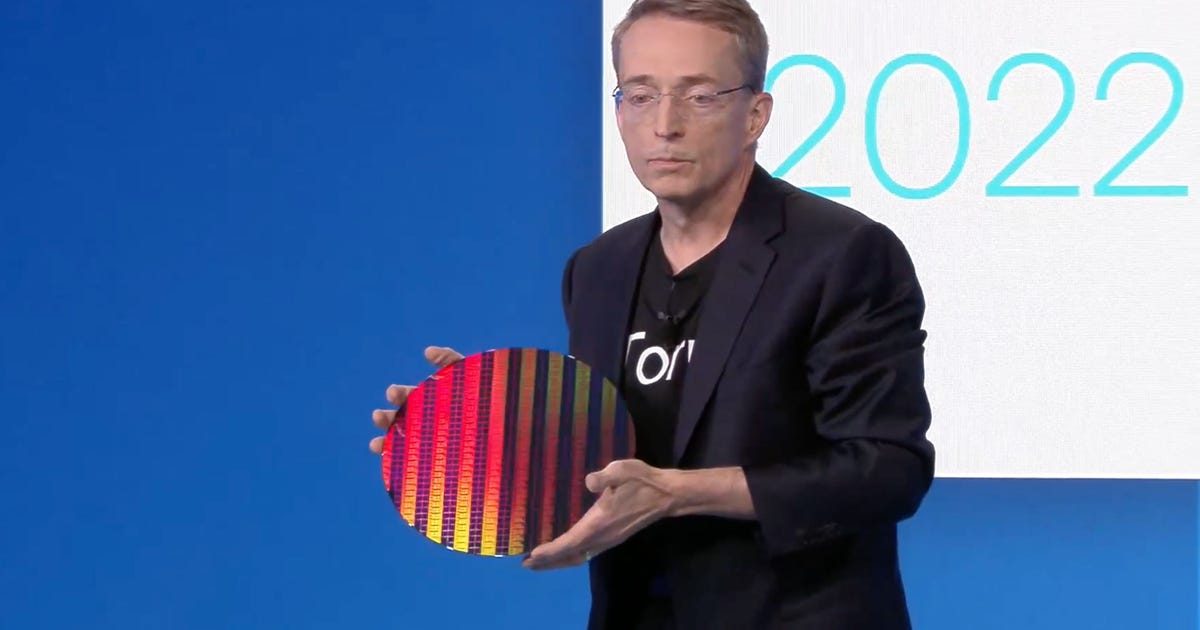

Intel’s own problems, like quality issues with the chips that fill tech giants’ data centers, also were a major factor. The problems led Chief Executive Pat Gelsinger to issue an apology for the company’s poor showing, and the chipmaker saw an 8% drop in its share price in after-hours trading.

“This quarter’s results were below the standards we have set for the company and our shareholders,” Gelsinger said in a statement. “We must and will do better.”

The results show how hard a time Intel will have clawing its way back to the cutting edge of chip manufacturing and leading the US semiconductor industry to reclaim clout lost to Asia. Intel’s near-term problems pose real risks to long-term plans.

Revenue dropped 17% to $15.3 billion in the second quarter, and Intel’s profit of 29 cents per share, excluding some charges like stock-based pay and inventory write-downs, was a 76% decrease compared with the year earlier. Both results were well below Intel’s own forecasts and analyst expectations. Including those charges, Intel posted a loss of $454 million.

It could have been a happier day for Intel. Congress approved the CHIPS and Science Act on Thursday, which will provide $52.7 billion in subsidies to chipmakers if President Joe Biden signs it, as expected. That’ll lower the cost of a new chip fabrication plant, or fab, to $7 billion instead of $10 billion. Those investments are key to Gelsigner’s turnaround plan to catch up to chipmaking rivals in 2024 then reclaim its manufacturing lead in 2025.

But that turnaround looks a long way away. Today’s problems include a sudden drop in spending on PCs as worries about inflation and the economy combined with Intel’s losses to rivals like AMD in data center sales.

Revenue from Intel’s PC business dropped 25% to $7.3 billion. Its data center unit’s revenue dropped 16% to $4.6 billion. But Chief Financial Officer Dave Zinsner said the second and third quarters are “the financial bottom for the company.”

Intel expects a grim third quarter, too. As a result, the company lowered its expectations for full-year revenue to a range of $65 billion to $68 billion, well down from its earlier guidance of $76 billion. In response, it’s pruning its capital expenditures by $4 billion for the year, now down to $23 billion.

When he took over as CEO in 2021, Gelsinger promised clear-eyed assessments of the company’s successes and failures, and on a conference call with analysts, he detailed some failures.

Among the problems: Quality problems forced Intel to revise its new Sapphire Rapids server chip, delaying shipments; its new graphics chips were hampered by Intel’s immature software; and it’s losing share in the server market. “It’s not the facts we like, but it’s what we see,” Gelsinger said.

He and Zinsner encouraged analysts and shareholders to keep Intel’s long-term recovery plan in mind, saying the company is in a growth industry and has weathered economic downturns before and has now laid a foundation for a long-term turnaround. Upgraded manufacturing processes remain on schedule or ahead of schedule.

“We remain firmly on track to achieve process parity in 2024 and superiority in 2025,” Gelsinger said.

That effort to improve manufacturing dovetails with support for the CHIPS Act in Congress and the White House. Allies — including Intel, which lobbied hard for the bill — see it as an effort to restore US semiconductor industry strength. Two other companies lead today’s cutting-edge processors, Taiwan Semiconductor Manufacturing Co. (TSMC) in Taiwan and Samsung in South Korea. Intel hopes the CHIPS Act will help increase the US share of chipmaking from today’s 12% to an eventual 30%.

The company expects its prospects to improve in the fourth quarter. That’s when PC makers likely will increase chip purchases and new products like the Raptor Lake PC chip will go on sale. That processor will arrive in the fall for desktop PCs and toward the end of the year for laptops, Gelsinger said, and improve performance more than 10% compared with the current Alder Lake chips.

He’s got some convincing to do.

Intel’s “long term targets remain outlandish,” Bernstein analyst Stacy Rasgon said in a research note earlier this week, which downgraded his expectations for the chipmaker’s prospects. “Frankly, anyone owning the stock is not there for the near term … but rather strapping into a 5+ year nebulous story that is just barely getting started.”