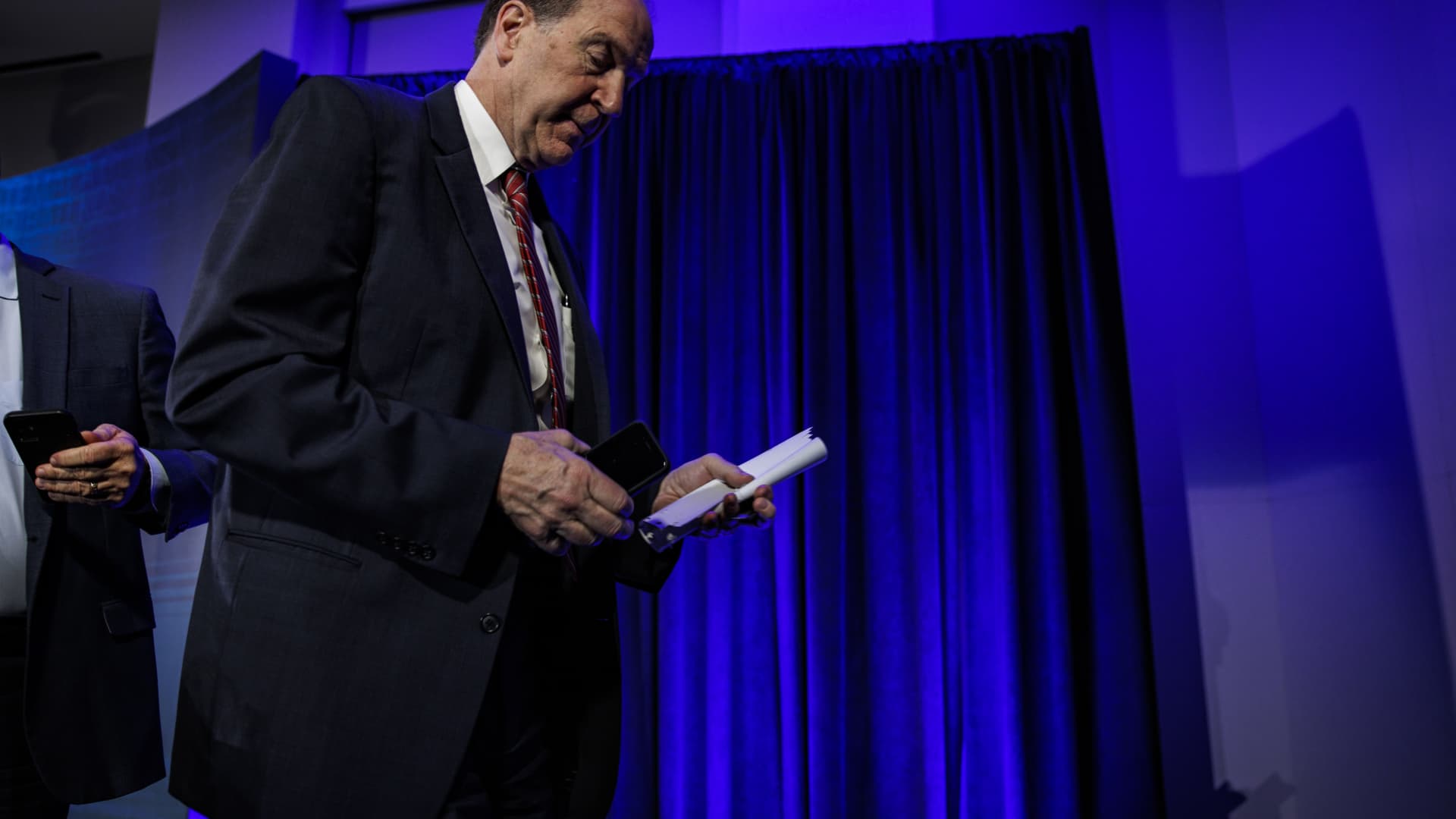

David Malpass, president of the World Bank Group in Washington, DC, on April 13, 2023

Bloomberg | Bloomberg | Getty Images

Developed economies across the world are facing a debt problem, and that’s piling onto other headaches in the global economy as central banks continue to grapple with persistent inflation, according to World Bank President David Malpass.

Speaking to CNBC’s Martin Soong at the G-7 finance ministers and central bank governors’ meeting in Japan, Malpass emphasized that record-high global debt levels need to be addressed for stability.

“The debt-to-GDP ratios for the advanced economies are higher than ever before,” he said, adding that developing countries are also facing a similar issue. “That means the economy has to work that much harder just to pay back money that’s already been borrowed.”

The World Bank has emphasized the need for transparency in addressing rising debt in the face of a number of global economic issues, including stress in the banking sector and sticky inflation.

The organization last month chaired the Global Sovereign Debt Roundtable in Washington D.C. and highlighted its call for information sharing to speed up the process of debt restructuring in the world.

In its year-end report released in December, the World Bank said the total external debt of low- and middle-income countries increased by 5.6% in nominal terms to $9 trillion.

For all countries, the International Institute of Finance estimated earlier this year that the nominal value of global debt ticked lower from 2020 levels, standing below $300 trillion in 2022.

“One of the things for the advanced economies is to try to find as stable as an environment so that growth can come back that’s really important for the world at this point,” Malpass told CNBC.

“The risk-less rate has gone up from the advanced economies, but the credit spreads have widened for developing countries as well,” he said.

The risk-free rate of return indicates the interest rate an investor can expect to earn on an investment that carries zero risk.

“They[investors] are always going to choose the safest advanced economies first, so what’s left over is what can flow into the developing countries, and it’s simply not enough,” Malpass said, adding that less-developed economies face a “double whammy of increased debt burden costs and not the opportunity to roll it over.”

When asked about his plans after he steps down in June — earlier than April 2024 when his term expires — he said that he’s “exploring options.”

“We’ve been so busy at the bank with things that are really important — this debt, the growth initiative, we’re in our final quarter of our fiscal year,” he said.