[ad_1]

Airbnb is an excellent investment platform, and conducting a proper Airbnb property analysis will help you find profitable properties.

Even though Airbnb properties can be lucrative, buying a property without proper analysis is a sure way to lose money. Therefore, it will be wise for you to investigate any Airbnb you want to invest in.

Table of Contents

- Find a Good City

- Study the Local and State Rules for Airbnb

- Find a Good Neighborhood

- Find the Best Airbnb Investment Property

- Find Airbnb Rental Comps in the Neighborhood

- Calculate Your Expenses

- Calculate Potential Revenue

- Note Your Profit/Loss

- Get Professional Advice

- Use a Real Estate Investment Tool

- What’s the Best Tool for an Accurate Airbnb Property Analysis?

You must do your due diligence when buying an Airbnb property. There are many properties you can invest in, but not all of them are profitable. If you decide to buy an Airbnb property based on its aesthetics and without proper research and analysis, you’re gambling your money away.

In this article, you will discover how to conduct a proper Airbnb property analysis to find out if your investment will be profitable or not. You will also learn how Mashvisor’s real estate tools will help you properly analyze your Airbnb property.

Below are the 10 steps you should take for a proper Airbnb property analysis.

1. Find a Good City

Your first and most crucial step in performing an Airbnb property analysis is to find a good city to invest in. Some cities are attractive to tourists, making them good places to invest in. Also, people prefer to live in certain cities with favorable tax laws or good climates.

Whichever city you choose, ensure there is enough traffic to guarantee that your Airbnb occupancy rate stays up all year. Also, be sure that the city you choose offers all the necessary amenities that make life comfortable. For instance, there should be adequate transportation, amenities, and retail and recreation centers.

You may want to find a city wherein the rent is a bit higher than normal, but the tenants are willing to pay. It will be the sweet spot for you as a real estate investor. If you can find a city with all the requirements above, you will have no problem charging higher than usual. You’ll also have no problems finding tenants. People will happily pay for good accommodation and comfort.

2. Study the Local and State Rules for Airbnb

Different cities and states impose various regulations for short-term rentals. Studying the local and state rules and regulations should be a significant part of an Airbnb property analysis. Go through the laws in the ideal city you want to invest in and get familiar with them so that you don’t get into trouble with the law.

Some cities strictly regulate short-term rentals, while some ban such types of investments outright. Therefore, before you decide to invest in a city, meet with the officials in that city and ask about their rules concerning Airbnb short-term rentals. Your best bet will be to find a city whose regulations favor Airbnb rental properties.

3. Find a Good Neighborhood

After deciding on the city you want to invest in, and you realize that their rules are favorable to short-term investment properties, your next step is to find a good neighborhood. Neighborhoods differ; you can make more money in one neighborhood than you would in another.

What makes for a good neighborhood? A good neighborhood is one with good transportation, reputable schools, and complete amenities. It also attracts tourists all year round. During your Airbnb property analysis, you will come across neighborhoods with some of the said traits. Your job is to find one with all or a good number of them.

One other important thing to note is that the majority of your renters will be tourists. Therefore, they will be looking for a place with amenities like parks, tourist centers, and maybe beaches, depending on the location. Keep them in mind when looking for a good neighborhood.

4. Find the Best Airbnb Investment Property

Now that you’ve gotten the first three steps out of the way, your next step in the Airbnb property analysis process is to find the best property. While the neighborhood is good and the city favors short-term rentals, you must find a profitable property if you want to remain in business.

There are many ways to do it. You can do the legwork yourself by looking at each Airbnb property individually, calculating the cap rate, cash on cash return, and other important data. You can even use a realtor and rely on their judgment. But there is only one sure way to ensure that you pick the best Airbnb property in the neighborhood―Mashvisor’s Property Finder!

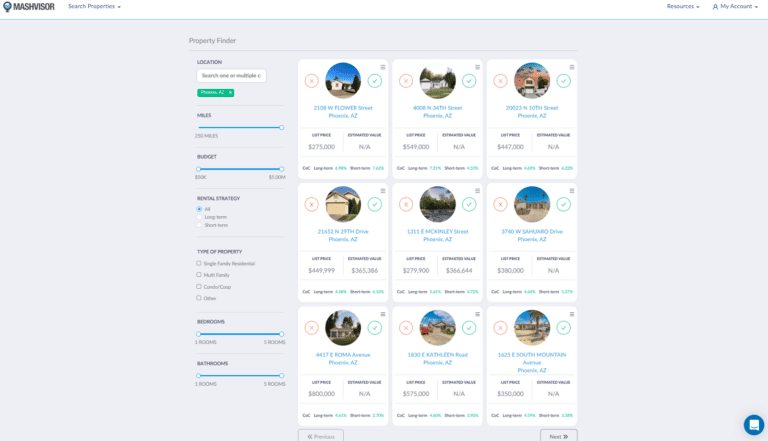

Mashvisor’s Property Finder tool is a great tool for this particular reason. It uses artificial intelligence (AI) to help with proper real estate investing by helping investors identify the best properties. All you need to do is enter the city you want to invest in and other criteria, and the tool will help you find the best Airbnb available.

Related: How Is Mashvisor’s Property Finder Helping Real Estate Investors?

5. Find Airbnb Rental Comps in the Neighborhood

After finding a good Airbnb property, your next step is to compare the property to similar properties in the neighborhood. Use Mashvisor’s neighborhood analytics page to locate similar Airbnb properties.

The reason you’re doing this is to see how much income your Airbnb property will bring in based on how much other rental comps are earning. If there are three similar properties like yours in the neighborhood, and they bring in a certain amount monthly, the chances are yours will bring in an average of those numbers.

Next, make the necessary adjustments based on the numbers you got from the rental comps. Then, in your Airbnb property analysis process, you can figure out how much your Airbnb property will bring in every month.

6. Calculate Your Expenses

If you realize that your monthly rental income is high, hold your excitement because there’s another important metric you need to consider. Some costs come with owning a real estate investment, and you must figure out how much this Airbnb property will cost you every month.

Even though you find a great property that costs little to buy and generates enough rental income, ensure that the costs of running the property do not exceed your income. Else, you are not an investor but a non-profit organization.

Some of the costs that come with owning an Airbnb property include taxes, insurance, utilities, furnishing fees, inspections, and repairs. Your Airbnb property analysis should cover this step extensively, as costs can creep in and eat into your income.

Related: How to Estimate Rental Income on Short Term Rentals Using Mashvisor

7. Calculate Potential Revenue

The next step in your Airbnb property analysis process is to calculate how much the property will bring in monthly.

It is the main reason why you are investing in real estate, and it would be a waste if you ended up with a cash-guzzling property and little income. Therefore, ensure that you know how much the property will put into your pocket as profits.

Mashvisor can help you with this. During the process of finding the ideal property using Mashvisor, you will see how much a property brings in. You will also be able to locate Airbnb’s daily rate. It removes all the guesswork from your search for the most lucrative Airbnb property.

8. Note Your Profit/Loss

Once you’ve calculated your expenses and income on your Airbnb property, you will be able to see if you will make a profit on the property or not. And as soon as you notice that you will not make any profits from this property, dump it and continue your Airbnb property analysis on another property.

But if it turns out that you will make a killing on this Airbnb property, there are two more simple steps you must take, which are formalities.

9. Get Professional Advice

Yes, you just found out from your Airbnb property analysis that you will make a pretty nice sum every month. Don’t pull the trigger just yet. Get some professional advice to take a last look at the property and its numbers.

You will need professionals like tax attorneys who will look at your taxes and inspectors who will let you know if the Airbnb property is still in top shape, as you saw online. Professionals can help you avoid unnecessary headaches later down the line.

If the professionals give you the go-ahead, then you can pull the trigger and make an offer on the Airbnb property.

10. Use a Real Estate Investment Tool

The steps discussed above are crucial when conducting an Airbnb property analysis. But they can be cumbersome and overwhelming for some real estate investors. That’s why it is advisable to use a good real estate investment tool like Mashvisor to reduce the load and make the process of finding a good Airbnb easier.

It can be difficult to conduct the Airbnb analysis and do the calculations on your own. Mashvisor provides tools that can help you accurately perform the required calculations in 15 minutes. It includes helping you find the best Airbnb property.

All you need to do is plug in the city you want and enter your chosen criteria, and Mashvisor will show you great Airbnb properties you can invest in.

Related: Mashvisor Reviews: What Do Investors Think of This Real Estate Platform?

What’s the Best Tool for an Accurate Airbnb Property Analysis?

To conduct an accurate Airbnb property analysis, you need a combination of tools, and Mashvisor provides the tools that will help you reduce your analysis time to minutes. Some of the tools Mashvisor offers Airbnb investors include:

Property Finder

We covered the Property Finder tool in a previous section. The tool helps you find the best-performing Airbnb in a city. All you need to do is put in your criteria and your investment goal, like how much you would like to earn monthly, and the Property Finder tool will do the rest.

The tool uses AI technology to bring the best Airbnb property based on your needs. It will save you the time and energy of looking for the properties yourself.

Mashvisor’s Property Finder tool can help you find the best-performing Airbnb properties in a particular city based on your chosen criteria.

Neighborhood Analytics

Mashvisor’s neighborhood analytics tool helps you locate the best neighborhoods within a city to invest in. It also provides an in-depth analysis of the neighborhoods, so you know what you are getting into.

The neighborhood analytics page provides information like the cash on cash return of the neighborhood, its average cap rate, occupancy rate, and the average return on investment (ROI) on the properties in the neighborhood.

The information helps you know if the neighborhood is worth investing in or not.

Heatmap

If you would like to know how each area of a market is performing, Mashvisor’s heatmap tool is your friend. The heatmap helps you locate the areas of the market that are performing well and those that are performing poorly.

The information is shown to you through the use of a color-coded overlay.

Rental Property Analytics

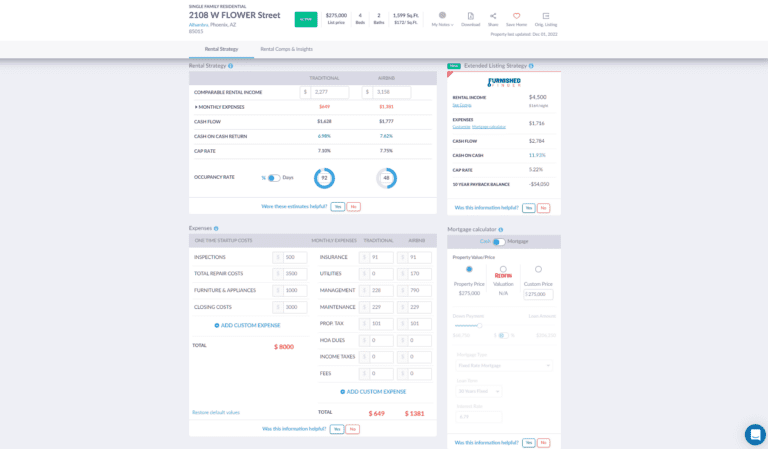

Rental property analytics is a tool that helps investors know the projected numbers of any Airbnb property. With the rental property analytics, each property has its page that shows the investor everything they need to know about it to make an informed buying decision.

The tool also comes with different Airbnb calculators, such as the rental strategy calculator, mortgage calculator, and expenses calculator. They help the investor know their numbers before committing.

With Mashvisor’s Rental Property Analytics tool, you can use different calculators to arrive at different projections.

Rental Comps and Reports

One of the steps discussed concerning Airbnb property analysis is that you should find rental comps in the neighborhood. Mashvisor lets you compare Airbnb properties with ease to find the one that you want.

It shows you the numbers of the different properties in the neighborhood you are looking to invest in. This way, you will know how well your Airbnb will do as compared to other similar Airbnbs in the same neighborhood.

Ready to use Mashvisor for your Airbnb property analysis? Sign up for a 7-day free trial now.

Conclusion

Airbnb property analysis is important if you plan on making any money. With the 10 steps discussed above, you will have no problem making a profit with your Airbnb property. You can choose to perform this analysis yourself, or you can rely on a good Airbnb analysis tool like Mashvisor.

Mashvisor comes with the tools mentioned above that will help you as an investor find profitable properties that will be easy to manage and that will put more money in your pockets.

To learn more about Mashvisor’s tools, schedule a demo today.

[ad_2]