To understand why many people get into real estate investing, you must first answer, “what is real estate investing, and how does it work?”

Table of Contents

- What Is Real Estate Investing?

- How Does a Real Estate Investor Make Money?

Real estate investing has become one of the more popular ways that people build wealth. Those looking to expand and diversify their portfolios know that investing in real estate is one of the best ways to do so. Though it comes with certain risks, real estate investing can be quite rewarding, especially when you do it right.

Often, people end up in a bad spot because of bad decisions. Some might have been a little overeager with the prospect of earning a lot without doing their homework first. Others could have ended up incurring losses due to negligence.

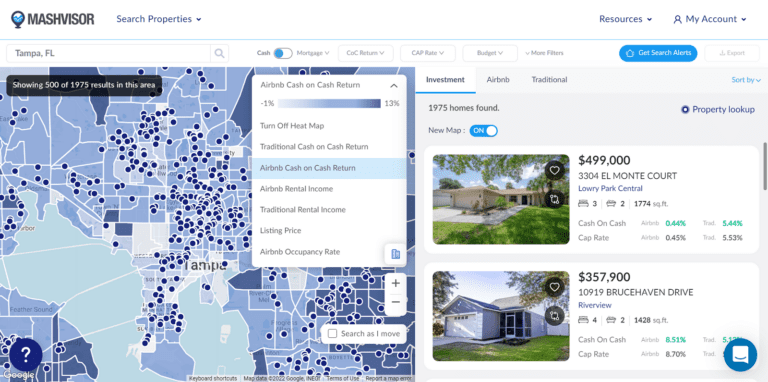

The truth is, you won’t achieve success in real estate investing out of pure luck. You need to put in the work if you want to get the best possible investing experience. To increase your chances of success, you need to have the right real estate investing tools like Mashvisor to spot the most profitable investment properties in any market.

In this article, we will talk about what real estate investing is and address some of your typical concerns about investing. We hope to enlighten you on how real estate investing is one of the safest and soundest investments you can make when done right.

Let’s get started.

What Is Real Estate Investing?

There are a lot of misconceptions surrounding real estate investing. The biggest one is that you need to have plenty of money to make an investment. That’s not true at all since there are alternative ways of getting into real estate investing. However, if you want to get a good return on investment and a decent profit to take to the bank, yes, a larger capital might be needed.

Real estate investing simply refers to the purchase of real estate properties as a means to generate additional income instead of using them as a primary residence. It can be any land, building, infrastructure, or any other tangible asset that is mostly immovable but transferable.

Real estate is classified into the following:

- Residential

- Commercial

- Industrial

- Mixed-Use Properties

- Retail Spaces

- Fix-and-Flip Properties

- Land

Among all of them, most investors prefer to go into residential real estate and fix-and-flips. It is easier to make money off them since there will always be a demand for housing.

Investors can earn from real estate in several ways. A house flipper, for instance, buys undervalued properties and rehabilitates them to sell at a profit.

Related: Flipping Houses for Beginners: What You Need to Know Before Starting

Rental property owners, on the other hand, create a passive income source with their monthly rental income. The amount will depend on the rental strategy, though. Traditional rentals provide landlords with a fixed but smaller income compared to vacation rental owners, who make up to three times as much depending on the season.

How much you make from real estate investing largely depends on your chosen investment strategy.

What Is the Point of Real Estate Investing?

So what is really the point of investing in real estate? Why do people seem to go gaga over real estate investment opportunities?

The main goal of investing in real estate, or any type of investment, is to make money. We’re not just talking about a return on investment but also profit and a positive cash flow through passive income. Thus, investing in real estate is a good way to protect your assets and make them grow.

To understand the point of getting into real estate investing, let’s take a look at some of its advantages and disadvantages. Knowing both will make you appreciate it more as a whole and see why people are lining up to buy properties even in a pandemic.

Is Real Estate Investing Worth It?

To answer the previous section, investing in real estate is justified when you are aware of the rewards (as well as the risks) involved. The advantages will make you see what you’re missing out on, while the drawbacks make you aware of what you could potentially face if things go sideways.

Advantages of Investing in Real Estate

On the other hand, real estate investing can be very rewarding when done right. Here are some of the advantages of getting into real estate investing:

Recurring Income

As a real estate investor, you have the potential to create an additional recurring income source, especially if you get into rental property investing. According to the real estate website Mashvisor’s August 2022 location report, the median monthly rental income for traditional and Airbnb rentals (state-level) is $1,813 (Utah) and $3,232 (Kansas), respectively.

Rental property investing is one of the most popular forms of real estate investing mainly because of the passive income it provides rental property owners. If you pick a property in a market where the cash on cash return and cap rate are above 2%, you’re already in a pretty good position.

Most rental property investors take a look at both cap rate and cash on cash return as their main indicators of a property’s profitability. The cap rate basically just takes the property’s net operating income (NOI) and divides it by the property’s purchase price or market value. The metric assumes that the buyer purchases the property in an all-cash transaction.

Cash on cash return, on the other hand, takes into account financing by dividing the NOI by the total amount of cash initially invested.

The two metrics are important for anyone who plans to invest in rental properties for sale.

Property Appreciation

One great advantage of owning real estate investment property is that it will inevitably increase in value over time. Those who are in the buy-and-hold business get the most out of property’s appreciation.

Since the year started until August, there has been a significant increase in property values. If we look at the state-level data from Mashvisor’s January 2022 report, the median property value nationwide was only $387,167. Today, based on the company’s August 2022 report, the median property price is already $$413,371.

Imagine buying a property and holding onto it for a few years and then selling it. You’ll probably get nearly half of what you initially spent on it in profit by that time.

Tax Benefits

One of the other top reasons investors get into real estate is the tax advantages it provides. Real estate investments offer several ways to lower your taxable net income.

Among the more common deductions on rental properties include leasing fees, maintenance and repairs, and property management fees. You can also deduct mortgage interest, property taxes and insurance, and owner expenses related to the operation of the rental property.

Leverage Other People’s Money

Leverage is a simple real estate investment method that lets you borrow money to purchase a real estate investment property. Since most people cannot afford an all-cash transaction, they leverage other people’s money instead to buy real estate properties.

For instance, instead of purchasing a property worth $250,000, you may use that amount as a down payment for other cash-flow rental properties.

When you leverage other people’s money, you get 100% control over the property with a small down payment.

Portfolio Diversification

Perhaps the most common answer many people give you when you ask the question, “why real estate investing” is this. A lot of investors believe that diversification is a sound investment strategy.

Diversification is simply not putting all of your eggs in one basket. It is wise for an investor not to put all of his or her money in one particular asset type in case the economy goes sideways. This is why a lot of investors spread their money over different assets like stocks, bonds, mutual funds, precious metals, and other asset classes.

Real estate provides you with another investment type that is not (or very lowly) correlated with the stock market. When the price swings are wild in the stock market, your real estate investment is slowly and steadily increasing in value in a far less volatile environment.

Inflation Hedge

Since real estate is not correlated with the volatility of the economic market, it gives you better protection against inflation. Why? Because, as inflation causes every commodity to increase in price, it also causes property values and rental rates to go up as well.

If you own a real estate property and decide to sell, its appreciation will get you far more than the amount you initially invested in it. If you own a rental property, you can increase your rental rates accordingly (and within reason) to allow you to pass through higher operating costs caused by inflation.

Whether you decide to leverage, do a fix-and-flip, go into alternative real estate investing, or take the wholesale route, investing in real estate still brings far greater rewards than you can imagine.

Disadvantages of Investing in Real Estate

Here are some of the risks involved in real estate investing:

Larger Capital

It is general knowledge that a real estate property is one of the most (if not the most) expensive purchases you will ever make in your lifetime. While it is generally true, it is not entirely accurate as there are other non-capital-intensive ways of investing in real estate.

Other alternative investment avenues are available for those who want to get started in real estate investing.

Related: How to Start Investing in Real Estate With $500

More Time Consuming

Whether you wholesale or manage a rental property, it will take up a lot of your time if you want to succeed in real estate investing. What usually happens is people get into it and think that once they purchase a property, they’ll start making money right off the bat.

It doesn’t work that way. What separates a successful investor from a struggling one is the amount of time and effort given to the venture. Rental property owners put in a lot of time and effort in managing their property and making sure it is in good habitable condition. The same goes for house flippers who take time to make sure the home improvements are done right.

Investing in real estate isn’t about sitting on your laurels and waiting for the next payout. You must be actively involved in it to succeed.

Not Liquid

One of the bigger disadvantages of owning investment properties is that while they are tangible assets, they are not liquid. It will take some time to sell a house. How fast you make a sale will depend on the market and season you’re in.

During peak seasons, you can probably sell fast and get more than your asking price if you get a good number of interested buyers. However, lean seasons are tougher for sellers. Buyers aren’t as many, and lots of sellers are forced to go below their asking prices just to make a sale.

Liability Risks

And then there’s the risk of being sued by tenants, guests, or contractors that get involved in an accident on your property. To protect yourself from liability risks, you must purchase a landlord insurance policy and require your tenants to buy their own renter’s insurance policy.

How Does a Real Estate Investor Make Money?

The typical follow-up to the question “what is real estate investing” is usually this. When people already know what real estate investing has to offer, the next thing they want to know is how to make money from it.

Generally, an investor can make money off a real estate investment with any of the following:

- Appreciation

- Rental Income

- Related Commission

- Real Estate Investment Trusts

Let’s discuss each quickly.

Appreciation

As we already mentioned earlier, real estate properties tend to increase in market value as the years go by. An investor who buys real estate, regardless of investment strategy, is bound to end up with a property of higher value compared to how much they initially put into it.

However, while real estate has no correlation with the stock market and is spared from its volatility, there are instances when home prices may go down unexpectedly.

Rental Income

Another great way of earning well in real estate is by investing in rental properties. There will always be a demand for rental properties as not everyone can afford homeownership, especially at this time. Prospective homebuyers are pushed to the rental space instead.

The savvy investor knows to take advantage of such a situation and looks for income properties to rent out as traditional rentals. This is a win-win situation in that a tenant’s need for housing is met and the landlord gets to earn a reasonable monthly income.

When it comes to vacation rentals, you will find that the demand for short-term rentals is also increasing, especially in a post-pandemic economy. While the monthly income varies, vacation rentals have the potential to generate up to three times what you would earn from a long-term rental.

Investing With Mashvisor

Your success as a real estate investor lies in finding the right rental property. Fortunately, a website like Mashvisor exists.

Mashvisor is a real estate website that gives its users access to valuable data on almost every real estate market in the US. Its massive database is regularly updated so you can come up with the most accurate and realistic investment property analysis.

The platform offers one of the best property search tools in the industry today. The site is easy to navigate and very user-friendly. Tens of thousands of investors have found lucrative investment deals with Mashvisor’s help.

To learn more about how Mashvisor can help you find profitable investment properties, schedule a demo.

As a real estate investor, a website like Mashvisor can help you find the right investment property using its massive database of properties located across the US.

Related Commission

Commissions typically apply to real estate brokers and agents, as well as management companies. They earn a certain amount of money from real estate transactions by getting a percentage of the total amount involved.

If you’re in the wholesale or microflipping business, it may also be synonymous with how you make money. Wholesalers act as middlemen between buyers and sellers. They purchase contracts from buyers and assign them to potential sellers at a small profit.

Microflippers, on the other hand, look for distressed properties online to sell quickly at a slightly higher price. A lot of times, they just go online to find buyers for certain properties and do what wholesalers do.

Either way, they earn by selling properties at a slightly higher price than the buyer is asking for. The spread or the price difference serves as their commission for helping make the sale happen.

Real Estate Investment Trusts (REITs)

Real estate investment trusts, or REITs, are an alternative way of investing in real estate without owning physical property.

REITs are companies that own and operate income-generating real estate properties. They include commercial buildings, apartment complexes, shopping centers, hospitals, warehouses, and other similar income-producing properties.

Historically, REITs have delivered very competitive returns, making them one of the more popular real estate investment alternatives today.

Related: Direct Real Estate Investment vs REITs

Wrapping It Up

We hope that we’ve answered the question, “what is real estate investing and how does it work” with this article. The important thing you should remember is that real estate investing needs to be approached with plenty of thought and careful planning. Due diligence and a hands-on approach are required if you want to succeed.

A real estate website like Mashvisor makes investing in real estate a lot easier. Finding the best possible deals in the most profitable real estate market is one of Mashvisor’s specialties. Countless investors can attest to this. If you’re looking for the right investment property that aligns with your investment needs, give Mashvisor a try.

To get access to our real estate investment tools, click here to sign up for a 7-day free trial of Mashvisor today, followed by 15% off for life.