Conducting a real estate market analysis using the best competitive market analysis software is crucial to your success as an investor.

Table of Contents

- Why Is Competitive Market Analysis in Real Estate So Difficult to Do?

- What Is the Best Competitive Market Analysis Software for Real Estate?

- How to Do a Competitive Market Analysis in Real Estate With Mashvisor?

Real estate competitive market analysis is a way to estimate the value of your house by comparing it to similar houses in the same neighborhood. Brokers and investors use various competitive market analysis software to gather data about a home they want to buy.

If you’re looking to buy a home, performing competitive market analysis on that home and its neighborhood is a must. When you do it, you will be able to accurately estimate how much the home is worth. It ensures that you are not being taken advantage of and are paying a fair price for your home.

Competitive market analysis looks at how old the property is, its square footage, the number of bedrooms and bathrooms, plus other special features. It also shows you how the real estate market in that area is performing at the moment. At the end of this article, you will discover how to use Mashvisor’s competitive market analysis software when trying to buy a home.

Why Is Competitive Market Analysis in Real Estate So Difficult to Do?

It can be difficult to perform adequate real estate analysis if you do not use good competitive market analysis software. It can be much more difficult if you perform the competitive analysis yourself or through a broker, without the help of software. Here are some challenges investors can face when doing a competitive market analysis without tools:

Limited Data

One of the challenges you will face performing a real estate market analysis without good software is access to limited data. Imagine walking to a stranger’s home and asking them how much they bought their houses or how much their rent is. They’ll probably turn you away.

The point is, you won’t get many answers. And the ones who manage to lend you their ears will probably leave out some important details about the neighborhood or market. Now, imagine someone opens their door and thinks they don’t want you as a neighbor. They can feed you false information about the market to deter you from buying a home in that neighborhood.

Time Factor

Timing is critical in real estate investing. If you are not fast enough, someone else might snatch up a property that you are contemplating buying. It is why you must use a reliable tool that does all your competitive market analysis in a fraction of the time.

If you are pressed for time, doing a competitive market analysis without software can be futile. And by the time you’re done, someone else would have bought the house. Then, you will have to do the same thing all over again with another house and maybe in another neighborhood. That’s tedious.

Lack of Funding

Do you have the money to go from door to door asking questions about their houses? If you do, then by all means, go ahead. But if you don’t, invest in good software to reduce your competitive research time to minutes.

What will it say about you as an investor if you spend money going from house to house in a neighborhood asking questions? It shows you are not very prudent with your money. Maybe real estate investing is not the best for you.

As a smart real estate investor, you know the place of tools and systems to get the best out of any opportunity. You understand that systems can perform the job better and faster than you, which is why it is best to use a tool or software that will accurately perform a competitive market analysis on your property.

Related: What Is Driving for Dollars in Real Estate?

Overestimating or Underestimating the Value of the Home

As humans, we are all subject to emotional and cognitive biases. It is why it is strongly possible that you may overestimate or underestimate the fair market price for a house you want to invest in.

Don’t get me wrong, in all competitive analyses, there should be room for adjustments. Imagine going through a property online and you see that the property includes only four rooms. The listed price on the property works for four rooms.

Now, you visit the property physically and realize that the property also comes with an attic, an office, and a basement, you may be so excited that you overestimate how much the property is worth. And if the owner of the house asks for a much higher price, you will be willing to pay.

What Is the Best Competitive Market Analysis Software for Real Estate?

The best competitive market analysis software for real estate is Mashvisor. With its range of tools and features, you can be sure to get the best analysis of any property. Mashvisor is the best software for competitive market analysis in real estate because it provides tools like the Property Finder, heatmap, and real estate analytics to help you make the best investment decision.

Property Finder

Mashvisor’s Property Finder tool can help you find investment properties in minutes. The tool helps you to locate any property that matches your search criteria. Just enter the necessary information on the search page and voila, you are shown your potential dream house.

The Property Finder will also show you vital information about the property like its price, the average monthly income, and the availability of the property. The tool will save you a lot of time by using artificial intelligence (AI) to find the property that best suits your needs. Also, you can search for your dream home in many cities at once.

With the Property Finder, you can search for homes based on location, budget, type of property, rent strategy, and the number of bedrooms and bathrooms.

Heatmap

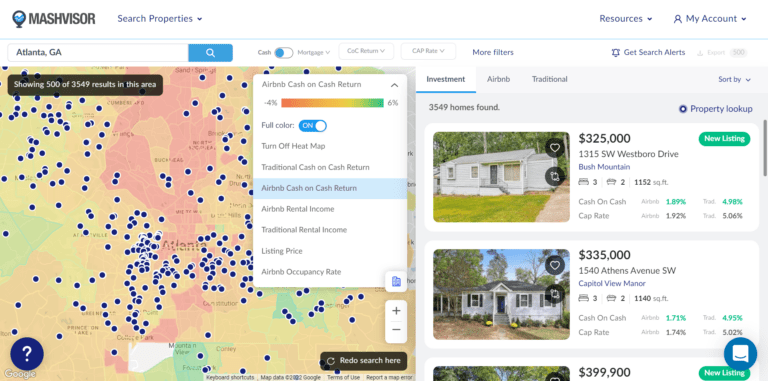

The heatmap feature of Mashvisor is one of the things that makes it the best real estate tool for performing competitive market analysis. The tool lets you easily locate the best neighborhoods to invest in.

You can filter your search based on the price of the property, traditional and Airbnb rental income, traditional and Airbnb cash on cash return, and also, the occupancy rate of the property.

Related: What Is a Good Cash on Cash Return?

Mashvisor’s heatmap tool allows investors to easily locate the best neighborhoods to invest in, based on metrics such as listing price, rental income, cash on cash return, and occupancy rate.

Property Analytics

Mashvisor does not only help you locate great properties, but it also provides you with valuable information about the property you are about to invest in. Mashvisor uses its AI tools to estimate how much income your investment property will provide. You will know how much you will earn from your investment before buying the property.

The metrics that will be analyzed are estimated rental income, cash on cash return, cap rate, expenses, occupancy rate, and rental comps. Don’t be confused; the neighborhood might look good to invest in but not all the properties in that neighborhood are good investments. Property analytics will help you pick good properties.

To learn more about how Mashvisor can help you profitable investment properties, schedule a demo today.

How to Do a Competitive Market Analysis in Real Estate With Mashvisor?

Now that you‘ve discovered the best competitive market analysis software in real estate, you should know how to perform a competitive analysis. Below are five steps to help you perform competitive market analysis like a pro. This way, you will always wind up getting the most lucrative houses in a neighborhood.

1. Know the Neighborhood

Location is a critical aspect of any real estate investment. If you find yourself with a property in a less-than-desirable neighborhood, you may lose a lot of money. Ensure that you perform a neighborhood analysis before you decide on where to invest.

The neighborhood should have amenities that make it attractive to high-value renters. For instance, how good are the schools in the area? What are the crime statistics like in the neighborhood?

All you need to do is visit Mashvisor’s neighborhood analytics page. There, you will be shown information about the neighborhood you are looking to invest in. The analytics page will give you information like the average prices of homes in the neighborhood, cap rate, rental income, and cash on cash return, and occupancy rate.

2. Gather Information About the Property

If you are satisfied with the neighborhood, it’s time to find a property. To get the best property, you will need information like the price of the house, the square footage, the number of bedrooms and bathrooms, and even the age of the property.

The point is to know as much as you can about the property so that you don’t end up regretting your decision. When you have the necessary information above, it will be easier to compare the property with other properties within the same neighborhood.

You can obtain all the necessary information about a property on Mashvisor’s property analytics page. All you need to do is to enter the city you want on Mashvisor’s home page, click on start analyzing, then find the property you want.

3. Perform Competitive Analysis

Once you’ve obtained the information you need about a particular property, you will want to compare that property to other similar properties in the same neighborhood. When you do this, you will get information on the average price and average rental income of the property, among other important data.

Select around three to five recently sold properties that are similar to your property. If you want to look at more properties, that’s even better.

This step is the most important step when performing market analysis on your property. Note that these properties should be similar to your property in the number of bedrooms, bathrooms, and square footage.

Related: Rental Comps: What Are They and Where Can I Find Them

4. Estimate the Market Value

After performing the competitive market analysis above, you will be able to get the estimated market value for your property. Does it fall within your budget? If so, you can go ahead to the last step. If not, you may want to start the process all over.

To know the estimated market value, you will need all the information you’ve gathered in the previous three steps above using Mashvisor’s software. The data will help you accurately determine how much your property is worth.

5. Visit the Property in Person

This is your final step. It is not mandatory but you are advised to do it. This is because some properties might have undergone some renovation from the time they were listed, and those changes might not have been updated in the listings.

Also, by visiting the property in person and accessing not only the property itself but it’s the neighborhood, you will get a real-life feel of how the area is.

If it turns out that there are some issues with the property that were not listed, you can adjust the competitive market analysis to arrive at a new and more accurate estimate.

Final Thoughts: Competitive Market Analysis

Performing a competitive market analysis can be the best thing you do to guarantee success as a real estate investor. That’s why it is highly recommended that you invest in good software that will help you pick the best property in the market. In such a way, you boost your chances of being profitable.

In this article, we’ve looked at what competitive market analysis is, why it is so difficult to do and what the best competitive market analysis software is for investors. You’ve also been shown the step-by-step guide to ensure you do a great job.

Mashvisor is an excellent resource for competitive market analysis because it uses AI to help you find a profitable property in a desirable neighborhood.

Therefore, to guarantee a profitable investment, use Mashvisor to conduct your competitive market analysis. It provides you with the best resources for gathering real estate data, analyzing neighborhoods and individual properties, and coming up with an accurate estimate of the property.

Click here to sign up for a 7-day free trial of Mashvisor today, followed by 15% off for life.