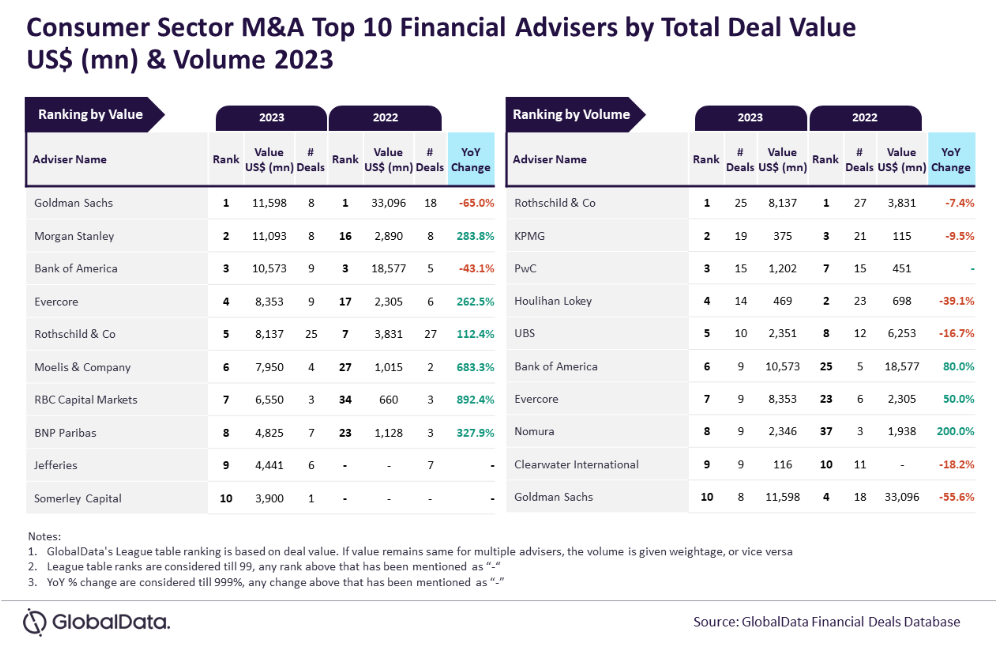

Goldman Sachs and Rothschild & Co. were the top M&A financial advisers in the consumer sector in 2023, analysis of deal data suggests.

According to the deals database of GlobalData, Just Food’s parent, Goldman Sachs topped the charts when measuring the value of deals, while Rothschild advised on the most transactions.

Aurojyoti Bose, lead analyst at GlobalData, said: “Interestingly, both Goldman Sachs and Rothschild & Co. were also the top advisers by value and volume, respectively, in 2022 and despite registering a decline, they managed to retain their leadership positions in 2023 as well.

“Apart from leading by value in 2023, Goldman Sachs also occupied the 10th position by volume. Similarly, Rothschild & Co., apart from leading by volume, also featured in the top ten list by value, occupying the fifth position.”

Looking at the value of deals, Morgan Stanley occupied the second position in terms of value, by advising on $11.1bn worth of consumer deals, followed by Bank of America with $10.6bn, Evercore with $8.4bn and Rothschild & Co. with $8.1bn.

KPMG was second when looking at the volume of transactions, followed by PwC, Houlihan Lokey and UBS.

Access the most comprehensive Company Profiles

on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Company Profile – free

sample

Your download email will arrive shortly

We are confident about the

unique

quality of our Company Profiles. However, we want you to make the most

beneficial

decision for your business, so we offer a free sample that you can download by

submitting the below form

By GlobalData

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.

Interviews with M&A bankers: Cautious optimism oozes around food M&A outlook in 2024 as risks fester