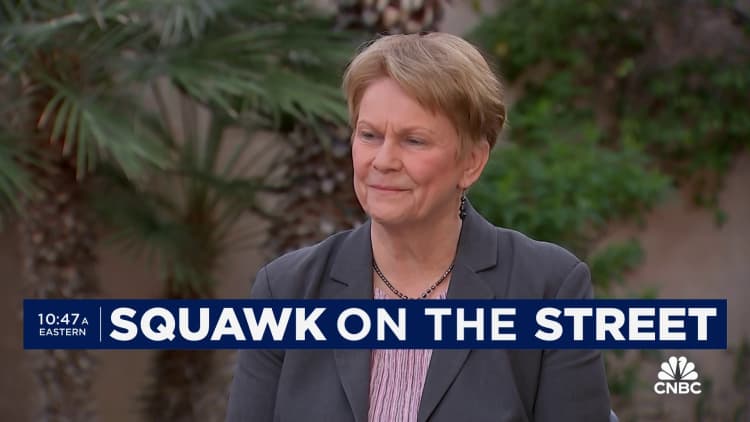

Occidental CEO Vicki Hollub speaks at the panel dicscussion during the Abu Dhabi International Petroleum Exhibition and Conference held at ADNEC Exhibition Center on October 2, 2023.

Ryan Lim | Afp | Getty Images

The oil market will face a supply shortage by the end of 2025 as the world fails to replace current crude reserves fast enough, Occidental CEO Vicki Hollub told CNBC Monday.

About 97% of the oil produced today was discovered in the 20th century, she said. The world has replaced less than 50% of the crude produced over the last decade, Hollub added.

“We’re in a situation now where in a couple of years’ time we’re going to be very short on supply,” she told CNBC’s Tyler Mathisen at the Smead Investor Oasis Conference in Phoenix, Arizona.

For now, the market is oversupplied, which has held oil prices down despite the current conflict in the Middle East, Hollub said. The U.S., Brazil, Canada and Guyana have pumped record amounts of oil as demand slows amid a faltering economy in China.

But the supply-and-demand outlook will flip by the end of 2025, Hollub said.

“The market is out of balance right now, but again, this is a short-term demand issue,” Hollub said. “But it’s going to be a long-term supply issue,” she said.

OPEC is forecasting global oil demand will grow by 1.8 million barrels per day in 2025 on a solid economy in China, outstripping crude production growth of 1.3 million barrels per day outside OPEC. The forecast implies a supply deficit unless OPEC ditches current production cuts and boosts its own output.

West Texas Intermediate and Brent futures finished out 2023 more than 10% lower as record production in the U.S. and a weakening economy in China weighed on prices.

U.S. crude and the global benchmark are up roughly 2% so far this year with WTI last trading at $72.82 a barrel and Brent trading at $77.89 a barrel.

Hollub told CNBC in December that Occidental expects WTI to average around $80 in 2024.