The decision to buy rental property in 2020 is an easy one to make. Want to enjoy positive cash flow, appreciation, and possibly even passive income? Invest in rental properties. It’s the best way to invest in real estate in 2020.

But once you jump into the rental property search and buying process, you’ll soon find that making the call to become a real estate investor was the easiest part. Now you’ll have to choose among hundreds of rental properties for sale. Well, I’m here to tell you this doesn’t have to be the hard part. With these 5 real estate investment tools, you can stop wondering how to buy a rental property and start running your own real estate business in no time:

- The Heatmap Analysis Tool

- The Rental Property Finder

- The Mashvisor Property Marketplace

- Mashboard

- The Rental Property Calculator

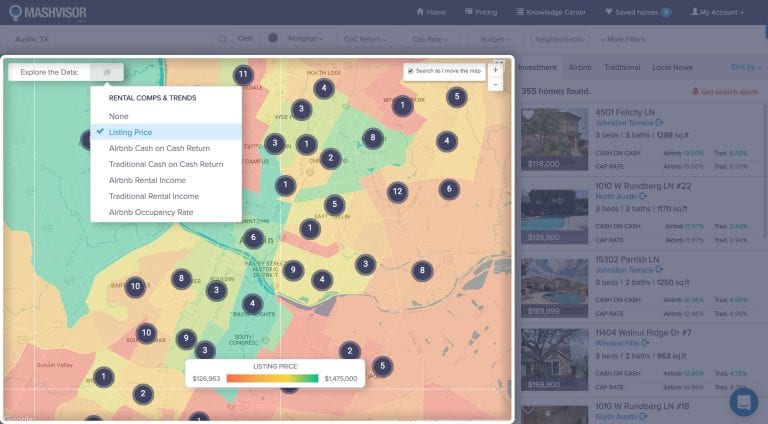

Tool #1: The Heatmap Analysis Tool

The most challenging part of buying rental property is just figuring out where to begin your search. You want to try to make a purchase in the best places to buy a rental property. And to make things even more challenging, you can’t just choose a city, you have to find a great neighborhood. So maybe you’ve checked out a few lists of the best cities to invest in real estate and you know you want to invest in the Austin housing market. The next step is to use the Heatmap Analysis Tool to identify profitable neighborhoods.

Mashvisor’s Heatmap Analysis Tool helps you conduct a neighborhood analysis:

If you type in Austin, TX in the real estate search engine, you’ll be shown all the neighborhoods in the city as well as all the investment properties for sale. To activate the Heatmap, you click the “Explore Data” button and select one of the following filters:

- Listing Price

- Airbnb Cash on Cash Return

- Traditional Cash on Cash Return

- Airbnb Rental Income

- Traditional Rental Income

- Airbnb Occupancy Rate

That’s when the magic happens. Every neighborhood will be assigned a color based on real estate data. So, for instance, if you’re looking to buy rental property in the price range of $100,000 to $200,000, you’d start your search in the neighborhoods marked in red or orange as pictured above. To ensure you don’t just buy rental property that is affordable but also one that is profitable, you’ll want to set the other filters as well, one by one. This will help you narrow your property search down to one neighborhood and answer the question of where to buy rental property in minutes.

Try Mashvisor’s Heatmap Analysis Tool Now.

Learn More: Real Estate Heatmap: A Revolutionary Tool for Neighborhood Analysis

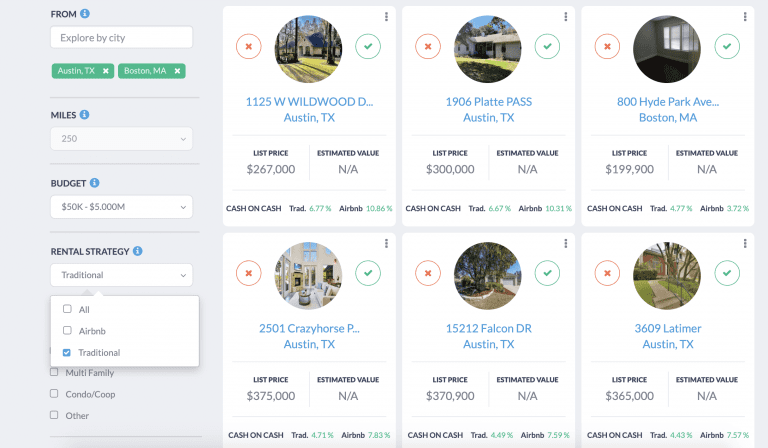

Tool #2: The Rental Property Finder

What if you can’t decide on a city? You can’t let this slow you down or stop you from buying a rental property. Even if you do have a city in mind, you might still want to fast-track the investment property search and be instantly shown the top-performing rental property in the location of your choice. For this, you can use the Rental Property Finder.

The Rental Property Finder allows you to search for the best rental properties in different cities at the same time. Here’s how to find rental properties using this tool:

First, type in the cities where you may want to buy rental property. Perhaps you aren’t sure which is the best place to buy rental property: the Austin real estate market or the Boston real estate market. Once you enter in these cities, you can set a few more filters to narrow down your search:

- Miles (This only works when you’re searching in one city)

- Budget

- Rental Strategy (Do you want to buy a Traditional or Airbnb rental property?)

- Type of Investment Property (Single-family, multi-family home, condo/coop, other)

- Number of Bedrooms/Bathrooms

Instantly, the Rental Property Finder’s powerful AI will show you a list of high cap rate rental properties for sale. And you’ll easily be able to spot which city has the best rental property for sale. If you wanted to buy a traditional rental property, it seems that the Austin real estate market would be the winner. Take a look:

The Rental Property Finder is one of the best property search tools for investors thanks to its ability to quickly show you the rental properties with the highest return on investment across the US housing market. It will help ensure you buy rental property that will make you money.

Try Mashvisor’s Rental Property Finder Now.

You Might Also Enjoy Reading: How to Find Property with a 20% Return on Investment

Tool #3: The Mashvisor Property Marketplace

Perhaps you want to get started in real estate investing with cheap investment properties for sale– foreclosures, short sales, bank owned homes, or auction homes. Buying this type of investment property can be a challenge, but finding them doesn’t have to be. Simply start your search in the Mashvisor Property Marketplace. Here, real estate investors can find a large supply of off market properties that are in one stage or another of the foreclosure process.

The best part is that you will get a quick real estate investment analysis for each off market property. You’ll get to see the potential cash on cash return of each property. That way, you can figure out if any of the investment properties for sale will make you money if rented out to tenants. And you’ll get both the traditional cash on cash return and the Airbnb cash on cash return to help you decide which rental strategy is best when buying investment property. There’s no easier way to buy rental property of this kind!

Visit the Mashvisor Property Marketplace Now.

Tool #4: Mashboard

While foreclosed homes can make for a good real estate investment, some property investors are looking for a different kind of off market rental property. Some of the best real estate deals are those where the homeowner has yet to list the home for sale. Successful real estate investors have long been implementing marketing strategies where they identify who owns a property and how likely this person is to sell. They figure out what the right number is and make an offer.

Of course, the challenging part of finding these real estate deals is getting property owner data and information. This is why you’ll only find more experienced real estate investors enjoying these opportunities in the housing market. But with Mashboard, you can actually carry out this strategy even if you’re buying your first rental property! Here’s how to find out who owns a house using this tool:

- Visit Mashboard

- Click Add Owner List

- Set the Property Owner Search Filters:

- Address

- City

- State

- Property Type

- Year Built

- Sales Date

- Contact Data (addresses, emails, and phone numbers)

- Download the Property Owner Data Report

The great thing about Mashboard is you can find out who owns a property even without an address. If you want to find off market investment property in the Austin real estate market, you can simply set the city and state and the contact data that you wish to receive. You’ll then be notified when your list of property owners is ready! You can also use the platform’s CRM to get in touch with owners directly and start negotiating for off market deals.

Visit Mashboard and Get Property Owner Information Today.

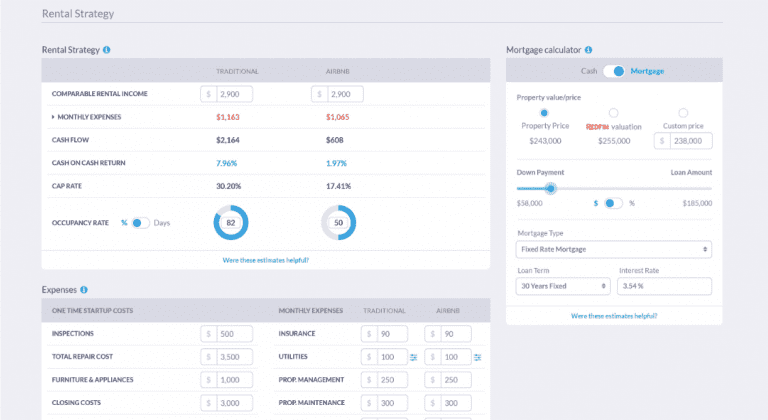

Tool #5: The Rental Property Calculator

The last real estate investment tool that will help you buy rental property is the Rental Property Calculator. This tool is actually accessible from all of the other tools on this list and that’s because it is the most necessary. If you want to buy rental property with a good return on investment, then you need a way to perform a quick and accurate rental property analysis. And this is exactly what the Rental Property Calculator does. For any rental property for sale that you click on from the Heatmap, Rental Property Finder, Property Marketplace, or even an address that you enter into the platform from data taken from the Mashboard, you can get a full rental property analysis that includes:

- Rental Income

- Rental Property Expense Estimates

- Cash Flow

- Built-In Mortgage Calculator

- Rate of Return on Rental Property (Cap Rate and Cash on Cash Return)

- Occupancy Rate

- Rental Strategy Comparison (Airbnb vs Traditional)

- Real Estate Investment Payback Balance

- Real Estate Comps

All of this property data will be precalculated. For instance, if you want to know the future rental property cash flow, you no longer have to add up expenses, figure out how much to charge for rent, and then do the math. It’s all there in front of you.

And it’s also an interactive real estate tool. Any changes you make to rental property expenses or on the mortgage calculator will be reflected in the cap rate and cash on cash return.

Related: Buying a Rental Property Calculator? Read This

What makes Mashvisor’s Rental Property Calculator unique is that it can be used if you’re buying off market real estate, traditional real estate, or even if you’re buying Airbnb property. You get all the rental property data you need in one place thanks to the traditional and Airbnb analytics available.

Get Access to All of These Tools and Buy Rental Property With Ease

If you’re going to buy rental property in 2020, do it the right way. Make decisions backed by market data and AI using only the best real estate investment tools available to you. Get access to these tools by signing up for a 7-day free trial now.