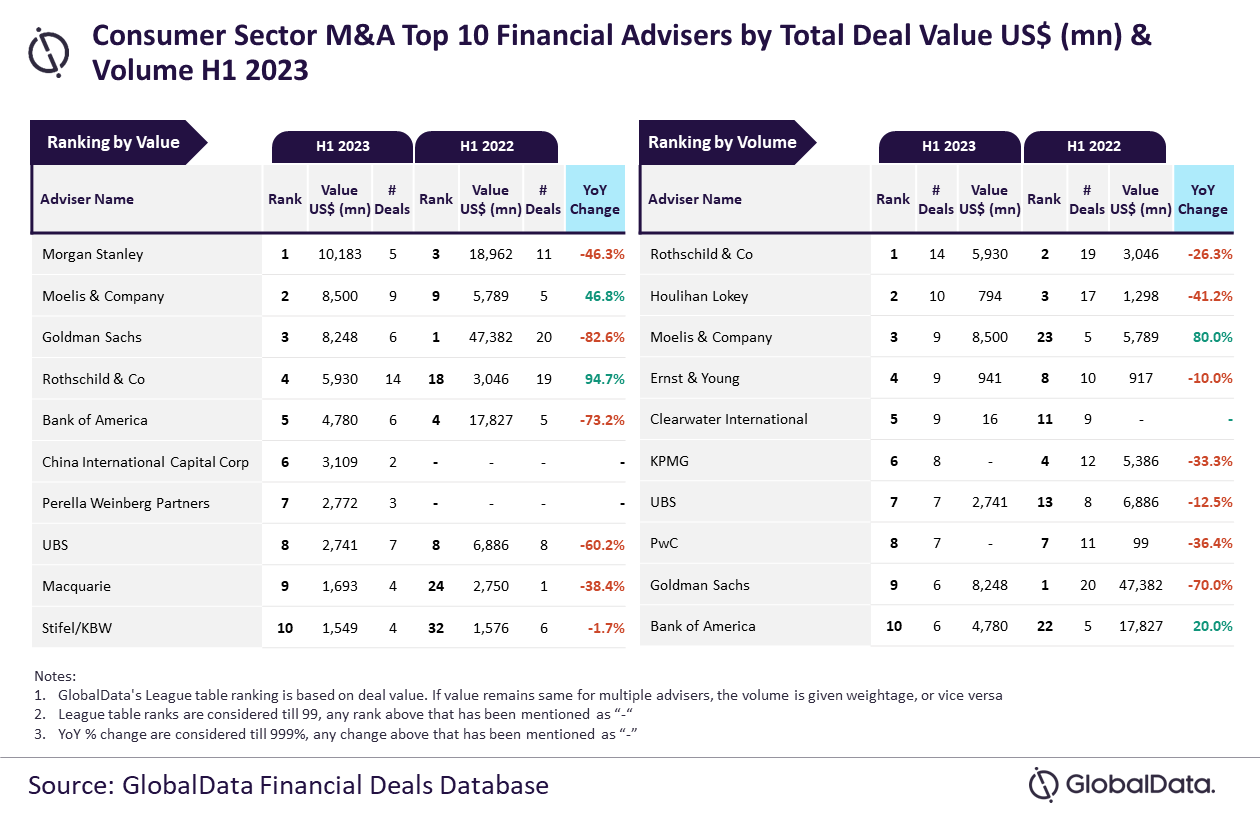

Morgan Stanley and Rothschild & Co. were the top M&A financial advisers in the consumer sector in the opening six months of 2023, analysis of deal data suggests.

According to GlobalData, Just Food’s parent, Morgan Stanley topped the charts when measuring the value of deals, while Rothschild advised on the most transactions.

Aurojyoti Bose, lead analyst at GlobalData, said: “Morgan Stanley achieved the leading position by value and was the only firm to touch the $10bn mark in total deal value in H1 2023. It also improved its ranking by value from third position in H1 2022.”

He added: “Similarly, Rothschild & Co., which led by volume, went ahead from occupying the second position by volume in H1 2022 to top the chart in H1 2023. Moreover, it also occupied the fourth position by value.”

Looking at the value of deals, US-based Moelis & Co. jumped from ninth a year ago to second in the first half of the year. The bank was third by number of transactions, advising on nine deals worth $8.5bn.

Goldman Sachs was third by deal value, followed by Rothschild & Co. and Bank of America.

Houlihan Lokey was second when looking at the volume of transactions, with EY fourth.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.