Cristiano Amon, president and CEO of Qualcomm, speaks during the Milken Institute Global Conference on May 2, 2022, in Beverly Hills, Calif.

Patrick T. Fallon | AFP | Getty Images

Qualcomm reported second-quarter earnings on Wednesday that were in line with analyst expectations but saw sales from handset chips, a core business for the company, decline 17% on an annual basis.

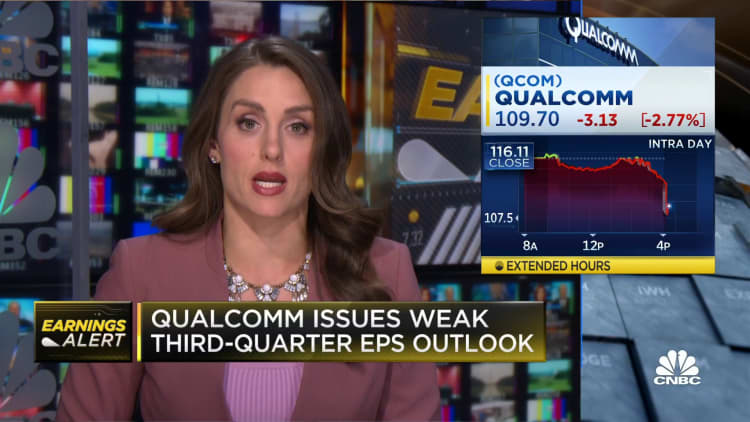

Qualcomm shares fell over 2% in extended trading.

Here’s how the chipmaker did versus Refinitiv consensus estimates:

- EPS: $2.15 per share, adjusted, versus expectations of $2.15 per share

- Revenue: $9.27 billion, versus expectations of $9.1 billion

In the quarter ending in March, Qualcomm said net income fell 42% to $1.70 billion, or $1.52 per share, from $2.93 billion, or $2.57 per share, a year ago.

Qualcomm said it expected around $8.5 billion in sales in the current quarter, short of Wall Street expectations of $9.14 billion. Analysts were expecting current-quarter earnings guidance of $2.16 per share, but Qualcomm said it expected it that to be around $1.80.

Qualcomm CEO Cristiano Amon in a statement blamed the results on a challenging environment, and the company said it had not seen evidence that smartphone sales are recovering in China. The smartphone market is looking at a tough 2023, with shipments for the global market declining over 14% in the first quarter, according to IDC.

“The evolving macroeconomic backdrop has resulted in further demand deterioration, particularly in handsets, at a magnitude greater than we previously forecasted,” Qualcomm CEO Cristiano Amon said on a call with analysts.

Qualcomm’s chip segment, called QCT, sells smartphone processors, automotive chips, and other parts for advanced electronics. It declined 17% to $7.94 billion in revenue during the quarter.

The biggest part of QCT’s sales come from handset chips, which are the processors at the heart of most Android phones. Qualcomm reported $6.11 billion in handset sales, down 17% from last year.

Qualcomm said it expected a larger-than-normal decline in the third-quarter for QTL revenue, saying that it was related to “the timing of purchases by a modem-only handset customer.” Qualcomm rarely discusses its business with Apple, and didn’t name the company, but Apple does purchase modems from the company for its iPhones and other devices.

Qualcomm’s automotive business, which includes chips and software for cars, is still small, although it showed 20% growth during the quarter to $447 million in revenue. It’s reported as part of QTL.

Qualcomm’s licensing segment, QTL, which sells access to technologies needed for cellular service, reported an 18% annual decrease in revenue to $1.29 billion.

Qualcomm said it made $900 million in share repurchases and paid $800 million in dividends during the quarter.