A good way to succeed in real estate investing is to find affordable investment properties and rent them out as long or short term rentals.

Of course, other investment strategies could make you equally successful, like fix-and-flips or REITs. But the continuing and growing demand for rental properties makes it one of the safest routes to get a good return on investment and make a decent profit.

Table of Contents

- Is It Good to Invest in Real Estate Properties in 2023?

- Find Affordable Investment Properties Using This Tool

- 10 Cities With the Most Affordable Investment Properties

Investing in rental properties is a route taken by countless investors who wish to have a passive income source and generate a good monthly cash flow. However, just because rental properties make for good investment vehicles does not mean that you can invest in the first property for sale that you see. There’s more to it than that.

One, you need to make sure that the location is good for the investment strategy you have in mind. Two, you need to find affordable investment properties to optimize their income-generating potential. And three, you need to have the right information and tools to ensure you make the best possible investment decisions.

In this article, we hope to show you how to spot those deals with the help of Mashvisor. Using its tools like the Market Finder and its massive database that covers nearly every US real estate market, you will find great deals in the top investment locations in the country.

Let’s get started.

Is It Good to Invest in Real Estate Properties in 2023?

Investing in real estate properties has been one of the surefire ways to build equity and wealth. It was an arena where the wealthy used to play in. We say “used to” because now, even if you don’t have millions of dollars in the bank, you can invest in real estate and be relatively successful.

Technology has leveled the playing field and allowed regular folks like us to get a piece of the real estate investing action. But why should you go into it? Why should you invest in real estate, especially in 2023? Is it wise to buy an investment property at this time, given the current global economic conditions?

Let’s take a look at some of the ups and downs of investing in real estate today.

Related: How to Find Profitable Rental Investment Properties for Sale

The Upsides of Investing in Real Estate Properties

Real estate investing can be very financially rewarding if you do it right. This is the main reason a lot of people get into it. And while each investor has their own goals and motivations, universally, there are certain benefits to investing in real estate.

Today’s Market Conditions Are Ideal for Real Estate Investing

One of the reasons why you should invest in real estate now is that the current market conditions are generally good for investing in this industry.

“Why?”, You may ask. Isn’t now a bad time to invest, especially with the unstable economy?

On the contrary, there are several variables why getting into real estate investment now makes sense.

First, property prices are expected to rise in the next few years. Prices are much lower in 2023 by about 5.5%. This means that properties are 5.5% more affordable now compared to the previous year. This mainly has to do with real estate markets cooling down and sellers lowering their prices.

Second, we currently have lower interest rates compared to 2022. While it is not at all-time lows like they were during the pandemic, mortgage rates have gone down in the past few months.

At the time of writing, Bankrate shows that the mortgage rate for a 30-year fixed-rate mortgage is 7.00%, down by 5 basis points from the previous week. The average for a 30-year fixed refinance is 6.97% which went down by 12 basis points from last week.

Third, there is still a high demand for rental properties across the country, which we’ll discuss next.

There Is a Growing Demand for Rental Properties

Since we’re on the subject of rental property demand, investors like you should note that demand for rental properties will never go away. Housing affordability remains one of the average American’s challenges. Not everyone can afford to buy their own home, so the default for them is to rent until they can finally afford one.

At this time, the rental property market continues to grow because the demand for rental properties is growing at an amazing rate. Experts and industry insiders anticipate that the strong demand for rentals will continue to rise over the next few years. This is due to higher housing costs and the attractiveness of the flexibility that renting provides.

Real Estate Properties Remain Solid Investment Vehicles

Time and time again, real estate has proven itself to be a very stable investment. Even during times of crises or economic downturns, real estate has been quite resilient and has been able to bounce back quickly, just like it did during the COVID-19 pandemic.

Regardless of the economic state, there will always be a steady demand for housing. There’s also the fact that, more likely than not, property values will go up over time which makes real estate a good long-term investment.

Related: 9 Factors That Will Affect Your Rental Rate Calculation

The Setbacks of Investing in Real Estate Properties

While there are plenty of reasons to get into real estate investing, there are also several that could keep you away from them, even if they are affordable investment properties.

High Inflation Rates Have a Significant Effect on Mortgages

We’re living in a time when mortgage rates are on a roller coaster ride, especially last year. Initial forecasts for 2022 were that mortgage rates will hit the 5%-mark by year’s end. We were all taken by surprise at how quickly we got to that point (and beyond) during Q2 2022. Since then, it has gone on a wild ride, hitting a peak of 7.08% back in October.

Since then, mortgage rates have gone down. This year, we have seen far more affordable rates compared to 2022 but they’re still high for a lot of folks looking for a decent and affordable loan. As mentioned earlier, the rate for a 30-year fixed mortgage went down by 5 basis points from last week. Whether it goes up or down in the following weeks, nobody knows for sure.

For this reason, a lot of investors are hesitant to buy a property. After all, not everyone has enough extra cash lying around to make an all-cash transaction. Generally, plenty of investors need to take out a loan to buy an investment property. Some may consider mortgage rates today very expensive and will choose to wait it out before diving in.

They Cost a Lot More Compared to Other Investments

The thing about real estate investing is that it generally costs a lot more than other types of investments. If you want to buy a property, whether you intend to rent it out or resell it for a profit, you will need hundreds of thousands of dollars. Of course, there are several other ways of investing in real estate with little to no money, but those are exceptions and not the rule.

They Are Not Easy to Liquidate

Just as investment properties are expensive, they’re also not liquid assets. In the world of finance, liquid simply refers to assets that can be converted into cash in the shortest time possible.

Real estate properties may have high market values but it will take you some time to convert them into cash. Selling a property typically takes several weeks, depending on the condition of the local market it is in. If you’re in a jam and are in urgent need of money, it will be harder for you to get cash from your property.

This is why most financial experts recommend diversifying your assets. Real estate properties make for good additions to your investment portfolio but you should also have other types of assets that will give you better liquidity in case of emergencies.

The thing about investing in real estate is more than having the financial resources and finding the right location, you also need the right tools to increase your chances of success.

For this reason, investors turn to different real estate platforms that offer different tools and features that make investing easier. Some of these platforms provide data while others give you access to tools, like an investment property calculator.

The question now is, among the many investment property websites out there, how will you know which one is right for you?

Related: How to Research an Airbnb Market and Quickly Find a Good Place to Buy Rental Property

Mashvisor: Your One-Stop Shop for Affordable Investment Properties

One of the best platforms for real estate investors today is Mashvisor. The website gives you both high-quality data and the best tools available that will make real estate investing a lot easier for you.

It gathers real estate data from reliable sources like Zillow, Realtor.com, the MLS, and Airbnb. It also regularly updates its database so you have the most accurate information available to you. This makes ROI projections a lot more realistic, whatever market you’re in.

On top of that, it also comes with certain tools that allow you to spot the most affordable investment properties in any market of your choice. Tools like the Property Finder, the real estate heatmap, and the rental property calculator make it easy for rental property investors to identify the right properties for them.

Related: Real Estate ROI Calculator vs Excel Spreadsheets—Which Is Better?

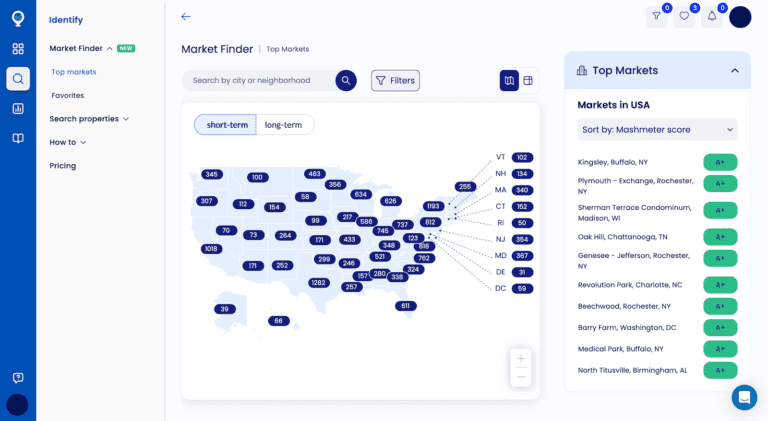

Introducing the Market Finder

Mashvisor has a new tool, called the Market Finder, that lets investors like you look at the US housing market from a bird’s eye view. This makes it easier for you to identify profitable markets that line up with your goals as a rental property investor.

The tool lets you examine certain markets and neighborhoods in greater detail to see what they have to offer you investment-wise. This is especially useful for people who don’t have the time to go through all the markets one by one. It also makes comparative market analysis a lot quicker and more efficient.

Get access to Mashvisor’s Market Finder and other tools to spot affordable investment properties and get you on your way to a thriving real estate investing career. Get started on your 7-day free trial today.

Using Mashvisor’s Market Finder, it’s now much easier to find cities with affordable yet profitable investment properties.

10 Cities With the Most Affordable Investment Properties

Now that you have the reasons and the tools, where should you start looking for affordable investment properties?

We went through Mashvisor’s March 2023 location report to look for cities that have the most affordable yet profitable properties. This list has been ranked according to affordability and has been filtered using the following criteria:

- Each location should have at least 100 listings for both long term and vacation rentals;

- Each location should have an average of $2,000 and up for both long and short term rental income; and,

- Each location should have a minimum of 2.00% long and short term rental cash on cash return.

That said, here are the 10 locations with the most affordable investment properties in the US today:

1. Bridgeport CT

- Median Property Price: $308,612

- Average Price per Square Foot: $265

- Days on Market: 77

- Number of Long Term Rental Listings: 290

- Monthly Long Term Rental Income: $2,010

- Long Term Rental Cash on Cash Return: 3.77%

- Long Term Rental Cap Rate: 3.85%

- Price to Rent Ratio: 13

- Number of Short Term Rental Listings: 128

- Monthly Short Term Rental Income: $2,903

- Short Term Rental Cash on Cash Return: 4.42%

- Short Term Rental Cap Rate: 4.51%

- Short Term Rental Daily Rate: $208

- Short Term Rental Occupancy Rate: 45%

- Walk Score: 84

2. Oak Park IL

- Median Property Price: $332,161

- Average Price per Square Foot: $294

- Days on Market: 110

- Number of Long Term Rental Listings: 126

- Monthly Long Term Rental Income: $2,008

- Long Term Rental Cash on Cash Return: 2.70%

- Long Term Rental Cap Rate: 2.77%

- Price to Rent Ratio: 14

- Number of Short Term Rental Listings: 721

- Monthly Short Term Rental Income: $2,658

- Short Term Rental Cash on Cash Return: 2.73%

- Short Term Rental Cap Rate: 2.80%

- Short Term Rental Daily Rate: $161

- Short Term Rental Occupancy Rate: 52%

- Walk Score: 81

3. Zephyrhills FL

- Median Property Price: $350,557

- Average Price per Square Foot: $205

- Days on Market: 83

- Number of Long Term Rental Listings: 127

- Monthly Long Term Rental Income: $2,058

- Long Term Rental Cash on Cash Return: 4.25%

- Long Term Rental Cap Rate: 4.32%

- Price to Rent Ratio: 14

- Number of Short Term Rental Listings: 102

- Monthly Short Term Rental Income: $2,487

- Short Term Rental Cash on Cash Return: 3.69%

- Short Term Rental Cap Rate: 3.76%

- Short Term Rental Daily Rate: $124

- Short Term Rental Occupancy Rate: 45%

- Walk Score: 70

4. Deerfield Beach FL

- Median Property Price: $363,420

- Average Price per Square Foot: $287

- Days on Market: 61

- Number of Long Term Rental Listings: 471

- Monthly Long Term Rental Income: $2,242

- Long Term Rental Cash on Cash Return: 4.73%

- Long Term Rental Cap Rate: 4.86%

- Price to Rent Ratio: 14

- Number of Short Term Rental Listings: 365

- Monthly Short Term Rental Income: $2,399

- Short Term Rental Cash on Cash Return: 2.51%

- Short Term Rental Cap Rate: 2.57%

- Short Term Rental Daily Rate: $228

- Short Term Rental Occupancy Rate: 36%

- Walk Score: 78

5. Brandon FL

- Median Property Price: $378,173

- Average Price per Square Foot: $228

- Days on Market: 78

- Number of Long Term Rental Listings: 162

- Monthly Long Term Rental Income: $2,135

- Long Term Rental Cash on Cash Return: 3.79%

- Long Term Rental Cap Rate: 3.85%

- Price to Rent Ratio: 15

- Number of Short Term Rental Listings: 129

- Monthly Short Term Rental Income: $3,127

- Short Term Rental Cash on Cash Return: 4.52%

- Short Term Rental Cap Rate: 4.58%

- Short Term Rental Daily Rate: $171

- Short Term Rental Occupancy Rate: 51%

- Walk Score: 75

6. Skokie IL

- Median Property Price: $399,522

- Average Price per Square Foot: $246

- Days on Market: 66

- Number of Long Term Rental Listings: 114

- Monthly Long Term Rental Income: $2,259

- Long Term Rental Cash on Cash Return: 3.23%

- Long Term Rental Cap Rate: 3.28%

- Price to Rent Ratio: 15

- Number of Short Term Rental Listings: 505

- Monthly Short Term Rental Income: $3,214

- Short Term Rental Cash on Cash Return: 3.63%

- Short Term Rental Cap Rate: 3.70%

- Short Term Rental Daily Rate: $162

- Short Term Rental Occupancy Rate: 53%

- Walk Score: 64

7. Grand Prairie TX

- Median Property Price: $400,992

- Average Price per Square Foot: $185

- Days on Market: 34

- Number of Long Term Rental Listings: 440

- Monthly Long Term Rental Income: $2,108

- Long Term Rental Cash on Cash Return: 3.38%

- Long Term Rental Cap Rate: 3.44%

- Price to Rent Ratio: 16

- Number of Short Term Rental Listings: 258

- Monthly Short Term Rental Income: $3,024

- Short Term Rental Cash on Cash Return: 3.94%

- Short Term Rental Cap Rate: 4.00%

- Short Term Rental Daily Rate: $198

- Short Term Rental Occupancy Rate: 48%

- Walk Score: 77

8. Arlington TX

- Median Property Price: $402,137

- Average Price per Square Foot: $198

- Days on Market: 117

- Number of Long Term Rental Listings: 1,334

- Monthly Long Term Rental Income: $2,103

- Long Term Rental Cash on Cash Return: 3.41%

- Long Term Rental Cap Rate: 3.47%

- Price to Rent Ratio: 16

- Number of Short Term Rental Listings: 496

- Monthly Short Term Rental Income: $3,198

- Short Term Rental Cash on Cash Return: 4.42%

- Short Term Rental Cap Rate: 4.49%

- Short Term Rental Daily Rate: $165

- Short Term Rental Occupancy Rate: 44%

- Walk Score: 47

9. Fort Worth TX

- Median Property Price: $403,196

- Average Price per Square Foot: $195

- Days on Market: 157

- Number of Long Term Rental Listings: 4,660

- Monthly Long Term Rental Income: $2,334

- Long Term Rental Cash on Cash Return: 3.81%

- Long Term Rental Cap Rate: 3.87%

- Price to Rent Ratio: 14

- Number of Short Term Rental Listings: 1,380

- Monthly Short Term Rental Income: $3,391

- Short Term Rental Cash on Cash Return: 4.64%

- Short Term Rental Cap Rate: 4.71%

- Short Term Rental Daily Rate: $165

- Short Term Rental Occupancy Rate: 50%

- Walk Score: 38

10. Royal Oak MI

- Median Property Price: $410,759

- Average Price per Square Foot: $287

- Days on Market: 98

- Number of Long Term Rental Listings: 310

- Monthly Long Term Rental Income: $2,017

- Long Term Rental Cash on Cash Return: 3.54%

- Long Term Rental Cap Rate: 3.60%

- Price to Rent Ratio: 17

- Number of Short Term Rental Listings: 189

- Monthly Short Term Rental Income: $2,955

- Short Term Rental Cash on Cash Return: 4.10%

- Short Term Rental Cap Rate: 4.18%

- Short Term Rental Daily Rate: $161

- Short Term Rental Occupancy Rate: 50%

- Walk Score: 96

To start looking for and analyzing the best and most affordable investment properties in your city and neighborhood of choice, click here.

Wrapping It Up

To end, investing in real estate properties involves several factors that need to be considered. First, you need to have the right reasons for investing. Then your investment property needs to be in a profitable market to ensure you get a good return on investment. And lastly, you need to have the right set of investing tools to help you make informed decisions.

Join the countless investors who have trusted Mashvisor as their primary real estate investing tool. You will be given access to high-quality data that will help you come up with the most accurate and realistic ROI projections. On top of that, you also have access to our Market Finder, so you can pinpoint a profitable location that offers affordable properties.

Want to learn more about Mashvisor’s Market Finder and how it can give you access to the best and most affordable investment properties in the most profitable markets? Schedule a demo with us.