The Airbnb Resident Hosting program now allows long-term renters to sublet their apartments for short-term stays. Learn more about it here.

Airbnb has recently partnered up with major property management companies, landlords, and homeowners associations to introduce the Airbnb Resident Hosting Program. The idea behind the program is to showcase so-called “Airbnb-friendly” buildings.

Table of Contents

- What Is Airbnb Resident Hosting Program?

- How Will Multifamily Property Investors Benefit From the Airbnb Resident Hosting Program?

- Pros and Cons of Letting Tenants Sublet on Airbnb

- How to Find Out Your Multifamily Property’s Profit Potential on Airbnb

In essence, the program will allow long-term renters to list their apartments on Airbnb and sublet them for short-term stays.

Rental buildings, as you might know, generally aren’t Airbnb-friendly. However, that’s all about to change with the Resident Hosting program, which will allow investors to become more visible on the network.

The program will also allow investors to calculate their potential income through Airbnb’s custom dashboard.

That seems to be great news for long-term renters looking to host on Airbnb as a way of earning additional income. However, the question remains:

Should multifamily property owners join the Airbnb Resident Hosting program?

That’s what we aim to find out in this guide.

What Is Airbnb Resident Hosting Program?

The Airbnb Resident Hosting program is a new method for multifamily property owners, building managers, and homeowners’ associations to enter the world of Airbnb hosting.

These select buildings are considered Airbnb-friendly, meaning their residents and owners can host on the Airbnb platform—provided they respect the building’s rules and policies.

The Resident Hosting program enables building owners to set their own rules when it comes to hosting, including the number of nights per year that hosting is allowed. Of course, they are still expected to respect the local short-term rental rules and Airbnb’s community standards.

What’s important to note about this program is that the focus is not on tourists. Instead, the main idea is that it will make it easier for long-term renters to find apartments that allow hosting on Airbnb—and then occasionally sublet them to earn extra income.

The main difference between this and previous iterations of Airbnb’s multifamily program is that landlords will no longer act as short-term rental property managers. The platform connects these would-be tenants with landlords—but everything related to hosting is up to the renter.

The program also features tools that support responsible home-sharing and provide insights into hosting activity through a customizable dashboard. Even more so, it enables landlords to earn a share of revenue on every booking—without getting involved in the operations side of hosting.

It’s also worth noting that currently, the program is only open to investors from the United States; that’s something to keep in mind if you’re interested in partnering up with Airbnb.

How Will Multifamily Property Investors Benefit From the Airbnb Resident Hosting Program?

The Airbnb Resident Hosting program’s main goal is in line with the platform’s overarching effort to allow more people to reap the financial benefits of hosting—and offset the rising cost of living.

Airbnb has reported that, over a three-month trial period, renters who have hosted an average of nine nights per month earned an additional $900 through Airbnb’s Resident Hosting program.

But how is this beneficial for multifamily property investors?

The property owners can actually benefit from the program in several ways:

For one, it will enable them to attract tenants who are already interested in subletting on Airbnb.

Two, it’ll make it possible for them to create building rules in line with the residential community and have insight into hosting activities for the units that are a part of the program. They are also able to set a limit on how many nights per month the participating apartments can be sublet.

And three, they earn passive income by collecting a share of the revenue for each participating listing. In fact, the property owner can charge their primary tenant up to 20% of the cost of every booking.

The program is designed to be beneficial for all parties involved while ensuring that the building residents’ interests are still protected. The goal is not to disrupt the residential community for the sake of profit but to find a solution that works for investors and residents alike.

Pros and Cons of Letting Tenants Sublet on Airbnb

The program can make a genuine difference in the property’s performance, especially when you consider making it a short-term rental. However, before you become a part of the Airbnb hosting program, you should take a closer look at the most significant pros and cons.

If you’ve never dabbled in short-term rentals before, know that there are many things to consider beforehand—good and bad.

That’s why in this section, we’ll cover all the pros and cons the Airbnb Resident Hosting program brings to the table—and to your real estate investing portfolio.

Advantages of Letting Tenants Sublet on Airbnb

Let’s start with the most notable advantages; then, we’ll move on to discuss the potential risks of joining Airbnb’s Resident Hosting program.

Effortless Way to Generate More Income

One of the most significant benefits of joining Airbnb’s Resident Housing program is the fact that it offers you, as the property owner, a hassle-free way to generate more income.

The program is set up so that it removes the need for landlords to double as short-term rental property managers. The responsibilities associated with Airbnb hosting are now up to the primary tenants to handle:

They need to take care of everything—from listing their apartment to communicating with guests and maintaining the space between guests. You don’t have to bother with the operational side of things—and you still get to earn a commission on every booking made through Airbnb.

If that does not sound like a low-effort, hassle-free way to generate more income, we’re not sure what will. That can be enough to convince some investors to say “Yes” to this type of arrangement.

Of course, your tenants will also take it upon themselves to approve guests beforehand—which could be a cause for concern. But remember that you and your tenants have the same interests:

Everyone involved wants each booking to go swimmingly—because it means higher profit for you and the tenants who are choosing to host on Airbnb.

Improved Airbnb’s Guest Screening

A while ago, Airbnb had no background screening measures for guests. Now, the platform relies on more than just the honesty of all parties involved:

Both hosts and guests are screened for potential criminal records and cross-referenced through state and national sex offender records. During this process, all users with convictions for violent crimes and offenses are promptly removed from Airbnb’s platform.

It’s understandable if you’re wary of new, unfamiliar people coming and going from your building or vacation home on a daily basis. But knowing that there is indeed a background check could give you peace of mind and be the final push towards saying “Yes” to this arrangement.

Of course, Airbnb’s background check is not failproof—but that is something we’ll discuss later.

Related: 10 Things to Include in a Short-Term Rental Agreement

Higher Income

Short-term rentals are associated with a higher income—especially in tourist-popular towns and cities. Plus, you can set the prices according to the demand:

If you notice that there are more tourists in the area during the weekend, Airbnb daily rates can be increased to reflect those trends. Also, you can charge more on holidays or during the week of a popular local event.

While you might only get a share of the revenue from every booking, the income potential is still there. At the end of the month, you’ll earn more per square foot than you would with “traditional” renting alone—even if the apartment doesn’t have a 100% occupancy rate.

Airbnb’s Popularity

All current trends point to Airbnb becoming more popular in the next decade, and experts agree that short-term rentals will only rise in demand—which, in turn, will raise the potential for profit in the Airbnb business.

Here’s something to keep in mind:

People who travel a lot miss the comfort of their homes while on the road—and hotels don’t offer that home-like feel, privacy, and comfort. Besides providing a place to stay, Airbnb also offers an overall better experience—and better pricing—than a typical hotel would.

That alone puts you at an advantage.

You know that the demand for Airbnbs is already there—why not tap into this potential stream of income?

Related: Airbnb Market 2023 Trends, Data, and Analysis

Risks of Letting Tenants Sublet on Airbnb

There are, of course, certain risks associated with letting your tenants sublet on Airbnb:

Inconsistent Screening Process for Foreign Guests

Collecting extra revenue without having to increase the amount of work seems like a compelling proposition—but there is an important thing to consider:

Yes, your tenants doing the work may seem like an easy way to earn extra cash—because they are handling everything, from preparing the apartment to selecting guests. However, that last bit may not work out in your favor due to the inconsistent screening procedures.

There are several issues related to the lack of a guest screening process, the first one being that, as the landlord, you won’t be able to keep track of all the guests that are coming and going. This opens doors for property damage and criminal activity on your property, among other concerns.

Sure, all Airbnb users go through an account verification process before proceeding and making a booking. However, the Airbnb platform only checks the person making the booking rather than the entire party.

Speaking of screening, here’s another thing to consider:

Airbnb does run a background check on guests—which includes the OFAC list, public state and county criminal records, and state and national sex offender registries. However, that’s limited to the USA; guests coming from abroad are generally not screened for their local criminal records.

If your multifamily property is situated in a popular tourist destination, that should be a key factor to consider before entering the Airbnb Resident Hosting program.

Relying on the Tenant’s Judgment

As we’ve pointed out earlier, the fact that the tenants are in charge of finding guests means that the screening process will be out of your control—and inconsistent at best.

But another problem that may arise in this scenario is potential discrimination.

It’s typically difficult to prove discrimination in housing, but it remains a real issue—and you can’t know for sure if one of the tenants subletting on Airbnb might be guilty of it. And you certainly do not want to be hit with a lawsuit—or break the Fair Housing Act without even realizing it.

Increased Risk of Property Damage

On the platform, guests can review their potential hosts—and vice versa. Most of the time, hosts will select polite, considerate, and responsible guests who will honor their commitments, respect building rules, and leave the apartment the same way they found it.

However, that doesn’t mean you won’t sometimes come across guests that leave some damage behind. Even worse, someone could get injured while staying at your property.

The issue is that you—the property owner—will have to cover these expenses.

Strained Relationship With Other Tenants

Airbnb promotes the new Resident Hosting program as an excellent way to attract more tenants and build good relationships with them.

But while you will certainly be on your tenant’s good side if you say “Yes” to short-term renting of apartments, it could also have a negative impact on your relationship with other tenants. Keep in mind that not everyone will be open to the idea of having guests coming in and out.

You’ll have two choices here:

Either you join the Airbnb Resident Hosting program and upset those who weren’t on board with the idea, or you don’t join the program and let go of the potential added income.

In an ideal scenario, everyone will agree to the idea. But it’s just a potential downside to keep in mind before proceeding.

How to Find Out Your Multifamily Property’s Profit Potential on Airbnb

Before you opt to list your multifamily property with the Airbnb Resident Hosting program, there are several things to consider. First, you’ll need to weigh the pros and cons and decide whether that makes sense for you and your investment property.

Then, it’s time to do a short-term rental analysis and assess whether renting your property short-term is profitable compared to long-term, “traditional” renting.

If your property is located somewhere that tourists frequent, it is likely that you will never be short of guests. An apartment building with amenities like a gym or a pool would be more popular, too.

Related: Best Places to Buy Short-Term Rental Property in 2023

Aside from these qualities, you also need to run the numbers to determine if your property will actually be profitable. In this matter, you need to use an online real estate calculator.

The Perfect Tool for Calculating Your Property’s Airbnb Profit Potential

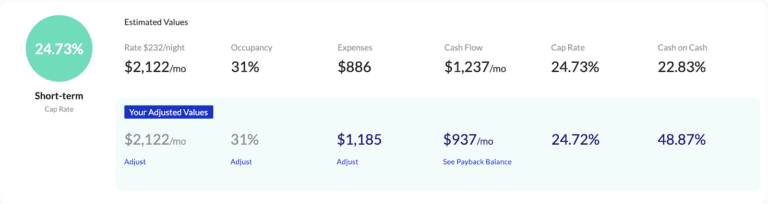

This calculator will give you all the necessary information and spare you the hassle of doing your research manually. The Mashvisor Airbnb calculator tool is highly interactive and allows you to customize and fine-tune it to your liking.

Mashvisor’s short term rental calculator has a new look. Simply click “Adjust” to change the values you want to edit. The calculator will then project the cash flow, cap rate, and cash on cash return accordingly.

For example, you have the option to add the following features to the calculation:

- Purchase price

- Expected rental income

- One-time and recurring expenses

Furthermore, you can enter a financing method you’re using or planning on using. That way, you can see when your property will turn a profit.

The Mashvisor calculator will estimate the ROI and expected profits to give you all the data you could possibly need. You can make an informed decision regarding whether you should list on Airbnb or not.

Forget about performing a market analysis yourself; Mashvisor’s platform can handle everything for you.

The results are calculated in a matter of minutes. So Mashvisor’s real estate investing tool can save you a lot of time you’d otherwise spend on manual research.

Start your 7-day free trial today—and see for yourself how simple the investment process can be when you have access to the right tools.

Final Remarks

The Airbnb Resident Hosting program is not exactly new; it was introduced back in 2016. But with the recent updates to the program, the arrangement seems like a great way to generate more income.

So if you own a multifamily property owner, consider the benefits, as well as potential downsides, of joining this program.

Short-term rentals are generally associated with different “issues” compared to traditional rentals and generally require more hands-on work. However, they can also generate a heftier income because of the higher daily rates.

Joining this program would allow property owners to tap into the income potential without having to host the guests. The tenants handle everything—but you still earn a commission on every booking.

Short-term rentals could be the perfect way to make your multifamily properties more profitable. And the program can be your way in.

However, to truly determine if hosting via Airbnb is the most profitable deal, be sure to check our Airbnb calculator and get the most accurate estimates for your property.

Mashvisor offers a free inquiry for investors looking to improve their property’s financial performance. Schedule an appointment with our Product Specialists today and get a free introduction to the platform.