Read this guide to learn more about how Mashvisor’s Airbnb occupancy rate calculator can help you decide on your next profitable investment.

Generally speaking, depending on the location and the amenities surrounding the property, investing in Airbnb can ensure a generous return for the investor.

Table of Contents

However, as with any investment in real estate, it is necessary to do a thorough analysis in order to determine whether it is profitable to continue with your investment strategy. That is where our platform can help.

Mashvisor’s Airbnb rental calculator makes it much easier for real estate investors to do their research and choose the most suitable Airbnb investment.

To find out whether Airbnb investments will remain profitable in 2023 and where some real estate hotspots are, be sure to scroll down. Check out also how Mashvisor’s Airbnb occupancy rate calculator can help you.

Will Airbnbs Be in High Demand in the US in 2023?

When analyzing the US housing market as a whole, we must look at everything. Find out how the US market has progressed, what the current situation is, and what the possibilities are in the near future.

One thing you should know when talking about Airbnb is that this type of investment has enjoyed a good reputation for a long time now.

Short term rentals have largely replaced hotel stays, helping improve the travel experience and, as it turns out, helping tourists save some money.

That’s not all, though.

Airbnb also brought some notable advantages when it came to investors. So, it is no surprise that we saw an increase in interest for this type of investment in 2022.

But the question remains:

Will Airbnb demand continue to rise in 2023?

According to AirDNA’s US 2023 Short-Term Rental Outlook Report, the forecast for Airbnb investments in 2023 is more than positive. After growing a whopping 20%, 2023 will see modest but promising growth of 5% in Airbnb investments.

September 2022 holds the record for 1,374,075 listings available in the US, according to the same AirDNA report.

Granted, 2023 didn’t get off to the best start. A potential recession is on the horizon, and we’re dealing with shocking price increases across all segments of the market.

Still, despite the somewhat rocky start, the demand for Airbnb is still going strong and shows no signs of stopping.

Why Should You Invest in Airbnb?

Airbnbs have established their popularity—especially in the last couple of years. They have become widespread among beginners and seasoned investors alike.

The question that arises is, what are the specific reasons for pursuing this investment path in 2023?

We’ve rounded up the most significant advantages of investing in Airbnb below.

Using Vacation Rentals for Your Purpose

Arguably, one of the benefits of investing in Airbnb properties or vacation rentals for sale is that the property remains available for personal use when you have no guests.

If you’re the host of an Airbnb, just clear the dates on the calendar, and you get to use your investment property as a second home—pretty much whenever you like.

Of course, you shouldn’t go overboard with occupying your own property. Remember, the main purpose of your Airbnb is to generate passive income. It can’t do that if you only keep it available for personal use.

Generating Passive Income

Since we’ve already mentioned passive income, it makes sense to focus on that particular advantage of Airbnb investments next and take a moment to explain it.

As you might be aware, Airbnb’s popularity throughout the US real estate housing market experienced a surprising increase over the last two years. It’s predicted to grow even more in the coming years.

And as the real estate market slowly gets back on its feet, it opens the door to prospective investors interested in short-term rentals.

Unlike the past few years, Airbnb is now ahead of long-term rentals. And since the implied nightly, weekly, or monthly (at most) stays, investors are entitled to raise rental rates and make more profit.

Here’s a fair warning, though:

While you can set higher prices for Airbnb properties, it is important not to get carried away. Be sure always to consider factors that determine rental rates in your area and set your prices accordingly.

More Control Over Your Guests

Another advantage that comes with investing in Airbnb is that you typically have a bit more control when choosing who your guests will be.

Unlike long-term rentals, which are pretty much reserved for families with kids and couples, with Airbnb, you get to set certain criteria and rules that should be respected.

For instance, your Airbnb may or may not be pet-friendly. By establishing such “conditions,” you are essentially creating a space that corresponds with what you imagined.

Related: Where Can You Find Airbnb Properties for Sale?

Things You Should Be Aware of When Investing in Airbnb

First off, you should be aware that there is no investment that’s completely risk-free. And the same applies to Airbnb.

The fact that such properties represent a truly lucrative investment opportunity for investors remains. However, it does not exclude the fact that there are some things you should be aware of before proceeding with your investment plans.

More Time on the Field

Guests will be coming and going in your Airbnb property—so it goes without saying that you, as the host, will be required to spend more time “on the field.”

Sure, Airbnb is great for generating passive income. However, if you own other investment properties or have a job that takes up a huge portion of your day, it can be a challenge.

Irregular Income

Airbnbs can help you generate a substantial profit within a relatively short time frame, but they can also leave you almost penniless during the other months of the year.

On that note, the success of your Airbnb greatly depends on the location of your investment property and the amenities surrounding it.

Namely, there are vacation rentals that are considered “jackpots” during the summer season. On the other hand, during the winter, they face a huge problem with low occupancy rates.

It is not uncommon at all, though. You just need to be prepared for such a risk before you invest in short-term rentals.

High Regular Expenses

In addition to location and other critical external factors, such as amenities, regular expenses can be a financial challenge.

Here’s the thing:

The better equipped your Airbnb is, the more attractive it’ll be to potential guests. And when it comes to short-term stays, guests want to feel at home.

If you want your Airbnb to generate income and be full year-round, you need to invest in better appliances, air conditioning, furniture, plants, and interior design, among other things. Of course, how you’ll go about it depends on the style and guest demographic you hope to attract.

Bottom line?

Airbnb will definitely be an investment hotspot in 2023. You just need to decide whether it’s a risk you’re willing to take.

Related: Mashvisor’s Rental Property Calculator: A Guide for Beginner Real Estate Investors

How to Calculate Your Airbnb Occupancy Rate Using Mashvisor

As we mentioned at the beginning of our guide, calculating your expected income from an Airbnb property is easier if you choose Mashvisor’s Airbnb occupancy calculator.

Our Airbnb occupancy rate calculator is specifically designed to assist investors in going through a ton of information and getting accurate results. And, in this case, we mean potential Airbnb income.

We understand that you want to be 100% familiar with the features of this Airbnb occupancy rate calculator and its abilities. So, let’s delve deeper into the essence of this investment tool.

What Is an Airbnb occupancy rate calculator?

Simply, an Airbnb occupancy calculator is an online real estate investment tool created to help real estate investors determine the potential income of an Airbnb investment property.

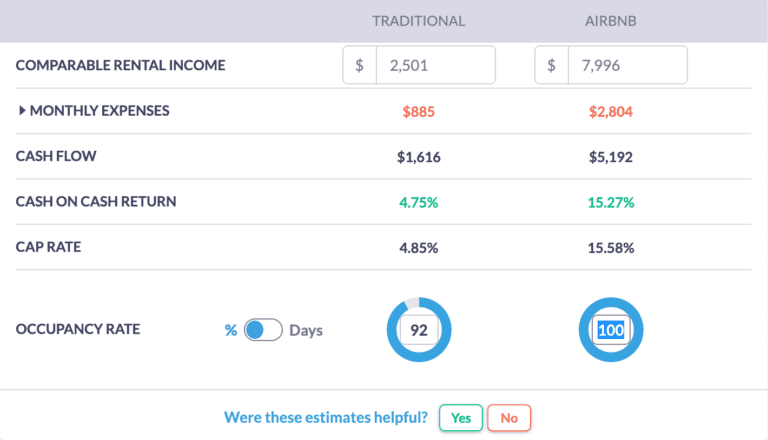

Mashvisor’s Airbnb occupancy rate calculator relies on several key metrics to help investors, such as yourself, determine the profitability of their investment property.

The metrics include the cash on cash return, cap rate, cash flow, Airbnb daily rate, Airbnb occupancy rate, and monthly income—which we’ll discuss more in a minute.

In that sense, the purpose of an Airbnb occupancy rate calculator is to answer the question of whether the investor should proceed with their investment strategy or give up.

And while numerous online occupancy rate calculators provide these types of assessments to investors, not all of them can guarantee 100% accuracy.

However, with Mashvisor, you can count on up-to-date information, accuracy, reliability, and speed when calculating the potential profitability of your Airbnb investment property.

Mashvisor’s Airbnb Calculator allows you to edit the occupancy rate field to see how a higher or lower occupancy rate would affect your bottomline.

How Does Mashvisor’s Occupancy Rate Calculator Work?

Now that we’ve established the purpose of Mashvisor’s Airbnb occupancy rate calculator, we would like to explain how the investment tool works.

Right off the bat, we have some excellent news for investors:

Navigating the features of this investment calculator is straightforward.

The first thing Mashvisor’s investment tool takes into account is your property’s location.

When you enter the location, the tool takes the other metrics we’ve mentioned and does the math for you.

If you select a home from the existing database, for example, you will be able to see a quick overview—also known as the rental property analysis.

The Airbnb occupancy rate calculator also gives you a chance to edit the numbers manually to help you reach a final decision.

Related: The Airbnb Profitability Calculator: The Best Friend of the Short-Term Rentals Investor

Metrics That the Airbnb Calculator Analyzes

Finally, here is a list of some key metrics that the Airbnb occupancy rate calculator analyzes:

Rental Income

The first metric worth mentioning is the rental income of the property. It refers to the amount of money that the investor may expect to earn from their Airbnb investment monthly.

Mashvisor’s AI collects listings and relevant data to ensure you get updated information every time you start your search. Most beginner investors like to use the Airbnb occupancy rate calculator feature to decide on rental rates.

And as mentioned earlier, you get to tweak the numbers to see how the final result increases or decreases depending on the rates you choose.

Occupancy Rate

The second—and perhaps the most important—feature is the occupancy rate calculator.

You see, depending on the location of your investment property, it might experience changes in bookings and occupancy rates that are related to seasonality.

Take a ski town Airbnb, for example. Such a type of Airbnb investment will certainly yield a high income during the winter season. However, during the summer, it can experience a drop in bookings.

A logical sequence would be:

The more bookings you get each month, the more profit you will generate. To calculate your potential Airbnb income, we must take into account the occupancy rate.

What is the ideal occupancy rate for your Airbnb?

Generally speaking, your Airbnb occupancy calculator should show you that your investment property has an occupancy rate of at least 51% or that it generates enough profit off-season.

If one—or both—of the said conditions are met, you’re advised to proceed with your investment plan.

Expenses

Our Airbnb occupancy rate calculator also facilitates the process of calculating one-time and monthly expenses for your Airbnb property.

Although our Airbnb occupancy rate calculator already features a list of common expenses, as well as their amounts, investors can edit them manually.

In addition to the metrics mentioned above, Mashvisor can provide insight into cash on cash return, cap rate, and other relevant data.

That’s to say that using our Airbnb occupancy rate calculator is just one of the many benefits that Mashvisor offers.

There is another very important tool that Mashvisor offers its investors—neighborhood analysis. It is one of the main stages of your investment strategy.

Before taking into account the metrics we mentioned, Mashvisor’s neighborhood analysis helps you locate the best place for your Airbnb investment property. The tool shows the investors a 12-month historical occupancy rate of the property in question.

If Airbnb’s occupancy rate is good, investors are going to feel encouraged about investing in the property.

Note that the “ideal Airbnb occupancy rate” is not 100%. It’s determined by other factors, such as the housing market, season, your listing’s position, and so on.

In order to experience the advantages of this calculator, be sure to sign up for a 7-day free trial now.

3 Ways to Improve Your Airbnb Occupancy Rate

In addition to using Mashvisor’s occupancy rate calculator, there are other things you can do to increase your occupancy rate and make your rental property more profitable, such as:

1. Add Professional Photographs

Naturally, you want your Airbnb listing to stand out and attract as many guests as possible all year round—and hiring a professional photographer is one of the ways you can achieve that.

Your listing should feature first-class photographs that show your Airbnb in the best possible light. Focus on good angles and include them in your listing.

2. Read Reviews

Our second tip—and an essential part of running an Airbnb business—is reading the reviews your property gets from guests.

Obviously, reading praises will boost your confidence, but that’s not the only thing you should focus on here. Take note of the negative reviews, as well as suggestions on what you can do to improve.

3. Hire a Property Manager

If you own several Airbnb properties in different locations, it can be a bit challenging to stay on top of everything. They include all the messages, bookings, reviews, and property visits that are a part of running an Airbnb.

So, you might want to consider hiring a property manager—someone who will make your job much easier and ensure that everything’s running smoothly.

Mashvisor’s Airbnb Occupancy Rate Calculator: Summing Up

We’ve successfully covered the topic of how to optimize your Airbnb occupancy rate using Mashvisor’s Airbnb occupancy rate calculator.

The popularity of Airbnb right now is undeniable. It has replaced “traditional” hotel stays and has changed the travel experience for the better. Most importantly, though, Airbnb—as a type of investment property—has enabled investors to generate a substantial passive income.

Mashvisor’s Airbnb occupancy rate calculator is an investment tool specifically designed to assist investors in getting accurate results while preparing their investments.

The Airbnb occupancy rate calculator uses several metrics, like rental income, cash on cash return, and cash flow, to get accurate results and help investors make informed decisions.

Investing in Airbnb is definitely a fruitful venture. It offers passive income and gives the investor more control when choosing guests and setting house rules. Also, it allows them to utilize their property for personal use.

However, like all other forms of investments, investing in Airbnb isn’t risk-free.

There is always a chance of irregular income, the need to spend more time on the field, and higher expenses. The good news? An Airbnb occupancy rate calculator can help you foresee such challenges—and achieve a successful investment property.

You can further increase your occupancy rates by adding professional photographs and reading reviews (and being open to criticism). Hiring a property manager can also help with running the business.

If you’re considering investing in 2023, our Airbnb occupancy rate calculator will help you reach an informed decision. There’s one more thing we’d like to add, though:

For real estate investors who are eager to upgrade their investment game, Mashvisor offers a free demo. Schedule an appointment with us and get a free introduction from one of our product specialists.