Real estate investment may be a terrific way to generate wealth in 2023. With the housing market shifting, consider it a long term investment.

When investing, several elements must be considered—the purpose of the investment, where it will be done, how much funds will be invested, and so on. But one topic that’s sometimes ignored is when is the best time to do it. 2023 might be changed into a fantastic opportunity for your income to flourish.

Table of Contents

- Is Real Estate a Good Investment in 2023?

- Which Investment Is Best in Real Estate?

- How to Invest in Real Estate

The real estate market in the US is one of the most solid in the world, and it is anticipated to stay so for the years ahead. As a result, 2023 will surely be a good time to make real estate investments.

It is mainly because the economy is solid and rising steadily. In 2010, the US real estate industry business began its upward trend, and it is predicted to continue into the future.

We’ll cover everything you need to know about the real estate housing market and investment in 2023, all with the help of Mashvisor and its best apps and tools for investors.

Is Real Estate a Good Investment in 2023?

Rising property prices and increased demand benefit individuals with investment properties in desirable real estate markets.

However, it is not the greatest moment to buy a new home. Intense competition means you’ll be up against several offers, many of which will surpass your intended purchase price. It also implies that you will most likely spend extra for the property.

The price of a real estate investment is not the only aspect that influences its success. Demand, cash flow, and the cost of borrowing are all critical aspects that affect the return on investment. However, the cost is an essential factor. Prices are still rising, although many experts and analysts expect a declining trend in 2023.

For instance, according to Goldman Sachs, home price growth might slow to 0% in 2023. Other analysts are more positive, predicting that demand and prices in the real estate business will continue rising if interest rates do not continue going up.

We’re already witnessing a decline in demand and, as a result, less competition in the real estate industry. Inventory is up significantly, helping slow the rate of home price increases. It is a trend expected to continue throughout the year.

Let’s list some real estate investment pros and cons you should know.

Advantages of Real Estate Investment in 2023

All indications point to a slowing housing market in 2023, which may or may not be followed by a recession. Purchasing rental houses at a discount might be a fantastic buying opportunity.

1. Real Estate Is a Reliable Investment

The real estate business remains a steady and successful investment throughout time, especially during economic downturns. One of the reasons real estate is such a secure investment is that it is a physical asset with a constant value.

There will always be a need for homes, regardless of the economy’s condition. Furthermore, because real estate is a long term investment, it might take several years to witness a return on your investment.

However, the advantages of long term investment are apparent. Real estate investors often see their property prices rise over time, generating a significant financial return on their investment. For such reasons, real estate will remain a secure and successful investment for many years.

Related: Is Real Estate Investing Recession Proof?

2. Demand for Rental Units Increases Investment Returns

According to a recent study, demand for rental houses is increasing and is predicted to continue. The growth in demand can be attributed to various factors, including the high cost of buying a property and the freedom that renting provides.

Consequently, investors who purchase rental homes may expect a significant return on their investment. Furthermore, the number of people relocating to cities is rising, resulting in a greater demand for many types of rental apartments in urban areas.

Therefore, investors may enjoy a consistent income from their rental property types with the appropriate real estate investment and renters. However, they should start with their investment plan on time.

3. Tax Advantages Are Unique to Real Estate

Tax advantages are one of the primary reasons why people invest in real estate. Unlike some other investments, the real estate business offers several tax benefits that may save owners money.

For example, investors can deduct the interest they plan to spend on their mortgages from their taxes. The deductions can result in substantial savings over the duration of the loan. Furthermore, owners of rental properties can subtract a number of costs from their taxes, such as maintenance and repairs.

The deductions can assist in offsetting the expense of property ownership and make real estate investment more feasible. As a result, tax relief may be an extremely valuable financial instrument for real estate investors even in 2023.

Related: How to Get the Best Mortgage Rate for Investment Property in 2023

4. Long Term Property Investment Opportunity Window

Such an opportunity window exists not because homes are inexpensive but because the amount you would pay for a house now will appear cheap in three years.

Moreover, the opportunity exists because customer confidence is low, and many potential homeowners and investors are on the fence. Savvy investors will seize the possibilities our real estate market will provide over the next several years. Doing so will maximize their upsides while minimizing their disadvantages.

Buyers are still interested but more hesitant. There is currently a “rush to quality,” with A-grade houses and rental units selling quickly. On the other hand, secondary assets are stagnating in the real estate business market. Also, it is the perfect chance to search for homes with the help of online real estate apps.

Disadvantages of Real Estate Investment in 2023

If you opted for a real estate investment plan this year, we should also cover some drawbacks you may or may not experience in your real estate business.

Nevertheless, we would like to point out that there is no “best” or “worst” time to invest in real estate.

1. Issue With Interest Rates

Although prices may become more reasonable in the coming months, rising interest rates will remain a concern. The Federal Reserve continues to take an aggressive approach to the federal funds rate, which does not set mortgage rates but affects them.

Debt rates for a 30-year fixed-rate mortgage for a real estate investment property were approximately 7% at the beginning of December 2022. If the Fed proceeds to raise interest rates to combat inflation, the figure could rise by 2% to even 3% in 2023.

Higher interest rates imply a higher mortgage payment each month, which reduces the estate’s cash flow.

2. Potential Recession

Economists have been warning about a possible recession in 2023 for most of the second part of 2022. In light of this, taking on a major expense like a property might be risky.

To be sure, a recession does not mean that you will lose your job. Furthermore, a recession is not a certainty. However, you may want to avoid taking the risk of purchasing a property at a time when some experts believe the economy is set to collapse.

It’s also particularly true if you will be pushing your budget to purchase a house due to rising housing prices and borrowing rates.

3. Home Prices Are Still High

Even though home price increases have eased in recent months, property prices are still rising across the country. It means you should expect to pay a greater price for some homes you plan to purchase.

Overpaying for, well, anything is typically not a smart idea. On the other hand, overpaying for a property may be pretty risky. What if your situation changes and you must relocate in a few years?

You may lose money if you spend $500,000 on a property that would usually sell for $450,000 and then have to resell it a few years later.

Which Investment Is Best in Real Estate?

There are several ways to invest in real estate, from taking out a house mortgage to establishing a nationwide property empire. While the latter is undoubtedly out of sight for the majority of us, there are plenty of different business scenarios. Here are three investments for increasing your real estate visibility:

1. Real Estate Investment Trusts

Look into real estate investment trusts (REITs) if you want to invest in real estate right away and with as little money as feasible.

The said public corporations raise cash by selling stock and issuing bonds. The revenues are used to buy and rent real estate assets, such as office buildings, retail malls, multifamily apartment complexes, and warehouses. REITs are obligated to distribute virtually all of their after-tax income to their shareholders in the form of dividends.

REITs simplify real estate ownership. Management businesses do all ownership and rental procedures. All you need to do is sit back and receive dividends, usually larger than many stock-type investments.

Similar to any other public corporation, you may buy and sell REIT stock in the marketplace using a brokerage account. As a result, REITs are among the most liquid real estate investments accessible.

You may also purchase shares of exchange-traded funds that own shares of multiple REITs. New investors with little funds can buy additional shares in REIT ETFs through several investing business applications.

Pros of REITs

- The majority of core properties are long-term, cash-producing leases.

- Essentially, they are dividend-paying stocks.

Cons of REITs

- The usual rental real estate leverage is not applicable.

Related: What is REIT and Is It a Good Real Estate Investment Strategy?

2. Rental Properties

Think about owning rental homes if you want to invest substantially in real estate. Rentals can provide consistent income flow and the potential for growth over time, but they are one of the most time-consuming types of real estate investment business.

There are two basic ways to profit from rental properties:

- Long term rentals: These homes are typically planned to be leased for at least a year, giving a consistent monthly revenue flow. However, it is dependent on your renters’ trust. You might purchase a multifamily or single family home to rent to others.

- Short term rentals: Such properties appeal to rotating tenants whose visits can be as short as one night. While you’re away, you might offer your entire multifamily home or apartment or invest in a second property designed just for short term rentals.

While the rental investment business offers more profit potential, it also demands significant effort. You must locate and screen renters, pay for ongoing upkeep, handle repairs, and handle any other issues that may occur.

Employing a property management firm can minimize some of the hassles, but it will affect your profits. The resources and cheap mortgage rates available for primary residences may not be accessible for rental properties. It may increase the cost of purchasing a rental property.

3. House Flipping

You do not need to purchase rental properties to optimize your earnings from real estate investment.

Buying and flipping houses is a frequent business technique, albeit flipping, like renting out properties, requires a lot of labor. It entails refurbishing properties and learning to spot up-and-coming districts where you can resell your acquisitions at a profit. It is similar to investing in turnkey properties.

However, turnkey investments are a passive kind of real estate investing, as opposed to property flipping.

If your house flipping business approach includes remodeling and construction, you are taking on additional risk and spending significant out-of-pocket expenses. To cut a long tale short, it’s more complex than it appears on HGTV.

Building licenses are required for renovations. Remodeling expenses may be greater than expected, especially if you engage contractors or outsource additional work.

Look for real estate properties in up-and-coming neighborhoods that don’t require major improvements to reduce the effort involved in flipping properties. This may be made much more profitable if you rent out the house while you wait for home values to increase. At this point, make your process simpler by employing some of the best real estate apps.

Remember that the neighborhood you believe would become popular may never catch on, presenting you with a home that will be difficult to recoup your investment.

Pros of House Flipping

- Possible quick returns

- Capital is tied up for a shorter amount of time

Cons of House Flipping

- More market knowledge is required

- Unexpected cooling in hot markets

How to Invest in Real Estate

Once you’ve completed all of the fundamental knowledge and chosen your path, it’s time to begin your investment journey step by step.

If you lack expertise, we propose making a residential real estate investment. If you have prior expertise handling commercial properties, you should then pick commercial. Moreover, learning and investing in residential real estate is better if you have little capital or lower risk tolerance.

Below, you will see a step-by-step guide on how to invest in residential real estate. Also, take a look at one of the best real estate apps out there.

How to Invest in Real Estate: First Five Learning Steps

Here is a detailed guide with advice when it comes to starting with your first investment.

- The first stage is to identify the ideal location—if your location is excellent, your best investment property will provide a decent and consistent return on investment.

- You should get information from local real estate brokers and investors before embarking on this adventure. Always seek the advice of real estate specialists if you have any doubts. It is all about constant learning in real estate.

- You should keep looking for off-market bargain houses and be familiar with the chosen home market. Real estate investing is a risky endeavor.

- Learn about the dangers associated with real estate transactions. Every type of transaction comes with some level of risk. Rental apartments need maintenance and upkeep, and delinquent renters may necessitate eviction.

- Don’t just buy the first rental property you come across. Find various investment properties and then decide which best meets your investing objectives.

Related: Should Investors Work With Real Estate Agents Near Me?

Learn How to Easily Assess a Property With Mashvisor

Mashvisor is among the best online real estate apps that use advanced algorithms and artificial intelligence technologies to help you identify profitable real estate assets in any market in the US. It is one of the best apps for investors seeking homes and properties that meet their financial and investment objectives.

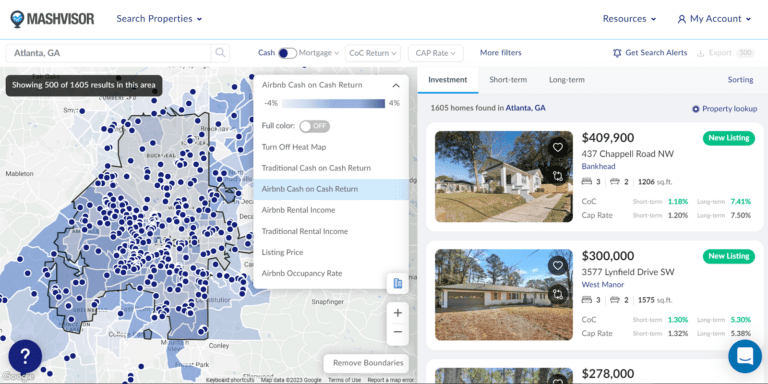

Making Use of the Heatmap Tool

Mashvisor apps will assist you in conducting an in-depth neighborhood study. Our heatmap tool provides you with appropriate visual cues and vital information. You can use the heatmap to assess distinct neighborhoods in a given city using the following criteria:

- Listing price

- Cash on cash return

- Rental income

- Occupancy rate

The real estate heatmap can help you swiftly filter down a city’s many neighborhoods to just a few top picks. Additionally, Mashvisor apps recognize the need to continue conducting local research. As a result, we offer in-depth neighborhood analyses for every location of the US housing market.

You can use Mashvisor to conduct an in-depth neighborhood study and identify potentially lucrative properties based on their listing price, cash on cash return, rental income, and occupancy rate.

How to Invest in Real Estate: Second Five Learning Steps

We now move to essential investing steps so you can easily find the best way to maximize your future revenue.

- You must learn to understand the tax breaks for real estate investors since they will benefit you in the long term. Engage the services of an accountant to help you with the time-consuming chore of dealing with complex property taxes and deductions.

- When acquiring an investment property, investigate all available sources, seek the best markets, and contact nearby real estate investors.

- Examine your credit score and ability to fund real estate ventures regularly. You must also choose a competent bank and the best loan broker to be a successful real estate investor.

- Understand your market and learn about the prevailing real estate conditions. The best investors develop a large real estate network of sellers, buyers, professionals, and anyone interested in real estate investing.

- Real estate investment clubs provide educational materials, mentors, and networking opportunities. Join at least one local real estate investment group. A real estate investment club may be valuable for learning, purchasing, and selling property.

How to Invest in Real Estate: Last Five Steps

The following last five pieces of advice may help you determine what you should or shouldn’t do while on your investing journey.

- Conduct an adequate screening procedure with renters in the case of rental property investment.

- Investment in real estate is a business. Begin by creating a solid business plan that covers the specifics of starting and running your real estate investing business and realistic goals.

- Begin with single family houses and work your way up to duplexes or fourplexes, and ultimately apartment complexes as your cash flow and equity grow.

- You should choose a reputable and dependable real estate attorney to get the best assistance. A lawyer can help you comprehend complex real estate legislation.

- Try using the best online real estate apps to ease your research work and turn an analysis that usually takes seven days into a 15-minute process.

How Mashvisor Can Help

Mashvisor’s home pricing and long term rental pricing statistics are sourced from the most well-known sites and the MLS. It examines millions of variables to create a price index that displays average pricing throughout the US and may be sorted by state, county, or city.

In addition to the data sources mentioned above, Mashvisor apps provide statistics on short term rentals, such as Airbnb occupancy data and average rental income on the site. All of the information comes straight from Airbnb and is strictly accurate.

It allows an investor to compare revenue from long term rentals versus income from short term rentals before deciding which path to take.

Mashvisor goes above and beyond other rental data sites by providing rental comps for all areas of the US. It automatically calculates critical indicators such as cap rate, cash on cash return, and rental income. The best part is that the investor does not need to deal with data analytics that much.

For each house posted for sale, all data for both short term and long term rentals are displayed. It’s fully linked with the listing network, allowing customers to find houses worth investing in more quickly. When exploring, they may even add a heatmap filter to the map to find locations with higher rental income.

Are you ready to start your real estate investment journey? Get a 7-day free trial from Mashvisor and take your investing to the next level.

Conclusion

When the real estate market starts to recover, real estate investment becomes an even more appealing concept—either as a career or as a lucrative side job. However, like every work, there is a right and wrong approach.

It is not simple to achieve success in real estate investment. Being fortunate with one investment does not equate to being a successful real estate investor. The best way to grow into a successful investor is to learn from and follow in the footsteps of other great real estate investors.

Contrary to popular belief, now is a good time to purchase a home. Do your research, and don’t be frightened to invest in real estate during a downturn.

Importantly, you should utilize the Mashvisor platform to locate profitable rental homes and thoroughly analyze areas and property.

Schedule a demo today to explore how Mashvisor can assist you with your investing journey.