As we enter the first month of the new year, plenty of homebuyers and real estate investors are keeping an eye on the January 2023 mortgage rates.

2022 ended with a 6.57% mortgage rate on a 30-year fixed loan, as of December 28, 2022. The mortgage rates for a 15-year fixed-rate loan averaged 5.93%, while the 5/1 ARM was at 5.45%.

According to Bankrate, the mortgage rates for January 2023 at the time of writing this are:

- 30-year fixed-rate mortgage rate: 6.42%

- 15-year fixed-rate mortgage rate: 5.86%

- 5/1 ARM mortgage rate: 5.52%

- 30-year jumbo mortgage rate: 6.38%

Generally, mortgage rates are slightly lower from a week ago. The rates for fixed-rate and jumbo mortgages went down while adjustable-rate mortgages rose a bit.

For those unaware, mortgage rates went on a wild roller coaster ride last year. Predictions and forecasts for 2022 were that the year would end with mortgage rates hitting 5.00%. The figure was nearly double the rates in 2021, as we experienced historic low rates back then.

However, the Eastern European conflict emerged as the unexpected left hook that stunned everyone and became the catalyst for high global inflation rates that affected nearly everything. The real estate market was not immune to the global upheaval. We saw rising interest rates as the Federal Reserve took an aggressive stance against inflation.

Bankrate’s chief financial analyst, Greg McBride, said:

“The speed with which mortgage rates have increased in recent months has been whiplash-inducing and the cumulative effect — from near 3 percent at the beginning of the year to near 7 percent now — would’ve seemed laughably unlikely at the beginning of the year.”

Related: How to Get the Best Mortgage Rate for Investment Property in 2023

How the Market Has Reacted in the Last Month

Because of high-interest rates, we saw a significant decrease in home sales as the year 2022 ended. We published a report last week about how November 2022 home sales went down 7.7% for the tenth consecutive month. High mortgage rates are one of the leading causes of the said downward home sales trend.

On top of higher mortgage rates, another culprit for the decline in home sales in 2022 was high inflation.

In its quest to battle the current high inflation rate, the Fed raised rates again in its November meeting. The Fed’s latest move brought it to a total of seven federal funds rate increases in 2022.

Finance and business experts and analysts are divided on what to expect in 2023. Some say that several more rate increases are coming our way in 2023, and it might even hit 8%. Others say that things will start to stabilize, citing the expected impact of the past hikes in 2022. Still, others anticipate that the Fed will most likely pull back towards the year’s end.

And because it is wintertime, we anticipate seeing another month added to the downward sales trend as the December 2022 report comes out. Historically, winter is a downtime in real estate where seller premium drops to an average of 7.9%.

The winter slowdown makes it an ideal time to buy property because of lower asking prices. Ironically, because of high-interest rates, many potential homebuyers and real estate investors are putting their plans on hold for the time being.

Some of those who can still afford high mortgage rates over the loan’s full term still went ahead and purchased investment properties. However, the majority prefer to let things subside and stabilize.

What to Expect from the Real Estate Market in 2023

As the Fed continues in its fight against inflation, people fear the economy will enter into another recession. Such economic uncertainty plays a huge role in the decline in mortgage demand. While it’s still a toss-up from where we’re at right now, housing affordability is still a major concern among potential buyers.

Even if property prices are going down at present, mortgage rates are still high enough to make potential investors and buyers stay still at this time. Redfin analysts anticipate median property prices to drop 4% early in the year. While it is far from a housing market crash, it clearly indicates that we will see housing price growth stabilize for the time being.

Those waiting for home prices to drop will probably need to wait a bit longer, at least until mortgage rates stabilize. It’s already financially challenging to buy a property, but to see high mortgage rates associated with it as well as crazy inflation rates? You know what we mean.

Affordable housing goes beyond just property prices. It is also related to mortgage rates and the cost of living in the area. And since we’re still in recovery mode moving forward from a pandemic, financial stability is still something a lot of people are worried about and working on.

Related: What Is Housing Inflation Storm and Why Should Real Estate Investors Care?

What This Means for Real Estate Investors

At this point, given that a lot of markets are cooling down, the high interest rates are turning off a lot of investors from purchasing income properties for sale. However, it doesn’t mean they should not take advantage of a lucrative investment opportunity.

When an investment opportunity comes, we still recommend that investors do some research and analysis. It is the best way to gauge whether an investment property is worth buying or not. As a rule of thumb, everyone who plans on going into real estate investing should be willing to do the legwork and not just rely on everything they see and hear.

While keeping your eyes and ears open is great, you should also be willing to get your hands dirty and do some work. Each real estate market has something unique to offer investors, depending on the investment strategy they decide to employ. One market may be lucrative for rental properties but may not do as well for fix-and-flips.

Related: How to Sell Your Fix and Flip Property Quickly

Do Your Homework

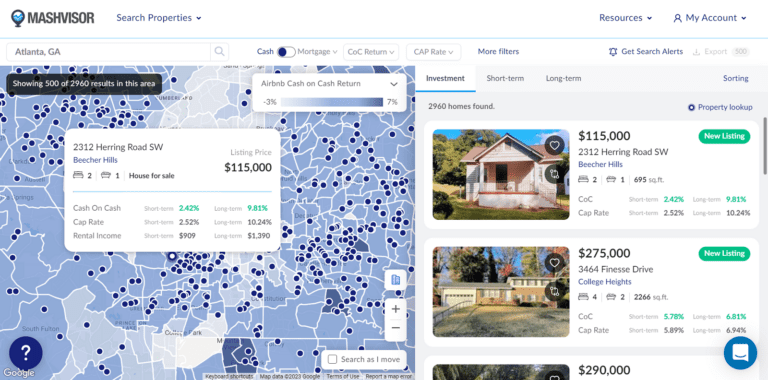

It is why due diligence should never be underestimated and neglected. For this reason, a real estate platform like Mashvisor comes in really handy. Mashvisor is a real estate website that specializes in helping people find the right investment properties in the most profitable markets that align with their goals.

Because Mashvisor has a massive real estate database that is regularly updated, investors have an easier time with research and analysis. What typically takes months to do only takes minutes with Mashvisor.

The platform provides handy tools that make investment property analysis a breeze. Tools like the Property Search tool, real estate heatmap, and investment property calculator help users come up with accurate and realistic numbers for ROI projections. Additionally, the said tools will point you in the direction of the best deals in any market of your choice.

If you’re keen on investing in real estate this year, we highly recommend working with Mashvisor to get you started right. As an investor, you will appreciate how the site can help you spot properties with the best cash on cash return rates that will give you a positive cash flow every month, even with the current mortgage and inflation rates.

Mashvisor’s real estate heatmap, along with its investment property calculator, provides accurate and realistic numbers for ROI estimates.

Wrapping It Up

Despite the uncertainty we’re facing with mortgage and inflation rates, as well as rising housing prices, it is still possible to get into real estate investing in 2023 as long as you do it with a plan. The best way to go about it is to work with a platform like Mashvisor to give you better chances of real estate investing success.

Get started on your 7-day free trial with Mashvisor today on your way to a thriving real estate investing career.