Mashvisor will help you make a well-calculated decision about whether to invest in stocks or real estate in 2023 with this thorough guide.

Table of Contents

- The Stock Market in 2023

- Benefits and Risks of Investing in Stocks in 2023

- The Housing Market in 2023

- Benefits and Risks of Investing in Real Estate in 2023

- Investing in Real Estate? Use This Tool to Help You Succeed

Investing is an effective way of obtaining profit; we are sure you’re aware of that. What most people struggle with is deciding where to invest their money.

On the one hand, we have the US housing market—and a growing interest in real estate as an investment opportunity. Whether the focus is on long or short term rentals, this business venture certainly proved to be fruitful for many investors.

But on the other hand, we have investing in stocks, which has also captured the attention of US investors and financial experts alike. And even though the process is not necessarily the same as real estate, it still brings profit.

And with that in mind, the question remains:

Should you invest in stocks or in real estate in 2023?

This complex issue requires thorough analysis, thoughtfulness, and consideration of various factors.

We’re now in the year 2023—and it is high time you made investment plans for the year ahead.

Luckily, Mashvisor has gone the extra mile to simplify your decision.

By the end of this guide, you will hopefully have a clearer understanding of both investment opportunities. This should help you be one step closer to deciding if you should invest in real estate or in stocks.

The Stock Market in 2023

When looking at the state of the stock market, one thing is certain:

Interest rates will likely rise a bit more in 2023.

The inflation has had devastating consequences in 2022, but what interests investors on the stock market the most is:

Has the stock market hit rock bottom—or will it emerge from inflation in 2023?

It’s not the news you were expecting as someone who’s trying to decide whether to invest in stocks or real estate, but:

The high-interest rates that we’ve seen throughout 2022 are bad news for stock prices.

These high stock prices increased the cost of capital, automatically discouraging companies from borrowing and investing to expand their businesses.

That does not translate into a full-blown crash for stock investors, though. It merely suggests that the largest banks will prioritize staying afloat in the year ahead.

So, it’s not going to be a stock apocalypse, but rather a “micro recession.”

There’s a silver lining for stock investors here, though:

The S&P 500 index is expected to reach 4,200 points by the end of 2023—which would be a bump of about 8%.

After hearing the good news, you might ask yourself, “Should I Invest 100k in stocks?”

If you’re the type of investor that prefers a hands-on approach, then investing 100k in mutual funds and EFTs should be your main route.

EFTs follow the above-mentioned S&P 500 index, while mutual funds are a carefully composed portfolio of stocks—either way, it’s a great idea to place your money in a safe spot.

Financial services companies predict that we might be in for a bumpy ride—but holding tight and being patient will pay off for long-term investors in 2023.

Read Also: Conducting Accurate Airbnb Rental Market Analysis in 7 Steps

Benefits and Risks of Investing in Stocks in 2023

Now that you are familiar with the stock market forecast for 2023, it’s time to look at investing in stocks a bit closer—and evaluate the risks and benefits of this type of investment.

The Pros

Let’s look at the advantages of investing in stocks:

Taking Advantage of Economic Growth

As the economic situation improves, so do corporate earnings. So, with that in mind, the first advantage of investing in stocks is taking full advantage of economic growth.

This growth is responsible for creating more jobs—automatically contributing to more income and, ultimately, sales. The “fatter” the paycheck at the end of the month, the more significant the consumer demand.

That is wonderful news for stock investors who got lucky enough to invest in companies with exceptional performance.

Even more so, it also does wonders for the companies because it drives more revenues into their cash registers.

So, if you’ve got your eye on a company that is performing exceptionally well at the moment, consider investing in stocks, as they have yielded a generous annualized return.

Easy Purchase

One of the key advantages—and the difference between stock and real estate investing—is that stocks are more accessible to the potential investor, and the process of buying stocks is much shorter and to the point.

If you are interested, you can purchase stocks through a broker, a financial planner—or even online. Just set up an account, and the stock purchase will be complete within minutes.

Small business owners even have the option to invest in stocks through their business—as a business entity, that is.

You Might Also Like: How To Find Vacation Homes for Sale To Rent Out

Liquidity

The stock’s liquidity, by definition, refers to how quickly stock shares can be bought and sold without impacting the stock price substantially.

The good thing is that the stock market allows investors to sell their stock at any time. Due to this, economists and other financial experts will typically make use of the term “liquid” when referring to stocks.

That essentially means that you get to turn your shares into cash relatively quickly—and with low transaction costs.

The Cons

And now, for the potential disadvantages:

Losing Your Investment

One thing to keep in mind when deciding whether to invest in stocks or real estate would be the potential losses. The truth is that stock investors could be in danger of losing their entire investment.

How does this happen?

Remember what we said about looking for companies that have shown outstanding financial performance? Well, that is the best-case scenario—but in the stock world, it’s not always like that.

Unfortunately, if a company does poorly, investors will likely sell—which will, in turn, have the stock prices plummeting. And when that happens, you, as a stock investor, will probably lose a chunk of your initial investment.

Unstable Prices

Investing in stocks can be a real-life emotional rollercoaster at times, and it definitely isn’t for everyone.

And as you could’ve guessed, stock prices are the main reason for that.

Stock prices are known to rise and fall in a matter of seconds, which creates huge confusion among investors—especially newbies.

Stock investors are likely to make impulsive decisions and rush to buy high out of greed and sell low out of fear. It’s definitely a stressful venture, and it could influence you in the long run and, quite possibly, put your profits in danger.

The Danger of Being Paid Last

This does not apply to preferred stockholders, bondholders, and creditors. These people will get paid first in the event of a company going bankrupt.

If you are a common stockholder, however, you may have to wait longer to get paid, which is fine—as long as money is not your absolute priority.

The Housing Market in 2023

Slowly but surely, we’re one step closer to answering the question, “Is it better to invest in stocks or real estate in 2023?”

Now that we’ve covered your first option—stocks—it is time to look at investing in real estate and everything that this business venture entails.

As with stocks, in order for you to be 100% knowledgeable on the matter, the first step you’ll need to take is to look at the picture from a larger angle—that is, the housing market forecast for 2023.

Home sales will remain muted. With 85% of homeowners paying mortgage rates below 5%, they will likely delay moving until the rates retreat below 5% or at least until the prices adjust.

While we’re at it, we’d like to clear the air about the real estate investors’ worst nightmare:

The 2008/9 crisis won’t happen again.

However, there’s certainly plenty of concern surrounding those markets in which the housing demand, prices, and rent rates have jumped to levels that are, in a sense, detached from the local incomes.

And since we are here to help you decide whether to invest in stocks or real estate, we feel it is important to note the following:

Inflation is now stronger than ever—and it doesn’t plan on slowing down soon.

Lawrence Yun, a Chief Economist for the National Association of Realtors, has a bright view about 2023. She believes that in 2023, more than 4.8 million existing homes will be sold and that the prices will remain stable.

She also believes that Atlanta will be the top real estate market in the year ahead.

Additionally, her forecast mentions the sales declining by 6.8%—compared to 2022—and the median home price reaching $385,800, which is a 0.3% increase.

We’ll have to wait to see which of these predictions come true, though.

Read Also: How To Find the Best Vacation Rentals for Sale

Benefits and Risks of Investing in Real Estate in 2023

Now that you have some insights into how the real estate market might perform in 2023, we can take a moment to evaluate the potential benefits—and risks—of this kind of investment.

The goal, again, is to encourage you to weigh your options before deciding whether to invest in stocks or real estate.

The Pros

As with stocks, we’d like to start with some notable benefits of investing in real estate:

Real Estate Appreciation

By definition, real estate appreciation refers to your property’s increased value over a certain period. Historically, homes in the US tend to appreciate 2–3% per year on average.

That is why location is a crucial factor to consider when investing in real estate.

A well-chosen location for investing in real estate ensures that the property’s value continues to appreciate over time and does so at a rate that will outpace annual inflation.

As you can imagine, that’s the ideal scenario for the real estate investor. It is actually the real estate equivalent of the stock market mantra that goes:

Buy low and sell high.

Stocks may go down to zero in value, but a real estate property will always retain some value. And if you made the wise choice to buy real estate in a booming market, the potential for appreciation goes up even more.

Steady Cash Flow

One of the main benefits that make investors turn to real estate is that properties can provide them with a steady flow of monthly income—also referred to as “cash flow.”

By definition, cash flow in real estate refers to the money you are left with after deducting the expenses from your income on a monthly basis.

Here’s another thing to consider:

Since this is mainly passive income, real estate investors can spend more time on other ventures—like building another profitable business or reinvesting in more real estate.

Unique Tax Benefits

When it comes to real estate, tax benefits can be a double-edged sword. But in this segment, we will look at real estate taxes from the positive side.

The benefits associated with real estate taxes allow real estate investors to grow their wealth over time. Real estate investors actually enjoy numerous benefits, such as lower tax rates on long-term profits.

And to add to it, your rental income will not be subject to self-employment tax.

There is a chance that your rental property will also save you money through tax deductions, which typically apply to the expenses related to maintaining and managing your property.

The Cons

And now—the potential downsides real estate investors should be aware of:

Need for Financial Power

In real estate, the golden rule is:

You need to have money to make money.

But how much do you need? Would 100k be enough?

It’s enough to get you started, for sure. With this amount of money in your account, you could start thinking about rental apartments and single-family homes, for example—but don’t get ahead of yourself.

It is not necessary to have an in-depth understanding of real estate to know that this industry requires you to have some financial power. That is a prerequisite for someone to get into the housing market and achieve their goals.

Here’s what we mean:

In order to get started in real estate investing, you will have to apply for a mortgage, make a down payment, and have cash set aside for the necessary repairs or potential renovation of your property.

But that doesn’t stop there.

After you are done with the so-called “initial payments,” you will have to deal with property taxes, insurance, mortgage payments, and property management and maintenance.

It can be a lot to deal with financially, that’s for sure.

Time-Consuming

Whether you are investing in long or short term rentals, one thing is certain when it comes to real estate—and it’s that this business can be pretty time-consuming.

It is important for newcomers who believe that it is easy to navigate the real estate market by just being familiar with the basics to realize that that’s not even remotely close to the truth.

As a real estate investor, you will spend quite a bit of your time learning about and managing real estate investments and plans.

You will need to review investment portfolios, educate yourself on the current market climate, and above all, participate in managing your rental properties.

Getting Overleveraged

Another thing that could negatively impact your investment is getting “overleveraged.”

What does this mean?

Well, in essence, it means that despite the market crisis, inflation, and other dangers lurking behind the corner, real estate investors must still be able to stay afloat financially and pay all their obligations.

In simple terms:

You don’t want to end up in so much debt that you’re unable to pay it back.

After going over the advantages and disadvantages of these two investment options, we can conclude that real estate investing will be a promising venture in 2023. And, if you’re on the fence about whether to invest in stocks or real estate, that’s something to keep in mind.

However, relying on information that you pull from different sources and the word of mouth of other investors will be nowhere near enough to ensure long-term profits.

You need accuracy—and Mashvisor’s tool ensures that.

Mashvisor is a platform designed to help real estate investors find and analyze the potential of different housing markets and properties before making a purchase. It’s also referred to as a rental property calculator.

Our calculator relies on access to nationwide real estate data—as well as AI and machine learning algorithms—which is a must if you hope to land profitable deals in this industry.

With Mashvisor, you get access to the following features:

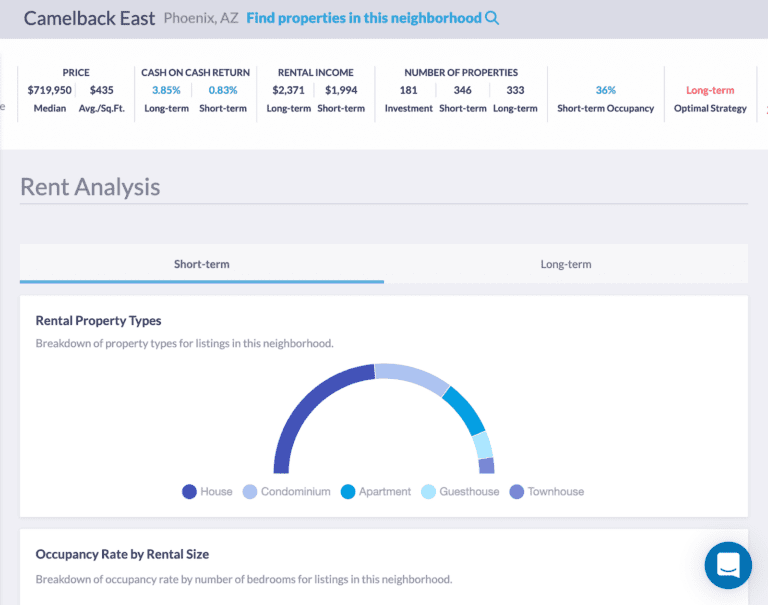

Neighborhood Analysis

Once you have identified the top-performing neighborhoods that fit your investment strategy, Mashvisor’s calculator allows you to analyze the neighborhoods more thoroughly.

The calculator provides the following data:

- Mashmeter score

- Median stories

- Average price per square foot

- Average rental income

- Average cash on cash return (short and long-term rental)

- Average short term rental occupancy rate

- Optimal rental strategy

- Optimal property type

- Number of listings for sale

- Number of active rentals (short and long term rental)

- Walk Score

- Transit Score

- Bike Score

- Real estate comps

Mashvisor’s Neighborhood Analysis

Real Estate Heatmap

If you want to devote yourself to in-depth neighborhood analysis, the best way to do that is to use Mashvisor’s real estate heatmap.

The heatmap tool is color-coded to display the performance of neighborhoods in your desired market based on several metrics, including:

- Listing price

- Rental income (short and long term rentals)

- Cash on cash return (short and long term rentals)

- Short term rental occupancy rate

Investment Property Analysis

Once you’ve pinned down the most lucrative neighborhood, the next step is finding an actual investment property.

That’s not an easy process, though. It requires analyzing multiple property listings to find one that fits your budget and your investment goals.

Mashvisor allows you to simplify the process and pin down the investment property by using Mashvisor’s Property Finder. This is an advanced tool that scours up to 10 cities of your choice and provides you with a list of properties that match your exact search criteria.

Check Out Also: The Millennial’s Guide to Building a Rental Property Portfolio

Rental Income

Mashvisor also has a rental income calculator. This tool provides accurate rental income estimates based on the current and historical performance of long term and short term rental comps.

Start your investing journey today—and make use of the real estate industry’s leading analytics—by subscribing to Mashvisor now.

The Final Verdict

We have successfully covered the topic of whether to invest in stocks or real estate. And after analyzing both investment opportunities and relying on up-to-date data about the stock and housing markets, here’s what we’ve been able to deduct:

Investing in stocks is a lucrative investment opportunity, as it can provide the investor with a generous annual income. However, the stock market has been struggling with high-interest rates throughout 2022—a trend that’s likely to continue in 2023.

Although investing in stocks is simple, ensures liquidity, and allows you to take advantage of economic growth, it can also be risky due to unstable prices. And you might be in danger of losing your investment.

Meanwhile, the real estate market is doing its best to stay afloat. Despite the inflation hitting hard, there are still many lucrative investment properties in the US housing market.

With that in mind, it’s evident that investing in real estate entails home appreciation, a steady cash flow, and great tax benefits. That said, you should still be wary of getting overleveraged and not having enough time—or cash—to start your investment journey.

Mashvisor’s tool is here to help real estate investors in their ventures and provide up-to-date and accurate information on anything and everything related to the housing market.

For prospective investors, Mashvisor offers a free inquiry. If you wish to know more, you can schedule an appointment and get in touch with one of our product specialists to get an informed introduction.