Rising mortgage rates can significantly affect investor home purchases. As mortgage rates go up, investors are slowly dropping out of the market.

The continuous increase in rates can cause property prices to also go down, albeit at a slower pace. Real estate investors, as well as those interested in going into real estate investing, are putting their investment plans on hold. It seemed to be the case for Q3 2022.

According to one of CNBC’s recent “Squawk on the Street” episodes, investment property purchases dropped by 30% year-over-year. CNBC’s senior real estate correspondent Diana Olick confirmed that overall sales were dropping fast due to rising rates. Olick said:

“While investors don’t always use mortgages, they certainly don’t want to get into a market where prices are weakening.”

Redfin puts the drop in investor home purchases at 30.2% compared to the same period last year. The figure, said Olick, is the biggest decline since the housing market crash, not counting the brief pause at the pandemic’s onset.

Interestingly enough, Olick adds that the fall in investor home purchases outpaces the decrease in the overall market, where sales went down by about 27%. In the same breath, the overall share of investor home purchases also fell down to 17.5% year-over-year from 18.2% previously. Investors who are still in the market are paying an additional 6.4% compared to a year ago.

The following markets experienced some of the biggest year-over-year declines in investor home purchases:

- Phoenix, AZ: -49%

- Portland, OR: -47%

- Las Vegas, NV: -45%

- Sacramento, CA: -43%

- Atlanta, GA: -42%

- Charlotte, NC: – 42%

- Miami, FL: -38%

The above markets were the hottest ones during the pandemic but are now seeing huge declines in sales and property prices.

Related: When Will Mortgage Rates Go Down in 2022?

3 Reasons Investors Are Not Buying New Properties

A lot of folks buy investment properties because they want to add another income stream so they can earn more. But the thing is, with the state of the 2022 US housing market, buying an investment property might not be such a good thing, at least for the time being.

Since CNBC’s report stated that investors are dropping out of the market for now, what could be the probable causes of the decline in investor interest? Here are three of them:

1. Rising Mortgage Rates

According to the report, the surge in mortgage rates is one of the main reasons why a lot of investors are opting to put their investment plans on hold for now. Due to inflation’s continuous upward movement, the Federal Reserve raised interest rates several times this year to help mitigate the effects of rising prices.

The Fed jacked up interest rates in hopes of tempering consumer demand for goods and services. This way, spending – and, more importantly, borrowing – is more controlled since it is now more expensive to borrow money. It includes all forms of borrowing, like credit card purchases and home mortgages.

Many first-time investors dove into the real estate market at the height of the pandemic due to historically low interest rates and lower property prices. However, this year, we’ve seen both mortgage rates and property prices go on a wild roller coaster ride.

Experts and analysts initially predicted that we would see 2022 end with mortgage rates at 5.00%, but the Eastern European conflict was something they failed to take into account. The Russia-Ukraine conflict sent things spiraling down and caused rates and inflation to go up.

2. Weakening Real Estate Markets

Another thing that was mentioned in CNBC’s report was the weakening real estate markets. As we already wrote earlier, investors get into real estate investing to make some money. However, with a lot of local markets cooling down, investors aren’t entirely confident in investing their hard-earned money to get so-so returns.

As a real estate investor, your goal is to optimize your investment and ensure you get a good return on investment regardless if you took out a loan or paid in cold cash for a home. With a lot of markets seeing drops in property prices, it kind of defeats the purpose of buying an investment property at this time.

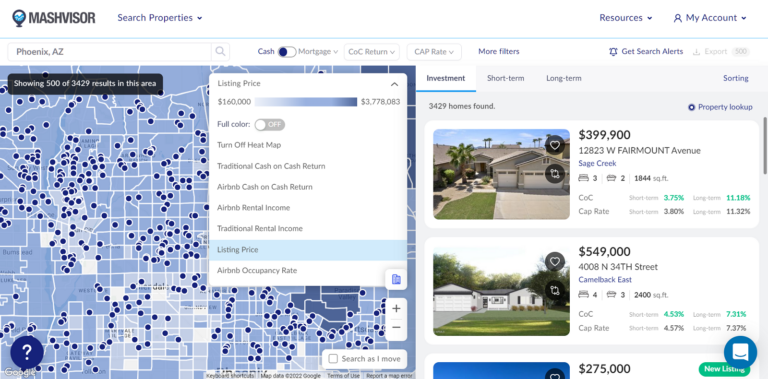

We listed down seven cities that suffered significant declines in investor home purchases in Q3 2022. We went over Mashvisor’s end-November 2022 location report to see what the present median property prices are for the said locations. For comparison’s sake, we also included their numbers for June 2022.

1. Phoenix, AZ

- June 2022: $664,937

- November 2022: $571,437

2. Portland, OR

- June 2022: $683,088

- November 2022: $578,667

3. Las Vegas, NV

- June 2022: $587,395

- November 2022: $534,202

4. Sacramento, CA

- June 2022: $719,826

- November 2022: $487,049

5. Atlanta, GA

- June 2022: $618,119

- November 2022: $528,153

6. Charlotte, NC

- June 2022: $562,498

- November 2022: $489,191

7. Miami, FL

- June 2022: $1,000,790

- November 2022: $854,001

Learn more about how Mashvisor can help you look for and analyze the best investment properties in any city and neighborhood of your choice.

3. Inflation

Perhaps one of the most obvious reasons why investors choose to hold on to their investing money at present is inflation. Inflation hit the 7.00% mark in December 2021 to usher in 2022. When the geopolitical conflict in Eastern Europe broke out, the rate of inflation went from February 2022’s 7.87% to a whopping 8.54% in March.

Inflation seemed to peak in June, going as high as 9.06%. Since then, it’s been cooling down a bit. The October 2022 inflation rate ended at 7.75%, the lowest since January.

Inflation rates affect real estate investors because, like everyone else, they also need to spend on other goods and services that may or may not be related to their investment properties. What could have easily gone into their investment funds is now being eaten by their daily expenses as the costs of goods and services go up.

Related: Homebuilders Expecting Downturn in the Real Estate Market in 2023

Is It Still Safe to Invest in Real Estate Now?

Given the current situation we’re facing right now, a lot of people are asking if it is still safe to go into real estate investing at this time.

The Strategy Matters

The answer is it depends. It depends on how you plan to go about your investment property purchase. As mentioned earlier, one of the reasons why investors are holding off on home purchases is the weakening market. It directly applies to investors who are into house flipping.

Real estate investors whose strategy mainly revolves around fix-and-flips are faced with the dilemma of whether or not to continue investing or temporarily stop following the decline in property values. It takes a lot of money to purchase a home, remodel and update it, and market it.

Given the drop in property prices today, they might end up at a great loss. Breaking even might even be considered good luck at this point.

However, if you’re in the market for rental properties, you’re somehow still better off than house flippers. Rental property owners who plan to sell their homes can eventually hold on to their properties until the market improves.

Next, rental rates are also going up as prices of goods and services increase. Rental property owners can adjust their rates accordingly (and reasonably) to sustain their property and keep their business going, regardless if it’s a long term rental or a vacation rental.

Lastly, rental property owners get to enjoy a steady income source as long as they keep their vacancy rates to a minimum. It beats waiting for a buyer to take interest in a property you’re selling. Not many people are in the market to buy homes at this time, given the high mortgage rates and inflation.

Rental property investment is the way to go if you’re seriously considering getting into real estate investing at present.

Related: How to Find Profitable Rental Investment Properties for Sale

You can use a real estate platform like Mashvisor to find profitable investment properties, despite the prevailing inflation.

Wrapping It Up

The bottom line is investor home purchases may be down at this time, but it doesn’t necessarily mean that real estate isn’t a good investment now. It is still one of the most profitable investments, even with inflation around.

To make sure you find the right investment properties that offer high ROI, use a platform like Mashvisor to locate and analyze potential rental property investments.

To get access to our real estate investment tools, sign up for a 7-day free trial of Mashvisor today, followed by a 15% discount for life.