[ad_1]

Are you wondering how data reshaping real estate is helping investors in 2023 and beyond? Keep reading to see how you can access reliable data.

Technology continues to reshape the real estate industry in major ways. While many people believe the real estate scene is slow to adapt to technology, the statistics prove otherwise.

Table of Contents

- 5 Challenges of Investing in Real Estate Today

- 7 Ways Real Estate Investors are Using Data to Succeed

- Where to Find Reliable Real Estate Data

- Access Reliable Real Estate Data

According to the National Association of Realtors (NAR), in 2020, 51% of all homebuyers in the US found their homes on the internet. The figure is only going to rise as millennials who are tech-savvy now form a large part of the modern market.

We are seeing a growing number of real estate PropTech platforms being launched nowadays. However, just because a random online company claims to provide reliable data doesn’t mean that it’s trustworthy. Investors must choose their data sources carefully.

Today, we’re going to look at why real estate data is important in investors’ lives and how it enhances their investing experience and expectations. Since we want you to succeed, we’re also going to talk about one important source of data for all your real estate investing needs.

But first, let’s look at some of the obstacles that many real estate investors face today.

5 Challenges of Investing in Real Estate Today

To understand the importance of data reshaping real estate industry, we first need to look at the challenges investors face today.

1. Market Volatility

Market volatility is arguably the predominant challenge investors face today. Markets change depending on global and economic conditions. Geopolitics specifically changes the market situation drastically since these trends can poorly affect markets and economies.

Most investments require you to dedicate one to five years to pay off. Some can go up to two decades. Geopolitics can greatly interfere with your investment.

A more recent example of the causes of market volatility is the COVID-19 pandemic.

As an investor, your strategy matters a lot when it comes to these situations. Your strategy needs to be modified to adapt to the changing market needs. Data analytics help in a great way since you can accurately predict future scenarios depending on the condition.

2. Negative Cash Flow

Cash flow refers to the amount of money you’re left with from your revenue once you take away all property and business expenses. A negative cash flow means that more money is going out than coming in. It is disadvantageous and is one of the most common killers of businesses and investments.

Different factors can lead to negative cash flow. They include flawed rental strategies, low occupancy rates, and high vacancy rates.

The best solution for negative cash flow is to run a comprehensive analysis of an investment property before investing. Assess the risks that come with investing in that specific property and neighborhood, and also choose an ideal rental strategy.

Related: 3 Tips to Avoid Negative Cash Flow with Rental Property

3. Increased Liability

Liability keeps increasing by the day. Regulators keep introducing legislation for property managers and operators. Such laws and regulations can significantly slow down the investing process.

Also, delays can sometimes be costly for real estate investors, especially if they’re working under tight guidelines.

4. Low Inventory

Limited inventory also affects real estate investors. Remember, the population is growing and the demand is rising too. When the supply can’t satisfy the demand, the market becomes competitive and home prices rise. Such things make it hard for investors to find properties that can give them good profits.

Limited inventory greatly affects investors who rely on one investment strategy, such as fix and flip. You can go around the issue by investing in areas with more inventory. You can also invest in areas where new inventory keeps coming up regularly.

5. Choosing the Best Rental Strategy

When it comes to rental strategies, long term and short term rental properties aren’t equal. One of the most important decisions you’ll make as a real estate investor is choosing the best rental strategy for your investment.

Unfortunately, there just aren’t enough platforms or resources available online to inform investors’ decisions on rental strategies. Most platforms either focus on long term rentals or short term properties alone.

You can only choose the best strategy when you can access a platform that provides you with comprehensive data. You need to be able to access the key property metrics, such as cash flow and return on investment, for both strategies to carry out a side-by-side comparison.

7 Ways Real Estate Investors are Using Data to Succeed

In today’s digital and automated world, any business that chooses to operate without data analytics is committing a grave mistake. Real estate investments are especially tied up to a lot of money. It is why data analytics should be the backbone of your investments.

For starters, data analytics refers to gathering statistics in a particular way for market predictions, motivations, and decisions. Data is mainly collected from government or private records, social media, census figures, and business and consumer surveys.

That said, here are seven ways in which data reshaping real estate industry is helping investors:

1. Property Pricing

Data analytics is the key to correct pricing. The said benefit of data in real estate spreads across multiple real estate industry players.

Buyers and sellers need to know the market they’re operating in so that they can make effective business decisions. On the other hand, real estate agents need data analytics to advise their clients on the best investment decisions to make.

Also, data analytics in property pricing isn’t limited to buying and selling only. All aspects of real estate need data analytics, including the pricing of services, the pricing of building materials, rental prices, and property taxes.

Data analytics are the only way to get in-depth market and property information to inform your pricing decisions.

2. Location Analysis

Investors need a lot of location data while investing in a specific property. They need to understand the historic property and rent prices, as well as what market trends to expect. As you can tell, manually gathering the data can be time- and energy-consuming.

Data analytics put you one step ahead of your competition by providing you with all location-specific metrics to help you pick the right location for investing. Data shows you what’s trending in your location and also gives you access to historical data.

To gain a comprehensive insight into a location, real estate professionals must dive into complex data about what’s hot and what’s not hot in the location, what particular areas in the location are selling faster, and what areas are dormant.

Data analytics gives you access to all the above metrics plus much more, such as crime rates, traffic congestion, proximity to amenities, school ratings, and general life quality.

3. Faster and Accurate Appraisals

Getting an appraisal is an essential step for anyone looking to purchase a property through a loan or mortgage. It’s also essential when obtaining property insurance for your home.

For starters, an appraisal is a process used to estimate the fair market value of a property. In most cases, lenders hire an appraiser to get the value of a home to avoid lending more or less money to the property owner. Insurance providers also get an appraisal to calculate a property’s insurance premiums.

Regardless of whatever reason you’re getting an appraisal for, you need to do it well and ensure the results are accurate. Appraisals are guided by the current property market rates.

Data analytics handle large amounts of data. One type of data that data analytics help you analyze is real estate comps. Comparable properties give you an accurate estimation of property values.

Property owners, sellers, and buyers can use data analytics to obtain property appraisals far more quickly and accurately.

Related: What Are Real Estate Comps and Why Are They Important for Real Estate Investors?

4. Lending Demographics

Real estate investors can either pay for their investments in cash or obtain a loan or mortgage. In many cases, they follow the latter.

An investor must go through several steps before getting a mortgage. Some of the first steps include understanding what mortgage lenders are lending to who and what their interest rates are. The steps can give you a competitive edge when applying for financing.

The said benefit doesn’t only apply to real estate inventors. Agents can use it to inform their clients about the best mortgage providers depending on their financial situation. Mortgage providers, on the other hand, can use data analytics when deciding whether to lend to an investor.

5. Commercial Trends

As an investor, you can either invest in residential or commercial real estate. Commercial properties include malls, office buildings, health facilities, and any real estate that is used for business rather than living.

Commercial real estate investing is often on a larger scale than residential investing. To succeed in this type of investing, you need more in-depth insights into the current consumer market.

Data analytics allows you to analyze consumer trends and answer the following questions:

- What types of businesses exist in your local market?

- What are the local consumers’ preferences?

- Is the market large enough for a new shopping mall?

- Do diners in the market need a new restaurant?

- Is there a parking shortage to necessitate the development of a new parking facility?

Answering the above questions is an essential foundation for commercial real estate investors. Data analytics help in exactly that.

6. Competitor Analysis

Data analytics give insight and performance reviews into different types of real estate agents and businesses. You can use data analytics to understand who is selling most or who are the most trustworthy developers and contractors in your market. You can also look at the consumer ratings for different businesses and identify the public real estate businesses to invest in.

Data-driven research will help you review your own performance and compare it with your competitors. Data analytics for sales figures, consumer reviews, and profits will help you evaluate your performance and that of your competitors.

Since consumer information is made publicly available, investors and potential customers can use it to steer clear of scams and instead find reputable agents and companies.

7. Business Decisions

Data analytics are reshaping how investors make business and investment decisions.

Investors can now carry out an analysis on their target clients to understand what type of people are looking for, the type of property they own, and what their needs, tastes, and preferences are. The investors can then tailor their properties to match their client’s tastes and appeal to them.

It applies even to property developers since they can determine what projects are worth pursuing based on their target customers’ preferences. On the other hand, real estate agents can segment their target market and come up with an effective marketing strategy to communicate with them.

Where to Find Reliable Real Estate Data

Now that we’ve understood how data reshaping the real estate industry is beneficial for investors, how do you actually access reliable data?

Mashvisor is, without a doubt, the best source of reliable real estate data in 2023 and beyond. We provide accurate and reliable data and analytics for the US housing market.

Why is Mashvisor the best source of reliable real estate data? Here are a few reasons:

Helps You Locate the Best Investment Markets

Your first step in investing in real estate should be selecting a profitable market to invest in. Choosing a profitable market requires you to carry out comprehensive analyses at both city and neighborhood levels. Mashvisor helps you in both processes.

Firstly, Mashvisor’s investor blogs regularly provide updates on the best markets in the US for both long term and short term investment properties. You can easily find such resources in the Top Locations and Airbnb Rentals sections of the blog.

We rank our top cities based on several criteria, such as the highest cash on cash returns, cap rates, rental incomes, and occupancy rates. Mashvisor ensures the rankings are up-to-date by regularly carrying out nationwide market analyses using our own AI algorithms. You don’t need to worry about accuracy and reliability since we pull our data from other reliable sources.

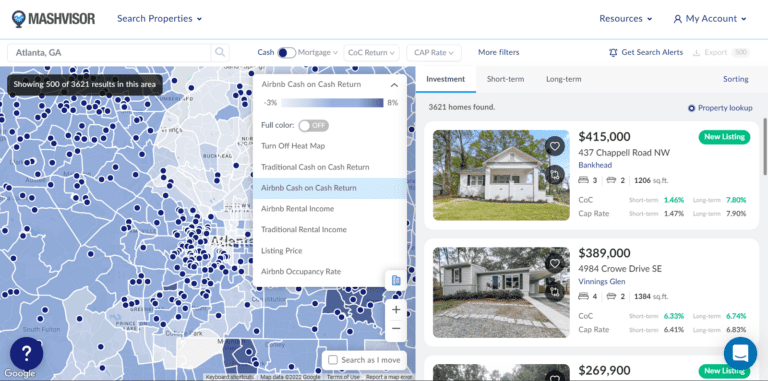

Once you’ve selected a few potential investment locations, Mashvisor provides the best tool to help you select the best long term and short term investment neighborhoods. Our real estate heatmap allows you to access trustworthy data to find suitable locations.

The heatmap tool allows you to analyze neighborhoods using the following metrics:

- Cash on cash return

- Rental income

- Listing price

- Occupancy rate

Afterward, you can now use our neighborhood analysis pages to dig deeper into your analysis and get all the metrics you need to inform your investment.

In short, Mashvisor helps you select the best market based on your financial and investment goals.

You can use Mashvisor’s real estate heatmap to analyze neighborhoods based on several property metrics, such as cash on cash return, rental income, listing price, and occupancy rate.

Helps You Spot Profitable Investment Properties

Mashvisor goes a step further and helps you access reliable data to invest in lucrative properties.

We offer an investment property search engine that allows you to search for property listings based on your requirements. There are various filters, such as budget, location, estimated income, property type, and rate of return on investment, to help you with your search for properties.

Once you’ve set your search criteria, the tool then provides you with a list of properties that match your requirements. The properties are listed by order from highest to lowest. For example, if your search criteria are based on return on investments, the properties will be ranked from the highest ROI to the lowest.

The best thing about the said tool is that it makes data available to everyone. Traditionally, MLS listings were only available to licensed realtors. Mashvisor allows you to see listings from the MLS database and off-market properties.

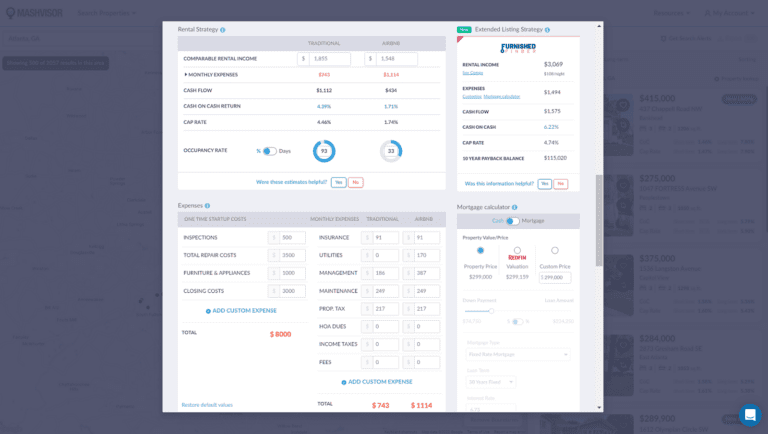

On top of that, our investment property calculator helps you carry out an in-depth analysis of any property you’re interested in. You get reliable estimates for different property metrics, such as startup costs, property expenses, rental income, occupancy rate, cash flow, cash on cash return, and cap rate.

The estimates are based on comparable properties within the same neighborhood (rental comps), so you won’t worry about reliability and accuracy.

Related: The Only Airbnb Analytics Tool You’ll Ever Need

With Mashvisor’s investment property calculator, you can perform an in-depth analysis of any property you’re interested in and obtain reliable estimates for several property metrics.

Helps You Choose the Optimal Rental Strategy

One of the main reasons why Mashvisor stands out from its competitors is that it provides you with data to choose the best rental strategy for your investment. Most online real estate platforms only focus on one rental strategy, but Mashvisor provides you with data analytics for both.

Long term and short term property investments offer different rental incomes and returns on investment, even if they’re in the same neighborhood and of the same property type. It is why it’s important not only to select a lucrative market and profitable rental property but also to choose the best rental strategy for that specific property type in that particular market.

As a comprehensive real estate data provider, Mashvisor offers you a side-by-side evaluation of the property as a long term rental and as a short term rental. In less than a minute, our investment property analysis data helps you see which rental strategy can offer you the best return on investment.

We don’t stop there. We maintain short term rental regulation pages to help you understand which cities allow non-owner-occupied Airbnb rental properties. It is an essential step in the investment process since some cities in the US don’t allow short term rentals while others strictly regulate the trade.

In most cases, you’ll need to look for government records, newspapers, and magazines to see your city’s short term rental regulations. However, it can take a lot of time. On the other hand, Mashvisor provides you with all the relevant data with just the click of a button.

Covers the Whole US Housing Market

One more thing that makes Mashvisor the best source for reliable real estate data is that it covers the entire US housing market.

Mashvisor allows you to analyze the best neighborhoods and search for lucrative investment properties in the largest cities in the US, as well as the smallest towns. It is beneficial for real estate investors since you can access profitable properties regardless of your preferences and budget.

Sign up to Mashvisor today to start your 7-day free trial and enjoy all the benefits that come with accessing reliable real estate data.

Access Reliable Real Estate Data

We’ve looked at data reshaping real estate industry in 2023 and beyond. Real estate investors today are continuously searching for reliable data to analyze and evaluate investment properties before investing.

Real estate data is helpful not only to investors but to buyers and agents as well. Data helps them accurately estimate a property’s fair market value, analyze locations, access lending demographics, and make better business decisions.

Data also benefits mortgage lenders and financiers since they can carry out appraisals fast and accurately to determine how much money they should lend their customers.

Mashvisor is the best source of reliable data in 2023 and beyond. Our estimates are accurate since we pull our data from reliable sources, such as MLS, Redfin, and Airbnb. Additionally, the metrics reflect the actual performance of real estate comps in the same neighborhood.

Schedule a demo today to access the most reliable data in the US housing market.

[ad_2]