Investors thinking of buying long term or short term rentals in 2023 are looking for the top real estate investment ROI calculator on the market.

Table of Contents

- What Is a Good ROI for Real Estate Investments?

- What Is the Best Real Estate Investment ROI Calculator to Use?

- Way Forward: How to Get Started With the Best ROI Calculator for Real Estate Investing

According to US housing market predictions 2023, next year will be a good time to invest in real estate. Property price increases are slowing down; mortgage rate surges are leveling off; individuals and families are returning to large cities and renting; and demand for vacation rentals is accelerating. Overall, the market is turning neutral.

All the said factors mean that newbies will be searching for an entry into the real estate investing business, while experienced investors will be expanding their portfolios. In other words, the demand for the best investment properties for sale will be strong. So, investors will need all the help they can get hold of in order to beat the competition and succeed.

One of the best friends of both beginner and experienced investors is the real estate ROI calculator. The tool helps rental property investors evaluate the potential of listings for sale quickly and efficiently so that those who use it can snatch the good deals before everyone else.

And this renders the question: What is the best real estate investment ROI calculator for 2023?

The short answer is: Mashvisor is the best calculator for return on investment in real estate in 2023.

In this article, we will look at the features and functionalities that make Mashvisor the top choice for investors who want to buy the optimal traditional and Airbnb rental properties in any US market.

What Is a Good ROI for Real Estate Investments?

There is no single number that signifies a good return on real estate investments. The range of good ROI depends on the metric you use to calculate return on investment.

So, how do you calculate ROI on real estate?

There are three main measures that investors use to calculate return on investment in real estate:

- Cash flow

- Cap rate

- Cash on cash return

If you’re a beginner, you might not be familiar with the above concepts, their meaning, their formulas for calculation, and what translates into good ROI for each one of them.

So, let’s answer all the above questions before getting to the top real estate investment ROI calculator in 2023:

What Is a Good Cash Flow in Real Estate?

Cash flow is the simplest way to evaluate ROI in residential real estate investing. The cash flow is basically the difference between the money that you get from your rental business and the money that you put into it. That’s the difference between the rental income and the rental expenses.

Cash Flow Formula:

Cash Flow = Total Income – Total Expenses

The cash flow is usually calculated on an annual basis. To get the total income, you just need to multiply the monthly rental rate by 12 and add any additional sources of income. Additional income might come from renting out parking spaces separately, charging for laundromats, etc. In any case, calculating the total income is relatively straightforward.

Calculating the total expenses gets a bit more complicated, however. Here, you must include all expenses associated with owning, managing, and renting out an income property. You need to factor in things like management fees, maintenance, repairs, utilities, HOA fees, property tax, insurance, and every other cost that leaves your pocket… or bank account.

So what is good ROI in terms of cash flow?

Well, your cash flow should be positive, for sure. If you own negative cash flow properties, it means that you are losing money from your investment endeavor rather than making money.

To give a more specific answer, though, investors refer to the 1% rule in real estate. According to the 1% rule, the monthly rental rate should be equivalent to a minimum of 1% of the property purchase price in order to generate positive cash flow and good returns.

Related: 3 Tools You Need to Find Cash Flow Properties for Sale

What Is a Good Cap Rate on Rental Properties?

Cap rate is arguably the best measure of return on investment in real estate. The reason is simple: While it provides more comprehensive information than the cash flow, it is relatively easy to calculate and compare across multiple real estate markets and investment properties for sale.

The cap rate is the ratio of the net operating income (NOI) over the current market value of the long term or short term rental property.

Cap Rate Formula:

Cap Rate = Net Operating Income/Current Market Value x 100%

The NOI is calculated by subtracting the expenses necessary to operate the rental business from the gross rental income. The net operating income is calculated on an annual basis and does not include financing and taxes. So, it’s different from the total income in the cash flow formula.

It is the main drawback of the capitalization rate as an ROI metric; it doesn’t take into account the cost of purchasing the property. But as investors know, buying in cash and buying with a mortgage are different.

A good cap rate in real estate is between 8% and 12%. It assures a high enough return without taking an unreasonably high risk, as the cap rate also evaluates the risk of investing in a certain property.

So, in case you are wondering: Is 7% ROI good for real estate?

No, 7% ROI for real estate investment properties is not good when looking at the cap rate.

What Is a Good Cash on Cash Return on Investment Properties?

The cash on cash return, or CoC for short, is the most thorough measure of ROI in single family and multifamily real estate investing. Unlike the cap rate, it considers the method of financing, so it yields different results when you buy a rental property in cash or use an investment property loan.

The cash on cash return calculates the ratio of the pre-tax cash flow over the total cash invested. The pre-tax cash flow is the difference between the total rental income and all rental expenses, excluding taxes, annualized.

The total cash investment, on the other hand, includes all cash that you’ve put into obtaining and renting out your property. It comprises the property price (if paying in cash) or the down payment (if using a mortgage) plus closing costs, necessary repairs, etc.

Cash on Cash Formula:

Cash on Cash Return = Pre-Tax Cash Flow/Total Cash Investment

A good cash on cash return is usually considered anything above 8%-10%. Indeed, savvy investors are often able to see double-digit numbers with regard to the CoC metric.

So, if you’d like to know: Is 20% ROI good in real estate?

Yes, 20% ROI in real estate is really good when looking at CoC return.

As you can imagine, calculating all the above measures for ROI when evaluating a few different listings for sale and ensuring they are good can get very complicated and frustrating. So, investors need to use a real estate investment calculator to speed up the analysis process and be able to get good deals.

What Is the Best Real Estate Investment ROI Calculator to Use?

Mashvisor is the top ROI calculator in real estate investing in 2023.

Why?

Because the Mashvisor real estate investing app deploys the power of technology and AI to calculate all the abovementioned metrics of return on investment in addition to many other crucial numbers.

Indeed, the Mashvisor ROI calculator is not a single calculator but a collection of several calculators. Each one of them reveals a different piece of data on the traditional and Airbnb rental properties for sale that you analyze.

Let’s look at the main types of real estate calculators available on the Mashvisor platform and how each helps investors make smarter and more profitable investment decisions:

Cash Flow Calculator

The cash flow calculator is exactly what it sounds like: An online tool that calculates the cash flow expected on a specific investment property.

What makes the Mashvisor calculator unique is that it provides reliable estimates of the cash flow on hundreds of thousands of properties for sale without the need for manual data inputs.

The tool is part of the Mashvisor real estate investment platform. As such, it conducts analysis on the performance of comparable long term and short term rental properties – rental comps – in the local area to calculate all relevant data points. They include rental rates, vacancy rates, operating expenses, property tax, insurance, and others.

Once the calculator obtains all the above numbers, it computes the expected cash flow on any MLS listing or off market property available on the Mashvisor real estate marketplace. Moreover, the investment property analysis and calculations are available for both renting out the property traditionally and on Airbnb.

Related: What Is a Cash Flow Calculator for Real Estate Investors?

Cap Rate Calculator

The second major functionality of the Mashvisor real estate investment ROI calculator is its ability to compute cap rate.

Similar to the cash flow metric, the tool looks at the past and present performance of all comparable rental listings in the local market to predict how a certain property will do.

What it means from the point of view of investors is that they can get access to cap rate estimates on all properties that match their investment criteria in a market within a few minutes. There’s no need to collect data manually, enter it into Excel spreadsheets, and run calculations.

Importantly, the forecasts provided by the Mashvisor real estate calculator are highly accurate and very reliable.

First of all, they use big data, which means millions of relevant data points. No human can gather and analyze such a large amount of real estate data without losing their sanity. Second, using AI and machine-learning algorithms eliminates the risk of human error from manual calculations.

So, you can see whether a property will yield a good cap rate if you rent it out on a monthly or nightly basis.

Moreover, all real estate and rental data is available for every single city and town within the US residential market.

Cash on Cash Return Calculator

One of the most exciting features of the Mashvisor ROI calculator is the cash on cash return functionality. As shown above, calculating the CoC return on a single property is complicated because it depends on so many data inputs.

Not to mention how time-consuming and cumbersome things get if you want to analyze the ROI metric on dozens of available properties for sale. Getting all the necessary real estate and rental data points can take weeks or even months, while the required calculations guarantee to be a real nightmare.

At the same time, the cash on cash return is a must as it provides the most comprehensive overview of the expected performance of a property as a rental.

The Mashvisor real estate investment calculator eliminates possible concerns as it pairs up as a cash on cash return calculator, too.

To give you an idea of how the Mashvisor real estate app arrives at the CoC return for both long term and short term rentals for sale, here are the data points that it calculates:

- Listing price

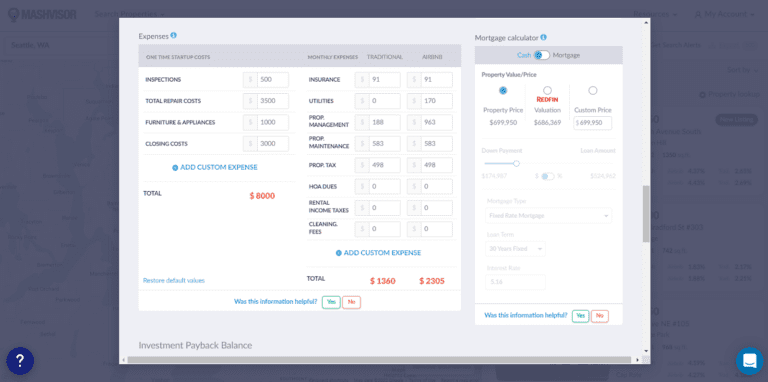

- One-time startup costs: Inspections, total repair costs, furniture and appliances, closing costs, and others

- Comparable rental income for traditional and Airbnb

- Monthly expenses: Insurance, utilities, property management, property maintenance, property tax, HOA dues, rental income tax, cleaning fees, etc.

- Traditional and Airbnb cash flow

- Traditional and Airbnb occupancy rate

Once again, all these numbers are not random but obtained from rental comps.

The Mashvisor real estate app considers several data points, such as one-time start-up costs and monthly expenses, to calculate the cash on cash return for an investment property.

Mortgage Calculator

As we already discussed, how you pay for your rental property is a major determinant of return on investment in real estate. Thus, the top real estate investment ROI calculator should offer a mortgage calculator as well.

The Mashvisor mortgage calculator allows investors to customize a number of factors in order to adjust the rental property analysis to their particular financing situation.

Specifically, income property owners can choose and modify the following:

- Property price

- Down payment

- Loan amount

- Mortgage type

- Loan term

- Interest rate

All the above values are preset to reflect the predominant investment property loan in the market, but they can be adjusted if the investor prefers a different approach or plan.

As you modify any input in the mortgage calculator, measures of ROI will be automatically recalculated accordingly.

The responsiveness and interactivity of the Mashvisor real estate calculator are some of the features that make it the best rental property investment tool in the US housing market.

Related: Investment Mortgage Calculator: How to Calculate Your Monthly Mortgage Payment as an Investor

Traditional Rental Property Calculator

The Mashvisor real estate investing app can be used to calculate the rate of return on both traditional (long term) and Airbnb (short term) rental properties. That’s what gives it a competitive edge over other applications that focus on traditional rentals only (like Rentometer) or vacation rentals only (like AirDNA).

With a single subscription to the Mashvisor platform, you get access to a long term rental property calculator and a short term rental calculator.

When analyzing traditional rental properties for sale with the help of the Mashvisor calculator, you obtain estimates of all the important measures of return on investment. That’s not all, as you get to see how the estimates are obtained.

If, as a landlord, you believe that you can perform better than the market, you can change all values like rental income, occupancy rate, or rental expenses to customize your analysis.

Airbnb Calculator

Recent nationwide data from Mashvisor shows that short term rentals reemerging as the more profitable rental strategy, after a small dip during the pandemic. Moreover, Airbnb demand is expected to surge at the end of 2022 and throughout 2023. People are hoping to compensate for the missed travel opportunities in 2020 and 2021.

What it means for investors is that they should look into the vacation rental strategy. And the best way to find a profitable Airbnb for sale is with the help of a real estate investment calculator.

The Mashvisor ROI calculator functions as an independent Airbnb profit calculator, similar to the AirDNA Rentalizer. However, the Mashvisor Airbnb calculator offers more features than the AirDNA alternative. It allows investors not only to analyze the investment potential of properties as vacation rentals but also to search for top-performing Airbnbs.

With our short term rental ROI calculator, you will obtain immediate access to Airbnb occupancy rate, Airbnb rental income, and Airbnb cash on cash return. The said metrics are available for both neighborhoods in all US cities and towns and properties for sale or off market properties.

Way Forward: How to Get Started With the Best ROI Calculator for Real Estate Investing

When using the top rental property investing tools, you don’t need to worry about: How do you calculate ROI on real estate? That’s because you will get all calculations done for you, with maximum level of accuracy and efficiency.

Nevertheless, to be able to make confident – and profitable – investment decisions, you must use the top real estate investment ROI calculator and not just any tool.

In this article, we’ve shown you why Mashvisor is the top calculator for buying and analyzing both long term and short term rentals across the US market.

All that’s left now is for you to sign up for a 7-day free trial of Mashvisor to test the power of our app for yourself.