Wondering about Orlando housing market predictions for next year? Let’s look at some facts in this article and see what we can expect.

Table of Contents

- How Has the Orlando Housing Market Performed So Far in 2022?

- What’s Next for the Orlando Housing Market?

- Top 10 Orlando Housing Market Locations to Invest in 2023

Orlando’s housing market, as well as its job sector, has been growing. But, can we expect this rise to last, and how will it affect property purchases in the region?

We’ll review the most recent Orlando housing market trends and forecasts and see how they can affect purchasers and sellers next year. Moreover, tight supply and purchasers returning to the market who were cautious after the pandemic’s beginnings indicate that Orlando property prices will probably continue to be solid in 2023.

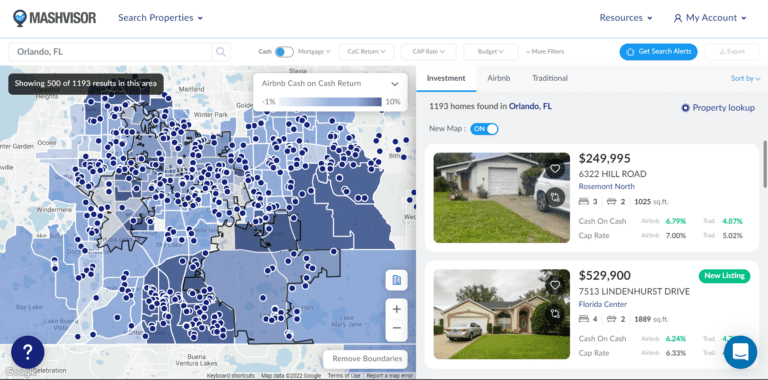

In addition, with the help of Mashvisor, we will find out if Orlando will continue to be a seller’s market according to the specific Florida housing market predictions. Let’s get started.

How Has the Orlando Housing Market Performed So Far in 2022?

When we look at this year, according to USA Today, yearly listing prices in Orlando have risen by 21% in the last year, making the city one of at least five that have witnessed an increase of 18% or more.

For instance, in August 2022, Orlando house prices were 19% higher than in the same period a year ago, with a median price of about $400,000. Below, we will see the September median price, which is even higher at $459,142. In addition, properties in Orlando sell in two weeks on average, compared to 10 days in 2021.

Moreover, inbound relocation from high-tax and high-cost-of-living locations such as California is one of the main reasons the Orlando housing market is strong. Individuals and companies opt for less crowded places with lower living and business costs and low housing prices.

And if we focus on Orlando real estate market as a whole, it benefits from long-term economic and demographic developments. The housing industry, in particular, expects to gain from the continued influx of individuals who choose Florida as their new home. Moreover, according to the most recent Realtor.com data, home sales in the Orlando region fell by 7.3% compared to March 2022 and 6.9% if we look at last year.

Nevertheless, as interest rates keep increasing, it is possible that the Orlando market could begin to cool. It might become more difficult for some buyers because their monthly property payments would also be greater—since the interest rates keep rising. However, overall demand is high, and properties are selling fast.

Now, let’s see the Orlando city-level data as of September 2022, provided by Mashvisor. It will give us an insight into what we can expect in 2023.

Orlando City-Level Data as of September 2022

The median cost of a property sold in Orlando increased by more than 25% year over year, with properties coming under contract within 25 days of being offered for sale. Below, we can see the latest city-level data for Orlando:

- Median Property Price: $459,142

- Average Price per Square Foot: $270

- Days on Market: 62

- Monthly Traditional Rental Income: $2,128

- Traditional Cash on Cash Return: 2.57%

- Traditional Cap Rate: 2.63%

- Price to Rent Ratio: 18

- Monthly Airbnb Rental Income: $2,763

- Airbnb Cash on Cash Return: 2.12%

- Airbnb Cap Rate: 2.16%

- Walk Score: 41

Based on essential investment factors such as cash flow, affordable housing prices, and an expanding population and employment market, Orlando was named one of the best areas to buy a rental property in 2022. Looking at the data above, we expect that tendency to continue throughout the year and possibly even in 2023.

Another important fact is that Florida offers lots of sunny weather and does not impose a state income tax, making the local real estate market even more appealing. These are just two of the numerous reasons why many people and companies come to Orlando from other cities where taxes and living costs are high.

Lastly, tight inventory and purchasers returning to the market who were reluctant after the pandemic’s beginnings indicate that Orlando property prices will continue to be solid for the rest of 2022.

What’s Next for the Orlando Housing Market?

We now move to Orlando housing market predictions for next year. As the Orlando housing market remains strong and the projections show growth, we can only expect the same (or better) situation in 2023. We can start with the fact that Livability ranked Orlando as the 73rd best place to live in the US, with a score of 673 for the following factors:

- Civics

- Demographics

- Education

- Economy

- Housing

- Health

- Infrastructure

Nevertheless, we must know what housing market situation will await us next year.

Now, for the question everybody probably thought of—will home prices drop in 2023 in Orlando? Well, the outlook for 2023 varies depending on who you consult. Most home sector experts predict weaker buyer demand, reduced prices, and higher borrowing rates. In addition, low availability and great demand are driving up property prices.

According to the Orlando Regional Realtor Association, the median house price in April was $370,000, up 2.5% from $361,000 in March 2022—a record level for the third month.

Moreover, Orlando property prices have increased by 30.1% in the last year—meaning that Orlando is unquestionably a seller’s market. Because there is a limited supply of properties in Orlando, buyers are typically driven to compete, resulting in higher prices or faster sales that favor sellers.

Related: Is It a Buyer’s or Seller’s Market in Real Estate? How to Tell the Difference

Let’s break it down into a few crucial prediction categories.

1. Job Market

According to Forbes, Orlando ranks sixth in the US for employment growth and boasts one of the best neighborhoods to live in in 2023. Furthermore, typical employment in Orlando is expected to increase by 19% by 2030, almost double the national average.

According to the BLS, the employment sectors in Orlando that are expected to increase the quickest next year are recreation and hospitality, finance, education and health services, and business and professional services.

Moreover, when it comes to Orlando’s housing market predictions for 2023, we can see Orlando’s improving unemployment rate, which is down to just 2.6%. In addition, according to the Orlando Business Journal, job growth in Orlando was 11% in the three years before the pandemic, with approximately 130,000 new positions added to the city’s economy.

2. Population Expansion

Orlando has the second-fastest growth rate among the 30 major cities in the United States, with the region attracting more than 1,000 new people each week. According to Orlando.org, new citizens aren’t simply tourists—they’re highly educated and come from slow-growth states.

Moreover, according to the latest census, the population of Orlando has risen by roughly 70,850 people since 2010. In addition, last year, the Orlando metro area’s population increased by more than 1.4%.

To sum it up, according to the Orlando Economic Partnership, the Orlando area is expected to add 1,500 people every week by 2030, reaching a population of 5.2 million. Quite impressive facts and numbers, aren’t they?

3. Strong Real Estate Market

As interest rates rise, the Orlando housing market may begin to cool in 2023. Some buyers will find it increasingly difficult to meet their monthly mortgage payments. Nonetheless, demand is strong, and houses are selling quickly.

Property economists usually consider a five to six-month inventory to signal a strong market balance between purchasers and sellers. Less than that is termed a seller’s market. That demonstrates that Orlando is a seller’s market, with low inventory and a high number of buyers seeking houses.

With all this in mind, Orlando’s housing market will continue to be a seller’s market, as it has been in recent years. It is also one of the top housing markets for real estate investing.

Now, what does it imply for Orlando homebuyers? The most common mistake purchasers make is waiting for selling prices to fall while their possible mortgage payment drops. With mortgage rates rising, now is the moment for purchasers to take advantage before prices rise again.

4. Center for Tourism

Ever since the beginning of 2018, Orlando has enjoyed economic stability. Tourism growth and prospects are two primary reasons for its impressive progression.

Orlando, known as the “Theme-Park Capital of the World,” gets the majority of its visitors due to the existence of Universal Studios, SeaWorld, and the most famous, Disneyland. In addition, many tourists visit Orlando yearly because of its lovely beaches and pleasant weather.

Orlando’s housing market has a strong potential for development, given the city’s economic prosperity and population surge. It now provides an attractive scenario for US investors in residential housing, particularly for turnkey real estate acquisitions.

5. Flexible Taxes

Investing in the Orlando housing market can help investors save money on taxes because Florida is among the few states that do not have a personal income tax. Its flexible tax regulations are a plus to investors, particularly in this rising economy. Moreover, Florida’s tax regulations are regarded as the fourth friendliest in the US, which is why many companies want to locate here.

In addition, the corporate income tax in Florida is 5.5%. With its favorable tax climate and inexpensive real estate, Orlando might be a significant opportunity for emerging start-ups.

Related: Real Estate Taxes: Everything a Beginner Investor Needs to Know

Top 10 Orlando Housing Market Locations to Invest in 2023

Investing in real estate in the Orlando housing market involves thorough research. Given that it is one of the hottest housing markets in the US for 2023, we took the time to prepare a list of the top five neighborhoods for traditional and Airbnb investments.

As per Mashvisor’s September location report, the neighborhoods below are listed from highest to lowest cash on cash return.

5 Best Orlando Neighborhoods for Traditional Rentals

The top five Orlando housing market neighborhoods for traditional rental investments are as follows:

1. Lancaster Park

- Median Property Price: $801,800

- Average Price per Square Foot: $320

- Days on Market: 48

- Monthly Traditional Rental Income: $2,977

- Traditional Cash on Cash Return: 2.62%

- Traditional Cap Rate: 2.66%

- Price to Rent Ratio: 22

- Walk Score: 40

2. Lawsona-Fern Creek

- Median Property Price: $660,989

- Average Price per Square Foot: $348

- Days on Market: 124

- Monthly Traditional Rental Income: $2,746

- Traditional Cash on Cash Return: 2.37%

- Traditional Cap Rate: 2.40%

- Price to Rent Ratio: 20

- Walk Score: 52

3. Park Lake-Highland

- Median Property Price: $979,667

- Average Price per Square Foot: $332

- Days on Market: 76

- Monthly Traditional Rental Income: $2,551

- Traditional Cash on Cash Return: 2.18%

- Traditional Cap Rate: 2.24%

- Price to Rent Ratio: 32

- Walk Score: 70

4. Colonialtown North

- Median Property Price: $600,854

- Average Price per Square Foot: $334

- Days on Market: 72

- Monthly Traditional Rental Income: $2,276

- Traditional Cash on Cash Return: 2.17%

- Traditional Cap Rate: 2.20%

- Price to Rent Ratio: 22

- Walk Score: 71

5. Lake Davis-Greenwood

- Median Property Price: $536,459

- Average Price per Square Foot: $360

- Days on Market: 28

- Monthly Traditional Rental Income: $2,146

- Traditional Cash on Cash Return: 2.06%

- Traditional Cap Rate: 2.09%

- Price to Rent Ratio: 21

- Walk Score: 24

Click here for more comprehensive and up-to-date information about traditional investment homes for sale in Orlando, Florida.

You can use Mashvisor and its various real estate tools to search for profitable traditional and Airbnb investment properties in Orlando.

5 Best Orlando Neighborhoods for Airbnb Rentals

Consider investing in Airbnb in the following Orlando housing market neighborhoods:

1. Colonialtown North

- Median Property Price: $600,854

- Average Price per Square Foot: $334

- Days on Market: 72

- Monthly Airbnb Rental Income: $4,859

- Airbnb Cash on Cash Return: 4.73%

- Airbnb Cap Rate: 4.80%

- Airbnb Daily Rate: $139

- Airbnb Occupancy Rate: 52%

- Walk Score: 71

2. Lake Weldona

- Median Property Price: $389,900

- Average Price per Square Foot: $232

- Days on Market: 128

- Monthly Airbnb Rental Income: $2,493

- Airbnb Cash on Cash Return: 3.64%

- Airbnb Cap Rate: 3.71%

- Airbnb Daily Rate: $138

- Airbnb Occupancy Rate: 50%

- Walk Score: 31

3. Bel Air

- Median Property Price: $500,750

- Average Price per Square Foot: $293

- Days on Market: 54

- Monthly Airbnb Rental Income: $2,914

- Airbnb Cash on Cash Return: 3.49%

- Airbnb Cap Rate: 3.58%

- Airbnb Daily Rate: $138

- Airbnb Occupancy Rate: 51%

- Walk Score: 45

Related: What Is a Good Cash on Cash Return?

4. Colonialtown South

- Median Property Price: $482,055

- Average Price per Square Foot: $376

- Days on Market: 45

- Monthly Airbnb Rental Income: $2,943

- Airbnb Cash on Cash Return: 3.13%

- Airbnb Cap Rate: 3.18%

- Airbnb Daily Rate: $137

- Airbnb Occupancy Rate: 52%

- Walk Score: 84

5. Lawsona-Fern Creek

- Median Property Price: $660,989

- Average Price per Square Foot: $348

- Days on Market: 124

- Monthly Airbnb Rental Income: $3,943

- Airbnb Cash on Cash Return: 2.72%

- Airbnb Cap Rate: 2.76%

- Airbnb Daily Rate: $138

- Airbnb Occupancy Rate: 51%

- Walk Score: 52

Click here to start looking for lucrative Airbnb investment homes for sale in Orlando, Florida.

Conclusion

To summarize, the Orlando and metro area housing markets are so intense that they cannot change to a total buyer’s market in the long run. In a stable real estate market, the supply would drop to zero in around five to six months.

Regarding the months of supply, if the current inventory surpasses five months, Orlando could become a buyer’s market in 2023.

We can say that demand has not only started to recover from the pandemic but has hit record levels by historical standards. As a result of the ongoing imbalance in supply and demand, the Orlando housing market predictions indicate that the city’s real housing market remains strong and is tilted toward sellers.

Orlando is an excellent place for real estate investors, and Mashvisor can help you choose the property that best suits your personal and business needs. Our Property Finder tool is intended to help you and other real estate investors find the right investment property within the entire US housing market.

To get access to our real estate investment tools, click here to sign up for a 7-day free trial of Mashvisor today, followed by 15% off for life.