[ad_1]

The best real estate investing opportunities are often highly sought out by competitors, so what can you do to gain an advantage over them?

Table of Contents

- Is It a Good Idea to Invest in Real Estate Right Now?

- 3 Tips on How to Find Real Estate Investing Opportunities

- 10 Cities to Find Lucrative Real Estate Investing Opportunities for 2023

Finding great real estate investing opportunities typically takes a lot of time, research, and analysis. For beginner investors, the process of finding and identifying good investment opportunities can take even longer, making it harder for them to compete.

By the time you’ve found a few good real estate investing opportunities, chances are that your competitors have already made offers on them. So, what can you do as a beginner investor to improve your chances and gain an advantage over your competitors in 2023?

In this blog, we will look at the real estate market in 2023 to see what is the most profitable real estate investment, how to find investment opportunities, and more.

We will also share with you some tips to get you started, as well as real estate market data about cities that we believe offer excellent real estate investing opportunities for 2023.

Is It a Good Idea to Invest in Real Estate Right Now?

The short answer to this question is: yes, investing in real estate is one of the best ways to make money.

But what is the most profitable real estate investment? Different investors offer different opinions about the most profitable real estate investment.

One thing for sure, however, is that the most popular and safest type of real estate investment is investing in rental properties.

Rental Properties

Rental properties are the most popular type of real estate investment for a number of reasons.

Firstly, no matter what real estate market you’re looking at, there is always demand for rental properties, making rental property investments a safe choice.

Secondly, many investors prefer making real estate investments that generate a cash flow instead of re-selling properties for an instant profit. It is because real estate properties almost always appreciate in value over time.

So, to maximize the profit from a real estate property, it is best to rent it out for several years before re-selling it for a profit. It is a very popular way of making money for beginner investors. The cash flow that rental properties generate can often cover the loan payments and other expenses of the property.

Finally, owning a rental property gives you leverage and flexibility because you own a physical asset that you can sell at any time or use as a primary residence instead of renting out.

Investing in Real Estate in 2022

It is a good idea to invest in real estate in 2022, 2023, and beyond.

At the start of 2022, the market started showing signs of recovery, following significant disruptions in the real estate market in the past two years.

Amid the COVID-19 pandemic, the US real estate market saw a massive inventory shortage, coupled with a significant increase in the demand for second homes. They all resulted in property prices increasing drastically across the US.

This year, we’re now seeing a slowdown in the increase in property prices, as the inventory is starting to recover and demand is slowing down. As a result, it may be harder now to find affordable and cheap real estate investing opportunities.

However, it doesn’t mean such opportunities no longer exist, as you will discover in a later section of this article.

In the next section, we’re going to give you a couple of tips to help you find real estate investing opportunities quickly and easily in today’s volatile and competitive market.

Related: 7 Ways COVID-19 Has Changed Real Estate

3 Tips on How to Find Real Estate Investing Opportunities

Finding the best real estate investing opportunities requires patience, thorough planning, and analysis.

If you’re looking for lucrative real estate investing opportunities before 2023, then the safest choice is to invest in rental properties due to the reasons mentioned above.

But to do it efficiently, you need develop a solid strategy and base your decisions on data and analytics.

Although finding lucrative real estate investing opportunities can seem intimidating and complicated for beginner investors, we’re here to give you three tips that will help you.

Whether you’re a beginner or an experienced investor, you want to find ways to gain an advantage over your competition. The following tips will help you out throughout your journey.

The Importance of Planning & Strategy

The first step to help you find real estate investing opportunities before your competition is to be prepared.

Before making any serious investment decisions, you need to thoroughly plan ahead for your investment. It means that you need to be fully aware of your financial situation to determine how much you can afford.

Your financial planning should include all possible sources of cash that you can conjure, such as liquidating assets or seeking private money lenders.

If you’re looking to borrow money, finding out what your credit score is and what types of loans are available to you is crucial.

Additionally, during the planning phase, it is crucial to identify the goals that you’re hoping to achieve from investing. If you want to invest in rental properties, in particular, you need to figure out how much rental income you want to achieve and over how long of a duration.

Figuring out all of the things above before you start can help you find real estate investing opportunities faster and more efficiently. It is because knowing how much you can afford and what you’re hoping to achieve with it can help you narrow down your search significantly before you even get started.

Decide on a Rental Strategy

Since we’re focusing on rental real estate investing as the best type of real estate investment, it’s important to decide on the rental strategy that you want to use.

Below are the two main types of rental strategies that real estate investors use:

- Short-term rentals, such as Airbnb properties

- Long-term traditional rental properties

Each type of rental strategy comes with its own advantages and disadvantages.

Depending on the strategy that you choose, you will be looking for different stats and metrics to identify good investing opportunities. It is why it’s important to make that decision at the start of your investing journey, as it also lets you avoid looking at markets and properties that don’t suit your strategy.

Related: Rental Strategy 101: A Beginner Investor’s Guide

Below are the main pros and cons of using each rental strategy:

Short-Term Rentals

Short-term rental properties gained a lot of popularity in the past few years with the rise of online services like Airbnb. As short-term rentals became popular among travelers and tourists looking for short-term stays, investors began using them as a rental strategy.

Thus, investing in a short-term rental and renting it out on Airbnb became one of the most popular and lucrative types of US real estate investing ventures.

Pros

- Short-term rentals offer a higher potential for profits

- The rental rates can be adjusted frequently to maximize profits

- Seasonality means that you can expect high demand during certain times of the year and adjust prices accordingly

- You can use your own primary residence as a short-term rental by renting out a room or part of your house to guests on Airbnb

Cons

- Short-term rentals are severely controlled by laws and regulations that make them illegal in many cities and counties

- In most places, you can only rent out short-term rentals for a limited number of days each year

- Some places require you to live in a property for a number of days in a year to be eligible to rent it out as a short-term rental

- Short-term rentals are typically considered riskier due to the governing laws and regulations changing over time

- During the low seasons, it can be very hard to rent out the property as the occupancy rates drop significantly

- Short-term guests are more likely to cause wear-and-tear damages to your property

- They require more time and effort into property management, cleaning, checking guests in and out, and property maintenance

Long-Term Rentals

Traditionally, long-term rentals are the most popular type of real estate property around the world.

It’s for a good reason that investing in long-term rentals is considered the safest and most common type of real estate investment. The biggest reason is that the demand for homes is always growing.

Since most people can’t afford to buy their first house, rental properties are always in high demand across most markets, especially in booming markets.

Additionally, the fact that you can use a property to generate a passive income for a long period of time before selling it for a massive profit is a very desired outcome for most investors.

Although short-term rentals are starting to compete with long-term rentals in some markets, traditional rentals are unlikely to disappear soon.

Pros

- You can buy and operate a traditional rental property in virtually any market around the world

- Long-term rentals are considered very safe and are almost always profitable

- You can sell the property at any point in the future to make a profit, depending on how much the property has appreciated

- Long-term tenants are more likely to take good care of the property

- They don’t require a lot of property management

Cons

- The laws concerning landlords and tenants are often in favor of the tenant, which may result in daunting legal processes

- You can’t adjust long-term rental rates as frequently or as easily as short-term rentals

- The potential rental income that traditional rentals can generate is much lower than the potential of short-term rentals

Use This Online Tool to Find Real Estate Investing Opportunities

Of course, finding the best real estate investing opportunities before your competition isn’t always about your skills. Sometimes, it’s all about the tools you’re using.

When it comes to that, most professional investors and investment firms typically use their own tools and systems to make the process easier for themselves. However, as a beginner investor, you might be looking for online tools and services that you can use to gain the upper hand.

Luckily, in today’s world, you can find a tool or a platform for anything that you need in relation to real estate investing and finding lucrative opportunities. But if you’re looking for a single tool that provides you with everything that you need, then look no further than Mashvisor.

What Is Mashvisor?

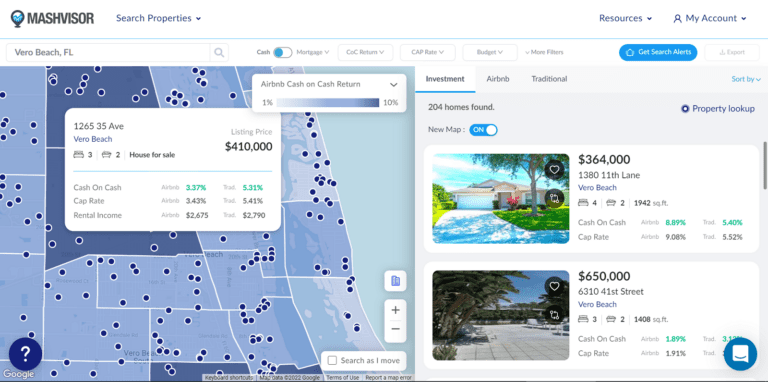

Mashvisor is a real estate investing platform designed to help beginner investors find investing opportunities in the US housing market. The platform focuses on rental investment opportunities, and it includes both traditional and short-term rentals in its features.

Mashvisor offers several tools and features that can help you find real estate investing opportunities, analyze them, and compare them to find the one that suits you best.

Find Rental Properties for Sale

The most popular tool that Mashvisor offers is an interactive heatmap tool that lets you search for properties in any US market. The heatmap comes with a wide range of filters that allow you to narrow down your search based on:

- Listing Price

- Airbnb Cash on Cash Return

- Traditional Cash on Cash Return

- Airbnb Rental Income

- Traditional Rental Income

- Airbnb Occupancy Rate

So, if you’ve already planned ahead your investment and with a solid strategy in mind, the above filters can help you find what you’re looking for in a matter of minutes.

Since the map is interactive, you can zoom in or out on any market, city, or neighborhood you want to inspect to take a closer look at that market’s stats and properties there.

Mashvisor’s interactive heatmap tool lets you find properties in any US market using a wide range of filters that allow you to narrow down your search.

Get Real Estate Data & Analytics

Mashvisor solves one of the biggest problems that beginner real estate investors face, which is getting access to reliable up-to-date real estate data. By gathering data from numerous reliable sources such as the MLS and Airbnb, Mashvisor provides the said information to the user in an easy-to-read and understandable manner.

Additionally, Mashvisor’s algorithm crunches the data to provide useful insights and analytics about the future of each property’s investing opportunity. By calculating important metrics such as the cap rate and cash on cash return, investors can know what to expect from investing in each property.

When using the interactive map tool or any of the other tools or features, you can click or hover over properties to get a quick glimpse of the data provided. Also, by visiting a property’s rental analysis page, you find more details and analytics, including a rental income calculator that you can adjust and customize.

All of the above information lets you get an idea and understanding of each market and property that you’re interested in.

Access Free Rental Comps

If you’re subscribed to Mashvisor, you gain access to rental comps, as well.

Rental comps are a method of comparing similar rental properties in the same area or neighborhood to gain insights about them and identify the best opportunities for investing.

Typically, the process of using rental comps for investing in real estate can be a long and daunting process. However, Mashvisor provides free rental comps to its users, which are accessible on each property’s rental analysis page.

In the analysis section, you will find a table that lists all similar rental properties in the area with their relevant stats and their similarity rating. You can even choose between traditional or short-term rentals to change the type of rentals you want to see in the rental comps.

It is a very effective tool that lets beginner investors find lucrative investing opportunities and learn about the differences that make a great real estate investment.

Read: The 10 Best Rental Websites for Real Estate Investors in 2022

10 Cities to Find Lucrative Real Estate Investing Opportunities for 2023

Finally, if you’re looking for the best places to find lucrative investing opportunities before 2023, the following markets offer a lot of potential. They are lucrative rental markets lucrative based on Mashvisor’s August 2022 data.

When choosing the markets, we picked the ones that are performing outstandingly well in one or more stats that are crucial to investors. Our criteria included:

- Median property prices must be below $1,000,000

- Monthly rental income of $2,000 or above

- A cash on cash return of 2% or above

- Market includes more than 200 listings for sale

The list is divided into rental strategies, so you’ll find a list for traditional rentals and one for short-term rentals.

5 Best Cities for Traditional Rentals for 2023

The cities listed below for finding real estate investing opportunities before 2023 are great for traditional rentals, arranged from those with the highest to the lowest cash on cash return.

Each of the top five cities stands out in one of the following areas:

- City with the highest cash on cash return (Vero Beach, FL)

- Highest monthly rental income (Thousand Oaks, CA)

- The most traditional listings (Edgewater, NJ)

- Lowest median property prices (Deerfield Beach, FL)

- Cheapest price per square foot (Waxahachie, TX)

1. Vero Beach, FL

- Median Property Price: $728,534

- Average Price per Square Foot: $296

- Days on Market: 75

- Number of Traditional Listings: 779

- Monthly Traditional Rental Income: $2,536

- Traditional Cash on Cash Return: 4.28%

- Traditional Cap Rate: 4.39%

- Price to Rent Ratio: 24

- Walk Score: 78

Vero Beach is the market with the highest traditional cash on cash return here. It means that, based on its stats, it is the most profitable market on this list in terms of investing opportunities in real estate.

2. Deerfield Beach, FL

- Median Property Price: $478,810

- Average Price per Square Foot: $334

- Days on Market: 35

- Number of Traditional Listings: 387

- Monthly Traditional Rental Income: $2,038

- Traditional Cash on Cash Return: 3.23%

- Traditional Cap Rate: 3.35%

- Price to Rent Ratio: 20

- Walk Score: 78

Most beginner investors are unable to allocate lots of funds for investing, which often puts them at a disadvantage. However, some of the best investing opportunities are in cheaper markets with a smaller number of properties.

Deerfield Beach is the most affordable market for traditional rentals. Also, its stats show very high potential for return on investment. The only downside is that properties are selling really fast there, which means that you will need to move fast to beat your competition.

3. Thousand Oaks, CA

- Median Property Price: $980,094

- Average Price per Square Foot: $517

- Days on Market: 37

- Number of Traditional Listings: 253

- Monthly Traditional Rental Income: $3,786

- Traditional Cash on Cash Return: 2.58%

- Traditional Cap Rate: 2.61%

- Price to Rent Ratio: 22

- Walk Score: 66

If you’re looking for a market where you can generate the highest monthly rental income, then Thousand Oaks can be a good option. Although it is one of the priciest markets on the list, it is still considered a profitable one for investing opportunities with a cash on cash return of over 2.50%.

4. Edgewater, NJ

- Median Property Price: $922,932

- Average Price per Square Foot: $466

- Days on Market: 92

- Number of Traditional Listings: 10,127

- Monthly Traditional Rental Income: $3,631

- Traditional Cash on Cash Return: 2.41%

- Traditional Cap Rate: 2.45%

- Price to Rent Ratio: 21

- Walk Score: 75

Edgewater is another expensive market but with a high monthly rental income. There are lots of traditional listings for sale there. It means that the competition is less intense, and property prices aren’t expected to significantly increase in the near future.

With such an abundance of investing opportunities, you have a high chance of finding lucrative rental properties that suit your investing strategy and goals.

5. Waxahachie, TX

- Median Property Price: $479,440

- Average Price per Square Foot: $191

- Days on Market: 97

- Number of Traditional Listings: 159

- Monthly Traditional Rental Income: $2,002

- Traditional Cash on Cash Return: 2.25%

- Traditional Cap Rate: 2.30%

- Price to Rent Ratio: 20

- Walk Score: 65

When it comes to buying cheap properties that are big in size, Waxahachie is the best place to look. It offers the lowest price per square foot, even though the median property prices aren’t the cheapest there. It means that properties in this market are large in size, making them very desirable for their price and rental rates.

5 Best Cities for Airbnb Rentals for 2023

Similar to the previous list, the list below includes the top five markets that stood out in certain stats or metrics. They include:

- City with the lowest median property price (Steelton, PA)

- Lowest price per square foot (Little Ferry, NJ)

- Highest monthly Airbnb rental income (Escondido, CA)

- Highest Airbnb cash on cash return (Rio Grande, NJ)

- Highest number of Airbnb listings (Rio Grande, NJ)

- Highest Airbnb occupancy rate (Bellingham, WA)

The locations below are ranked in descending order according to cash on cash return.

1. Rio Grande, NJ

- Median Property Price: $318,900

- Average Price per Square Foot: $245

- Days on Market: 52

- Number of Airbnb Listings: 603

- Monthly Airbnb Rental Income: $3,965

- Airbnb Cash on Cash Return: 8%

- Airbnb Cap Rate: 8.21%

- Airbnb Daily Rate: $301

- Airbnb Occupancy Rate: 52%

- Walk Score: 52

Rio Grande is the most profitable city here in terms of its Airbnb cash on cash return. The city’s short-term rental market is booming, and owning an Airbnb rental in Rio Grande is an excellent and lucrative real estate investing opportunity.

2. Steelton, PA

- Median Property Price: $182,294

- Average Price per Square Foot: $99

- Days on Market: 24

- Number of Airbnb Listings: 140

- Monthly Airbnb Rental Income: $2,634

- Airbnb Cash on Cash Return: 7.20%

- Airbnb Cap Rate: 7.44%

- Airbnb Daily Rate: $116

- Airbnb Occupancy Rate: 65%

- Walk Score: 66

If you’re looking for a market to buy affordable Airbnb rental properties, Steelton is the market for you. The median property price here is exceptionally cheap, making it a good entry point for most beginner investors.

3. Escondido, CA

- Median Property Price: $945,028

- Average Price per Square Foot: $490

- Days on Market: 44

- Number of Airbnb Listings: 101

- Monthly Airbnb Rental Income: $8,293

- Airbnb Cash on Cash Return: 6.32%

- Airbnb Cap Rate: 6.39%

- Airbnb Daily Rate: $304

- Airbnb Occupancy Rate: 62%

- Walk Score: 42

In terms of monthly rental income, Escondido’s stats are outstanding. Although properties in the area aren’t cheap, the amount of monthly rental income they can generate is very high.

The substantial monthly rental income, combined with a relatively high occupancy rate, lets you cover the property’s expenses and loan payments with ease.

4. Little Ferry, NJ

- Median Property Price: $463,480

- Average Price per Square Foot: $31

- Days on Market: 60

- Number of Airbnb Listings: 277

- Monthly Airbnb Rental Income: $3,882

- Airbnb Cash on Cash Return: 5.28%

- Airbnb Cap Rate: 5.39%

- Airbnb Daily Rate: $148

- Airbnb Occupancy Rate: 63

- Walk Score: 86

If you want real estate investing opportunities that let you maximize the value of the property, Little Ferry is a good choice.

The very low price per square foot means that you can buy a very large property for a reasonable price. As a short-term rental, it allows you to rent out more rooms to maximize your profits.

5. Bellingham, WA

- Median Property Price: $704,765

- Average Price per Square Foot: $454

- Days on Market: 66

- Number of Airbnb Listings: 152

- Monthly Airbnb Rental Income: $4,128

- Airbnb Cash on Cash Return: 4.12%

- Airbnb Cap Rate: 4.19%

- Airbnb Daily Rate: $144

- Airbnb Occupancy Rate: 78%

- Walk Score: 43

Finally, if you’re looking to minimize the risk while maintaining a good return on investment, Bellingham is a good market for your real estate investing needs. Investing opportunities are less risky due to it having the highest average Airbnb occupancy rate.

It means that you won’t experience a shortage of guests and tenants to stay in your Airbnb rental and generate rental income for you.

Bottom Line: How to Find Real Estate Investing Opportunities

Finding real estate investing opportunities before your competition is all about efficiency and speed while maintaining accuracy and thoughtfulness.

Before you start looking for real estate investing opportunities, it is crucial that you do your research and plan ahead to answer questions about what you can afford and what you want to achieve with it.

If you start the process of searching for real estate properties with a solid plan and strategy in mind, the process will be much faster and easier.

But to gain an advantage over your competition, we recommend Mashvisor’s platform to help you find suitable lucrative investment opportunities with ease before your competitors.

To get access to our real estate investment tools, click here to sign up for a 7-day free trial of Mashvisor today, followed by 15% off for life.

[ad_2]