Main oil shares like ExxonMobil are attaining extremes on a basic, technical, and comparative foundation. Time to quick crude in a non-crude method.

shutterstock.com – StockNews

The large rally in ExxonMobil (XOM) and the opposite primary oil gamers seems to be burning just a little too sizzling in recent times. ExxonMobil (XOM) is the biggest part within the Power ETF (NYSE:XLE). It accommodates over 23% of the total weighting, so let’s use that because the poster kid for large oil.

Surely, XOM has been on a significant bull run over the last yr. Stocks of ExxonMobil at the moment are up over 50% thus far in 2022 as they as soon as once more reached contemporary new highs at $99.09.

This is neatly above the typical analyst worth goal of $80.73. But even so the analysts, listed below are 5 truly just right causes XOM and different large oil shares like Chevron (CVX) are due for a drop.

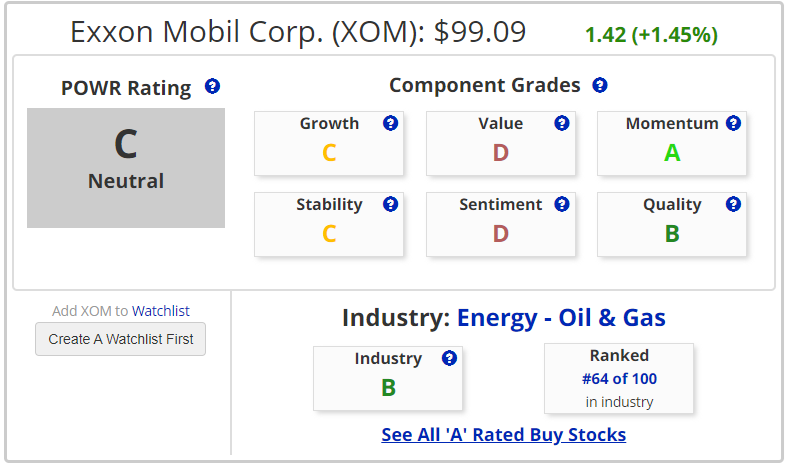

POWR Ranking

Regardless of buying and selling at all-time highs, XOM stays only a C Rated inventory – Impartial – within the POWR scores. It additionally ranks close to the ground within the Trade Workforce. Now not a sparkling endorsement for additional positive factors.

If no longer for the A Part grade in Momentum, ExxonMobil might very most probably be a promote inventory. Price and Sentiment each lift a D Grade.

As soon as the momentum breaks, search for XOM inventory to begin to head decrease as benefit taking starts to take over.

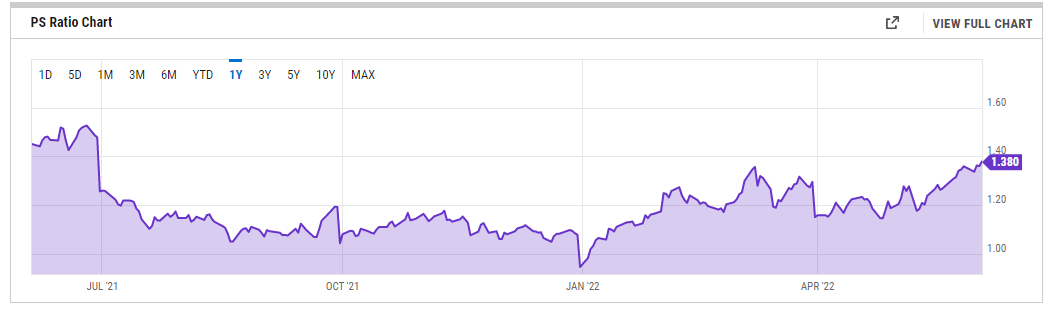

Valuation

The most recent leg in contemporary rally in ExxonMobil has been pushed to a big extent through a a couple of enlargement. Worth/Gross sales (P/S) for XOM inventory now stands at just about 1.4 x and is drawing near the loftiest ranges up to now yr. It’s also neatly above the median of one.08 over the last decade.

The ultimate time XOM inventory traded at 1.4x P/S used to be ultimate June which marked a vital temporary most sensible in ExxonMobil inventory. With out additional a couple of enlargement XOM inventory might most probably stall out and start to move in opposite.

Technicals

ExxonMobil has gotten to overbought studying from a technical research point of view. 9-day RSI is above 70. MACD hit a up to date prime however has began to melt. Bollinger % B were given to over 100 however has since fallen again. Stocks are buying and selling at a large top class to the commonly adopted 20-day transferring reasonable.

Earlier occasions a majority of these signs aligned in a similar way marked at quick time period most sensible in XOM inventory.

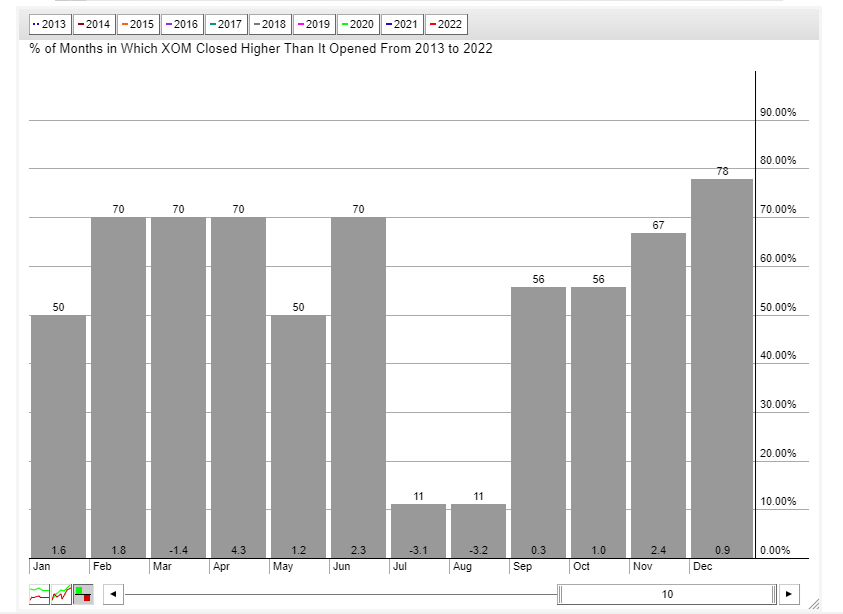

Seasonality

XOM inventory is nearing a traditionally tricky stretch. July and August had been through a ways the 2 worst acting months for ExxonMobil over the last decade. Stocks have misplaced over 3% on reasonable in each July and August and feature proven positive factors in just one of the ones 10 years.

Historical past won’t repeat itself, nevertheless it does rhyme to cite Mark Twain. Search for seasonality to be sturdy headwind for XOM inventory over the summer time months.

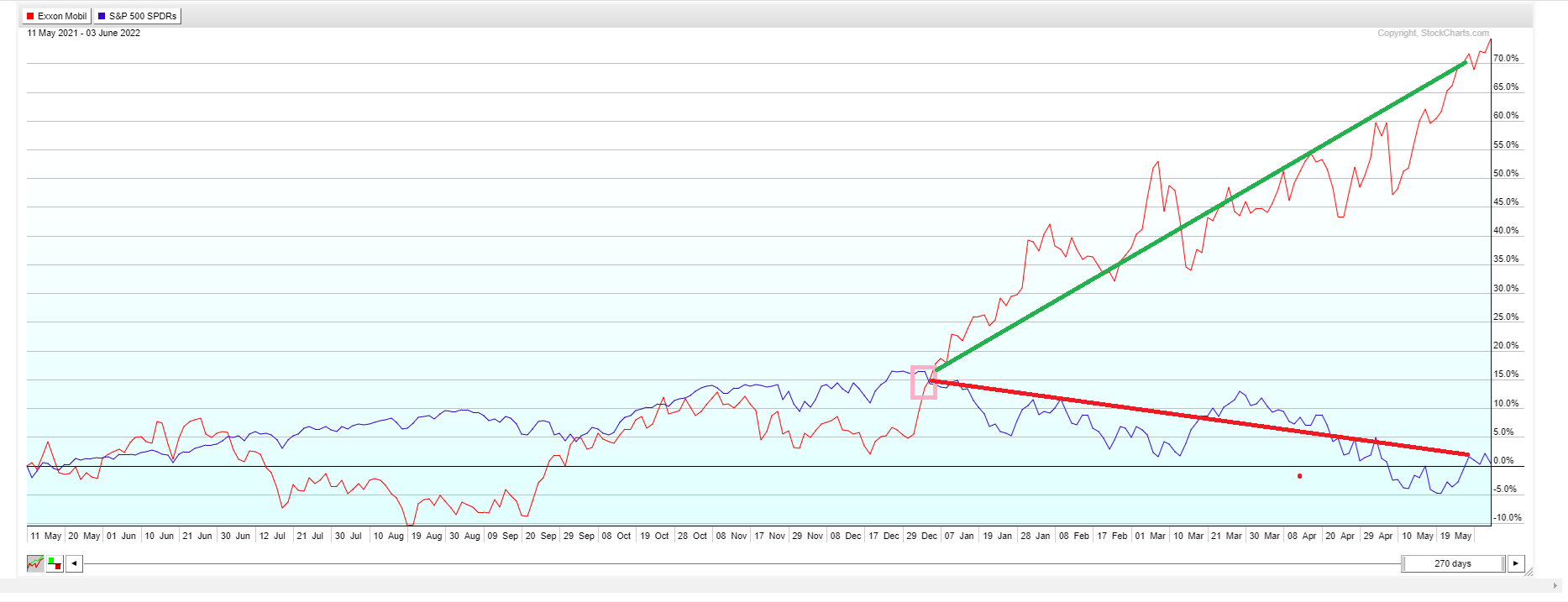

Comparative Efficiency

ExxonMobil has been an enormous out-performer to the total marketplace for the reason that starting of the yr. XOM is up over 50% in that time period with SPY falling just about 15%. Generally XOM and SPY have a tendency to be relatively neatly correlated as noticed within the first part of the chart.

Timber do not develop to the sky perpetually, regardless that. Search for this large divergence to start to converge with XOM being a relative under-performer to the total marketplace over the following a number of months.

XOM inventory could also be getting prolonged as opposed to the cost of crude oil. Since making a up to date prime round $125 in March, oil has fallen about 4% to near close to $120. ExxonMobil stocks, then again, have risen over 12% in that very same time period. XOM went from $88 to $99 although oil costs dropped from $125 to $120.

But one more reason the rally in XOM inventory could also be nearing an finish.

Attempting to pick out the precise most sensible in any inventory, let by myself oil shares, is an artwork, no longer a science. Plus, there may be the previous marketplace adage that shares that business at $90 will nearly all the time hit $100. For the reason that XOM is now buying and selling over $99, maximum of that receive advantages has been already reaped.

Whilst shorting XOM inventory is smart, it may be dear from a margin point of view. Plus, XOM can pay has a three.6% dividend yield which you’d be at the hook for when you shorted the inventory.

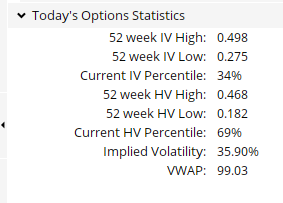

Fortuitously, the choices marketplace supplies an overly viable alternative-buying places. For the reason that implied volatility (IV) is most effective on the 34th percentile, it way possibility costs are relatively reasonable. They’re even less expensive when in comparison to the real, or historical volatility (HV) of 69%.

You’ll be able to outline you possibility up entrance whilst nonetheless with the ability to make out-sized positive factors. Whilst possibility control is all the time an important part of buying and selling, it has change into much more essential just lately.

Buyers taking a look to quick an over-valued, overbought and overloved XOM inventory might wish to imagine shopping reasonable put choices to position the possibilities on your choose. On the finish of the day, buying and selling is all about chances and no longer simple task.

That is the kind of business method and possibility technique we make use of day in and day trip within the POWR Choices portfolio.

POWR Choices

What To Do Subsequent?

If you are searching for the most efficient choices trades for lately’s marketplace, you must take a look at our newest presentation Find out how to Industry Choices with the POWR Rankings. Right here we display you the right way to persistently to find the highest choices trades, whilst minimizing possibility.

If that appeals to you, and you need to be informed extra about this robust new choices technique, then click on underneath to get get entry to to this well timed funding presentation now:

Find out how to Industry Choices with the POWR Rankings

The entire Perfect!

Tim Biggam

Editor, POWR Choices Publication

XOM stocks closed at $99.09 on Friday, up $1.42 (+1.45%). Yr-to-date, XOM has received 65.41%, as opposed to a -13.29% upward push within the benchmark S&P 500 index all over the similar length.

In regards to the Creator: Tim Biggam

Tim spent 13 years as Leader Choices Strategist at Guy Securities in Chicago, 4 years as Lead Choices Strategist at ThinkorSwim and three years as a Marketplace Maker for First Choices in Chicago. He makes common appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Community “Morning Industry Reside”. His overriding interest is to make the advanced international of choices extra comprehensible and due to this fact extra helpful to the on a regular basis dealer. Tim is the editor of the POWR Choices publication. Be told extra about Tim’s background, in conjunction with hyperlinks to his most up-to-date articles.

The submit 5 Causes Why It is In the end The Time To Promote Large Oil seemed first on StockNews.com