Wholesome client snacks and beverage corporate Merely Excellent Meals (NASDAQ: SMPL) inventory has been acting quite sturdy in comparison to the benchmark indices. The wholesome way of life meals corporate comprises well known manufacturers like Atkins and Quest Diet, recurrently present in grocery and comfort retail outlets. Just about part of the Corporate gross sales comes from diet bars, 1 / 4 from candy and salty snacks, and some other quarter from ready-made sports activities shakes. The Corporate used to be an epidemic winner. Gross margins fell (-250 bps) because of inflationary pressures from a difficult provide chain surroundings. Then again, its Q1 2022 value will increase have helped to mitigate one of the vital force as call for stays sturdy. The post-COVID reopening helped POS to develop just about 20% because of foot site visitors returning to comfort retail outlets and gymnasiums. E-commerce has been a strong channel that continues to boost up gross sales as Quest noticed 14% enlargement. Prudent buyers looking for publicity within the client energetic well being snack pattern can search for opportunistic pullbacks in stocks of Merely Excellent Meals.

MarketBeat.com – MarketBeat

Q2 FY 2022 Income Liberate

On April 6, 2022, Merely Excellent Meals launched its fiscal first-quarter 2022 effects for the quarter finishing February 2022. The Corporate reported a benefit of $0.36 consistent with percentage beating out consensus analyst estimates for $0.27 consistent with percentage through $0.09 consistent with percentage. Revenues rose 28.7% year-over-year (YoY) to $296.70 million beating consensus analyst estimates for $274.92 million. Merely Excellent Meals CEO Joseph Scalzo commented, “Retail takeaway used to be in step with our expectancies and the cost build up instituted remaining quarter is monitoring in step with our estimates and partly offsetting provide chain value inflation. Then again, overall web gross sales and income enlargement used to be more than our forecast because of the timing of shipments to toughen previous than expected 3rd quarter retail buyer systems.”

In-line Steering

Merely Excellent Meals equipped in-line steerage for fiscal full-year 2022 revenues to develop 13% to fifteen% as opposed to 13.5% or $1.14 billion consensus analyst estimates. Gross margins are anticipated to say no 250 bps YoY. Complete-year 2023 adjusted EBITDA is anticipated to upward push lower than web gross sales enlargement price and financial 2022 adjusted diluted EPS is anticipated to extend more than the adjusted EBITDA enlargement price. The Corporate higher inventory buyback authorization through an extra $50 million.

Convention Name Takeaways

CEO Scalzo famous that in spite of COVID surges, call for used to be sturdy sufficient to take in the top unmarried digit share value will increase carried out in Q1 2022. This helped web gross sales to develop 28.7%. It’s POS higher 19.2% within the U.S. The Corporate entered into an settlement to license Quest frozen pizza to Bellisio Meals, which recently licenses Atkins Frozen foods. General Quest retail takeaway in measured channels rose 40.1% just about doubling the Energetic Diet phase enlargement. Amazon’s 2d biggest buyer Q2 retail takeaway grew 20% YoY. Quest bars retail takeaway grew 22% pushed through upper consumer journeys in comfort retail outlets making up 55% of overall Quest gross sales. Quest snacks grew 88% within the quarter making up 40% of overall Quest gross sales and powerful enlargement is anticipated to proceed. Quest e-commerce grew 14% YoY. Timing of Q2 shipments will purpose web gross sales to fall under retail takeaway enlargement in the second one part. He concluded, “Our customer support ranges are making improvements to, we watch for that offer chain running surroundings will stay difficult. We’ve excellent visibility into our value construction for the steadiness of the fiscal 12 months and our enter prices are in large part coated. Subsequently, there’s no significant exchange to our fiscal 2022 provide chain value inflation or gross margin outlook. The associated fee build up introduced previous this month is essentially a receive advantages within the fiscal 2023. We are executing neatly towards our plans, and we imagine we’re ready to ship some other 12 months of cast web gross sales and altered EBITDA enlargement as a trail to expanding shareholder worth.”

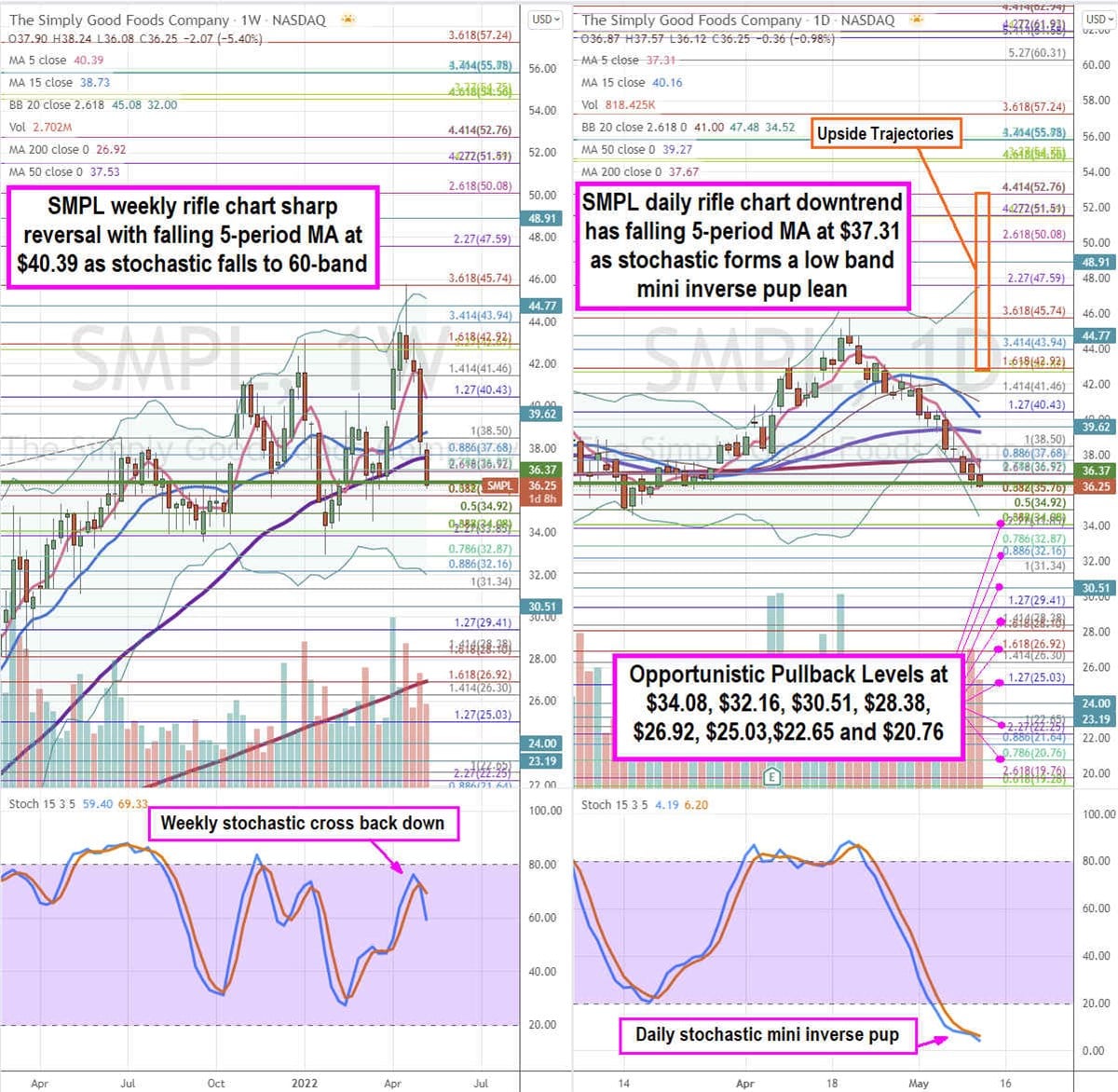

SMPL Opportunistic Worth Ranges

The usage of the rifle charts at the weekly and day by day time frames supplies a precision view of the panorama for SMPL inventory. The weekly rifle chart not too long ago peaked off the highs close to the $45.74 Fibonacci (fib) degree. Stocks took a pointy sell-off to plunge all the way down to the weekly marketplace construction low (MSL) purchase cause $36.37. The weekly 5-period shifting moderate (MA) is beginning to slope down at $40.39 whilst 15-period MA stalls at $38.73 and weekly 50-period MA at $37.53. The weekly stochastic rejected off the 80-band because it heads go into reverse. The day by day rifle chart downtrend has a falling 5-period MA at $37.31, day by day 200-period MA at $37.67, day by day 50-period MA at $39.27, and the day by day 15-period MA slipping at $40.16. The day by day decrease Bollinger Bands (BBs) sit down at $34.52. The day by day stochastic shaped a mini inverse puppy below the 10-band. Prudent buyers can look ahead to opportunistic pullbacks on the $34.08 fib, $32.16 fib, $30.51, $28.38 fib, $26.92 fib, $25.03 fib, $22.65 fib, and the $20.76 fib degree. Upside trajectories vary from the $42.92 fib degree up against the $52.76 fib degree.