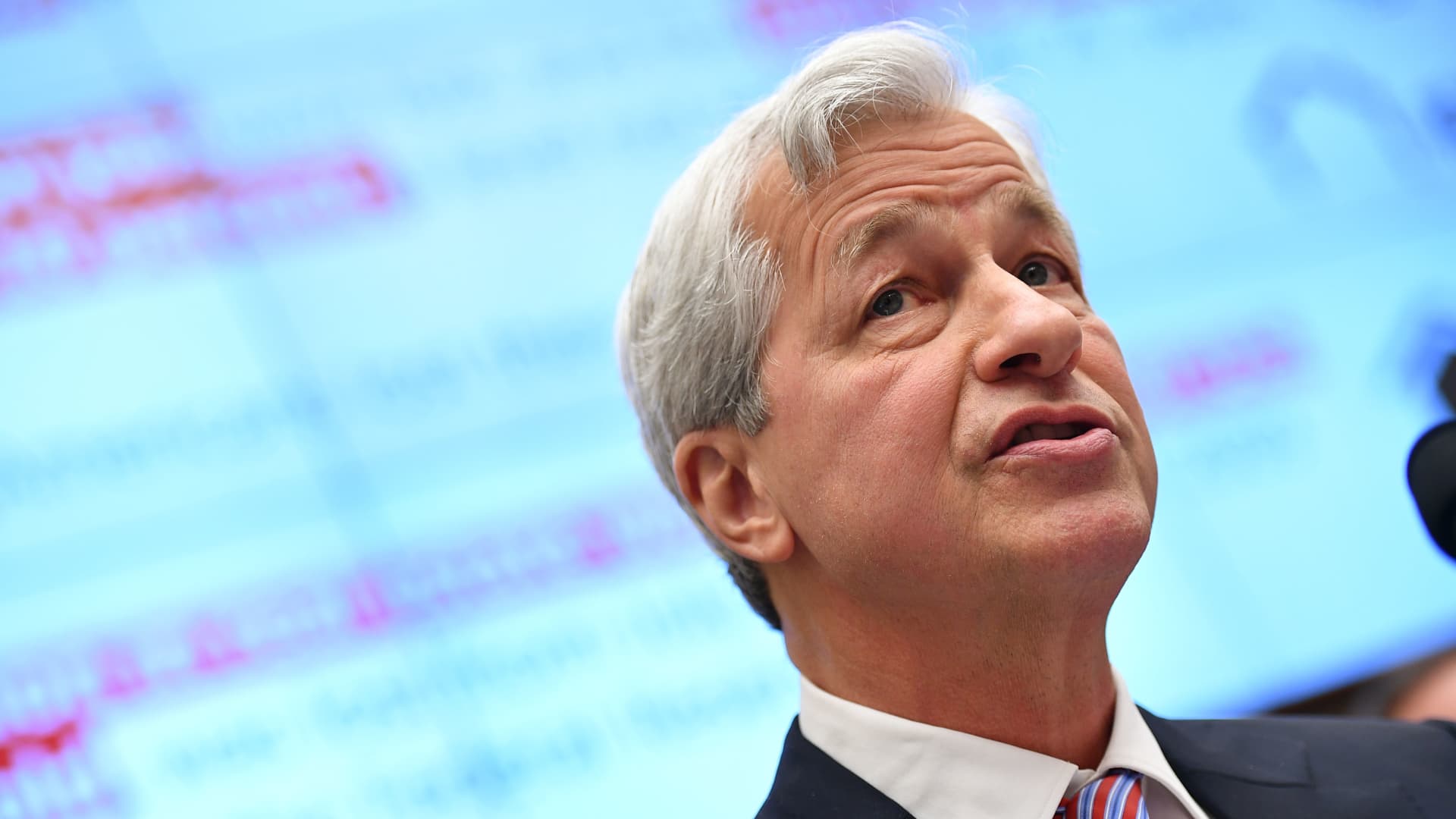

JP Morgan Chase & Co. Chairman & Leader Government Officer Jamie Dimon testifies prior to the Area Monetary Services and products Committee on responsibility for megabanks within the Rayburn Area Place of business Development on Capitol Hill in Washington, DC on April 10, 2019.

Mandel Ngan | AFP | Getty Photographs

JPMorgan Chase CEO Jamie Dimon was once passed an extraordinary rebuke on Tuesday with the shareholder disapproval of his large retention bonus introduced through the financial institution final yr.

Simply 31% of buyers taking part within the New York-based financial institution’s annual shareholder assembly supported the $52.6 million award that was once a part of Dimon’s 2021 reimbursement bundle.

The bonus, within the type of 1.5 million choices that Dimon can workout in 2026, was once designed to stay the CEO and chairman on the helm of JPMorgan for every other 5 years. Its estimated price, pegged final yr, fluctuates and relies at the financial institution’s percentage worth appreciation, in line with financial institution spokesman Joe Evangelisti.

“The particular award was once extraordinarily uncommon — the primary in additional than a decade for Mr. Dimon — and it mirrored exemplary management and further incentive for a a success management transition,” Evangelisti mentioned.

Whilst the result of the so-called “say on pay” vote are nonbinding, JPMorgan’s board mentioned it takes investor comments “severely” and supposed Dimon’s bonus to be a one-time match, he added.

The disapproval was once the primary time JPMorgan’s board suffered a down vote on reimbursement for the reason that pay-watch measures have been presented greater than a decade in the past. Dimon, 66, has led JPMorgan since 2006, serving to information it via a number of crises and construction it into the largest U.S. financial institution through property.

Previous this month, proxy advisory corporations together with Glass, Lewis & Co. advisable that shareholders vote in opposition to the pay bundle of Dimon and his most sensible lieutenant, Daniel Pinto. Together with the retention bonus, Dimon’s pay final yr was once valued at $84.4 million.

“Over the top one-off grants to the CEO and COO amid tepid relative efficiency irritate long-standing considerations in regards to the corporate’s executive-pay program,” Glass Lewis mentioned in its document.

Dimon and his different administrators won strengthen differently from buyers, which is extra conventional of a shareholder vote at a big corporate.

Glass Lewis had additionally suggested that shareholders vote in opposition to the reimbursement of rival CEO David Solomon, who leads Goldman Sachs and was once awarded a $30 million retention bonus in October. If so, alternatively, about 82% of Goldman’s shareholders voted in prefer of control.