An investor wishes a competent revenue calculator to make correct projections of his or her income in actual property making an investment.

An revenue calculator is a device incessantly utilized by actual property execs and buyers to decide what their returns on attainable or present investments are. A number of actual property web sites have their very own variations of an revenue calculator, however we advise Mashvisor’s funding assets calculator over the entire others.

On this article, we can speak about various kinds of actual property revenue resources, their prices, and the right way to calculate annual revenue and go back on funding the use of Mashvisor’s calculator.

7 Other Kinds of Source of revenue Resources for Actual Property Traders

In actual property, buyers have a number of techniques of incomes revenue. Even supposing every alternative provides other ranges of revenue, all of them assist generate a good gross per thirty days revenue for the investor. Some are costlier to get into than others. Some are riskier. After which some are extra rewarding. Both means, those other funding cars give people a possibility of creating fairness and being profitable.

1. Apartment Homes

Most likely the most well liked funding approach in actual property is the purchase of condominium homes.

Apartment homes assist no longer simply the person investor however different common other folks, too, as this can be a great way of offering refuge to those that can not manage to pay for to shop for any assets. In some way, it is helping deal with The us’s housing wishes via permitting buyers to hire out their homes at reasonably priced per thirty days charges.

The beauty of condominium homes is that their coins float is more straightforward to expect with higher accuracy. As a landlord, you know the way a lot you’re paying for and what to anticipate per thirty days out of your tenants, which makes computing gross annual revenue more straightforward.

2. Holiday Leases

A holiday condominium is one of those condominium assets meant to be occupied via a tenant for shorter classes. Those homes are incessantly ones that get indexed on home-sharing web sites like Airbnb, VRBO, and Vacasa.

Like conventional condominium homes, an investor has higher regulate over the funding as they get to select the valuables, display tenants, decide nightly charges, and put into effect control practices.

Most likely one of the crucial perfect benefits momentary leases have over long-term leases is their attainable to earn two times as a lot in the best marketplace. Let’s check out Mashvisor’s newest 2022 actual property marketplace information for the highest 5 states that experience the best moderate Airbnb per thirty days condominium revenue and examine it to how a lot they make with conventional condominium homes:

Hawaii

- Per 30 days Airbnb Apartment Source of revenue: $5,418

- Airbnb Money on Money Go back: 4.67%

- Airbnb Cap Charge: 4.75%

- Per 30 days Conventional Apartment Source of revenue: $2,348

- Conventional Money on Money Go back: 1.95%

- Conventional Cap Charge: 1.98%

California

- Per 30 days Airbnb Apartment Source of revenue: $5,169

- Airbnb Money on Money Go back: 3.18%

- Airbnb Cap Charge: 3.23%

- Per 30 days Conventional Apartment Source of revenue: $3,292

- Conventional Money on Money Go back: 1.68%

- Conventional Cap Charge: 1.71%

Wyoming

- Per 30 days Airbnb Apartment Source of revenue: $4,349

- Airbnb Money on Money Go back: 3.49%

- Airbnb Cap Charge: 3.57%

- Per 30 days Conventional Apartment Source of revenue: $1,803

- Conventional Money on Money Go back: 1.16%

- Conventional Cap Charge: 1.19%

Maine

- Per 30 days Airbnb Apartment Source of revenue: $4,282

- Airbnb Money on Money Go back: 4.04%

- Airbnb Cap Charge: 4.11%

- Per 30 days Conventional Apartment Source of revenue: $1,698

- Conventional Money on Money Go back: 0.97%

- Conventional Cap Charge: 1.00%

New York

- Per 30 days Airbnb Apartment Source of revenue: $4,270

- Airbnb Money on Money Go back: 1.18%

- Airbnb Cap Charge: 1.20%

- Per 30 days Conventional Apartment Source of revenue: $3,544

- Conventional Money on Money Go back: 1.27%

- Conventional Cap Charge: 1.29%

4 out of those 5 states display that holiday leases have nice attainable of incomes extra for an investor in comparison to renting out a space long-term.

3. Area Hacking

Area hacking is sort of a cousin to condominium homes. That is particularly useful for individuals who wish to get in on the actual property funding sport however don’t have get admission to to capital this present day.

Area hacking is solely renting out a portion of your house whilst dwelling underneath the similar roof as your tenants. Some who’ve single-family houses hire out rooms and basements to tenants whilst cohabitating in the similar house. Others hire out all of the space and simply are living in a cellular domestic parked at the assets. People who’ve cash purchase multi-family properties, like a townhouse complicated or duplex on the market, and are living in a single unit whilst renting out the others. This fashion, the revenue from the tenants will pay for the loan and utilities whilst the valuables proprietor will get to are living there at no cost.

4. Actual Property Funding Trusts or REITs

One of the best ways an aspiring investor can get into actual property making an investment is thru actual property funding trusts or REITs. Making an investment in REITs is solely making an investment in an organization that owns, manages, and funds income-generating actual property like workplace areas, warehouses, and rental gadgets.

There are two forms of REITs: Fairness REITs and loan REITs. The previous invests without delay in actual homes whilst the latter lends cash secured via the consider to buyers.

5. Actual Property Crowdfunding

Any other oblique means of making an investment in actual property is the fairly new actual property crowdfunding approach.

It’s what the title implies. A number of buyers pool their cash to fund larger actual property investments and initiatives and in flip, percentage in the advantages and rewards in their investments accordingly. This can be a smart way for buyers to diversify their portfolios and for amateur buyers to get into actual property, particularly for the ones with little or no cash to take a position.

6. Area Flipping

Flipping properties is any other nice technique to earn a good revenue in actual property. Area flipping comes to searching for undervalued distressed homes and rehabilitating them to promote at a benefit. A large number of buyers have made a livelihood with fix-and-flips. On the other hand, it calls for numerous laborious paintings and cash to do.

By means of the use of a web revenue calculator, you’ll get a excellent approximation of the way a lot you’ll earn via this funding approach. Whilst the computation is just a little other from condominium homes and different passive revenue investments, the basics are just about the similar. So long as you already know your acquire worth, last prices, rehabilitation prices, and financing approach, you’ll get a excellent image of what to anticipate.

For example, let’s say you purchase a assets price $100,000 and spend $40,000 on maintenance and updates. Moreover, you spend about $25,000 on last and wearing prices. Then you definitely make a decision to promote it at a pleasing spherical determine of $200,000. According to the given numbers, you earn a good-looking benefit of $35,000 on a $165,000 all-cash funding.

Now let’s say you had some assist with the capital and simplest produced $20,000 for the down fee and financed 80% of the acquisition together with 100% of the entire rehabilitation, last, and wearing prices. Although we upload $5,000 extra for charges and pursuits, you can nonetheless have a $30,000 make the most of your general coins funding of $50,000. That’s already a whopping 60% coins on coins go back price! On the other hand, taking into consideration the quantity of effort and time you want to place right into a fix-and-flip challenge, the go back on funding may not be as horny as it kind of feels.

7. Wholesaling

Wholesaling is very similar to space flipping with the one distinction being it doesn’t require any type of rehabilitation. The purpose of a wholesaler is to buy a distressed assets from a motivated supplier, get a freelance assigned to the topic assets, search for a possible purchaser (most often actual property buyers), and assign the contract to the patron.

A standard wholesale transaction will get closed in a brief time period, from a couple of days to a number of weeks. Since no domestic enhancements are concerned, the benefit margin for wholesaling isn’t as massive as space flipping. Nevertheless it’s nonetheless an effective way to earn additional revenue in a short while.

Similar: Actual Property Making an investment for Rookies With No Cash: Is This Imaginable?

11 Commonplace Kinds of Prices in Actual Property Assets Investments

Making an investment in actual property will take a toll for your pockets in additional techniques than one. In case you assume all you want is the preliminary funding, you’ve were given any other factor coming.

Listed below are the most typical prices and bills related to actual property making an investment:

Preliminary Funding

Your preliminary funding most commonly comes to one-time payouts that you want to make to procure and arrange your house.

Assets Acquire Worth

The majority of the preliminary funding will move to the acquisition of the valuables. This may increasingly or won’t come with home equipment and furnishings.

Remaining Prices

Remaining prices normally move between 3% and six% of the valuables worth. So if you are going to buy a $100,000 assets, your last prices will fall someplace between $3,000 and $6,000. A number of components would possibly impact last prices similar to location, loan lender, and mortgage kind.

House Enhancements

In case you’re within the fix-and-flip trade, then you definately must believe domestic restore prices as part of your preliminary funding. The volume relies on the full situation of your house and the maintenance had to make it as successful as you can need it to be.

Running Prices

In case you’re making an investment in condominium homes, be expecting to shell out cash often to stay your condominium trade working.

Assets Upkeep

Repairs is likely one of the issues that can consume up a large number of your per thirty days operational funds. Correct upkeep is had to make certain that the home is in excellent situation and appropriate for habitation.

Utilities

Utilities similar to electrical energy, web, heating, water, elementary cable, and different an identical issues had to stay your condominium trade operational wish to be paid per thirty days. However if you’re working a conventional condominium trade, your tenants will have to pay for those as a substitute.

Loan

In case you didn’t pay on your revenue assets in coins and opted to have it financed, you additionally wish to put aside a per thirty days funds for loan bills.

Insurance coverage

A accountable and sensible investor will all the time acquire insurance coverage for the valuables in addition to legal responsibility insurance coverage. Landlords typically additionally ask tenants to get insurance coverage to mitigate the monetary dangers.

Brokerage Charges

In the United States, dealers most often pay commissions of about 6% of the valuables acquire worth to all brokers and agents concerned. Patrons don’t have the load of paying commissions to any person. On the other hand, if the patron comes to a decision to hire out their homes, they’ll wish to pay dealer’s charges in the event that they availed their products and services to find a tenant.

Non-Running Prices

You’ll additionally must account for sure bills, specifically when submitting your taxes:

Amortization

In the United States, the federal government lets in buyers to deduct the amortization of the last prices’ financing over the mortgage’s time period. This non-cash expense will also be taken from the condominium revenue.

Depreciation

America govt additionally lets in funding assets homeowners to depreciate a assets’s acquire worth in addition to prices no longer associated with financing for a length of 27.5 years. This non-cash expense may also be deducted from the condominium revenue.

Taxes

Each actual property investor must dutifully pay any taxes related to their actual property funding. We will be able to speak about this within the subsequent segment.

Similar: Tips on how to Calculate ROI on Apartment Assets: The 2022 Information

Actual Property Traders’ Tax Duties

As discussed above, actual property buyers must pay their taxes irrespective of what their selected funding cars are. It’s each and every American’s duty to verify their taxes are filed, reported appropriately, and paid on time.

That is the place an after tax revenue calculator will turn out to be useful. You’ll be able to merely use a annually revenue calculator and deduct the quantity of tax fee you want to make to get a hold of your precise general annual revenue.

The next are the most typical taxes related to actual property investments:

Assets Taxes

A assets tax is a tax paid at the assessed price of a assets. The volume of assets taxes you’ll wish to pay varies relying at the assets’s location.

Internet Funding Source of revenue Tax or NIIT

Relying on the kind of funding automobile you select, you may wish to additionally pay for NIIT. It is a tax this is charged on an investor’s funding revenue (passion and dividends). The IRS has defined on its web page who’re topic to NIITs.

Actual Property Source of revenue Tax

If you make a decision to hire out your funding assets, you’re topic to paying actual property revenue tax because it is thought of as common revenue. Simply you’ll want to take a look at in case your condominium trade falls underneath the IRS’s definition of passive revenue, in a different way, you’ll chance submitting incorrectly, which might be topic to consequences and fines.

Industry Source of revenue Tax

Positive condominium companies fall underneath the trade revenue tax class if the valuables homeowners and hosts transcend simply offering the fundamentals of a condominium trade. For example, for those who’re a condominium assets proprietor and also you be offering bed-and-breakfast products and services on your visitors and tenants, then you’re prone to fall underneath this taxation class.

Capital Good points

Capital good points taxes are taxes buyers must pay from any benefit constructed from promoting an actual property funding.

Particular person Source of revenue Tax

This kind of tax is levied on dividends, pursuits, and every other investment-related income you’re making. This is applicable to actual property buyers who don’t personal any precise actual property assets.

Similar: Tips on how to Record Airbnb Source of revenue on Tax Go back: Investor’s Information

Tips on how to Compute One’s Actual Property Funding Source of revenue

Now that we’ve mentioned the other ways of incomes in actual property in addition to the bills that flatter it, let’s check out the right way to calculate web revenue the use of Mashvisor’s revenue calculator.

Ahead of the rest, it is important to to find out what your gross annual revenue is the use of a gross revenue calculator or an annual revenue calculator. To decide how a lot you make once a year pre-tax, all you want to do is upload up your entire per thirty days income and subtract the prices and bills incurred all through the 12 months. Your gross actual property revenue on this case will come with any revenue made on any actual property funding.

After you have your gross annual revenue, you’ll then deduct all the prices and bills (each one-time and ordinary) to get a hold of your web revenue.

What’s the Components for Internet Source of revenue?

Internet Source of revenue Components = Gross Annual Source of revenue – Overall Annual Prices and Bills (together with taxes)

From there, you’ll now make a correct projection of the way a lot you’ll doubtlessly earn in a month or 12 months. After all, crunching numbers might be so much more straightforward when you’ve got a competent per thirty days revenue calculator via your aspect.

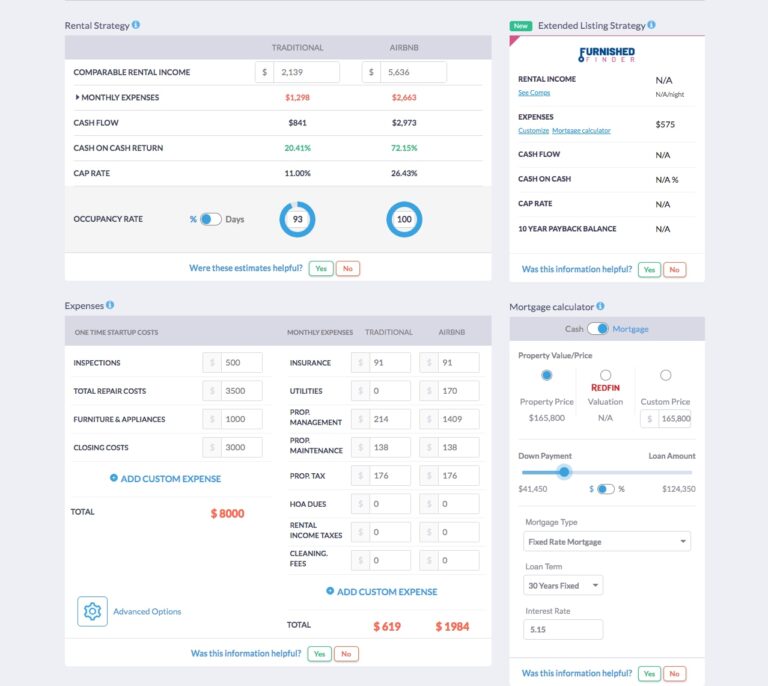

Mashvisor’s funding calculator is thought of as one of the crucial perfect on-line lately. It’s an clever instrument that comprises other variables to provide its customers extremely correct and dependable effects. It components in values like the amount of money invested, general annual funding, appreciation price, depreciation, and passion amongst others. All of this stuff will can help you get to a extra approximate projection of your attainable annual revenue.

Subsequent, the web page’s funding assets calculator additionally guarantees customers a smaller vary of mistakes, which ends up in just about splendid numbers. This will increase no longer simply person self assurance however investor self assurance as neatly. Now not simplest does it give them actual computations but it surely does so in a fragment of the time in comparison to doing issues manually, regardless of how excellent they’re at math.

Finally, Mashvisor’s revenue calculator leads customers to the best funding homes in places that are ideal for your funding objectives and standards. Take into account that every location has one thing other to supply buyers. One investor may to find good fortune in a location the place any other has skilled a number of demanding situations. It is going to very much rely at the investor’s imaginative and prescient and path. Mashvisor’s calculator will increase one’s likelihood of funding good fortune via serving to customers and buyers to find the best homes in the best actual property markets.

Mashvisor’s Source of revenue Calculator is located in each and every record at the web page, so you’ll calculate your attainable funding payback must you make a decision to procure the valuables you’re taking a look at.

Wrapping It Up

Having a annually revenue calculator that lets you make correct projections for funding income is a huge help make the best funding selections. And whilst there are a number of nice revenue calculators on-line, just a make a selection few can actually meet buyers’ expectancies and ship near-perfect effects. Mashvisor’s funding calculator is likely one of the few that has won the consider and self assurance of 1000’s of buyers in the United States.

To get get admission to to our actual property funding equipment, click on right here to join a 7-day unfastened trial of Mashvisor lately, adopted via 15% off for existence.