The cap price can inform if a belongings shall be a excellent funding. The use of the most efficient cap price system calculator is a very powerful to each and every investor’s luck.

Desk of contents

- What Is Cap Price?

- How you can Calculate the Cap Price

- When to Calculate the Cap Price in Actual Property

- What Is a Excellent Cap Price in 2022?

- What Is the Best possible Cap Price System Calculator for Rookies?

Each new and skilled buyers know that looking for an appropriate funding belongings can also be difficult. When discovering the suitable funding belongings, most pros imagine that location is the number 1 issue that may both make or smash your funding’s profitability. Whilst location will have to be basically regarded as, buyers will have to most effective use this metric along with different crucial measures to make a decision which is the most efficient belongings to put money into.

Relying to your deliberate funding technique, there are a number of different elements that you wish to have to believe that may lend a hand making a decision whether or not a belongings shall be price your money and time. That’s why you wish to have to do an in-depth funding belongings research to make sure you make the suitable resolution. For example, in the event you plan to put money into a standard apartment, you will have to believe the inhabitants on your desired location. You will have to additionally be mindful the price-to-rent ratio, which tells whether or not citizens will to find it inexpensive ultimately to hire or purchase a house.

If you happen to plan to put money into brief time period apartment houses, you will have to learn the way ceaselessly guests flock for your selected location. It’s additionally a very powerful to grasp the occupancy price and the stroll ranking throughout the house, as they are able to impact your profitability. Alternatively, whether or not you propose to put money into conventional or holiday leases, figuring out the cap price of an funding belongings may be very vital as this determine help you resolve if a specific belongings will convey excellent returns or now not.

What Is Cap Price?

Many new buyers are questioning what’s cap price in actual property and why it can be crucial. The cap price, brief for capitalization price, is outlined as the anticipated price of go back from an funding belongings. You want to grasp this measure as it is very important in figuring out whether or not an funding belongings can generate a enough go back on funding.

The cap price price is computed the usage of the anticipated web source of revenue from an funding belongings as opposed to its asset price. It’s expressed as a share, and it may be used to check identical funding houses available in the market. Through the usage of cap price actual property, you’ll successfully assessment doable houses within the house of your choice and discover a excellent deal.

Comparable: How you can To find Cap Price for a Actual Property Marketplace

How you can Calculate the Cap Price

The cap price is the ratio of the web running source of revenue to the acquisition charge or the present marketplace price of the valuables. Your financing way does now not impact the price of the cap price. Whether or not you purchase the valuables totally in money or with a loan mortgage does now not subject. When calculating a cap price, it’s a very powerful to make use of a correct cap price system calculator that considers the efficiency of tangible apartment houses on your most popular location.

To compute the cap price, you wish to have to divide the possible web running source of revenue by way of the valuables’s gross sales charge or present asset price, then convert the quotient right into a share.

Here’s the cap price system:

Cap price = web running source of revenue ÷ gross sales charge or present marketplace price

Observe that the cap price is not going to supply a precise quantity for the overall go back on funding. This measure is most effective used to give you an estimate of the way lengthy it is going to take to get well your preliminary funding. Your exact go back on funding will range relying on a number of elements, together with your bills, occupancy price, and financing way.

Steps in Calculating the Cap Price

Computing a belongings’s cap price manually can also be very tedious. This is the reason we propose the usage of a cap price system calculator to make the calculation so much more uncomplicated. Alternatively, in the event you plan to compute the cap price your self, you’ll do the next steps:

Step 1: To find the Present Marketplace Price or Assets Value

Some buyers use the present marketplace price in calculating the cap price. Alternatively, some buyers use the valuables’s gross sales charge. You’ll to find the valuables’s present marketplace price the usage of a house valuation estimation instrument. While you to find the marketplace price and buy charge figures, you’ll make a decision which one to make use of to compute the cap price.

Comparable: Be told the Distinction Between Actual Property Marketplace Price vs Marketplace Value

Step 2: Decide the Assets’s Gross Source of revenue

The gross apartment source of revenue is the overall source of revenue you get out of your tenants each and every yr. If your home earns different source of revenue streams, you will have to additionally come with them. Different source of revenue streams that are supposed to be integrated are parking charges or separate apartment source of revenue from parking, and another facilities that require further charges.

Step 3: Decide the Emptiness Price

You will have to believe the possible vacancies as it will impact your computation. Buyers recurrently think a mean of 10% emptiness in a yr. To get a correct estimate of the valuables’s occupancy price, it’s beneficial that you simply analysis identical apartment houses within the house.

Comparable: What Is Emptiness Price and How you can Stay It Low

Step 4: Listing Down All Your Bills

Get the overall of the bills related to the funding belongings. The most typical bills come with belongings taxes, restore and upkeep prices, insurance coverage premiums, felony prices, and different running bills.

Step 5: Compute the Assets’s Web Running Source of revenue

The next move is to know the way to calculate the web running source of revenue (NOI) of a specific funding belongings. The NOI is the valuables’s general source of revenue much less its general bills and emptiness price. Subtract the overall bills and the emptiness from the overall source of revenue to get the price for NOI.

Step 6: Calculate the Cap Price The use of the Cap Price Calculator System

The next move is to make use of the cap price system discussed above and divide the web running source of revenue by way of the present marketplace price or belongings charge. Then convert it to a share by way of multiplying the outcome by way of 100.

Whilst those steps glance easy sufficient, discovering correct figures for source of revenue, bills, occupancy price, and marketplace price can also be difficult and time-consuming. Thankfully, you’ll discover a cap price calculator on-line that may do that for you mechanically. Consider, despite the fact that, that now not all actual property cap price calculators to be had on-line can give a correct computation. Ensure to make a choice a depended on actual property analytics web page that can give exact and up-to-date figures.

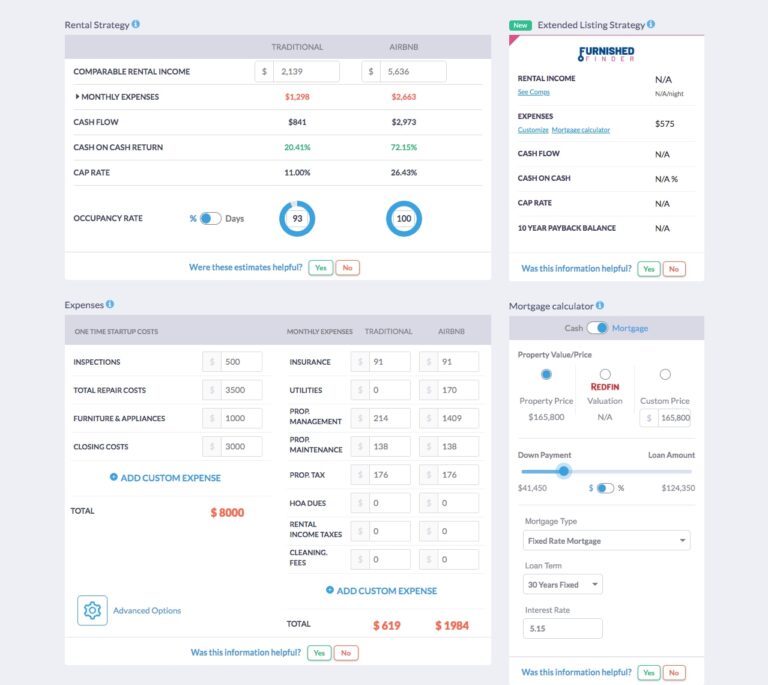

Mashvisor’s cap price system calculator makes it more uncomplicated to get this determine with out doing all your analysis. Mashvisor’s in-depth actual property information and research can lend a hand making a decision whether or not or now not a belongings shall be a profitable funding.

Get started a unfastened trial to enjoy what Mashvisor can do for you:

When to Calculate the Cap Price in Actual Property

Cap price is an actual property valuation way that takes into consideration each source of revenue and bills however does now not believe the best way in which you purchased the valuables. Many buyers who use the cap price normally acquire the valuables totally in money. Alternatively, although you purchase the valuables via a loan, you’ll nonetheless use the cap price that can assist you resolve whether or not or now not it is going to be a excellent funding.

You’ll additionally use a cap price actual property calculator to compute the cap price to check it to the price of cash whilst you purchase a belongings via a loan. If the cap price is upper than the loan’s rate of interest, the valuables is more potent than the mortgage. Which means that it might be a excellent doable for winning funding.

The most efficient time to calculate the cap price in actual property is when you find yourself nonetheless in search of an funding belongings to shop for. Cap price allows you to evaluate funding houses and make a decision which one will turn into a a success funding. The use of a excellent cap price system calculator, you are going to get a common evaluation of your doable go back on funding. It help you resolve how lengthy you’ll get well your preliminary capital.

For What Homes Are Cap Charges Used?

Cap charges are usually used in case you are making an investment in apartment houses as they are able to can help you see your doable returns. You’re going to in all probability see a cap price calculator apartment somewhat than a cap price calculator for purchasing and promoting. If you happen to plan to put money into uncooked land or repair and turn houses, the cap price will not be as useful in comparing if the valuables shall be a excellent funding. For the reason that cap price system will depend on annual web running source of revenue, it might now not observe to those investments.

Basically, you’ll use a cap price system calculator when assessing quite a lot of belongings varieties supposed for apartment. This contains apartment houses like multi-unit properties, condominium constructions, single-family properties, and townhouse complexes.

What Is a Excellent Cap Price in 2022?

Maximum buyers usually believe a excellent cap price to be 8% or upper. Alternatively, a number of elements can impact the common cap price particularly places. In sure markets, a cap price that hovers round 4% is regarded as excellent.

For buyers who don’t wish to tolerate an excessive amount of possibility however nonetheless wish to see cheap returns, a cap price between 3.0% and 5.0% is quintessential. Consistent with Investopedia, a excellent capitalization price will have to be between 4.0% and 10.0%. Alternatively, the precise collection of a excellent cap price depends upon the valuables’s location and the beneficial price of go back for a profitable funding.

Buyers use a cap price system calculator to measure the cap price when looking for an funding belongings as it supplies an concept concerning the belongings’s profitability. If you happen to put money into a belongings with the next cap price, you’ll briefly get well the valuables’s acquire price. Alternatively, buyers additionally use the cap price as a method to judge the danger. A belongings with a decrease cap price has a decrease possibility, whilst the only with the next cap price has the next possibility.

When the usage of a cap price for comparing funding houses, it’s vital to know the danger related to any specific belongings. As buyers, you will have to now not take extra dangers than you’ll find the money for to maintain. Additionally, cap charges will have to most effective be used with different crucial metrics. Plus, working out the apartment belongings research help you make an educated funding resolution.

What Is the Best possible Cap Price System Calculator for Rookies?

A cap price calculator actual property is a device you’ll use to compute a belongings’s cap price and assess whether it is price making an investment in. The most efficient cap price system calculator for rookies will have to be simple to make use of and supply correct knowledge. It successfully calculates the cap price for apartment houses based totally on the web running source of revenue and their marketplace price. Whilst a number of cap price calculators are to be had on-line, discovering one designed for each amateur and seasoned buyers is a very powerful for your luck.

Listed here are the issues that the most efficient cap price system calculator can do for you:

- Supplies correct values: A excellent actual property cap price calculator will take the valuables price, supply a hire estimate, resolve all running bills, and calculate the cap price for any source of revenue belongings on your selected marketplace.

- Is helping you’re making winning funding selections: The most efficient cap price calculator is helping buyers make knowledgeable funding selections extra hopefully, the usage of a well-researched funding belongings research and dependable figures.

- Tells how a lot you wish to have for an funding belongings: The most efficient actual property cap price calculator can estimate how much cash you wish to have to find the money for a specific source of revenue belongings.

- Is helping making a decision on the most efficient way of financing: A excellent cap price calculator will can help you work out one of the best ways to finance your acquire and what price of go back to be expecting from a specific belongings.

- Is helping you select a apartment technique: Your cap price calculator will have to be capable to provide the source of revenue doable of each conventional and temporary apartment strategies. Via this, you’ll be capable to see which apartment technique help you maximize your profitability.

Mashvisor’s Cap Price System Calculator additionally estimates the money drift and money on money returns.

Check out Mashvisor’s Cap Price System Calculator

Mashvisor supplies the most efficient cap price system calculator in 2022 as it has the entire abovementioned options. With Mashvisor’s apartment belongings calculator, apartment comps from exact funding houses throughout the house are being regarded as. Mashvisor obtains its information via group research, predictive analytics, and machine-learning algorithms. This complete information is then used to calculate the cap price of a apartment belongings in america housing marketplace.

Mashvisor’s database makes it more uncomplicated so that you can to find the most efficient source of revenue belongings to put money into. You simply need to enter your required location, select a belongings from the consequences, and get an outline of the actual property marketplace research. Mashvisor’s user-friendly interface will will let you see the entire essential knowledge, together with the valuables main points, apartment comps, and group comps. Its apartment belongings calculator supplies well-researched estimates, but it surely additionally permits you to input your personal figures for bills and financing to get a extra custom designed computation.

If you happen to’re able to put money into apartment houses, use Mashvisor’s Assets Finder instrument to seek for the most efficient source of revenue houses on your most popular location.