Wholesaling homes isn’t a brand new idea. However the query for actual property traders is whether or not it’s the proper technique for wealth-building?

Desk of Contents

- What Is Wholesaling Properties?

- How Does Wholesaling Properties Paintings?

- What Are the Benefits and Disadvantages of Wholesaling Properties?

- Wholesaling or Leases: Which Is Higher?

- Easy methods to Get started Wholesaling Properties: 5 Steps to Get within the Sport

- Wrapping It Up

On this article, we can communicate extra about wholesaling homes 101 and the way novice traders can get began.

What Is Wholesaling Properties?

Prior to we continue to speak about the fundamentals of wholesaling homes, we want to solution the query, “What is wholesale?“

Through definition, the time period wholesale approach the procurement of products in huge amounts to be retailed through others. If we have been to translate that into the actual property trade, wholesaling homes definition is ready a wholesaler contracting a space from a dealer and providing it to doable consumers at a better value than the unique contract. The wholesaler helps to keep the variation between the vendor’s asking value and his or her promoting value as benefit.

People who find themselves into wholesaling actual property in most cases search for distressed houses to promote since most homeowners of such varieties of houses need to get them off their palms. Wholesalers know sufficient to benefit from such eventualities to show them into winning industry ventures.

Similar: What Is Actual Property Wholesaling and Is It Proper for Me?

How Does Wholesaling Properties Paintings?

As we’ve already discussed above, actual property wholesaling is all about wholesalers purchasing undervalued houses from motivated dealers and discovering similarly motivated consumers to promote the funding houses at a better value level.

The primary objective of an actual property wholesaler is to make as a lot cash as they are able to through appearing because the intermediary of the transaction. Best, this time, the opposite events concerned – the vendor and potential purchaser – don’t want to be familiar with every different.

The wholesaler – the intermediary – seems to be for distressed houses that may be purchased at a cut price from a motivated dealer in need of to do away with a assets ASAP. They get the valuables below contract after which to find consumers to assign the similar contract to.

Normally, the wholesaler does now not acquire the valuables however as a substitute, the landlord’s transient contract provides the wholesaler permission to promote on their behalf. The wholesaler then attaches a wholesaling rate to the contract as their earnings. Most often, the wholesale rate quantities to a definite proportion of the valuables’s general price.

The wholesaler and the vendor come to an settlement to promote a assets inside of a definite period of time. In positive instances, the wholesaler may want to make investments some earnest cash to transport ahead with the transaction. Most often, sooner than a freelance for wholesaling homes is drawn, a mutual settlement must be arrived upon between the vendor and wholesaler.

Finally events comply with the phrases, particularly the volume and period of the promoting length, the wholesaler then begins searching for consumers, typically actual property traders searching for inexpensive source of revenue houses on the market to spend money on. If a purchaser is eager about the valuables and needs to continue with the funding, they take over the contract assigned to the wholesaler as soon as the consumer concurs to the wholesaler’s value.

For example, if a distressed off-market assets is being offered at $125,000 through the landlord, a wholesaler comes into the image to lend a hand the vendor do away with the valuables rapid. They input a freelance and the wholesaler seems to be for consumers keen to pay the cost the latter units. In this kind of case, the wholesaler may attempt to promote the valuables for $150,000. The extra $25,000 is known as the “unfold” or the variation between the unique asking value and the wholesaler’s fee. The unfold is thought of as the wholesaler’s benefit.

Is It Felony?

Wholesaling, when performed proper, is felony and could be a very profitable industry. Whilst it’s felony, positive sides of it will possibly get a wholesaler in bother in the event that they have no idea precisely what to do.

For example, it’s unlawful if a wholesaler brings in consumers with out coming into a freelance with a dealer. Then again, numerous wholesalers who took the time to know the internal workings of the industry are in a position to make a just right residing for themselves. They achieve this through following the native regulations and processes installed position to offer protection to all events concerned.

Some may well be questioning can an individual input wholesaling homes contracts with no actual property license? Normally talking, maximum states don’t require an actual property license for folks to begin a occupation in wholesale actual property. So long as they aren’t if truth be told managing the sale and most effective function a mediator within the transaction, they are able to function with no license. We extremely suggest consulting with an actual property attorney or trade skilled for your house first to make certain.

What Are the Benefits and Disadvantages of Wholesaling Properties?

Like all industry or funding alternative related to the actual property trade, wholesaling homes comes with positive advantages and disadvantages.

The Upsides of Wholesaling Properties

Listed below are probably the most explanation why a large number of other folks are interested in actual property wholesaling and get within the industry:

Minimum In advance Funding Wanted

Wholesaling doesn’t require the wholesaler to shop for the valuables. At best possible, it’ll absorb a lot of an individual’s time and effort to seek out the precise houses and consumers to make a sale. Even though there can be some circumstances by which a specific amount of earnest cash could also be concerned, it most often doesn’t price an excessive amount of to get into.

Doubtlessly Better Source of revenue in a Shorter Time Body

Not like different actual property funding methods like fix-and-flip or beginning a condo assets industry, wholesaling doesn’t take too lengthy to make the wholesaler a substantial sum of money. Whilst the 2 mentioned methods take a number of months to paintings on house enhancements and updates, wholesaling doesn’t require solving, serving to herald a big sum of money in as little time as conceivable.

Nice Access Level Into the International of Actual Property Making an investment

Since wholesaling does now not require a wholesaler to buy a assets, this is a nice alternative for first-time actual property traders to get into the actual property trade. It’s very true for individuals who wish to be concerned with actual property however lack the cash and sources to spend money on actual property. It provides them superb alternatives to be told in regards to the trade and connect to seasoned execs and traders.

The Downsides of Wholesaling Properties

Whilst wholesaling homes would possibly appear to be an excessively sexy industry undertaking, it additionally comes with positive dangers that would-be wholesalers and traders must pay attention to, like the next:

Source of revenue Is Now not as Strong as One Would Be expecting

Sadly for would-be actual property wholesalers, source of revenue in wholesaling isn’t as solid as some would assume. For those who fail to make a sale inside the agreed-upon period of time, you are going to finally end up shedding the contract with the vendor. One could also be prone to to find that wholesaling could be a seasonal factor. Every now and then there’s quite a lot of stock to make a choice from whilst at positive occasions of the yr, there’s slightly sufficient to move round.

Decrease Benefit Margin

Whilst actual property wholesaling could be a profitable industry, it does now not all the time be sure that those that make a decision to get enthusiastic about it’ll generate a gradual move of enormous source of revenue. A wholesaler’s benefit is dependent upon a number of components, together with the kind of assets being offered, its general situation, time of yr, and the native actual property marketplace situation. Because the houses enthusiastic about wholesaling are most commonly distressed and fixer-uppers, a wholesaler’s benefit isn’t as huge in comparison to space flipping the place the houses are rehabilitated for optimum benefit.

Extremely Depending on Different Patrons and Dealers

One fact about wholesaling actual property is that this is a industry that relies in large part on dealers and consumers. A wholesaler’s lifeline is hinged at the availability of houses being offered and traders keen to shop for distressed houses.

Wholesaling or Leases: Which Is Higher?

Now that we’ve talked in regards to the fundamentals of wholesaling homes, let’s discuss some other funding selection that’s similarly – if now not extra – rewarding: condo houses.

Making an investment in Condominium Homes

For plenty of actual property traders, making an investment in condo source of revenue houses is a superb solution to earn a just right go back on funding and create a passive source of revenue supply. They’re additionally a good way to diversify one’s funding portfolio and function a just right inflation hedge in comparison to different asset varieties.

Relying on a assets proprietor’s condo technique, she or he could make condo houses a facet gig or a number one source of revenue supply. The extent of involvement additionally is determined by the method. Conventional condo assets is thought of as a extra passive form of condo technique in comparison to a extra hands-on means wanted for a holiday condo assets.

Moreover, a large number of actual property traders desire to move with condo houses as a result of when performed proper, they make for winning money drift houses. On best of that, condo assets traders get pleasure from actual property appreciation. They may be able to make as a lot cash as they wish to as condo assets house owners. After a number of years, in the event that they make a decision to promote their condo houses, there may be just right cash to be made on account of how top actual property costs cross up over time.

Take as an example an Airbnb San Diego assets. In line with actual property web page Mashvisor, the median value of a San Diego assets in January 2022 was once $1,212,089. Simply 3 months after, in April 2022, the median assets value in San Diego went as much as $1,300,412. That’s just about an 80-grand bounce in assets worth in simply 3 months. Whilst the Airbnb leases are doing rather well in San Diego, house owners can choose to promote their houses at a far upper value than the volume that the houses have been purchased for.

Like actual property wholesaling, condo assets investments additionally include disadvantages. One is the amount of money wanted to buy the valuables. Some traders are in a position to pay for a assets in exhausting money. Then again, a better choice of traders face restricted money sources and rely on financing choices to make the acquisition. In some circumstances, would-be traders don’t qualify for loans, making them fail to notice very good funding alternatives.

Any other drawback to condo assets making an investment is its source of revenue steadiness. Condominium assets house owners aren’t all the time assured a standard source of revenue, particularly people who make a selection to spend money on non permanent condo houses indexed on Airbnb, VRBO, HomeAway, Vacasa, and different identical platforms.

Landlords of long-term condo houses, then again, also are vulnerable to finishing up with dangerous tenants. Such an unwanted state of affairs may end up in decrease per 30 days condo source of revenue, which is able to additionally imply funding losses if it helps to keep up in the long run.

Similar: Wholesaling Actual Property for Newbies: The Entire Information

Easy methods to Get started Wholesaling Properties: 5 Steps to Get within the Sport

For those who actually assume wholesaling homes is an ideal match for you, listed below are 5 steps that can assist you get began:

1. Do Your Homework

Appearing your due diligence will virtually all the time repay without reference to your selection of funding. In terms of actual property making an investment, it’s particularly necessary as a result of we’re most often speaking about huge sums of cash being invested in actual property houses. However although you select to move with a low money output funding technique like wholesaling, doing all of your analysis and research will lend a hand build up your possibilities of good fortune.

Thankfully, a web page like Mashvisor exists to lend a hand traders of every kind to find the precise funding houses for them. It focuses on serving to customers behavior actual property marketplace research to present traders a extra correct image of what they’re coming into.

Mashvisor is helping tens of 1000’s of traders to find the most efficient offers on-line in keeping with their funding objectives, standards, and instances. To provide you with a greater concept of what Mashvisor can be offering its customers, let’s check out a couple of of its Most worthy actual property funding gear:

Belongings Finder

The web page’s assets finder is possibly one of the crucial helpful gear any Mashvisor subscriber will use. Customers can to find houses through merely coming into an cope with, town, group, or zip code within the seek box. It is going to then take you to a web page the place a map of the site is proven in conjunction with a listing of to be had houses indexed at the MLS. The houses are labeled as funding houses, conventional leases, and Airbnb leases.

Customers too can slender down their searches the use of other filters equivalent to choice of bedrooms, choice of bogs, yr constructed, house through the sq. foot, assets kind, and condo source of revenue amongst others. The function makes discovering source of revenue houses much more explicit and tailor-fit for various traders’ wishes, subsequently, making it much more environment friendly.

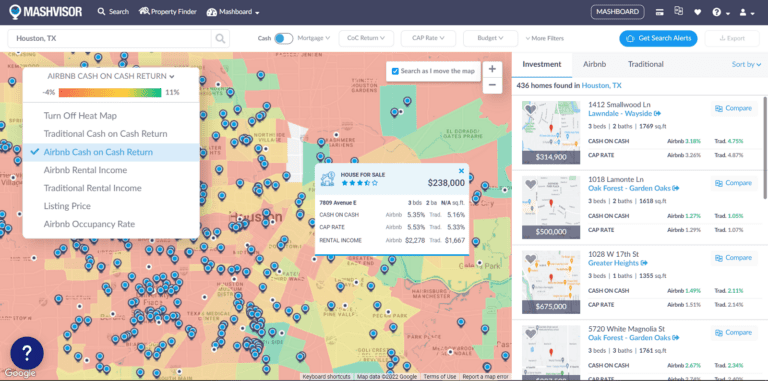

Actual Property Warmth Map

The following device we can discuss is Mashvisor’s actual property warmth map. The warmth map purposes in a similar way to a climate forecast map in that it’s color-coded to turn how positive spaces are appearing in keeping with other classes.

The warmth map’s filter out will also be edited through clicking at the drop-down menu on the left-hand nook of the map classified “Warmth Map Information Set.” Customers can make a selection which classes they wish to use for his or her searches equivalent to conventional/Airbnb money on money go back, conventional/Airbnb condo source of revenue, list value, and Airbnb occupancy fee.

The colour inexperienced represents spaces with top numbers in a given class whilst spaces which might be in purple point out the other. Normally, traders make a choice houses in inexperienced spaces below virtually all classes excluding the list value. For list costs, houses situated in purple spaces are extra inexpensive.

Mashvisor’s Actual Property Warmth Map presentations a color-coded illustration of a selected group or location in keeping with a number of metrics, together with conventional/Airbnb money on money go back, conventional/Airbnb condo source of revenue, list value, and Airbnb occupancy fee.

Funding Belongings Calculator

What would marketplace and funding assets research be with no correct calculator to crunch numbers? Mashvisor’s funding assets calculator is understood to be one of the vital best possible available in the market and on-line these days as it makes use of essentially the most up-to-date information and actual property comps. The device additionally permits customers to think about one-time startup prices, ordinary bills, or even taxes to decide a possible funding’s profitability.

In response to the computation, a consumer can to find houses that align with their projections the use of Mashvisor’s assets calculator. It additionally provides customers a side-by-side comparability between the numbers if a assets have been for use as a conventional or holiday condo.

Condominium Comps

People who find themselves critically taking into account making an investment in condo houses want to understand how different identical houses are appearing as leases in a given house. Mashvisor provides customers get right of entry to to condo comps to peer how their houses stack up towards different identical condo houses. It permits landlords or Airbnb hosts to set costs accordingly to stick aggressive and use it to get the threshold at the others.

Appearing your due diligence through accumulating vital marketplace data and group information is a superb solution to construct a robust basis in your wholesaling industry.

To be informed extra about how Mashvisor mean you can to find winning funding houses, time table a demo now.

2. Construct a Sturdy Patrons Record

Even sooner than getting down to search for the very best assets to jumpstart your wholesaling industry, it’s extremely advisable that traders curate a consumers listing first. Wholesaling is in large part depending on dealers for stock and consumers for gross sales. Even supposing you’re in a marketplace chock stuffed with nice stock, in the event you don’t have sufficient consumers to assign contracts to, you gained’t be as a hit as you are expecting to be on this line of commercial.

Wholesalers can construct a just right consumers listing through attending actual property occasions and gatherings, electronic mail and social media advertising, in addition to networking and connecting with as many of us as they are able to.

3. Safe Your Financing

Prior to you even cross out searching for assets to wholesale, you will have to make sure that you’ve sufficient sources to again up your funding. Discovering the precise assets gained’t imply a factor in the event you don’t have the approach to buy the contract. Search for a non-public or exhausting cash dealer to align your products and services to sooner than you get began. Doing this may increasingly lend a hand ensure that financing temporarily even sooner than your first deal comes.

4. Spot the Absolute best Imaginable Actual Property Offers

Upon getting the entirety in position, now you’ll get started searching for offers for your selected location. That is the place Mashvisor is particularly useful because it permits customers to seek out the most efficient conceivable offers at the MLS and off-market. You may additionally do it the traditional means through using round the city and chatting with folks to get leads. You’ll be able to additionally take a look at searching for them the use of public data.

5. Formulate a Neatly-Idea Go out Technique

There are two primary techniques wholesalers make a make the most of this kind of industry. The primary one is through promoting a freelance through matching up dealers with consumers. This manner, the wholesaler doesn’t want to purchase the valuables however can nonetheless make a just right benefit at the transaction.

Wholesalers may additionally choose to do a double-closing the place they purchase the valuables and covers all final prices. It is going to most effective paintings if the wholesaler unearths a purchaser who’s keen to pay a complete lot extra for the valuables.

In the long run, the kind of wholesaling deal will lend a hand level traders to the precise go out technique.

Similar: Digital Wholesaling: The Final Information for Novice Actual Property Buyers

Wrapping It Up

To sum it up, wholesaling homes is a good way to get into the actual property industry although with little or no to no sources to shop for an funding assets. It’s particularly useful for first-time traders and those that are strapped for money. Then again, as simple as it sort of feels, it’s not for everybody.

In our opinion, making an investment in condo houses supplies traders with a extra solid source of revenue supply that provides very good doable for developing a good money drift. Both means, an investor must all the time do the essential analysis and research to make sure a better likelihood of funding good fortune.

To get right of entry to Mashvisor’s actual property funding gear, click on right here to join a 7-day loose trial, adopted through 15% off for existence.