As traders, you will have to pay particular consideration to the running money drift method, as this is a an important issue for your funding technique.

Desk of Contents

- What Is Running Money Drift?

- Working out the Money Drift System

- Why Is Running Money Drift Essential?

- Running Money Drift Ratio: Defined

- Internet Running Source of revenue: How Is It Other?

- Why Is OCF Essential for Airbnb Homes?

- Running Money Drift System: Summing Up

Making an investment in actual property is on no account a secular procedure. It’s, actually, a fancy procedure that calls for traders to continuously track the statistics that decide the luck in their funding and alter their means accordingly. Therefore, traders will have to be capable to are expecting the profitability of each and every undertaking they’re interested in making an investment in. Another way, if they’re guided via miscalculations, they’ll to find themselves in a significant issue.

You’ve almost definitely heard of the running money drift method earlier than. In brief, the method can are expecting whether or not your actual property funding will likely be a a success one or no longer.

Naturally, you will have to be capable to sense its significance for your investments with out us spelling it out. Your monetary well-being—and all long run investments—normally rely at the money drift you’re ready to generate at the moment. Nonetheless, many are unfamiliar with the an important position it performs in monetary making plans, making an investment actions, and total industry operations.

When you’re hoping to comb up your wisdom in this making an investment metric, we’ll be discussing it in higher element under. Scroll down for more info.

What Is Running Money Drift?

At the beginning, we will have to make an effort to convey the idea that of running money drift nearer to anyone who would possibly no longer but be absolutely conversant in it. When you’re new to actual property making an investment, it may well be a good suggestion to learn the next with care.

Through definition, running money drift (OCF) represents the online sum of money that a person—or a company—generates from its actions (on this case, investments). The ideas collected from the method for running money drift is then used to evaluate the cost-effectiveness and viability of the funding undertaking. The sure end result in the sort of situation can be producing a good money drift, i.e., a gentle passive source of revenue—which is crucial for any short- or long-term funding to live on out there.

Right here’s one thing we really feel the want to explain earlier than going any longer. In line with professionals, calculating money drift is normally a a lot more vital indicator of luck than the extra ceaselessly mentioned internet running source of revenue.

Now that you’re conversant in this in concept, the following query is – how is that this analyzed?

As a normal rule, the running money drift method is analyzed intimately via a workforce of analysts and fiscal professionals. Alternatively, as of late’s funding gear can do the maths for you—and prevent an important time.

Comparable: 10 Guidelines To Be certain A Winning Quick-Time period Condominium Funding in 2022

Tactics of Calculating OCF: Direct and Oblique

There are two techniques it’s possible you’ll calculate your running money drift—direct and oblique.

In calculating OCF via following the direct manner, the person or group makes use of explicit accounting data to trace the affect of cash on all industry transactions. The result of the calculations are considered in money inflows and outflows, which can be related to the next elements:

+ Cash gathered from consumers

+ Pastime source of revenue and dividends gained

– Reimbursement paid

– Cash paid to providers

– Pastime paid to lenders

– Source of revenue taxes paid

= Running Money Drift

Then again, the usage of the money drift from running actions method consistent with the “oblique manner,” all depreciation, source of revenue taxes, amortization of monetary earning—and different bills—are subtracted from the online source of revenue.

Working out the Money Drift System

Traders will have to understand how to make use of the method for calculating money drift—and for, with a bit of luck, obtrusive causes. Now, the commonest method can be:

Running Money Drift = General Money Gained – Money Paid For Running Bills

That’s a long way from the one manner through which you’ll write the method down. Listed below are every other examples it’s possible you’ll come throughout as an investor:

OCF = (Your Income – Your Running Bills) + Depreciation– Source of revenue Taxes – Adjustments In Operating Capital

Running Money Drift = Internet Source of revenue + Depreciation – Adjustments In Operating Capital

Running Money Drift = Internet Source of revenue – Trade In Operating Capital + Non-Money Bills

Sure vs. Unfavourable Money Drift: How Does It Affect You?

The second one vital facet in regards to the internet money drift from running actions method is figuring out the very important distinction between sure and damaging money drift—and the way it affects you and your funding technique.

Naturally, a good money drift manner that you’ve more cash coming in than from your funding. It mainly signifies that the earnings you’re producing out of your funding assets are upper than what you first of all put into it.

Sure money drift is measured and in comparison roughly on a per month foundation. It’s the usual apply for temporary leases best, although. With long-term investments, it may be carried out each six or so months—or on a annually foundation.

Producing sure money drift signifies that the cash for your checking account is amassing; then again, it does no longer essentially imply extra funding alternatives for the investor. Even with sure money drift, the fitting factor to do can be to economize for attainable long run bills.

Now, let’s communicate in regards to the not-so-good risk—damaging money drift. It signifies that you’ve spent more cash for your funding than you’re making from it. The cash for your checking account isn’t amassing—and you need to doubtlessly to find your self suffering to make ends meet because of all of the assets bills.

When you’re taking a look at damaging money drift, it’s a transparent indicator that your go back on funding has no longer been triumphant—and due to this fact, you’re in want of a few primary adjustments on your technique.

That’s why the sensible factor to do can be to evaluate the profitability of your funding plan in due time and get ready for any upcoming prices.

Through the usage of Mashvisor’s condominium assets calculator, you’ll estimate the profitability of your subsequent short- or long-term funding technique inside of mins and, in the long run, make a well-calculated resolution.

Why Is Running Money Drift Essential?

The important thing to figuring out the significance of the money drift running actions method will be the investor’s money drift remark.

In short put, the money drift remark presentations data referring to all money inflows and outflows that your funding has been aggregating over a specified time period.

It’s of very good price to traders as a result of they are able to assessment the numbers and analyze them when had to get an in depth breakdown of crucial spaces for producing source of revenue. A large number of issues move into the equation, and getting on your final analysis is on no account simple.

On that observe, the money drift remark breaks down into:

- Running Money Drift: Cash move regarding day-to-day actions

- Funding Money Drift: Investments that generate earnings

- Financing Money Drift: Cash move between the funding and its house owners and collectors

- Internet Money Drift: The 3 earlier sections give perception into the online running source of revenue

For traders, the focal point will have to be at the running and internet running money drift method—as they’re the 2 maximum dependable signs of luck.

Through taking a look on the numbers carefully, the investor can see if—and the place—adjustments are wanted in an effort to keep away from going into debt and striving towards a top cap charge.

Comparable: What Is a Excellent Cap Charge?

Running Money Drift Ratio: Defined

How does the running money drift ratio method have compatibility into this—and why is it even vital for traders?

For starters, the running money drift ratio presentations the total “well being” of what you are promoting—what quantity of money it has controlled to acquire from its elementary actions.

The significance of calculating the running money drift method—and ratio—is in with the ability to see if what you are promoting can repay temporary liabilities. Right here’s easy methods to calculate it:

Running Money Drift Ratio = Running Money Drift / Present Liabilities

And that brings us to the following logical query:

What is thought of as a nice ratio?

A better money drift ratio—that means a ratio upper than 1.0—is predicted amongst traders and analysts as it signifies that they can pay their present temporary liabilities.

The best ratio can be 1:1, which might imply that the industry is in nice status.

The Execs and Cons of Calculating Money Drift Ratio

The usage of the running money drift method and calculating the ratio provides a number of benefits and drawbacks. Let’s get started with the upsides of the usage of the mentioned method:

It may be a competent monetary and luck indicator for what you are promoting. Traders and analysts acquire a greater perception into the present state in their actual property industry—and indicate the possible weaknesses.

With that mentioned, the reporting entity this is accountable for calculating the ratio can trade and manipulate the derivation of money operations. The planned adjustments can result in overseeing positive issues—and making a monetary remark that doesn’t replicate the present state of affairs.

The phrases “running money drift ratio” and “present ratio” can every so often get combined up, so we will be able to use this chance to elucidate the adaptation between the 2.

The running money drift ratio signifies that the money gathered will likely be used to pay present liabilities (essentially temporary), whilst the present ratio suggests present belongings will likely be used.

Internet Running Source of revenue: How Is It Other?

Since we’re already discussing the running money drift method, there’s any other calculation that individuals confuse it with—and that, as such, merits consideration—the online running source of revenue (NOI).

So, how’s the online money drift running actions method other from the running money drift ratio we’ve simply mentioned?

First, we provide the definition of NOI. In a nutshell, the online running source of revenue accounts for the profitability of the true property assets bought. It assesses the profitability as soon as the running bills had been subtracted. And in concept, the NOI is decided via taking all source of revenue minus all bills.

Right here’s the online running money drift method:

Internet Running Source of revenue = (Gross Running Source of revenue + Different Earning) – Running Bills

Earlier than you get into calculating the NOI, you’re going to want to calculate your gross source of revenue (that means, what you’re making from the funding) first. You’ll do it via subtracting emptiness charges from attainable condominium source of revenue.

The principle distinction between the running money drift method and NOI is the timeline it accounts for. With running money drift, traders are essentially inquisitive about bills in the back of day-to-day actions and whether or not they’ll be capable to pay temporary liabilities.

At the turn aspect, the NOI suggests whether or not the investor will have to put down their cash into the valuables in any respect—or get started in search of another.

Comparable: Information to the Internet Running Source of revenue System for Condominium Homes

Why Is OCF Essential for Airbnb Homes?

It’s now transparent why running money drift is an important for traders—particularly for other folks taking a look to put money into Airbnb houses. Right here, the emphasis is on temporary leases.

The running money drift is used to decide whether or not you’ll pay your temporary liabilities, and with Airbnb assets, it is necessary. When you fall in the back of for your tasks, you need to see your private home foreclosed. Typically, your tenants are going to go away your private home after 30 days most—which will give you house to have a look at the numbers and do the vital calculations.

After all, there are a number of techniques so that you can build up the profitability of your Airbnb assets, and some of the conceivable answers can be to take care of some prematurely prices. It comprises moving the expenses on your title, taking the time to put it on the market the valuables, and caring for vital maintenance—first.

Additionally, take into account that with temporary leases, location is essential. You’ll advertise sure money drift via selecting out the perfect position to shop for condominium assets.

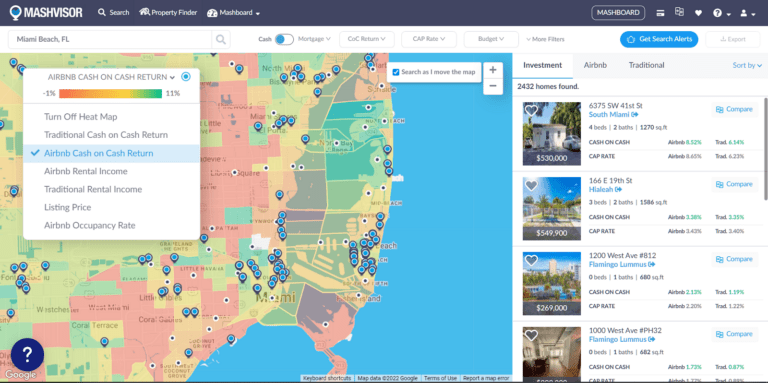

You’ll use Mashvisor to seek for successful temporary leases for your most well-liked location.

Running Money Drift System: Summing Up

That may be all at the running money drift method—and why traders will have to learn to decide the very best money drift ratio of their long run funding tasks.

Let’s simply briefly move over essentially the most crucial details, we could?

First, the running money drift represents the amount of cash a industry generates from its actions. It may be categorised as sure or damaging money drift—and it necessarily elements in all money inflows and outflows over a specified time period.

Then again, the NOI accounts for the total profitability of the funding—specializing in all source of revenue minus all bills after the funding procedure has been finalized.

The money drift running method is very important, particularly for traders, as it represents a competent indicator of luck. Much more so, it permits them to see the larger image and decide whether or not they are able to pay their temporary liabilities.

Mashvisor is helping traders identify a powerful funding technique and make bigger their portfolios.

To begin your unfastened 7-day trial of Mashvisor, click on right here.