Actual property buyers at all times search for Airbnb on the market as a result of its viability. Airbnb properties on the market be offering very good go back attainable.

Desk of Contents

- The Whole Information to Discovering the Proper Airbnb for Sale

- In finding the Proper Airbnb for Sale

- Wrapping Up

For those who’re an investor and also you’re out there for Airbnb homes on the market, there are specific issues you wish to have to grasp first prior to buying source of revenue homes.

On this weblog, we can communicate concerning the hows and whys of holiday apartment making an investment and the place to search out probably the most successful Airbnb homes within the nation.

The Whole Information to Discovering the Proper Airbnb for Sale

When coming into the apartment assets trade, discovering the best assets issues. Sure components come into play when searching for an funding assets, corresponding to location, tourism, financial system, and investor objectives, to call a couple of.

Find the best Airbnb on the market, one must believe how giant and how briskly the go back on funding shall be. Finally, no investor―amateur or skilled―will waste precious time and sources on an funding that received’t give them an optimum go back. The purpose isn’t just to wreck even however to in fact make a tight sufficient benefit. Buyers get into the apartment assets trade within the hopes that it’ll give them vital coins float from a slightly passive source of revenue supply.

It’s why buyers don’t seem to be simply out to search for Airbnb on the market however for the best Airbnb assets that traces up with their funding objectives and standards.

Why Is Airbnb Value Making an investment in?

Since its release, Airbnb’s grown somewhat standard amongst vacationers and vacationers. It supplies visitors with extra reasonably priced possible choices to dear lodges and accommodations.

Unmarried-family properties and condos, specifically, include a undeniable enchantment to visitors as a result of they offer vacationers a homier and extra at ease vibe in comparison to lodges. Whilst the latter does be offering sure benefits that enchantment to consumers, many vacationers these days are searching for lodging that supply them with a extra customized enjoy.

For example, the Florida actual property marketplace’s been regarded as one in all the freshest markets in america for years now, particularly the place Airbnb is worried. Airbnb in Miami will get a mean of $4,477 in per month Airbnb source of revenue with a coins on coins go back of 2.12% and a cap charge of 2.17%.

Airbnb in Orlando Florida is also getting a mean per month source of revenue of most effective $2,611, nevertheless it generates upper coins on coins go back charge of 2.92% and a cap charge of 3.01%. It is thinking about that the median assets worth in Orlando is most effective $486,404, which is considerably decrease in comparison to Miami’s $1,059,287. With the entire sexy figures, Airbnb on the market Florida makes for a viable choice for buyers even for out-of-state buyers.

As a result of how smartly the Florida marketplace is acting, buyers at all times search for condos in Florida to put money into Airbnb Fortress Lauderdale, Airbnb Anaheim, and different high-demand places within the Sunshine State.

As a trade, Airbnb or a holiday apartment is understood to be an excessively profitable trade value taking a look into. In comparison to conventional apartment homes, non permanent leases in most cases supply a better cap charge and coins on coins go back, giving house owners and buyers upper per month earning. It is going to nonetheless rely at the location and the landlord’s business plan, but if finished proper, it may possibly generate a sure coins float for Airbnb hosts and apartment assets buyers.

Comparable: 7 Causes to Put money into Florida Holiday Leases for Sale in 2022

The Professionals and Cons of Airbnb Funding

The item about making an investment in an Airbnb on the market is that, like every other funding, it comes with sure benefits and downsides. However in its case, the professionals outweigh the cons. Have a look.

Airbnb Professionals

It’s extra successful than conventional apartment investments. In comparison to long-term leases, holiday apartment homes in most cases have a tendency to be extra successful. There may be enough knowledge to again up the sort of observation. Airbnb house owners have a tendency to earn as much as thrice extra in scorching markets in comparison to landlords. Location nonetheless performs crucial function in Airbnb apartment’s profitability, however the best business plan may be chargeable for the upper profitability.

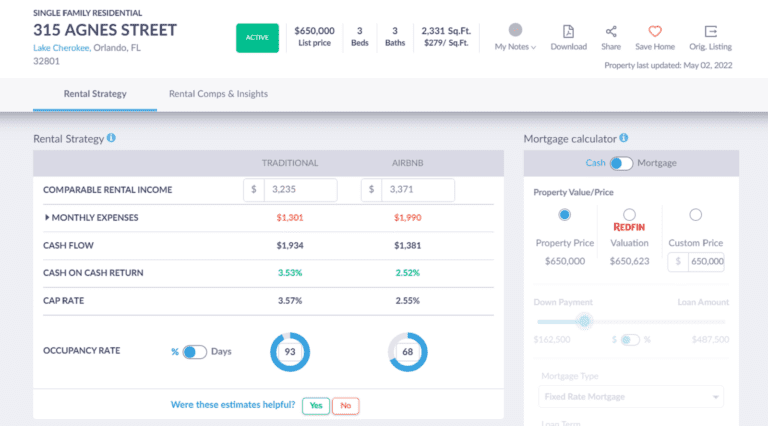

The use of Mashvisor’s Condo Source of revenue Calculator, one can see that Airbnb leases have a tendency to generate upper returns than conventional leases.

Airbnb hosts draw in a a lot more numerous tenant base. Landlords are in most cases pressured to care for shoppers for longer classes. In the event that they get caught with a nasty consumer (one that often misses bills or one that simply disappears), it’ll considerably have an effect on their source of revenue. It’s not the case with Airbnb hosts. Whilst the source of revenue is abnormal, the various clientele is made up of tenants from other backgrounds.

If, say, a visitor cancels a reserving on the final minute, the cancellation received’t lead to the similar affect financially. And relying at the salability of the valuables, a number can simply get some other reserving to catch up on the cancellation.

It provides house owners and hosts larger flexibility. One of the most perks of proudly owning a non permanent apartment assets is that it provides house owners the versatility of scheduling bookings and adjusting their Airbnb charges.

Airbnb Cons

The source of revenue is abnormal in comparison to long-term leases. Whilst Airbnb homes is also extra profitable than conventional leases, one in all their pitfalls is source of revenue inconsistency. In contrast to long-term leases, the place landlords be expecting to receives a commission a certain quantity on a undeniable date for a selected duration, Airbnb house owners take issues sooner or later at a time. Their occupancy and nightly charges range relying at the time of yr. Sure spaces carry out higher right through a undeniable season whilst others don’t and vice versa.

It calls for a extra hands-on solution to control. Opposite to standard trust that apartment assets house owners simply take a seat beautiful on their porches sipping piña colada all day, renting out a assets includes arduous paintings. Airbnb homes require house owners to be extra hands-on as they want to be certain that the day by day operations are going easily. It will probably imply the rest from answering messages and questions to assets upkeep to managing visitor transitions.

Airbnb hosts and apartment assets house owners would possibly get at a loss for words when tax season comes. When tax season comes, reporting Airbnb source of revenue will also be somewhat complicated for hosts and house owners. They want to be conversant in the diversities between source of revenue tax and accommodation taxes, plus in addition they want to know what Time table E and Time table C are. Because of this, we suggest running with a tax specialist to deal with any Airbnb tax-related problems so house owners can document accordingly to keep away from consequences and fines.

Comparable: Tax Season 2022: Information for Actual Property Buyers

In finding the Proper Airbnb for Sale

Relating to discovering the best Airbnb assets on the market, an investor is confronted with two major choices:

- Purchase an funding assets to make use of as an Airbnb trade; or

- Purchase an current Airbnb trade on the market.

Every of them gives distinct benefits and downsides, however in the end, it’ll rely at the investor which choice works for them.

Purchasing an funding assets to transform into a holiday apartment unit will entail making some upgrades at the assets, registering the trade, obtaining other lets in and licenses to function, advertising and marketing the apartment assets, and different connected start-up duties.

However at the turn facet, an investor and aspiring Airbnb host can transform the valuables to their very own desire and get a hold of a control machine this is extra aligned with the funding objectives.

However, purchasing an current Airbnb apartment that’s absolutely operational lets in buyers to keep away from the entire main legwork related to getting a trade off the bottom.

On the other hand, one of the crucial downsides of shopping for an already current non permanent apartment trade is it could be a fixer-upper in dire want of a few updates and renovations. The operations could be disrupted if the investor makes a decision to make main enhancements to the apartment assets. The trade’s momentum shall be stopped to deal with the valuables upgrades.

In the end, it’ll be as much as the apartment assets investor how she or he desires to move about it.

Now, so far as purchasing apartment homes is worried, one of the crucial very best and best tactics to do it’s to visit an actual property site. Mashvisor, specifically, is a brilliant actual property on-line platform that has already helped numerous buyers gain apartment homes in probably the most financially rewarding markets.

One in every of Mashvisor’s specialties helps buyers to find the best source of revenue homes for beginning a apartment assets trade like a conventional or holiday apartment.

To be informed extra about how Mashvisor will let you to find successful funding homes, time table a demo.

How Does One In finding the Proper Airbnb for Sale?

For buyers who’re out there to shop for Airbnb on the market, the primary fear is how do they to find the best source of revenue homes that align with their funding objectives and standards?

One, buyers can do it the traditional means of bodily going throughout the town to search for attainable Airbnb homes. Some buyers are more than likely considering, “It’s now not that onerous to search for an Airbnb on the market close to me.” There could be some fact to that observation, however someone who’s ever stated, “I will be able to simply discover a holiday apartment trade on the market close to me,” is aware of the other is right. It takes numerous arduous paintings, time, and cash to identify funding alternatives.

Making an investment in Airbnb calls for one to spot sure metrics that resolve a assets’s profitability. The ROI for such homes is normally decided by means of two components: cap charge and coins on coins go back. And whilst the 2 metrics appear synonymous, they’re somewhat other.

The capitalization charge is used to calculate returns if an all-cash transaction is (or shall be) utilized in buying the valuables. It implies that an investor buys a assets in chilly coins. However, coins on coins go back takes under consideration the process of financing since now not all buyers can have enough money to buy a assets in coins.

Cap Charge Method: Internet Working Source of revenue/ Present Marketplace Price of the Assets

Money on Money Go back Method: Internet Working Source of revenue/ Overall Quantity of Money Invested

That being stated, we suggest that buyers have a look at coins on coins go back in figuring out an funding assets’s value. Typically, the variation between the 2 is just a mere 0.10% in desire of cap charges.

Comparable: The place Can You Get the Maximum Dependable Airbnb Knowledge by means of Town in 2022?

Best Airbnb Condo Markets With Prime Money on Money Returns

In step with Mashvisor’s newest knowledge, the next places are those with the most efficient coins on coins go back charges for Airbnb homes, organized from the easiest to the bottom:

1. State School, PA

- Median Assets Worth: $603,649

- Reasonable Worth according to Sq. Foot: $248

- Days on Marketplace: 198

- Selection of Airbnb Listings: 269

- Per thirty days Airbnb Condo Source of revenue: $7,842

- Airbnb Money on Money Go back: 8.68%

- Airbnb Cap Charge: 8.80%

- Airbnb Day-to-day Charge: $494

- Airbnb Occupancy Charge: 52%

- Stroll Rating: 94

2. Bushkill, PA

- Median Assets Worth: $333,500

- Reasonable Worth according to Sq. Foot: $158

- Days on Marketplace: 50

- Selection of Airbnb Listings: 109

- Per thirty days Airbnb Condo Source of revenue: $4,327

- Airbnb Money on Money Go back: 8.05%

- Airbnb Cap Charge: 8.26%

- Airbnb Day-to-day Charge: $329

- Airbnb Occupancy Charge: 52%

- Stroll Rating: 0

3. Coachella, CA

- Median Assets Worth: $373,889

- Reasonable Worth according to Sq. Foot: $261

- Days on Marketplace: 113

- Selection of Airbnb Listings: 111

- Per thirty days Airbnb Condo Source of revenue: $4,677

- Airbnb Money on Money Go back: 7.91%

- Airbnb Cap Charge: 8.07%

- Airbnb Day-to-day Charge: $597

- Airbnb Occupancy Charge: 38%

- Stroll Rating: 63

4. Nashville, IN

- Median Assets Worth: $432,940

- Reasonable Worth according to Sq. Foot: $276

- Days on Marketplace: 82

- Selection of Airbnb Listings: 156

- Per thirty days Airbnb Condo Source of revenue: $4,639

- Airbnb Money on Money Go back: 7.86%

- Airbnb Cap Charge: 8.05%

- Airbnb Day-to-day Charge: $276

- Airbnb Occupancy Charge: 59%

- Stroll Rating: 56

5. Berkeley Springs, WV

- Median Assets Worth: $406,731

- Reasonable Worth according to Sq. Foot: $199

- Days on Marketplace: 74

- Selection of Airbnb Listings: 144

- Per thirty days Airbnb Condo Source of revenue: $4,146

- Airbnb Money on Money Go back: 7.61%

- Airbnb Cap Charge: 7.79%

- Airbnb Day-to-day Charge: $215

- Airbnb Occupancy Charge: 67%

- Stroll Rating: 5

6. White Agreement, TX

- Median Assets Worth: $250,505

- Reasonable Worth according to Sq. Foot: $173

- Days on Marketplace: 6

- Selection of Airbnb Listings: 107

- Per thirty days Airbnb Condo Source of revenue: $3,207

- Airbnb Money on Money Go back: 7.54%

- Airbnb Cap Charge: 7.80%

- Airbnb Day-to-day Charge: $145

- Airbnb Occupancy Charge: 61%

- Stroll Rating: 42

7. Wisconsin Dells, WI

- Median Assets Worth: $277,233

- Reasonable Worth according to Sq. Foot: $165

- Days on Marketplace: 33

- Selection of Airbnb Listings: 278

- Per thirty days Airbnb Condo Source of revenue: $3,176

- Airbnb Money on Money Go back: 7.50%

- Airbnb Cap Charge: 7.76%

- Airbnb Day-to-day Charge: $341

- Airbnb Occupancy Charge: 46%

- Stroll Rating: 69

8. Luray, VA

- Median Assets Worth: $480,243

- Reasonable Worth according to Sq. Foot: $209

- Days on Marketplace: 223

- Selection of Airbnb Listings: 212

- Per thirty days Airbnb Condo Source of revenue: $4,562

- Airbnb Money on Money Go back: 7.44%

- Airbnb Cap Charge: 7.62%

- Airbnb Day-to-day Charge: $272

- Airbnb Occupancy Charge: 60%

- Stroll Rating: 52

9. Sweetwater, FL

- Median Assets Worth: $431,111

- Reasonable Worth according to Sq. Foot: $353

- Days on Marketplace: 55

- Selection of Airbnb Listings: 319

- Per thirty days Airbnb Condo Source of revenue: $4,717

- Airbnb Money on Money Go back: 7.30%

- Airbnb Cap Charge: 7.46%

- Airbnb Day-to-day Charge: $154

- Airbnb Occupancy Charge: 56%

- Stroll Rating: 82

10. Broadview, IL

- Median Assets Worth: $253,900

- Reasonable Worth according to Sq. Foot: $211

- Days on Marketplace: 65

- Selection of Airbnb Listings: 249

- Per thirty days Airbnb Condo Source of revenue: $3,336

- Airbnb Money on Money Go back: 7.19%

- Airbnb Cap Charge: 7.42%

- Airbnb Day-to-day Charge: $128

- Airbnb Occupancy Charge: 64%

- Stroll Rating: 61

Comparable: In finding Dependable Airbnb Condo Knowledge in 2022

Wrapping Up

Discovering the best Airbnb on the market is all about spotting the best funding alternatives on the proper time. You can not simply depart issues to likelihood the place actual property investments are concerned. The sensible investor will at all times carry out due diligence to make certain that all bases are coated – from acquire prices to house updates to advertising and marketing the holiday apartment assets to operating operations. The whole thing must be calculated, and each contingency must be ready for.

Buyers will do smartly to paintings with funding equipment that can maximize their attainable as funding assets house owners. A site like Mashvisor provides them further energy and self belief to make the best funding choices that depart little or no room for mistakes and regrets.

To get get right of entry to to our actual property funding equipment, click on right here to enroll in a 7-day loose trial of Mashvisor nowadays, adopted by means of 15% off for lifestyles.