Berkshire Hathaway CEO Warren Buffett lambasted Wall Side road for encouraging speculative conduct within the inventory marketplace, successfully turning it right into a “playing parlor.”

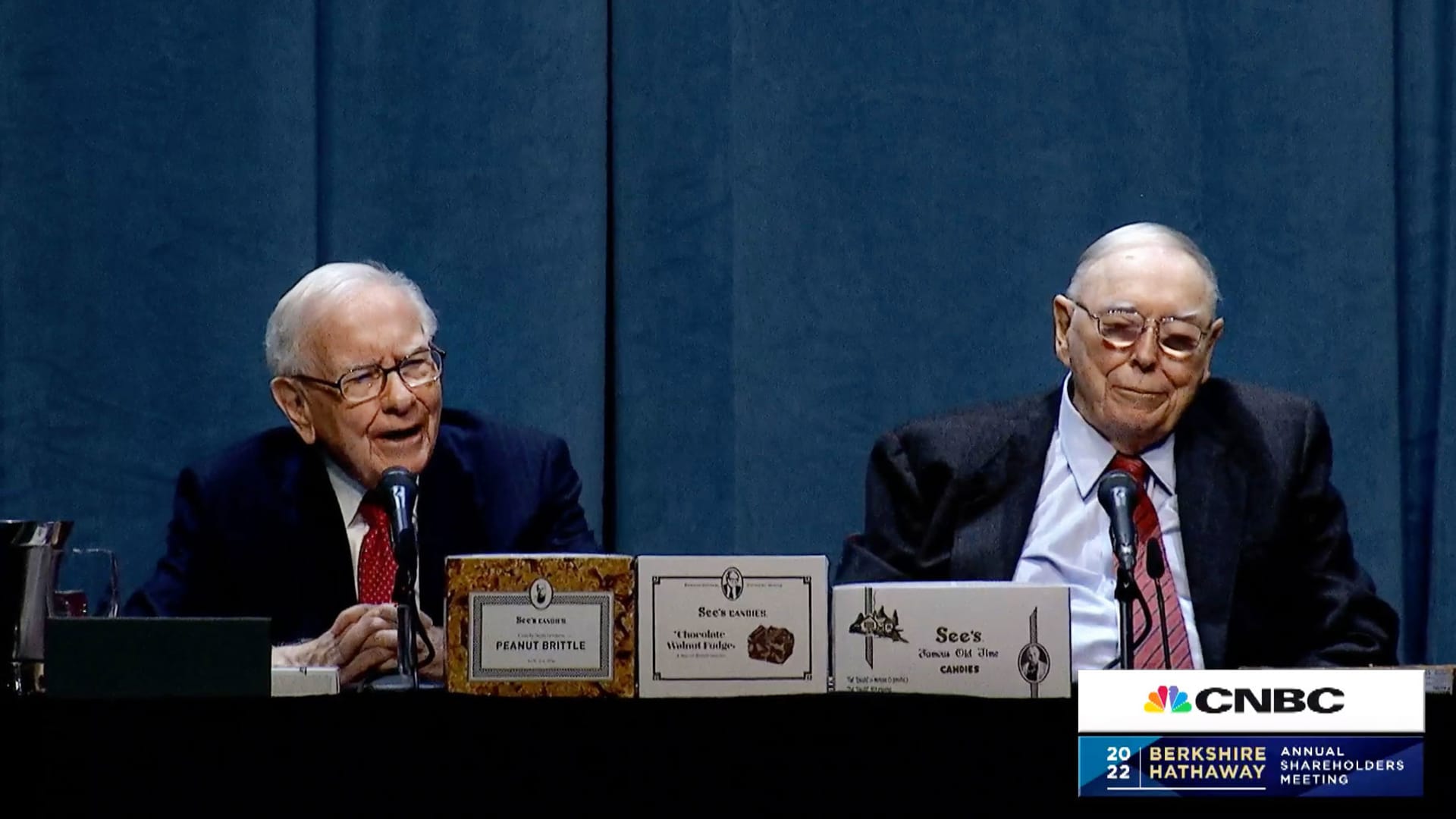

Buffett, 91, spoke at period all the way through his annual shareholder assembly Saturday about one in all his favourite objectives for grievance: funding banks and brokerages.

“Wall Side road makes cash, a technique or every other, catching the crumbs that fall off the desk of capitalism,” Buffett stated. “They do not generate profits except other people do issues, they usually get a work of them. They make much more cash when persons are playing than when they’re making an investment.”

Buffett bemoaned that enormous American corporations have “changed into poker chips” for marketplace hypothesis. He cited hovering use of name choices, pronouncing that agents make more cash from those bets than easy making an investment.

Nonetheless, the location can lead to marketplace dislocations that give Berkshire Hathaway a possibility, he stated. Buffett stated that Berkshire spent an implausible $41 billion on shares within the first quarter, unleashing his corporate’s coins hoard after a longer lull. Some $7 billion of that went to snap up stocks of Occidental, mentioning his stake to greater than 14% of the oil manufacturer’s stocks.

“That is why markets do loopy issues, and once in a while Berkshire will get an opportunity to do one thing,” Buffett stated.

“It is nearly a mania of hypothesis,” Charlie Munger, 98, Buffett’s long-time spouse and Berkshire Hathaway vp, chimed in.

“Now we have individuals who know not anything about shares being urged through inventory agents who know even much less,” Munger stated. “It is an implausible, loopy scenario. I do not believe any smart nation would wish this consequence. Why would you need your nation’s inventory to business on a on line casino?”

Retail buyers flooded into the inventory marketplace all the way through the pandemic, boosting proportion costs to information. Ultimate yr, the rush used to be fueled additional through meme-inspired buying and selling from Reddit message forums. However the inventory marketplace has grew to become this yr, striking lots of the ones new at-home buyers within the crimson. The Nasdaq Composite, which holds most of the favourite names of small buyers, is in a undergo marketplace, down greater than 23% from its top after an April weigh down.

Warren Buffett has a protracted historical past of deriding funding bankers and their establishments –pronouncing that they inspire mergers and spinoffs to harvest charges, fairly than toughen corporations.

He usually shuns funding bankers for his acquisitions, calling them expensive “cash shufflers.” Buffett’s $848.02 consistent with proportion be offering for insurer Alleghany reportedly excludes Goldman’s advisory rate.

Previous within the consultation, he famous that Berkshire would all the time be cash-rich, and in occasions of want, can be “higher than the banks” at extending credit score strains to corporations. An target market member made an inaudible remark whilst he used to be speaking.

“Was once {that a} banker screaming?” Buffett joked.

(Observe alongside to are living updates and a are living feed of the once a year assembly right here.)