A loan calculator is a device that each actual property investor wishes to make use of to be able to make calculations and predictions about their funding. However how are mortgages other than standard loans, and why would you want a loan fee calculator?

Desk of Contents

- What Are Mortgages for Homebuyers?

- How you can Calculate Your Loan Bills

- Mashvisor’s Loan Calculator – What Makes It Higher?

- Backside Line

On this article, I will be able to provide an explanation for the whole thing you want to find out about mortgages and their varieties, how mortgages are calculated, and I will be able to display you what makes Mashvisor’s loan calculator the most suitable option for you.

What Are Mortgages for Homebuyers?

Mortgages are mainly loans that have been designed for homebuyers. Then again, the variation between a regular mortgage and a loan is principally within the necessities and specifics of the mortgage.

There are a selection of cash lenders in america focusing on lending cash to homebuyers. Every lender imposes its personal standards and necessities to qualify for a loan. What all of them have in commonplace, on the other hand, is that all of them specialise in actual property financing. It comprises financing to be able to acquire a number one place of dwelling or purchase funding homes.

Under, we can pass over the several types of loans that you’ll be able to anticipate finding in america, in keeping with the kind of lenders, the construction of the mortgage, and its period.

Kinds of Loan Lenders

There are two tactics to categorize loan loans. The primary approach is to split loan varieties in response to the lender and {qualifications} had to borrow the cash. In accordance with this categorization, there are two primary kinds of mortgages that you’ll be able to anticipate finding:

1. Typical Mortgages

Because the title suggests, it’s the most typical form of loan mortgage. Typical loans don’t seem to be subsidized via the government, which means that non-public lenders be offering them. There are two kinds of standard mortgages:

- Conforming loan: This kind “conforms” to the set of requirements positioned via the FHFA, comparable to components in regards to the borrower’s credit score ranking and debt degree.

- Non-conforming loans: This kind does now not meet FHFA requirements, which means that they’re extra versatile and are utilized by debtors who’ve long past via monetary problems comparable to chapter.

Execs and Cons

As you can be expecting, there are benefits and drawbacks to the use of standard loan loans.

As an example, conforming loans have a strict restrict at the dimension of the mortgage. As of 2022, the boundaries on a conforming mortgage are $647,200 in maximum markets and $970,800 within the costlier spaces. Then again, standard mortgages generally tend to have decrease total prices than different kinds of loans, although their rates of interest are most often upper.

At the drawback, standard loans have stricter credit score ranking necessities, which might be ceaselessly 620 or above. Additionally they have upper down fee necessities than authorities loans.

General, standard loans are excellent choices if you happen to’re in search of source of revenue homes on the market and you have got a prime credit score ranking and the cash to make a large down fee.

Comparable: Brief-Time period Loan: The Entire Information

2. Executive-Insured Mortgages

In contrast to the former loans, government-insured mortgages are supplied via probably the most 3 US authorities businesses: the Federal Housing Management (FHA), america Division of Agriculture (USDA), and america Division of Veterans Affairs (VA).

Every of those departments supplies its personal form of loan mortgage to US electorate who qualify for that form of mortgage.

- FHA loan: This kind of house mortgage is designed to assist first-time homebuyers purchase a belongings with out being subjected to strict necessities, comparable to the ones via non-public lenders. The FHA mortgage will usually require a credit score ranking of 580 to get the utmost of 96.5% financing, which means that you simplest wish to pay a three.5% down fee with that credit score ranking.

- USDA loan: This kind of mortgage is supplied to homebuyers who need to personal a belongings in a rural location this is inside the USDA-eligible spaces checklist. USDA loans won’t require a down fee if the borrower has a low source of revenue.

- VA loan: This kind is supplied to present participants of america Military, veterans, and their households. It does now not include a down fee requirement or loan insurance coverage.

Execs and Cons

Whilst each and every of all these mortgages has its personal professionals and cons, government-backed loans most often have sure benefits. It’s most often more uncomplicated to qualify for a central authority mortgage than for a standard mortgage. Moreover, the credit score ranking necessities for those mortgages are a lot more comfortable and don’t require a big down fee.

Then again, additionally they include a number of drawbacks. The largest drawback of government-backed loans is that they’ll require loan insurance coverage premiums, particularly when it comes to FHA loans.

As well as, the mortgage limits on an FHA mortgage are less than standard loans, which is able to restrict the stock that you’ll be able to doubtlessly purchase from.

General, it’s trickier to make use of a calculator for a government-backed mortgage that has loan insurance coverage on it since it’s an additional price that you are going to wish to consider.

Kinds of Mortgages – Passion Charge Bills

The opposite direction to differentiate kinds of mortgages, particularly when the use of a calculator, is to take action in response to the mortgage’s rate of interest over its lifetime.

Prior to shifting on, it is very important indicate that the period of a mortgage will also be made up our minds via the lender, however most common mortgages come when it comes to both 15 or 30 years.

Relating to the kinds of rate of interest bills that actual property mortgages be offering, there are two varieties which are quite common:

Mounted-Charge Mortgages

A hard and fast-rate loan has a hard and fast rate of interest over its lifetime. It signifies that the rate of interest at which you’re taking the mortgage is not going to exchange for all of the period of the mortgage, and the per thirty days bills you are making will at all times keep the similar.

This kind of mortgage is the perfect to calculate when making plans for an funding, and it may be simply calculated with a easy loan calculator. Then again, the disadvantage of this mortgage is that it is going to most often have upper rates of interest than the second one form of loan I will be able to discuss.

Since 30-year fixed-rate mortgages are quite common, the rate of interest that you’d incur over this kind of lengthy period will also be really extensive.

Mounted-rate loans are well-liked amongst homebuyers who wish to reside within the belongings for a number of years and wish to keep away from possible adjustments to their per thirty days bills for that period.

Adjustable-Charge Loan

Against this, an adjustable-rate loan has a per thirty days fee plan that can exchange over the lifespan of the mortgage.

In most cases, the rates of interest will pass up or down relying available on the market prerequisites. Then again, maximum mortgages of this kind could have a hard and fast rate of interest for a collection period in the beginning earlier than the speed starts to modify at sure integrals.

As an example, an adjustable-rate loan can have a hard and fast rate of interest for the primary seven years, after which it will get started adjusting its rate of interest each six months till the tip of its lifespan.

Normally, this kind of loan is regarded as moderately dangerous, because the rates of interest can building up past what you’ll be able to have enough money ultimately. Then again, for the reason that total rate of interest is less than a fixed-rate mortgage, buyers ceaselessly desire an adjustable-rate loan.

In reality, many methods that revolve round refinancing, such because the BRRRR technique, will ceaselessly desire adjustable-rate mortgages as a result of you’ll be able to nearly keep away from having to pay the upper rates of interest via continuously remortgaging earlier than the preliminary length ends.

Comparable: Loan Charges: The Actual Property Investor’s Entire Information

How you can Calculate Your Loan Bills

Now that you realize what the several types of mortgages are, let’s discuss how a loan is calculated. When calculating the volume of per thirty days rate of interest, the calculation is relatively easy:

You divide the once a year hobby via 12, and also you multiply via the loan quantity to get your per thirty days rate of interest.

As an example, in case your annual rate of interest is 4%, your per thirty days rate of interest can be 0.33% (0.04/12 = 0.0033).

Then again, when calculating the per thirty days loan bills, issues get slightly sophisticated. Even for a hard and fast rate of interest loan, buyers would usually use a easy loan mortgage calculator to get a snappy outcome.

So, it isn’t surprisinging that different kinds of mortgages will require extra subtle calculators to make the entire procedure more uncomplicated for homebuyers and buyers.

Why Traders Desire a Loan Calculator

Relating to discovering a excellent calculator, all of it relies on the kind of data that you wish to have to get. As an example, a loan amortization calculator will inform you how lengthy it is going to take in your loan to amortize, and that would be the primary perspective of the output that it supplies.

Then again, a loan payoff calculator can even wish to have sufficient choices to incorporate all kinds of mortgages. The extra you’ll be able to customise the device, and the extra enter it permits you to give, the extra correct the effects it will provide you with. It’s principally as a result of maximum kinds of mortgages contain further prices that homebuyers can ceaselessly disregard about, comparable to insurance coverage prices and taxes.

In fact, if you happen to’re going to make use of a loan calculator with taxes, then it is going to need to account in your location and the taxes that can practice in your explicit case.

With all that during thoughts, there are lots of several types of calculator equipment on-line, each and every comes with its personal benefits and drawbacks. However if you happen to’re in search of a platform that features a calculator and also will assist you to to find source of revenue homes on the market, we now have the best device for you.

Mashvisor’s Loan Calculator – What Makes It Higher?

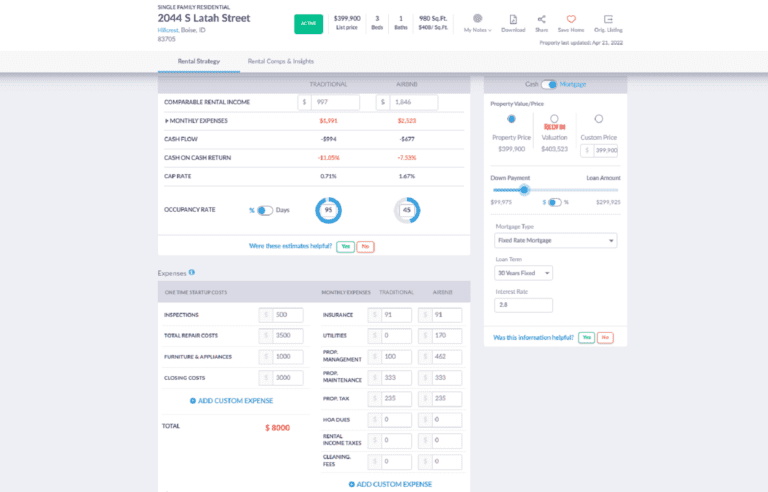

Mashvisor is an actual property platform that may assist buyers to find an funding belongings in response to precise knowledge and analytics. The platform supplies all of the equipment you want, together with a loan calculator and a apartment belongings calculator that accounts in your loan bills.

It signifies that, along with serving to you to find the best possible position to put money into actual property, the device will calculate the go back on funding {that a} apartment belongings could have after calculating your loan bills.

By means of the use of metrics such because the cap price and the money on money go back, the device can considerably cut back the period of time had to analyze the long-term result of making an investment in any apartment belongings.

Mashvisor’s loan calculator will give you the go back on funding from a apartment belongings after calculating your loan bills.

A Versatile Loan Calculator

In contrast to different calculators, Mashvisor’s calculator lets in you to select the kind of loan that you wish to have to make use of. It comprises each constant and adjustable-rate mortgages, and you’ll be able to pick out a 15- or 30-year period.

Whilst the fixed-rate possibility acts as a easy loan calculator, the adjustable-rate calculation is slightly complicated to be carried out via hand. For the reason that device is hooked up to the apartment belongings calculator, any enter you are making within the loan segment will right away be mirrored at the belongings’s analytics web page. It comprises the speed of go back on funding, the per thirty days bills associated with proudly owning the valuables, and the long-term payback research of your funding.

The entire above options make Mashvisor the most productive on the subject of examining your acquire earlier than making it.

Comparable: What Is a Just right Go back on Funding for Actual Property?

Backside Line

A loan calculator is an very important device that each investor wishes.

For those who’re taking a look to put money into actual property or purchase a house, chances are high that you’re going to desire a loan. Relying on the kind of loan you find yourself the use of, you’re almost certainly going to wish to use a loan payoff calculator to make sure about your monetary long term.

If that’s the case, you’re already in the most productive position to start out. With Mashvisor, you’ll be able to get admission to the most productive calculator device that may deal with all of the calculations you want to make sound funding selections.

To start out the use of our actual property funding equipment these days, join for a 7-day unfastened trial, adopted via 15% off for lifestyles to your Mashvisor subscription.