Purchase now and pay later acquire financing supplier Confirm (NASDAQ: AFRM) inventory has been on catastrophic sell-off since peaking out at $176.65 on Nov. 8, 2021. The preferred buy-now-pay-later (BNPL) platform used to be hit through a really perfect hurricane consisting of the macro marketplace sell-off, regulatory scrutiny, and an entire sentiment shift within the BNPL phase in spite of making improvements to expansion. Confirm insists it’s a generation corporate began through engineers enabling its platform to function flawlessly at scale. This has attracted well known service provider shoppers together with Goal (NYSE: TGT), Shopify (NASDAQ: SHOP), and Amazon (NASDAQ: AMZN). Whilst 80% of trade is performed offline, Confirm is on web sites that generate greater than 50% of all of the e-commerce within the U.S. To develop its offline point-of-sale (POS) marketplace penetration, Confirm partnered with Visa (NASDAQ: VISA) to roll out its Debit+ product later this 12 months. Prudent buyers searching for publicity within the BNPL phase can search for opportunistic pullback ranges in stocks of Confirm.

MarketBeat.com – MarketBeat

Q2 Fiscal 2022 Income Liberate

On Feb. 10, 2022, Confirm launched its fiscal second-quarter 2022 effects for the quarter finishing December 2021. The Corporate reported an adjusted earnings-per-share (EPS) lack of (-$0.57) except for non-recurring pieces assembly consensus analyst estimates for a lack of (-$0.22). Revenues grew through 77% year-over-year (YOY) to $361 million beating analyst estimates for $333.07 million. Gross products price (GMV) grew 115% YoY to $4.5 billion. Energetic traders grew from 8,000 to 168,000 pushed through adoption of Store Pay Installments through traders. Energetic customers grew $150% to 11.2 million, up 29% sequentially. Transactions in line with buyer grew 15% to two.5. Confirm CEO Max Levchin commented, “We greater than doubled gross products quantity 12 months over 12 months. During the last twelve months, now we have added just about seven million energetic customers to our community, whilst enabling 168,000 service provider companions to raised serve their shoppers. Tens of millions of other folks see Confirm as a sensible method to pay on account of our truthful, clear, and customizable fee phrases. Traders acknowledge our skill to assist them force expansion and ship the enjoy customers are hard at checkout.”

Blended Steering

Confirm issued inline steerage for fiscal Q3 2022 revenues of $325 million to $335 million as opposed to $332.72 consensus analyst estimates. The Corporate sees GMV of $3.61 billion to $3.71 billion and altered running loss as a share of revenues of (-21%) to (-19%). The Corporate raised steerage for fiscal full-year 2022 revenues of $1.290 billion to $1.310 billion as opposed to $1.28 billion consensus analyst estimates. Confirm expects fiscal full-year 2022 GMV of $14.58 billion to $14.78 billion and altered running loss as a share of earnings (-14%) to (-12%).

Convention Name Takeaways

CEO Levchin mirrored its decade lengthy lifestyles as an organization and its function of handing over “truthful monetary merchandise to toughen lives and to take action whilst delighting the folk we get to serve each day”. The Corporate has grown its buyer base through 150% to over 11 million offering them a wiser method to pay. For the buyer, Confirm is a protected and clear approach of paying for merchandise through the years whilst concurrently being without equal advertising software for dealers. They permit dealers to incrementally develop gross sales with out gimmicks. This has led to 20X expansion of service provider shoppers. Confirm is a generation corporate that used to be began through engineers, and it continues to take a position closely in scalable generation. It’s generation units them aside as illustrated through large title service provider shoppers like Walmart, Shopify, Goal, and Amazon. Confirm processed 1.6% of all U.S. on-line transactions for Black Friday, Cyber Monday in conjunction with triple digit YoY expansion. Along with BNPL, its generation has enabled numerous new merchandise temporarily to marketplace together with the Confirm SuperApp, Confirm Chrome Extension, adaptive checkouts, money again rewards, and consumer-friendly crypto financial savings. They introduced the Visa partnership and release of Debit+ which is these days on preliminary waitlist rollout. Despite the fact that he warned to not give ‘loopy forecasting’ of its affect at the Corporate’s best and final analysis at scale, he did give some perception, “On reasonable, the choice of weekly transactions through Debit+ user, except for our personal workers is bigger than an order of magnitude above that of a standard Confirm consumer. After all, those are enthusiastic early adopters, and we absolutely be expecting the quantity to normalize, however it is thrilling to look first glimpses of what Confirm as a day by day tool would possibly seem like. We stay very enthusiastic about the way forward for this product and be expecting to speak much more about it this 12 months.” The Corporate continues to make bigger and lead the world BNPL effort via PayBright in Canada and introduced in Australia. The Corporate accounts for 1% of U.S. e-commerce and continues to develop marketplace percentage.

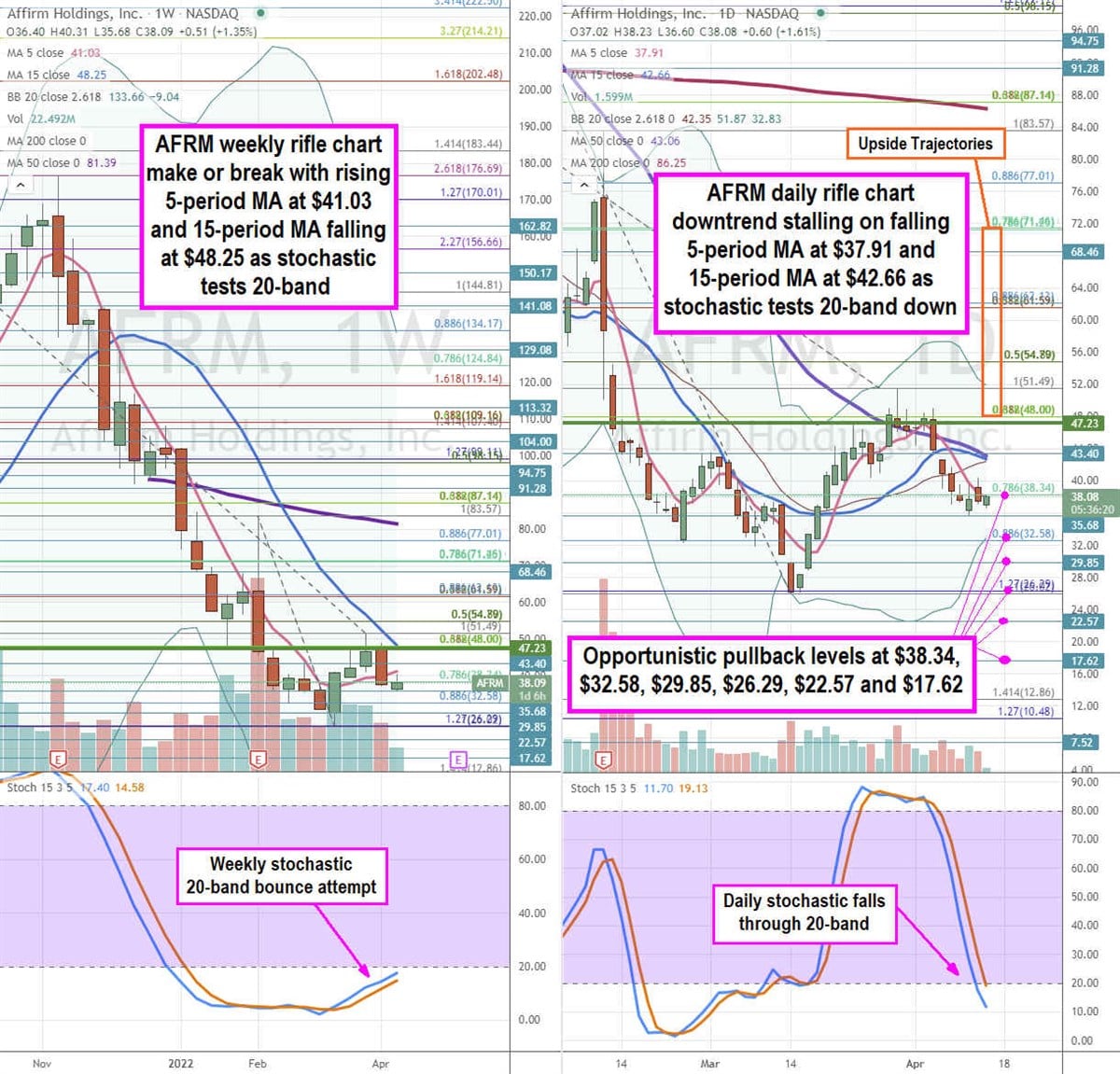

AFRM Opportunistic Pullback Ranges

The use of the rifle charts at the weekly and day by day time frames supplies a precision view of the taking part in box for AFRM inventory. AFRM inventory however in a backside close to the $26.29 Fibonacci (fib) stage and staged a rally that peaked at $51.49 fib. The weekly rifle chart has a stalled downtrend with a emerging 5-period shifting reasonable (MA) and falling 15-period MA at $48.25. The weekly stochastic shaped a leap against the 20-band to set-up a make or smash. The weekly 50-period MA sits at $81.39. The weekly marketplace construction low (MSL) purchase triggers on a breakout via $47.23. The day by day rifle chart breakdown shaped as 5-period MA makes an attempt to stall at $37.91 as 15-period MA stalls at $42.66 with 50-period MA at $43.06. The day by day decrease Bollinger Bands (BBs) take a seat at $32.83. The day by day stochastic made a complete oscillation that fell throughout the 20-band. Prudent buyers can search for opportunistic pullback ranges on the $38.34 fib, $32.58 fib, $29.85, $26.29 fib, $22.57, and the $17.62 worth stage. Upside trajectories vary from the $48.00 fib up against the $71.46 worth stage.