As an actual property investor, the usage of a deal analyzer may also be somewhat helpful in making profitable offers.

It’s no secret that discovering a excellent deal in the actual property marketplace may also be tiresome and hard. Ranging from discovering homes to calculating their possible in the actual property marketplace, to in fact renting them out, one can say the checklist of items to believe is somewhat in depth. It’s why an actual property deal analyzer is so the most important when making an investment in homes.

Desk of Contents

- What Is a Deal Analyzer?

- Do Buyers Want a Deal Analyzer?

- 3 Steps to Inspecting to Deal

- Most sensible 3 Deal Analyzer Gear

- The Backside Line

Deal analyzers have been designed to help actual property traders via each step of the funding procedure. From finding a possible belongings to evaluating to identical choices, there’s no reason why an investor shouldn’t employ the funding instrument. Stay studying to learn the way an actual property deal analyzer can assist, methods to use it, and which of them be offering the most efficient options to traders.

What Is a Deal Analyzer?

Because the title suggests, a deal analyzer is an app that is helping customers calculate the opportunity of a belongings as an funding belongings in the actual property marketplace. In more effective phrases, one can say a deal analyzer is very similar to a actual property calculator. Each display you a breakdown of ways a lot the valuables will value and what kind of it might doubtlessly generate in source of revenue after.

Alternatively, a deal analyzer incessantly displays greater than the fee breakdown and possible source of revenue of a belongings. Extra incessantly than now not, they may be able to additionally assist an investor make a decision on which actual property technique would best possible are compatible the valuables’s location. The most efficient deal analyzer may also evaluate possible offers to each other to make certain that you might be opting for essentially the most profitable one. Total, applying the instrument will assist make certain that you selected the proper belongings and understand a excellent go back on funding.

Do Buyers Want a Deal Analyzer?

Whilst getting a deal analyzer is handy, do actual property traders actually wish to use one? If the investor desires to purchase funding homes which are positive to be profitable, then the solution is sure. In this day and age, it could be in an investor’s best possible hobby to make use of a deal analyzer. With out one, actual property traders will wish to habits their very own belongings seek and knowledge analysis and calculate every metric of their funding manually.

Whilst it’s been accomplished successfully prior to actual property apps or the usage of a actual property funding calculator won recognition, actual property calculations are somewhat time-consuming and susceptible to human error. Doing the calculations and analyses manually can harm your probabilities of discovering a profitable funding deal.

First, the calculations in all probability take too lengthy, ensuing within the belongings now not being to be had. 2nd, in case you get the unsuitable information or miscalculate, you’ll be basing your funding on a false concept of ways the valuables will carry out.

If you wish to spend money on a profitable holiday condo, repair and turn belongings, or conventional condo, the usage of a deal analyzer is solely otherwise so as to add further insurance coverage that your funding shall be a excellent one.

Similar: Flipping Properties for Inexperienced persons: What You Want to Know Ahead of Beginning

3 Steps to Inspecting to Deal

Listed here are the other steps on methods to analyze an actual property deal:

1. Discovering a Location and Assets

As any seasoned actual property investor will inform you, location is the whole lot in relation to proudly owning a profitable funding belongings. There are a number of issues to believe when selecting the proper location for your belongings seek. The primary is in case you are on the lookout for a belongings inside your individual state for more uncomplicated control or one out of state with a greater actual property marketplace local weather.

When you selected to shop for a belongings inside your state or town, the following factor to do is locate the most efficient community that matches your actual property technique or condo scheme. Whilst you will be handiest taking a look at one town, other spaces in every town may also be extra profitable as a standard condo or an Airbnb condo. To determine which spaces be offering the most efficient go back in your actual property technique, join for Mashvisor’s 7-day loose trial for get admission to to the Assets Finder and Heatmap equipment.

Alternatively, you’ll be able to additionally glance to spend money on homes outdoor of your house state. In this sort of state of affairs, it is important to analysis which states are projected to develop into a profitable actual property marketplace. If you’ve selected the state, you’ll be able to start narrowing down town and community during which you’d love to spend money on.

2. Funding Assets Research

After discovering a location and belongings, the next move is calculating their possible in the actual property marketplace. Whilst there are lots of elements that play into how a belongings will carry out out there, listed here are an important elements to account for:

A. Money Glide

In elementary phrases, money drift refers back to the source of revenue a belongings can generate subtracted from bills fascinated by keeping up the valuables. This is a key indicator if a belongings is value making an investment in. Having a good money drift signifies that even in spite of everything the bills like mortgages and maintenance are accounted for, your private home continues to be supplying you with an extra source of revenue. Alternatively, a destructive money drift refers back to the state of affairs of getting no cash left over in spite of everything bills are accounted for. If the bills to handle the valuables are upper than the source of revenue it might generate, then chances are you’ll wish to pick out a distinct funding.

B. Cap Price

The following factor you want to calculate when inspecting a deal is the valuables’s cap fee. The cap fee takes into consideration the prospective source of revenue of the valuables to calculate its fee of go back at the funding. The usage of the money drift estimates you prior to now calculated, it is important to multiply that quantity by means of 12 to constitute your every year condo source of revenue.

If you calculate your every year condo source of revenue, you want to divide the volume by means of the acquisition value of the valuables. It’s going to provide the fee at which you are going to see your every year go back for your funding in line with your preliminary funding prices. Relying at the belongings, cap charges might alternate. Alternatively, a cap fee not up to 2% will have to be have shyed away from because it signifies a less-than-profitable funding.

C. Money on Money Returns

Every other issue you want to calculate when inspecting a deal is the valuables’s money on money returns. Cap charges be mindful the annual money drift from condo source of revenue and the whole preliminary value. Alternatively, money on money returns handiest believe the volume you paid prematurely in money.

To get your money on money go back fee, it is important to divide your money drift prior to taxes by means of the whole sum of money you invested into the valuables. Basically, excellent money on money go back levels from 8% to twelve%. It’s conceivable to nonetheless see a profitable funding if the money on money returns fee is relatively below the mentioned vary. Alternatively, as a basic rule of thumb, it’s best possible to try for a minimum of 8%.

Similar: What Is a Excellent Money on Money Go back?

3. Evaluating Assets Possible to the Marketplace

The general step in inspecting an actual property deal is to check the valuables’s efficiency in the actual property marketplace. There are two issues it is important to evaluate in relation to actual property offers. The primary is the person homes’ efficiency as a standard condo as opposed to as a momentary condo. The following is how one belongings will evaluate to identical homes inside the similar community. Here’s how you’ll be able to evaluate them.

A. Efficiency as a Conventional or Quick-Time period Condo

When inspecting an actual property deal, you want to decide if the valuables is extra profitable than a standard condo or an Airbnb condo. Relying for your belongings and actual property plans chances are you’ll want other condo schemes. As an example, in case you are doing the BRRR technique, then a BRRR calculator might assist making a decision how a lot hire you are going to want. Upon getting an estimated condo source of revenue you want, you’ll be able to calculate which condo scheme can generate that quantity higher.

Each conventional and momentary actual property condo methods have the prospective to make you 1000’s every month. Alternatively, in sure spaces, one might usher in more cash than the opposite. To make certain that you don’t depart any cash at the desk, you want to get information on each conventional and Airbnb leases within the space and spot which one provides extra source of revenue possible.

B. Actual Property Comps

After deciding which actual property technique is extra profitable for your selected space, it’s time to check your possible funding homes to the remainder of the actual property marketplace. To calculate your actual property comps, it is important to get information on identical homes across the space and the way they carry out within the total marketplace.

The method may also be somewhat tricky as there are a number of further elements that come into play when evaluating identical homes. For actual property comps, it’s extremely instructed that you just use some form of actual property calculator to make certain that to procure the entire important information and carry out correct calculations.

Similar: Actual Property Comp Research in 4 Steps

Most sensible 3 Deal Analyzer Gear

Now that you just’ve observed the entire elements and knowledge issues had to totally analyze the opportunity of a belongings, you will have a greater working out of why deal analyzers are so the most important. Whilst you’ll be able to manually calculate for the whole lot discussed above, it could be too time-consuming even for essentially the most seasoned actual property traders. This is the reason many savvy actual property traders take merit and make the most of on-line deal analyzers and apps to their merit.

Even though there are lots of choices out there, those are the highest 3 deal analyzer apps out there nowadays:

1. Mashvisor

Mashvisor is lately one of the vital main deal analyzers out there. With the entire choices to be had, the platform can simply be used as a purchase order or move deal analyzer, plus so a lot more. From serving to you slender down places in a town the entire approach to providing you with dependable actual property comps, Mashvisor is very important to any funding. Beginning with its belongings finder and heatmap, traders are in a position to temporarily select essentially the most profitable spaces in a town and selected the best possible position to shop for condo belongings.

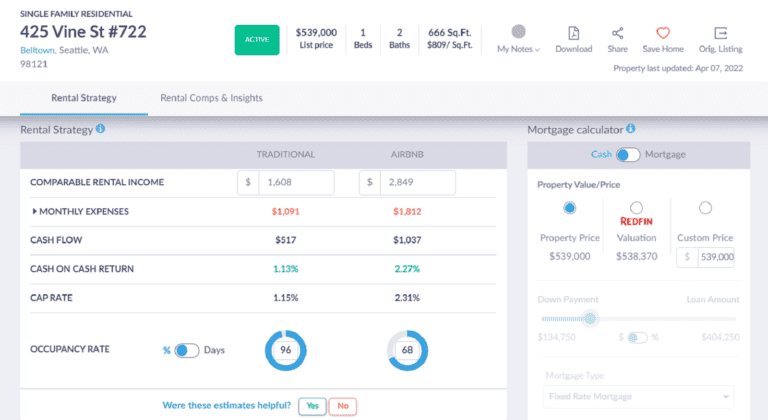

Subsequent, Mashvisor’s funding equipment can be utilized as a deal analyzer because it permits you to see the prospective prices and source of revenue you are going to gain when managing that exact belongings. They’re going to additionally provide the breakdown of the valuables’s possible, cap fee, money on money returns, value to hire ratio, occupancy charges, and different crucial information issues.

Finally, Mashvisor supplies its customers with a downloadable Excel actual property comps document for his or her assessment. Taking information at once from the MLS and Airbnb site, Mashvisor customers may also be confident that the calculations are as correct and up-to-date as they may be able to be. With the platform’s funding and deal analyzer equipment, traders are positive to make the most efficient actual property choices in line with correct and dependable information.

2. Roofstock Cloudhouse

Roofstock Cloudhouse is every other deal analyzer that traders can use for his or her actual property investments. To make use of the platform, customers merely wish to plug in an deal with in their possible funding belongings. If you’ve written down the deal with, the app will generate data just like the age of the valuables, measurement, selection of rooms, and different facilities. It’s going to additionally display you the cap fee, source of revenue possible, and money drift. Whilst it is important to have already got a possible belongings in thoughts prior to the usage of Roofstock Cloudhouse, it’s going to assist making a decision on which belongings is essentially the most profitable within the space.

3. RentZend

Whilst a relatively more moderen deal analyzer, RentZend’s proven possible to assist traders pick out the proper belongings to spend money on. You’re going to additionally want a explicit deal with to make use of the app, this means that it is important to in finding possible homes on your own. Alternatively, when you do download the deal with, RentZend offers you the entire important information issues like cap fee and possible source of revenue. In addition they come with tax advantages of their information level listings for every belongings.

Whilst the app does lean slightly bit extra against being an actual property calculator, it nonetheless supplies the fundamental advantages of a deal analyzer. Total, the usage of the RentZend app continues to be higher than forgoing any form of deal analyzer instrument and doing all your calculations and research manually.

All the above deal analyzer apps have the prospective to assist any investor when purchasing a belongings. Every one supplies key data and knowledge issues that may information traders to essentially the most profitable offers to be had. Alternatively, in case you are on the lookout for an all-in-one deal analyzer that may assist from begin to end, Mashvisor is a transparent selection.

The Backside Line

The usage of a deal analyzer actual property app is the most important in any actual property funding. With plenty of choices to be had out there, many actual property traders in finding it tricky to slender down and pick out a belongings to spend money on. With a deal analyzer, now not handiest are they in a position to weed out homes with low returns sooner, however they’re additionally in a position to peer the prospective efficiency in their belongings in the marketplace.

For the best possible actual property app and deal analyzer, Mashvisor is easy methods to move. With its information and calculations pulled from dependable assets just like the MLS and Airbnb, the knowledge and computations are unequalled. Moreover, its skill to assist right through all of the funding procedure signifies that traders may also be much more assured of their choices every step of the way in which. To get admission to Mashvisor’s deal analyzer equipment, join right here.