drug financial savings and virtual healthcare platform GoodRx (NASDAQ: GDRX) inventory has falling to all-time lows sped up via the sell-off in benchmark indexes. The platform has stored customers over $35 billion in prescription prices since inception. Over 700,000 healthcare suppliers have used the GoodRx platform. The Corporate continues to develop its community of customers and suppliers. Its acquisition of flipMD will enlarge engagement with suppliers and building up and supplement pharma production answers. Regardless of the Omicron affects which dampened its This fall 2021 effects, expansion continues. Its Gold subscription plan has grown to over 1.6 million energetic individuals. GoodRx strives to transform the most important healthcare platform within the U.S. Prudent traders in quest of publicity in virtual healthcare financial savings can look ahead to opportunistic pullbacks in stocks of GoodRx.

Depositphotos.com contributor/Depositphotos.com – MarketBeat

This fall Fiscal 2021 Profits Free up

On Feb. 28, 2022, GoodRx reported its fiscal This fall 2021 income document for quarter ended December 2021. The Corporate reported an earnings-per-share (EPS) benefit of $0.09 except non-recurring pieces as opposed to consensus analyst estimates for a benefit of $0.10, a (-$0.01) omit. Revenues grew 39% year-over-year (YoY) to $213.3 million, lacking analyst estimates for $217.51 million. Per thirty days energetic customers grew 14% YoY to six.4 million. Prescriptions transactions for the quarter grew 21% YoY to $158.8 million. Subscription revenues grew 79% YoY to $17.4 million.

Drawback Steering

GoodRx decreased its fiscal Q1 2022 earnings steering to come back round $200 million, falling in need of $227.44 consensus analyst estimates. Fiscal full-year 2022 earnings steering is predicted round $916 million as opposed to $1.02 consensus analyst estimates, up 23% however nonetheless falling in need of analyst expectancies.

Convention Name Takeaways

GoodRx Co-CEO Dough Hirsch reviewed one of the most tendencies for 2021 together with really extensive investments within the emblem and acquisition of goods that offer new client content material and sources. He commented, “Our platform has grown as has our succeed in. We are particularly enthusiastic about the supply of our content material projects round GoodRx Well being and well being care supplier targeted platform extensions that lend a hand suppliers lend a hand their sufferers and fortify our pharma producer answers providing.” The Corporate has helped save greater than $35 billion for American citizens since its inception. It stored 5 million customers over $500 in comparison to pharmacy money worth. The Corporate raised its NPS to 90 with well being care suppliers matching its NPS with customers. GoodRx Co-CEO Trevor Bezdek identified that the consequences of COVID were underestimated in length and affect to its trade. It created a compounding impact through the years because of replenish frequency and the long-term nature of prescriptions. The Corporate has persisted to develop its marketplace proportion and revenues in spite of the headwinds. The Corporate introduced its GoodRx for Suppliers product in This fall because it performs an very important cornerstone in its function of changing into the most important home supplier platform. The Corporate has had historic adjusted EBITDA margins of 40% because of the numerous money glide technology. Bezdek expects mid-20% annual earnings expansion long-term. GoodRx reached over 6.4 million per thirty days energetic customers and greater than 1.6 million subscription individuals in This fall. Omicron impacted the top of the quarter. The Corporate built-in with Wheel in This fall, a virtual healthcare platform powering digital number one care and behavioral well being services and products. This allows GoodRx reductions to tens of millions of sufferers of Wheel purchasers. Greater than 700,000 suppliers from number one care to oncology have applied the GoodRx platform. Bezdek identified, “Now we have been introducing our new supplier mode steadily to a subset of the suppliers who talk over with GoodRx and feature observed robust adoption, with over 90% of suppliers who’ve been offered opting into this new mode, which represents over 80,000 HCPs and rising. We consider this prime charge of adoption with none off-platform advertising underscores its extremely differentiated price from suppliers and issues to its aggressive superiority.”

GDRX Opportunistic Pullback Ranges

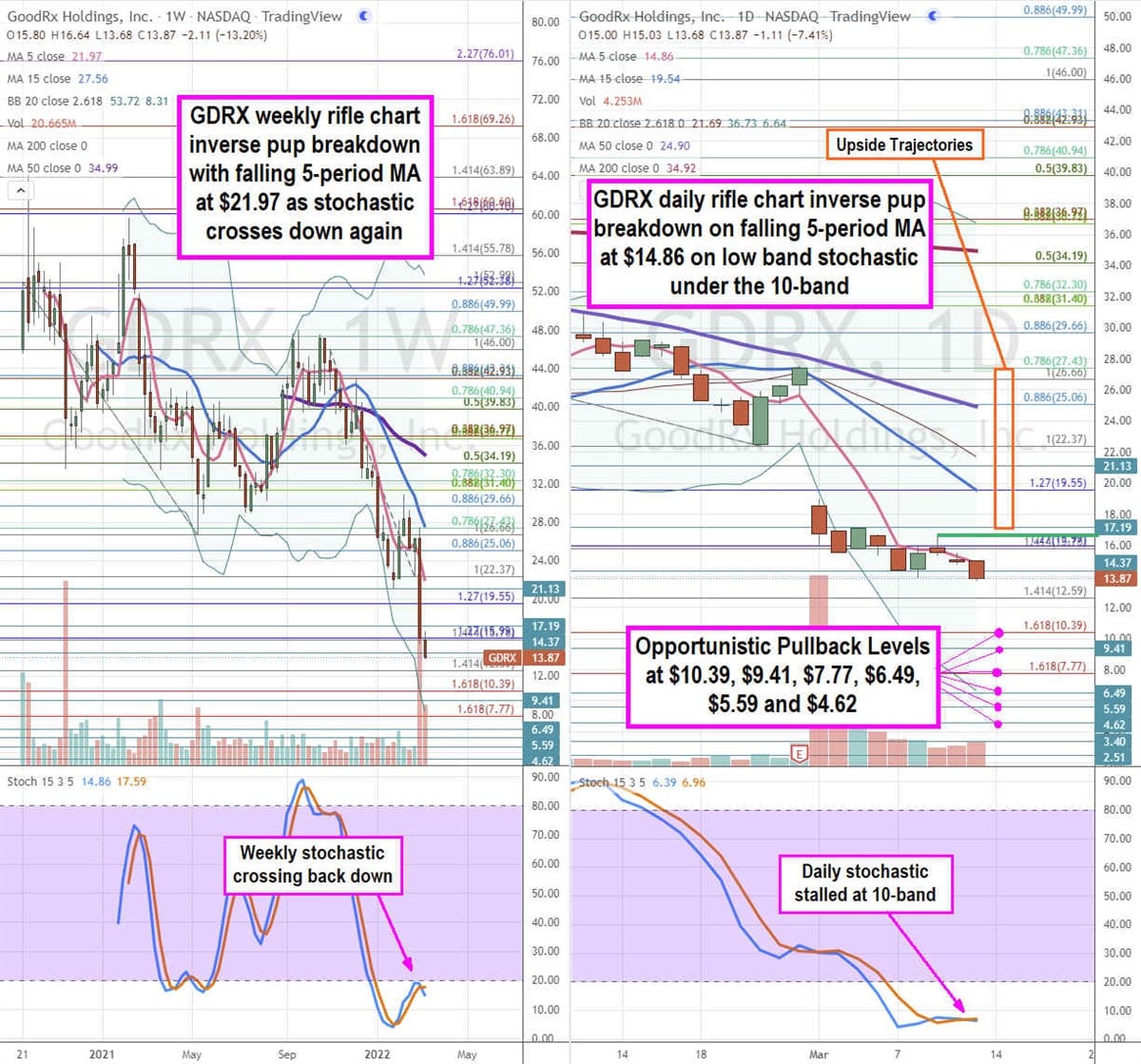

The use of the rifle charts at the weekly and day-to-day time frames allows a precision view of the fee taking part in box for GDRX. The weekly rifle chart peaked close to the $27.43 Fibonacci (fib) stage sooner than plunging on income effects. The weekly rifle chart shaped an inverse domestic dog breakdown with a falling 5-period transferring moderate (MA) at $21.97 adopted via the 15-period MA at $27.56 with decrease weekly Bollinger Bands at $8.31. The weekly stochastic rejected off the 20-band jump strive and has became back off once more. The day-to-day rifle chart downtrend continues with a falling 5-period MA at $14.86 and 15-period MA at $19.54 with decrease BBs at $6.64. The day-to-day stochastic is stalled below the 10-band. The day-to-day marketplace construction low (MSL) triggers on a breakout via $16.64. Prudent traders can look ahead to opportunistic pullback ranges on the $10.39 fib, $9.41, $7.77 fib, $6.49, $5.59, $4.62, $3.40, and $2.51. Upside trajectories vary from the $17.19 stage up against the $27.43 fib stage.