Because you’ve obviously proven an curiosity in making an investment in actual property, you will have to be in search of new knowledge on loan charges.

Ambitions for making an investment can also be various—it may well be purchasing a area the place you’ll spend your retirement, flipping a distressed house, or growing passive source of revenue as a landlord. And for all the above, you wish to have two issues—monetary steadiness and sources that’ll will let you make this mission a success and winning.

If we look again at previous reviews with banks, we will attest that buyers and first-time homebuyers, specifically, have encountered a lot of stumbling blocks in acquiring finances. Fortuitously, as of late’s banking machine provides extra alternatives and advantages to people who need to spend money on actual property.

Some of the important adjustments that immediately contributed to the rising curiosity in making an investment is the speedier and extra correct calculation of rates of interest and compensation phrases.

To stick up-to-date and make an educated choice, proceed with this information devoted to actual property buyers who need to reach prime earnings and maintain loan charges correctly.

To be informed about other loan mortgage sorts and the way to make a choice the most efficient one for you, take a look at our video underneath:

Similar: The best way to Spend money on Actual Property in 2022: The Whole Information for Freshmen

Transient Advent to Loan Charges

The very first thing we will have to focal point on here’s the overall knowledge on mortgages.

Loan charges are necessarily interest rates which are disbursed and added to mortgages. The lender determines those charges, and they are able to be both:

Simply as lenders are in command of figuring out charges, mortgages received’t be the similar for the entire debtors; in the long run, credit score rankings give a contribution probably the most. The charges may just upward thrust and fall, which immediately affects the marketplace and buyers’ technique on the way to spend money on actual property.

How Do Loan Passion Charges Paintings?

With a number of several types of mortgages we’ve got discussed—which recently exist and are to be had to homebuyers and buyers—the theory is similar: the lender finances your undertaking up to a couple 80% of the valuables value.

Below this settlement, you, because the borrower, are obligated to pay off a certain quantity in keeping with many elements.

You’re clearly anticipated to go back the cash given to you—however this quantity is dependent upon one thing known as the amortization price, which is additional calculated.

This amortization agenda determines the curiosity and major in your compensation. And in essence, the longer the time period to your mortgages, the longer it is going to take you to pay off it in complete.

Alternatively, mortgages don’t seem to be the one issue you will have to be told about right here. Along with mortgages, you will have to inquire about tax charges, insurance coverage, and different prices {that a} lender would possibly come with when making your acquire and shutting the deal to your funding.

For instance, the lender may require you to pay taxes and insurance coverage to your new house on the up to now established charges. That cash is going to a separate account—which the lender looks after.

It’s an important to remember the fact that those costs don’t seem to be mounted and that there’s a tendency for them to extend or lower through the years. Because the taxes and insurance coverage charges which are added to this don’t seem to be mounted (and will impact your loan charges), does the similar follow to rates of interest?

Sure. Present loan charges are matter to modify within the open marketplace.

Even though those adjustments are commonplace, they’re not anything like the ones we noticed 5 years in the past, when charges modified 5 instances in simply sooner or later.

Why is that this essential?

As house patrons and buyers on the whole, you will have to know that the lender won’t ever fee you with the day gone by’s loan charges.

Similar: A Information to Financing Airbnb Houses

Pre-mortgage Approval – A Necessity

Making use of for a loan isn’t as simple as simply going to the financial institution. Buyers and homebuyers will have to be granted pre-mortgage approval.

Those approvals paintings to decide how certified you might be to shop for a house and what kind of you’ll have the funds for. This will likely in the long run permit you to get well phrases to your loans.

The pre-mortgage approval record is legitimate for 90 days. Loan lenders take their time to study knowledge relating to your source of revenue, credit score ranking, and property to come to a decision.

Forms of Loan Passion Charges

When making use of for a loan, our humble recommendation is to collect details about the several types of rates of interest and the way they’re going to impact your per 30 days repayments.

Those are the fundamental varieties of loan charges to be had to people who need to purchase funding homes.

Fastened Charges

First at the checklist—and the most typical—are mounted charges. Because the identify suggests, the rates of interest which are integrated for your loan don’t exchange. They’ll stay the similar during the deal, without reference to the location available on the market.

Fastened loan charges can also be really useful on the subject of protective your price range and having peace of thoughts that issues is not going to exchange. However, those sorts or charges may well be upper than adjustable ones, bringing us to our subsequent level.

Adjustable Charges

The second one kind is adjustable charges. Opposite to mounted charges, those charges have a tendency to modify and don’t retain the unique fee quantity. Their variability is owed to consistent adjustments in the true property marketplace.

With that during thoughts, you will have to discover ways to put aside a certain quantity of finances with the intention to repay your tasks on time and steer clear of getting sucked into debt, which might jeopardize your funding belongings.

Similar: Adjustable-Charge Loan vs Fastened-Charge: Which Is Higher for a Actual Property Investor?

Making an investment in Actual Property With Present Loan Charges

Even though making an investment in actual property and paying off a loan does no longer appear to be the brightest industry thought from a lender’s standpoint, it’s worthwhile to nonetheless reach a typical money go with the flow—with the appropriate method of financing, this is.

As for the present scenario in the true property marketplace, the MLS database will provide you with an summary of the entire properties which are recently on sale. Alternatively, lenders are not making use of this knowledge or have get admission to to it.

In all probability probably the most posed query issues the verdict of whether or not you will have to make investments in actual property belongings, taking into consideration the present charges.

The only factor buyers will have to word is that rates of interest will all the time be upper if you make a decision to spend money on a residential and condo belongings.

As a common rule, you’ll be expecting an build up of 0.5 to 0.7%.

The cause of this soar is that the majority lenders consider that such investments are at the next threat. So, so as to offer protection to themselves, they’re going to spike up your rates of interest.

The present moderate price is 3.84% for a number one place of dwelling. Homebuyers and buyers can be expecting them to be round 4.25% for a number one funding belongings.

Additionally, do word a decrease down fee generally method the next rate of interest.

Will have to You Opt for It?

The query of the day: “Is it a great time to refinance a loan?“

Listed here are our ideas at the factor.

An funding or refinancing will best make sense when you arrange to cut back the charges through a minimum of 0.75%. The ultimate prices will go away you some room for a benefit with a identical aid.

You’ll see that rates of interest have risen through nearly 1% for the reason that starting of the 12 months. However in keeping with professionals, it’s assumed that about 7 million American citizens are in a positive place to speculate for the primary time—or refinance their loan.

Out of a complete of seven million, 3.8 million have been in a position to cut back their rates of interest, which supplies them an much more important benefit.

So, when you belong to this workforce, you will have to surely opt for it.

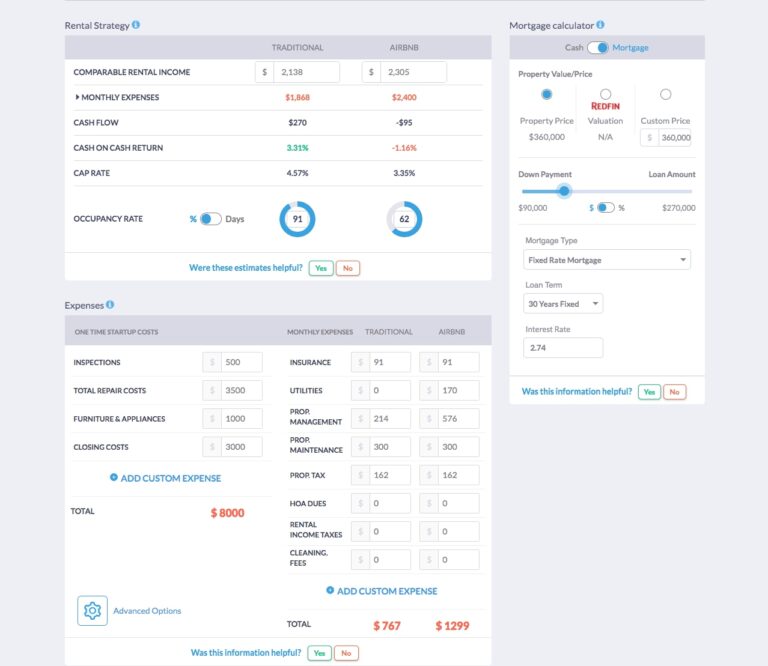

To be much more assured for your choices, don’t pass over the chance to request a serving to hand from Mashvisor’s Apartment Belongings Calculator.

Our condo belongings calculator is helping actual property buyers make a choice the very best location for his or her funding and lets them calculate the predicted benefit.

Mashvisor’s condo belongings calculator is located in each checklist at the platform. You’ll use it to include your loan charges and different phrases to estimate your attainable source of revenue, bills, money go with the flow, and extra.

States With Very best and Lowest Loan Charges

America actual property marketplace is big—and rates of interest have a tendency to change from state to state. To make a extra considerate choice, listed here are 5 states with the best and lowest rates of interest, respectively.

States with the best charges:

- Alaska: 0.27% upper than the nationwide moderate

- Montana: 0.08% upper

- Utah: 0.07% upper

- North Dakota: 0.07% upper

- Louisiana: 0.07% upper

Resulting from COVID-19, the industrial scenario has precipitated upper rates of interest. The obvious reason why for that is the larger call for for money. However a conceivable problem for homebuyers is decrease possibilities of go back on funding and issue paying off tasks.

States with the bottom charges:

- Massachusetts: 0.14% less than the nationwide moderate

- New York: 0.10% decrease

- New Jersey: 0.08% decrease

- North Dakota: 0.05% decrease

- Connecticut, Nebraska, Hawaii, Florida: 0.04% decrease

Low-interest charges end result from low-risk charges. They carry with them explicit advantages, comparable to borrowing prices changing into inexpensive or anticipating upper earnings on a holiday condo belongings.

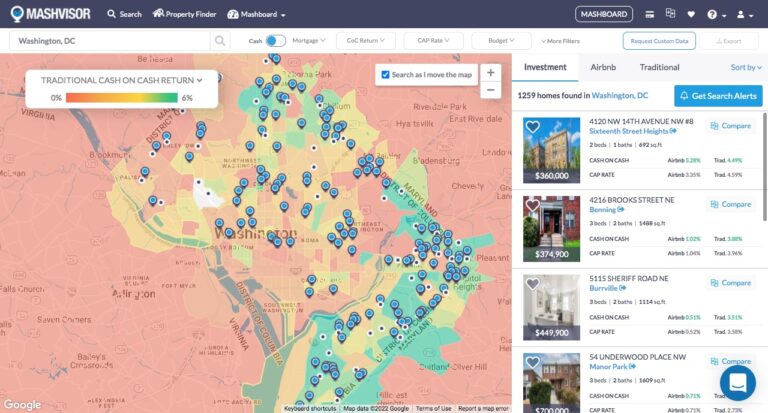

Now, holding in thoughts the rates of interest in numerous spaces, Mashvisor’s knowledge additional is helping you decide probably the most favorable location for making sure prime money on money go back.

Our gear take care of up-to-date knowledge on the true property marketplace and will let you have a greater perception into the present scenario.

Signs That You Are In a position to Make investments

We’ve long gone via probably the most crucial portions. Now it’s time to take a look at issues from a relatively broader attitude and check out to respond to the next query:

When are you able to spend money on a condo belongings?

After all, step one comes to an in depth condo research, and on your success, Mashvisor has huge revel in on this house, helping attainable buyers and serving to them do so with potency.

Listed here are some essential signs that provide the inexperienced gentle:

Monetary Balance

The primary—and maximum essential—indicator is that you’re financially solid for any such mission. That’s as a result of maximum lenders would require at least 15% down fee for funding homes.

You additionally wish to just remember to have further financial savings, particularly when you availed of an adjustable-rate loan.

ROI

A protected and common money go with the flow will in most cases make certain a prime go back on funding (ROI). And to calculate this, it is very important imagine your annual web and running source of revenue.

Mashvisor’s Apartment Calculator can do this for you. You simply wish to focal point at the actual property heatmap first—and discover probably the most profitable spaces.

Mashvisor’s actual property heatmap will provide you with a handy guide a rough review of the portions of a town with the best and lowest money on money go back, condo source of revenue, checklist value, or occupancy price.

Time

Something is evidently—you wish to have to have sufficient time to your palms to control your condo belongings.

Making an investment isn’t a one-time activity. To the contrary, after you end the formal phase with the financial institution, you’ll have to put aside time for promoting, interviewing tenants, having a look over your best competition, and making essential maintenance on your belongings.

Making an investment in a belongings is a one-time factor—however making an investment in its worth is a long-term undertaking.

Loan Charges: Conclusion

We now have finished every other information devoted to serving to buyers and homebuyers navigate the true property marketplace and make sensible, knowledgeable possible choices when making an investment in a condo belongings.

For the reason that as of late’s subject used to be loan charges, let’s move over probably the most essential issues:

Loan charges are an curiosity this is added on your per 30 days bills. The present moderate charges are 3.84%—however it’s worthwhile to be expecting an build up of as much as 0.07% when buying a condo belongings.

Sooner than you’re making the general name, you will have to be financially solid and use Mashvisor as your primary advisor for actual property making an investment.

Make a selection the plan that fits your wishes—and move from there.