Are you interested by getting cash in actual property? If you’re, you’ve most certainly been brushed up your wisdom of constructing winning actual property investments. If you wish to put money into Texas, one actual property funding technique that you simply will have to believe is flipping homes in Houston.

Flipping homes, when accomplished accurately, can yield a stupendous go back on funding. If you’re a type of desirous about the numerous house-flipping TV presentations, suppose once more. What you notice on TV is a glamorized model of dwelling flipping. The method comes with monetary dangers and a number of onerous paintings as you intend, purchase, repair, and promote.

This information will assist familiarize you with the repair and turn technique and come up with the information and equipment to make flipping homes in Houston winning. Let’s start with the fundamentals.

What’s Space Flipping?

Space flipping is an actual property funding technique that comes to purchasing, solving, and reselling a belongings for benefit. You can get into it full-time or as a facet hustle, relying on how a lot you want to earn from it, the period of time you want to put into it, and the choice of flips you’ll arrange.

Probably the most rules of dwelling flipping is purchasing low, promoting excessive. You wish to have to discover a cheap or undervalued belongings for your home flipping venture. Undervalued houses are the ones which can be foreclosed or in dire want of maintenance.

Consider a distressed belongings protruding like a sore thumb in a pristine location. That unmarried dwelling has the ability to drag down domestic values considerably locally. On the other hand, after you rehab that belongings, it may possibly additionally push up the values of the encompassing houses. Citizens locally the place you turn a dwelling are regularly receptive to this sort of technique.

A hit dwelling flipping initiatives are influenced by means of two vital elements – your wisdom of the marketplace and the turn-around time, and each require onerous paintings.

Similar: How To In finding Distressed Houses to Make investments In: 5 Techniques

Is Flipping Properties Winning?

In keeping with ATTOM’s 3Q 2021 record, 94,766 homes and condos throughout america have been flipped within the 1/3 quarter of 2021, about 5% of general domestic gross sales in the similar duration. The third-quarter efficiency used to be up 5.1% from Q2 2021 and 5.2% from Q3 2020. The median resale worth used to be $281,847, whilst the median investor worth used to be $213,000. The stated figures translate right into a benefit margin of 32.3% and a gross benefit of $68,847.

On the other hand, the similar record raised worry a couple of 33.2% fall within the benefit margin from the second one quarter and a 43.8% decline from 2020.

In the meantime, buyers proceed to be attracted to the Texas dwelling flipping marketplace for a number of causes:

- Space costs in Texas are not up to the nationwide moderate.

- The financial system is healthier than maximum states, rating No. 9 within the Economic system class of a learn about of the most productive states to reside in america carried out by means of U.S. Information. The affordability it gives draws extra other people to it.

- Texas’s inhabitants is rising, particularly with folks and companies shifting to the state.

How do those efficiency metrics and Texas’s points of interest affect dwelling flipping in Houston?

2021 Houston Space Flipping Marketplace Research

The similar ATTOM record additionally supplied information about the home-flipping marketplace in Houston, Texas, which ranked No.9 some of the nation’s peak 10 metro spaces for flipped houses in the similar quarter.

The choice of flips took a 5.6% proportion of Houston’s general Q3 gross sales, similar to at least one,685 houses. The flipping fee went up by means of 33% from the former quarter and 50% year-on-year (YOY). The median acquire worth closed at $239,612, and the median resale or flipped worth at $271,938, final its moderate gross benefit at $32,327. This gross benefit interprets right into a gross go back on funding of 13.5%, representing a 42% decline YOY. Flipped houses right through the duration took a median of 134 days to complete.

The decline in benefit margin is attributed to a number of elements: (1) the costs of Houston funding houses are on the upward thrust on account of the excessive call for and provide scarcity, (2) the excessive value of maintenance and renovations brought about by means of inflation, and (3) issues within the provide chain caused by means of the pandemic. Maximum dwelling flippers are people who don’t seem to be entitled to reductions loved by means of giant domestic developers, which compounds the issues of dwelling flippers.

Regardless of the hot decline of benefit margins in the home flipping marketplace, buyers stay certain about it. One explanation why is the rising pattern amongst millennials purchasing homes with out spending an excessive amount of time solving them.

Those that turn homes in Texas are additional buoyed by means of the low- and fair-valued homes to be had, the state’s high quality of existence, and coffee reworking prices. U.S. Information ranked Houston because the third-best position to reside in Texas in 2021, mentioning the town’s financial system as its primary merit.

However the query stays: Is flipping homes in Houston nonetheless winning?

Discovering the Proper Space to Turn

Don’t simply acquire a dwelling simply since you are charmed by means of it or be ok with it. Don’t lose your intention of why you’re doing this, and that’s, to earn benefit. You wish to have to believe 3 elements to your seek for the most productive belongings for flipping homes in Houston. Those are location, benefit possible, the valuables’s situation.

Location

Irrespective of the true property funding technique you select, crucial issue to believe is the valuables’s location. A brand new investor would have a tendency to in an instant discover a distressed dwelling in a pleasing location with elementary facilities reminiscent of faculties, groceries, and well being care services and products. On the other hand, that might take numerous time, so it’s perfect to slim down your group analysis.

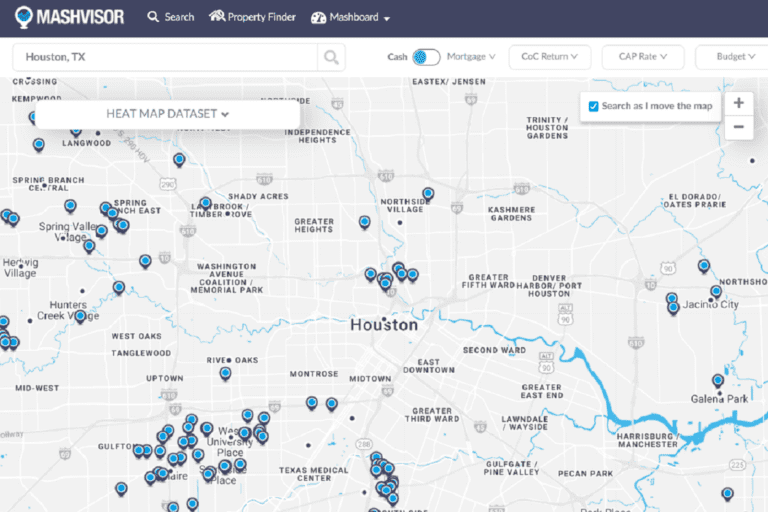

Carrying out a group analysis is very important in finding the most productive location for flipping homes in Houston. It’s going to direct you to spaces more likely to earn essentially the most benefit. You’ll want an actual property funding instrument like Mashvisor’s Heatmap to habits in depth analysis.

The heatmap presentations you the top-performing and low-performing neighborhoods according to the filter out you make a choice from some of the following:

Mashvisor’s Heatmap supplies you crucial knowledge for selecting a location, together with cap fee, money on money go back, condominium source of revenue, the choice of houses to be had on the market, and the fee.

After creating a shortlist of imaginable neighborhoods for your home flipping venture, you’ll get started checking on each and every group’s elementary facilities and no matter they’ve with regards to recreational and sport. If the positioning has amenities that cater to a various way of life, e.g., health club, theater, museums, parks, and so on., then the ones can be welcome bonuses, along side a excellent employment fee. Those points of interest will have to be useful if you end up in a position to resell the home. Along with group analysis, believe running with a seasoned native actual property agent that will help you along with your seek.

Similar: How To In finding the Easiest Houston Source of revenue Houses

A heatmap could be a very precious instrument in actual property making an investment, particularly when flipping homes in Houston.

Benefit Doable

If you’ve decided on an area for flipping homes in Houston, the following logical step is to select a belongings. It’s no longer sufficient that you’re in a excellent location – it’s important to come to a decision which belongings will deliver you your anticipated returns.

A number of assets are to be had that will help you seek for the best belongings.

One such supply is the Mashvisor Assets Market, designed to search out off-market funding houses, together with auctioned houses, bank-owned, foreclosed houses, quick gross sales, tenant-occupied leases. You’ll be able to streamline your seek by means of making use of the next filters:

- You’ll be able to do simultaneous searches of as much as 5 places

- How some distance do you need the valuables to be clear of the town?

- Finances

- Condominium technique. Choose from conventional and Airbnb

- Assets sort. Choose from the drop-down menu

- List sort. Choose from the drop-down menu

- Choice of bedrooms

- Choice of toilets

- Desired money on money go back

- Desired cap fee

While you’re accomplished atmosphere the filters, the instrument gives you a listing of to be had houses on the market that fit your standards. The checklist is organized in descending order of possible go back on funding, making it more uncomplicated for you to select a belongings for domestic flipping.

Similar: How you can Turn Properties With No Cash: 5 Steps

Assets’s Situation

But even so realizing the marketplace, some other issue that may assist flipping homes in Houston a rewarding enjoy is the turn-around time; this is, the rate with which you’ll resell the valuables after its acquire.

To make sure a handy guide a rough turn-around time, make a selection a belongings with excessive benefit possible that calls for fast maintenance. Search for cracks at the partitions and ground, mildew, water harm, indicators of leaks, rust, and different signs of restore necessities. Up to imaginable, acquire a belongings that can handiest require minor maintenance.

When you have no idea what to search for, it may well be wiser to herald knowledgeable. You do not need to start out doing maintenance handiest to determine later that there are extra damages to deal with. You wouldn’t need that as a result of that can imply further bills that would possibly devour up your finances and delays within the solving level.

Making Your Assets Winning

So now you’ve gotten your private home to turn, and all you want to do is acquire it. At this level, you get started taking measures to maximise your benefit. On the other hand, sooner than you’ll even make an be offering for the valuables, believe the next:

After-Restore Worth

Probably the most phrases you want to be told about flipping homes in Houston is After Restore Worth (ARV), which is the estimated worth of the distressed belongings in any case the renovations and maintenance are finished. The ARV is a very powerful determine for dwelling flippers as it supplies insights at the following:

- Doable resale worth

- Benefit margin

- Renovation finances

- Assets acquire worth

ARV is the sum of the valuables’s present worth and the projected renovation value.

Assets’s Present Worth

This worth represents the valuables’s price in its present situation, most often similar to the fee you pay for it sooner than doing any restore. This worth could also be known as the as-is worth. It can pay to have skilled actual property appraisers assess the valuables’s present worth as a result of they’ve a greater eye for main points. They may be able to simply spot any problems that can affect the valuables’s price. Let the professionals come up with a correct estimate of your private home’s present worth.

Projected Renovation Value

This worth refers back to the worth added to the funding belongings after finishing the renovations. You wish to have to make a excellent estimate of the renovation value and make certain that prices are smaller than the renovation worth to make a benefit.

Supply estimates from a minimum of 3 respected contractors to make your value estimates correct. Have each and every contractor come up with an itemized checklist of maintenance had to make a greater comparability.

Take a look at native domestic retail outlets for fabrics costs, and be in search of retail outlets that give reductions. In finding out what the patrons throughout the location’s marketplace expect with regards to high quality. You may wish to stay your prices as little as imaginable with out sacrificing the standard and protection of the renovated belongings.

Think about different prices reminiscent of hard work, maintaining, final, financing, and advertising and marketing prices.

After calculating your private home’s ARV, carry out a comparative marketplace research (CMA) to test the way it fares towards actual property comps. It will have to let you know at what vary you’ll successfully set your resale worth.

The 70% Rule

If you’re fascinated by flipping homes in Houston, you want to grasp and follow the 70% rule. The rule of thumb is helping you decide the utmost sale worth you will have to be paying for a belongings to revel in a minimum of 30% benefit.

The method for the 70% rule is:

Most Be offering Value = (ARV x 0.70) – Restore Prices

The ensuing determine tells you the utmost quantity you’ll spend on a house that you simply want to turn. When you move over that worth, you chance lowering or shedding your benefit. For instance, if the median worth of a belongings in Houston is $239,612 and your restore prices are estimated at $32,000. Your most be offering worth can be:

(239,612 x 0.7) – 32,000 = $135, 728

The important thing here’s to stay on your finances and test the place you should lower down prices. Keep in mind that the prices don’t seem to be restricted to maintenance. Imagine the preliminary acquire worth, sporting prices, promoting prices, and extra.

Buying the Assets

Assume you’ve gotten discovered the most productive belongings to get you began in flipping homes in Houston. Your subsequent transfer is to shop for the valuables. You wish to have to come to a decision if you’ll purchase it in money or have it mortgaged.

Money

In case you have the assets, a money acquire is a better option. With the exception of saving on pursuits, you’re at liberty to make the acquisition every time the marketplace is favorable to the consumer. A money acquire no longer handiest accelerates the final procedure; it additionally reduces the final prices.

Moreover, dealers choose money patrons as it saves them from being concerned in regards to the financing possibility falling thru. Additionally it is more uncomplicated to barter the fee if you are going to buy the valuables in money.

Most significantly, it doesn’t matter what occurs after buying a belongings in money, the home is already yours. While you purchase a belongings thru financing, and one thing occurs that makes you not able to pay, you chance shedding your private home.

Financing

If you can’t have enough money to pay in money, there are different choices that you’ll discover to buy your private home thru financing.

You might go for a difficult cash mortgage, a non permanent mortgage with a reasonably high-interest fee. Exhausting cash loans are most often utilized in actual property, availed by means of flippers who intend to make use of their belongings for flipping as collateral. The mortgage time period is most often one to 3 years.

Another choice is the house fairness line of credit score (HELOC), which is a line of credit score derived from your individual domestic fairness. It really works like a revolving credit score line, during which you borrow as much as a preset most quantity towards the credit score line, pay, then borrow once more. Even though it appears like having money on call for, you want to have a excellent credit score rating to avail this selection.

A 3rd possibility is the house fairness mortgage (HEL), which you get as a lump sum cost derived from your house fairness. Normally, this sort of mortgage has a set fee, making it simple for you to keep in mind what your per month bills are. This sort of mortgage is excellent for a one-time expense, reminiscent of a house place of job renovation. On the other hand, you want to pay a number of charges, together with origination charges, appraisal charges, mortgage processing charges, and extra.

5 Easiest Neighborhoods in Houston for Flipping 2022

You might discover the next towns if you wish to move house-flipping in Houston. Those are towns with low median sale costs, according to January 2022 knowledge.

1. Hunterwood

Hunterwood has a inhabitants of over 9,300. Positioned in Harris County, it has a suburban persona, with maximum citizens proudly owning their houses. The median sale worth of houses on this group is $220,000. Where is perfect for younger execs and the ones elevating their households. Hunterwood public faculties are above moderate.

2. Eldridge West

This group ranked No. 10 within the Easiest Neighborhoods to Carry a Circle of relatives in Houston. Eldridge West has a inhabitants of 99,392. Maximum citizens hire their houses, and the median sale worth of houses here’s $275,000.

3. Binz

Binz is an enthralling group throughout the Museum District and a haven for other people into arts and tradition. It is likely one of the maximum obtainable neighborhoods in Houston. Where is successful amongst clinical execs and scholars, with Houston’s Clinical Heart mendacity south of Binz. With a belongings median sale worth of $285,000, Binz gifts a number of actual property choices.

4. Afton Oaks – River Oaks House

Afton Oaks has a steady, neighborly really feel and advantages from 24/7 patrol services and products, trendy facilities, and commonplace space repairs. Where, characterised by means of huge so much, has an average belongings sale worth of $309,000. The houses are a mixture of ranch-style and trendy structure.

5. Washington Street Coalition – Memorial Park

Where is city, with a number of bars, espresso retail outlets, parks, and eating places. Washington Street Coalition is well-liked amongst younger execs and is likely one of the perfect puts to reside in Texas. It has a inhabitants of greater than 36,000. Maximum houses within the space are resident-owned, and houses have an average sale worth of $313,042.

Abstract

Is it winning to turn homes in Houston in 2022? Sure!

Regardless of the decline in benefit margins reported in Q3 2021, many of us are nonetheless desirous about making an investment in actual property by means of flipping homes in Houston, whose financial system is healthier than maximum towns national. Houston is thought of as one of the vital perfect towns for the repair and turn technique with its relatively low belongings costs.

Like different investments, flipping homes in Houston calls for cautious making plans and difficult paintings. You wish to have to have a excellent figuring out of the marketplace, a excellent turn-around time, and an figuring out of constructing the funding winning. To reach those, you want to have dependable actual funding equipment like the ones introduced by means of Mashvisor. Set an appointment on your loose demo or signal as much as get your 7-day loose trial.