This tale at the beginning seemed on Zacks

January CPI got here in above the 0.5% threshold illustrating an inflation acceleration (7.5% annualized), sending growth-focused equities into a little bit of a tailspin.

– Zacks

– Zacks

Then again, I see alternative right here to pick out up pre-earnings innovation-driven winners earlier than they file what will have to lead to a springboard worth motion over the following couple of weeks at the predication that that is certainly top inflation (with most of the maximum notable inflation drivers being temporary in nature).

Is The Worst Case-State of affairs Priced In?

Public fairness markets have a tendency to overreact to each the up and problem with any financial shift. This sort of exaggerated marketplace strikes is what we are seeing in high-growth names because of the just lately initiated duration of economic tightening (the method of the central financial institution elevating charges). When one thing surprising happens, knee-jerk reactions can simply overshoot underlying basics (which we have now noticed numerous lately).

The worst-case situation that appears to had been priced in (predominantly through high-growth innovators) is an financial backdrop of decelerating call for whilst inflation soars. On this match, the Federal Reserve could be compelled to impulsively tighten its financial method in an effort to save our economic system from an undesirable duration of stagflation (stagnant financial progress coupled with oversized inflation).

Price-sensitive progress shares have naturally been hit the toughest through the fears of an more and more hawkish Federal Reserve, as their projected income a long way sooner or later (the place maximum of its marketplace price is derived) get discounted again at a better price. Then again, it will seem that this sell-off overshot basics for the best-positioned marketplace disruptors.

America 10-Yr yield skyrocketed materially above 2% for the primary time for the reason that July 2019 industry started, and progress shares rallied in reduction. The 50% or extra capitulations from many innovation-fueled shares’ 52-week highs seem to have been pushed through not anything greater than uncertainty & worry surrounding financial expectancies.

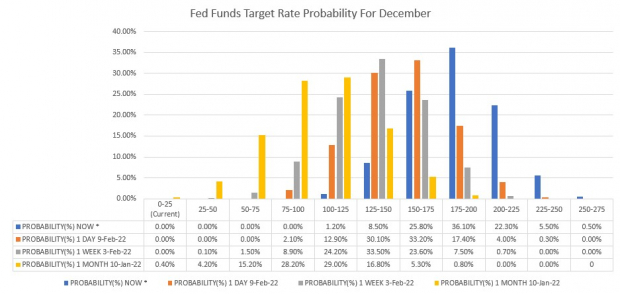

As of late, the ones expectancies had been pushed upper, however the vary of predictions have soared to round 6 to eight price hikes through yr finish after St. Louis Fed President, Bullard known as for a 50-basis level March hike (two 25-basis level increments in a single assembly). Consistent with CME’s Fed Budget futures information, there’s now a zero% chance of three or much less 25-basis level hikes earlier than the yr is up and a 64.4% probability that we can see 7 or extra price will increase (indicating a median of 1-hike consistent with assembly). A stark distinction to the 48% and nil.8% respective chances this futures marketplace had priced for 1 month prior.

My chart underneath displays this sentiment shift, evaluating Friday’s 2022 Fed Budget chances with 1-day, 1-week, and 1-month prior.

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

The higher self belief in charges permits analysts and buyers to raised quantify their valuation fashions and supplied the overly discounted progress sector with a pleasing reduction rally nowadays because the competitive short-sellers start unwinding their innovation-focused positions.

The January CPI studying this morning used to be above expectancies, however I consider that this can have been the height for inflation because the Omicron’s pandemic prolonging bottleneck impact subsides, permitting provide and insist imbalances to revert against a strong free-market equilibrium (worth stabilization).

The New Dealer

Many aged-school cash managers had been not able to regulate their funding approaches to conform to this novel buying and selling surroundings, the place momentum, self-fulfilling prophecies, technical research, and the tidal wave of freshman members with a penchant for innovation have taken priority over conventional price making an investment.

In truth, price making an investment does not even dangle the similar which means that it did twenty years in the past. With rates of interest close to 0% for nearly 2 years now, valuation multiples like P/E, P/S, P/B, and EV/EBITDA have change into convoluted measures of intrinsic price. Those reputedly antiquated requirements of relative price are lacking the important element of long-term progress outlooks because the post-pandemic virtual renaissance commences.

We’re getting into a sophisticated section of monetary building, which will also be characterised through digitally fueled secular progress from masses (if now not 1000’s) of younger innovators taking a look to switch the arena.

File low-interest charges coupled with the pandemic’s fast digitalization (accelerating adaptation) has allowed market-disrupting start-ups years clear of profitability to score valuations within the $10s of billions. Buyers don’t seem to be modeling for the perception that charges will likely be systemically decrease within the post-pandemic economic system (exemplified through the Fed’s aid of its long-term goal Fed Budget price) and extra gas the boundless successful progress attainable that many newly public innovators possess.

7 Best possible Shares for the Subsequent 30 Days

Simply launched: Professionals distill 7 elite shares from the present listing of 220 Zacks Rank #1 Robust Buys. They deem those tickers “Maximum Most likely for Early Value Pops.”

Since 1988, the entire listing has overwhelmed the marketplace greater than 2X over with a median achieve of +25.4% consistent with yr. So be sure you give those hand-picked 7 your instant consideration.

Need the newest suggestions from Zacks Funding Analysis? As of late, you’ll obtain 7 Best possible Shares for the Subsequent 30 Days. Click on to get this loose file

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis