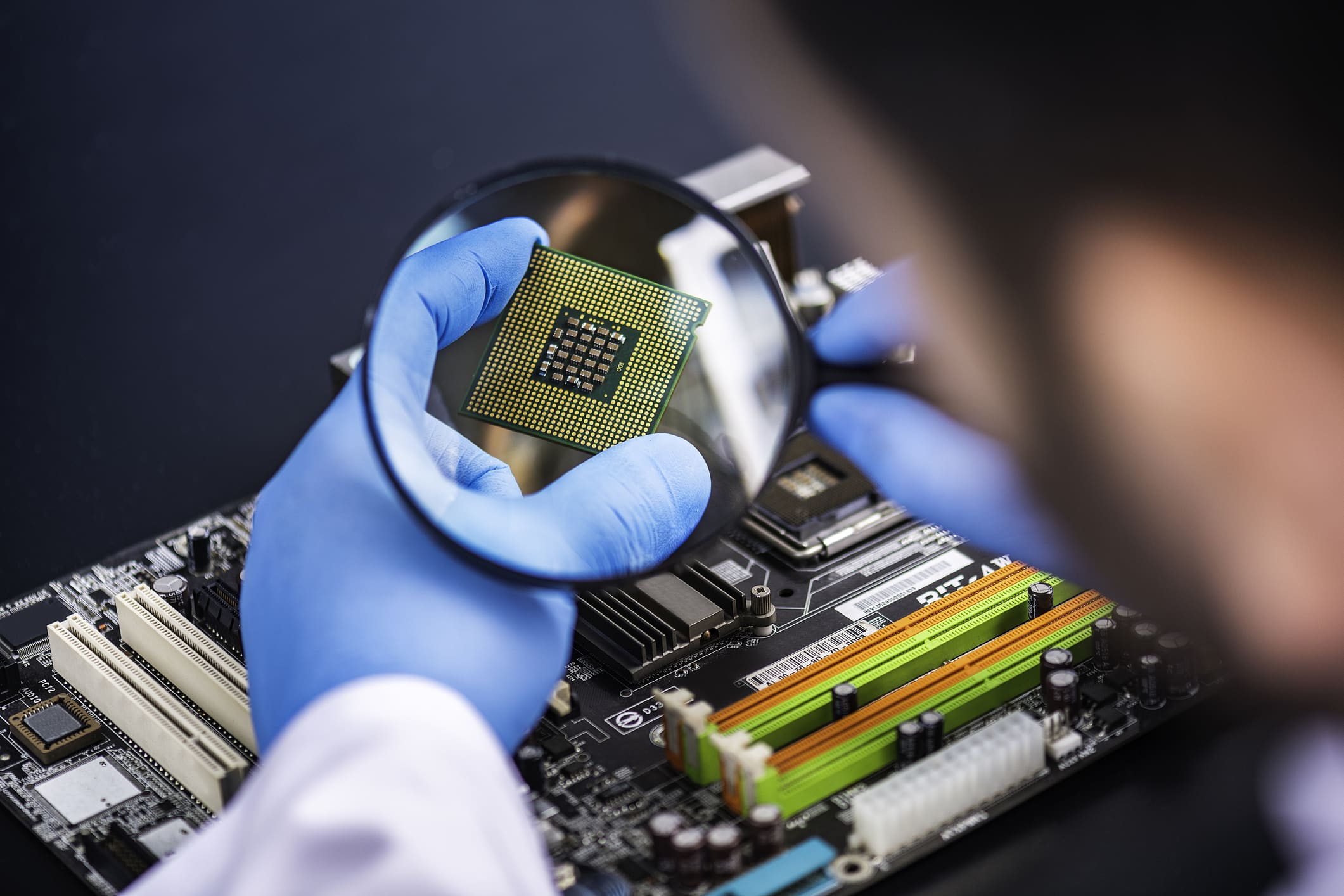

A technologist inspects a pc chip.

Sefa Ozel | E+ | Getty Pictures

Ecu Union lawmakers have laid out formidable plans to seriously ramp up manufacturing of semiconductors within the bloc and develop into a world chief within the business.

To try this, it’ll want probably the most key avid gamers from Asia and the U.S. to speculate closely within the continent, given the EU’s loss of era in crucial spaces like production, analysts stated.

On Tuesday, the Ecu Fee, the chief arm of the EU, introduced the Ecu Chips Act — a multi-billion euro try to safe its provide chains, avert shortages of semiconductors someday, and advertise funding into the business. It nonetheless calls for approval from EU lawmakers to cross.

Chips are crucial for merchandise from fridges to vehicles and smartphones, however a world crunch has impacted industries around the board inflicting manufacturing standstills and shortages of goods.

Semiconductors have develop into a nationwide safety factor for the U.S., and has even develop into some degree of geopolitical pressure between the U.S. and China. That conflict over semiconductors has resulted in sanctions on China’s largest chipmaker SMIC and the sector’s second-largest financial system doubling down on efforts to spice up self-sufficiency.

The EU is now seeking to mitigate a few of the ones dangers with its newest proposal.

“Confronted with rising geopolitical tensions, rapid expansion in call for, and the potential of additional disruptions within the provide chain, Europe will have to use its strengths and installed position efficient mechanisms to determine better management positions and make sure safety of provide inside the international business chain,” the Ecu Fee stated.

Production problem

The EU Chips Act seems to plough 43 billion euros ($49 billion) of funding into the semiconductor business and lend a hand the bloc to develop into an “business chief” someday.

Particularly, the EU needs to spice up its marketplace percentage of chip manufacturing to twenty% by way of 2030, from 9% lately, and bring the “maximum refined and energy-efficient semiconductors in Europe.”

A part of its plan comes to lowering “over the top dependencies,” even though the EU notes the desire for partnerships with “like-minded companions.”

Because it seems to develop into extra self-sufficient, the EU will nonetheless depend closely at the U.S. and specifically, Asia. That is as a result of the quirks of the semiconductor provide chain and the converting nature of the business.

During the last 15 years or so, corporations have begun transferring to a fabless type — the place they design chips however outsource the producing to a foundry.

In the true production of chips, Asian corporations now dominate, led by way of Taiwan’s TSMC which has a couple of 50% marketplace percentage on the subject of foundry income. South Korea’s Samsung is the following largest, adopted by way of Taiwan’s UMC.

U.S. company Intel, which used to be as soon as a key participant, has fallen in the back of lately. On the other hand, it’s now specializing in the foundry trade and plans to make chips for different avid gamers. However its era nonetheless stays in the back of the likes of TSMC and Samsung which may make essentially the most state of the art chips that cross into the newest smartphones, for instance. Intel stated final yr it plans to spend $20 billion on two new chip vegetation in Arizona, in a bid to catch up.

The EU, then again, has no corporations that may manufacture the newest chips.

“The principle space the EU will want to spouse is in bleeding edge wafer production. EU avid gamers lately are caught at 22nm and it is unrealistic to suppose that native EU avid gamers can catch up from 22nm (nanometers) to 2nm,” Peter Hanbury, a semiconductor analyst at analysis company Bain, informed CNBC.

The nanometer quantity signifies the dimensions of the transistors at the chip. A small quantity method the next selection of transistors can have compatibility, resulting in probably extra tough chips. The chip in Apple’s newest iPhone, for instance, is 5nm. Those are thought to be the modern chips.

EU corporations might also depend on semiconductor design equipment from the U.S.

Boosting chip manufacturing to twenty% marketplace percentage is an “an especially tall order” for the EU, in step with Geoff Blaber, CEO of CCS Insights. “The focal point on production is the most important problem there,” Blaber informed CNBC.

Is the EU horny sufficient?

As nations and areas around the globe glance to safe their semiconductor provides, there’s rising pageant to safe ability and persuade corporations to speculate.

As a part of a $2 trillion financial stimulus bundle, U.S. President Joe Biden earmarked $50 billion for semiconductor production and analysis. A invoice referred to as the CHIPS for The us Act could also be running its means during the legislative procedure.

International locations like Japan, South Korea and China are all boosting funding into semiconductors too.

“The principle problem can be in attracting new avid gamers to the EU. Particularly, the EU will have to develop into a extra horny location than different geographies,” Hanbury stated.

The EU has been seeking to woo modern chip producers. Intel is making plans to construct a brand new chip fab in Europe, even though a particular web site has now not but been selected. TSMC is within the early phases of assessing its personal manufacturing facility in Europe.

“The EU (or any geography) does not want to outspend the semiconductor avid gamers however slightly to steer their spend to happen of their geography,” Hanbury stated.

EU strengths

Even if Ecu corporations are in the back of in the newest production era, the EU nonetheless has some key avid gamers within the semiconductor business.

One of the vital necessary is ASML, a Dutch company that makes a gadget utilized by the likes of TSMC, and is used to take advantage of state of the art chips. Apple providers STMicro and NXP also are each based totally in Europe.

“[The] EU has a number of key property within the business,” Hanbury stated.

The EU’s center of attention may well be on securing chip provide for sectors the place Ecu corporations have a big presence such because the automobile business. Semiconductors that cross into vehicles are ceaselessly much less complex and do not require the newest production era.

“Consider a few of the ones sectors the place we are going to see the call for for the era within the coming years and automobile is one large alternative in Europe and I feel that is one thing I might be expecting the EU to be specializing in,” Blaber stated.