Wall Side road is reeling underneath excessive volatility because the starting of 2022. Buyers are extremely all for hovering inflation. Additionally, the uncertainty in regards to the tempo and magnitude of an rate of interest hike by means of the Fed to include inflation has injected critical fluctuations in daily buying and selling since mid-January.

– Zacks

– Zacks

The Fed has obviously indicated that it’ll elevate rate of interest in March, for the primary time in 3 years. In consequence, marketplace members are unsure concerning the course of inventory marketplace motion within the near-term. At this degree, it’ll be prudent to put money into low-beta, high-dividend-paying shares with a positive Zacks Rank. 5 such shares are — Pfizer Inc. PFE, Texas Tools Inc. TXN, Packaging Company of The us PKG, Atmos Power Corp. ATO and Crown Fortress Global Corp. CCI.

A Extra Hawkish Fed

On Jan 26, after the belief of the primary Fed FOMC assembly of this 12 months, Chairman Jerome Powell signaled the primary price hike in 3 years as early as in March. The central financial institution’s quantitative easing program can even lead to March.

Even though the Fed evaded declaring the month and magnitude of the rate of interest hike, Powell mentioned, “Inflation dangers are nonetheless to the upside within the perspectives of maximum FOMC members, and indisputably personally as properly. There’s a chance that the excessive inflation we’re seeing can be extended. There’s a chance that it’ll transfer even upper.”

The Fed Chairman additional added, “In mild of the exceptional growth we’ve observed within the exertions marketplace and inflation this is well-above our 2% long-run purpose, the economic system not wishes sustained excessive ranges of economic coverage give a boost to.”

In a separate press commentary, the FOMC has additionally indicated that the Fed is pondering of shrinking its $9 trillion stability sheet later this 12 months. Powell mentioned, “There’s quite a lot of shrinkage within the stability sheet to be completed. That’s going to take a while. We wish that procedure to be orderly and predictable.”

Wall Side road Tumbles

On Feb 10, the Division of Trade reported that the shopper value index (CPI) — popularly referred to as family inflation — jumped 7.5% 12 months over 12 months in January, marking its best possible per 30 days acquire since February 1982. The consensus estimate used to be 7.2%. The core CPI (aside from risky meals and effort pieces) climbed 6% 12 months over 12 months in January, its best possible since August 1982. The consensus estimate used to be 5.9%.

In consequence, the 3 primary inventory indexes – the Dow, the S&P and the Nasdaq Composite – tumbled 1.5%, 1.8% and a pair of.1%, respectively. 12 months to this point, the Dow, the S&P 500 and the Nasdaq Composite are down 3%, 5.5% and 9.3%, respectively.

Following the discharge of CPI knowledge, the yield at the benchmark 10-12 months U.S. Treasury Be aware crossed the two% threshold. The yield used to be 1.5% firstly of this 12 months as opposed to 0.9% firstly of 2021.

CNBC reported that according to the information to be had from the CME rate of interest long run, there may be recently virtually a 100% chance of a 50-basis-point build up within the benchmark rate of interest in March. Additionally, there’s a 61% likelihood that the Fed will hike rate of interest seven instances this 12 months.

Why Low-Beta Top-Yielding Shares?

At this degree, funding in low-beta shares with a excessive dividend yield and a positive Zacks Rank is also the most suitable choice. If the marketplace’s northbound adventure continues, the favorable Zacks Rank of those shares will seize the upside attainable. On the other hand, if markets take a downturn, low-beta shares will reduce portfolio losses and dividend cost will act as an ordinary source of revenue move.

Our Best Selections

Now we have narrowed our seek to 5 large-cap (marketplace capital > $10 billion) low-beta shares with a cast dividend yield. Those firms have sturdy expansion attainable for 2022 and feature observed certain profits estimate revisions within the final 30 days. Each and every of our alternatives carries both a Zacks Rank #1 (Robust Purchase) or 2 (Purchase). You’ll be able to see your entire checklist of lately’s Zacks #1 Rank shares right here.

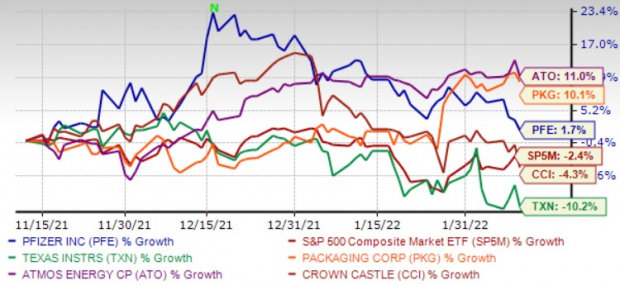

The chart under displays the fee efficiency of our 5 alternatives previously 3 months.

Symbol Supply: Zacks Funding Analysis

Symbol Supply: Zacks Funding Analysis

Pfizer expects sturdy expansion in key manufacturers like Ibrance, Inlyta and Eliquis to power gross sales. PFE’s COVID-19 vaccine has develop into a key contributor to its most sensible line. The approval of Paxlovid, Pfizer’s oral antiviral tablet for COVID, will convey in more revenues in 2022. PFE boasts a sustainable pipeline with a couple of late-stage systems that may power expansion.

The Shopper Healthcare three way partnership with Glaxo and the merger of the Upjohn unit with Mylan has made Pfizer a smaller corporate with a various portfolio of cutting edge medicine and vaccines. The smaller Pfizer will have to see higher income expansion.

The Zacks Rank #1 PFE has an anticipated profits expansion price of 49.8% for the present 12 months. The Zacks Consensus Estimate for current-year profits advanced 3.3% over the past 7 days. Pfizer has a latest dividend yield of three.11%.

Texas Tools is profiting from expansion within the non-public electronics marketplace owing to the coronavirus-led work-from-home development. Moreover, cast momentum around the Analog phase owing to tough sign chain and gear product traces, is reaping benefits the highest line of TXN.

The continuing rebound within the automobile marketplace is a tailwind for Texas Tools. Forged expansion within the commercial marketplace is every other certain for TXN. Strategic investments in new expansion avenues and aggressive benefits will have to additionally reap ends up in the long run. TXN’s portfolio of long-lived merchandise and environment friendly production methods are the opposite catalysts.

Zacks Rank #1 Texas Tools has an anticipated profits expansion price of 10.1% for the present 12 months. The Zacks Consensus Estimate for current-year profits advanced 10.6% over the past 30 days. TXN has a latest dividend yield of two.60%.

Packaging Company of The us manufactures and sells containerboard and corrugated packaging merchandise in the US. PKG continues to get pleasure from tough packaging call for subsidized by means of e-commerce and emerging requirement for the packaging of meals, drinks and drugs.

PKG’s Packaging phase will get pleasure from upper corrugated merchandise shipments with 3 further delivery days. For the Paper phase, the corporate expects upper costs and blend. Packaging Company of The us continues to enforce value hikes that can assist offset the have an effect on of excessive running prices, freight bills and provide chain problems on margins.

Zacks Rank #1 Packaging Company of The us has an anticipated profits expansion price of eleven.5% for the present 12 months. The Zacks Consensus Estimate for current-year profits advanced 10.4% over the past 30 days. PKG has a latest dividend yield of two.65%.

Atmos Power continues to get pleasure from call for emerging from its increasing buyer base. ATO is making plans to put money into the variability of $13-$16 billion within the fiscal 2022-2026 time frame to extend the reliability of its pipelines and serve consumers successfully. Returns inside a 12 months of capital funding proceed to spice up Atmos Power’s efficiency and make allowance it to pay common dividends. ATO has sufficient liquidity to fulfill near-term debt duties.

The Zacks Rank #2 Atmos Power has an anticipated profits expansion price of seven.8% for the present 12 months (ended September 2022). The Zacks Consensus Estimate for current-year profits advanced 0.9% over the past 30 days. ATO has a latest dividend yield of two.50%.

Crown Fortress is a number one impartial operator of wi-fi conversation towers in the US. An build up in cellular knowledge utilization, spectrum availability and excessive community investments by means of wi-fi carriers to deploy 5G networks are expected to spur call for for CCI’s towers.

Capitalizing on those, Crown Fortress is easily poised to develop. Moreover, the hot development in estimate revisions for first-quarter 2022 price range from operations according to percentage signifies a positive outlook for CCI.

The Zacks Rank #2 Crown Fortress has an anticipated profits expansion price of 6.2% for the present 12 months. The Zacks Consensus Estimate for current-year profits advanced 0.1% over the past 30 days. CCI has a latest dividend yield of three.27%.

Simply Launched: Zacks Best 10 Shares for 2022

Along with the funding concepts mentioned above, do you want to find out about our 10 most sensible alternatives for the whole lot of 2022?

From inception in 2012 thru 2021, the Zacks Best 10 Shares portfolios won an excellent +1,001.2% as opposed to the S&P 500’s +348.7%. Now our Director of Analysis has combed thru 4,000 firms coated by means of the Zacks Rank and has handpicked the most productive 10 tickers to shop for and grasp. Don’t omit your likelihood to get in…since the quicker you do, the extra upside you stand to seize.

Need the most recent suggestions from Zacks Funding Analysis? Lately, you’ll be able to obtain 7 Best possible Shares for the Subsequent 30 Days. Click on to get this loose document

Texas Tools Included (TXN): Unfastened Inventory Research Record

Pfizer Inc. (PFE): Unfastened Inventory Research Record

Crown Fortress Global Company (CCI): Unfastened Inventory Research Record

Packaging Company of The us (PKG): Unfastened Inventory Research Record

Atmos Power Company (ATO): Unfastened Inventory Research Record

To learn this newsletter on Zacks.com click on right here.

Zacks Funding Analysis