Trade optimism declined in January 2022 in comparison to December 2021, in step with an ongoing ballot via Verdict, as renewed COVID-19 restrictions because of the Omicron variant slowed expansion and provide chain bottlenecks persisted to impede companies international.

Verdict has been accomplishing the ballot to review the traits in industry optimism all over COVID-19 as mirrored via the perspectives of businesses on their long run expansion possibilities amid the pandemic.

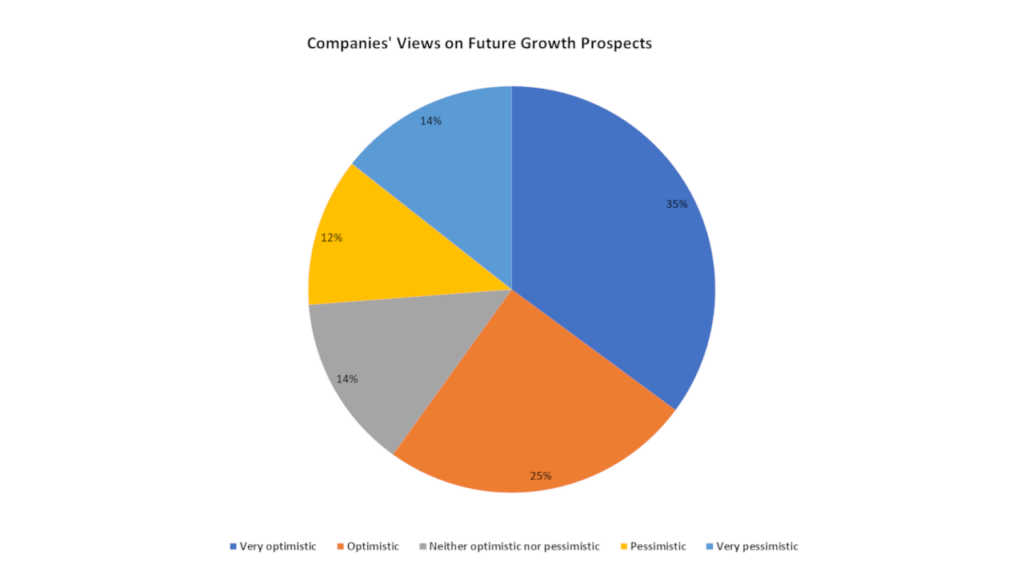

Research of the ballot responses recorded in January 2022 displays that optimism relating to long run expansion possibilities diminished via seven proportion issues to 60% from 67% in December 2021.

The respondents who have been constructive greater via 3 proportion issues to twenty-five% in January, whilst the ones very constructive diminished via ten proportion issues to 35%.

The respondents who have been pessimistic greater via 4 proportion issues to twelve%, while those that have been very pessimistic greater via two proportion issues to fourteen% in January.

The share of respondents who have been impartial (neither constructive nor pessimistic) greater via one proportion level to fourteen%.

The research is in line with 786 responses won from the readers of Verdict community websites between 01 January and 31 January 2022.

Provide chain disruptions and Omicron unfold continues to hose down industry optimism

Canada’s small industry self assurance over the quick and longer term dropped considerably right through January 2022. Trade efficiency expectancies dropped via 8 issues to 36.9, in step with the Canadian Federation of Unbiased Trade (CFIB) Trade Barometer Quick-term Index. In the meantime, the long-term optimism index dropped via 8 issues to 54.3.

All Canadian provinces reported a downward development in industry efficiency expectancies over the quick time period, with Ontario witnessing a marked lower in industry optimism. Provide chain disruptions persisted to impede industry efficiency with low unsold inventories and unfilled buyer orders.

The IESI (Istat Financial Sentiment Indicator) shrank from 112.7 in December to 105.4 in January, indicating a drop in industry self assurance local weather in Italy. The arrogance index slipped throughout more than a few sectors together with production, development, marketplace products and services, and retail industry.

In Europe, Belgium reported a decline in industry self assurance in January, in step with the Nationwide Financial institution of Belgium. The industry self assurance index dropped to two.7 in January 2022 in comparison to 3.6 in December 2021, the bottom since March 2021. The industry local weather weakened within the development trade, whilst it progressed for the industry products and services sector.

Eurozone industry task additionally slowed in January because of COVID-19 restrictions and fast unfold of the Omicron variant, in step with the IHS Markit Eurozone PMI and GDP. Trade optimism dropped to 52.4 in January from 53.3 in December, with provider sector expansion being probably the most impacted.

The Buying Managers Index (PMI) industry survey printed a slowdown in non-public sector industry task expansion in Scotland in January to 52.7, its lowest in ten months. The broader survey indicated an general slowdown in expansion throughout the United Kingdom. Higher COVID-19 restrictions pushed via the emergence of the Omicron variant ended in the gradual expansion in inflows of companies and orders all over the month, specifically in client products and services, whilst production picked tempo because of the enhanced availability of fabrics.

In Asia, the IHS Markit India Production PMI printed that India’s industry optimism dropped from 55.5 in December 2021 to 54.0 in January 2022, a 19-month low. The rustic’s production sector actions moderated all over the month because of Omicron-related restrictions that impeded its expansion and function.

The industry self assurance in the United States dropped from 64.6 in December 2021 to 56.2 in January 2022, in step with Creighton College’s January Mid-The united states Trade Stipulations Index. About one-third of the provision chain managers expect provide chain blockages, a key riding issue of top inflation in the United States, to irritate this yr.