[ad_1]

Mars’ planned $36bn takeover of Kellanova has helped propel Goldman Sachs up a ranking of M&A financial advisers in the consumer sector.

The US-based bank advised Kellanova on the deal, which is expected to be finalised in the first half of 2025.

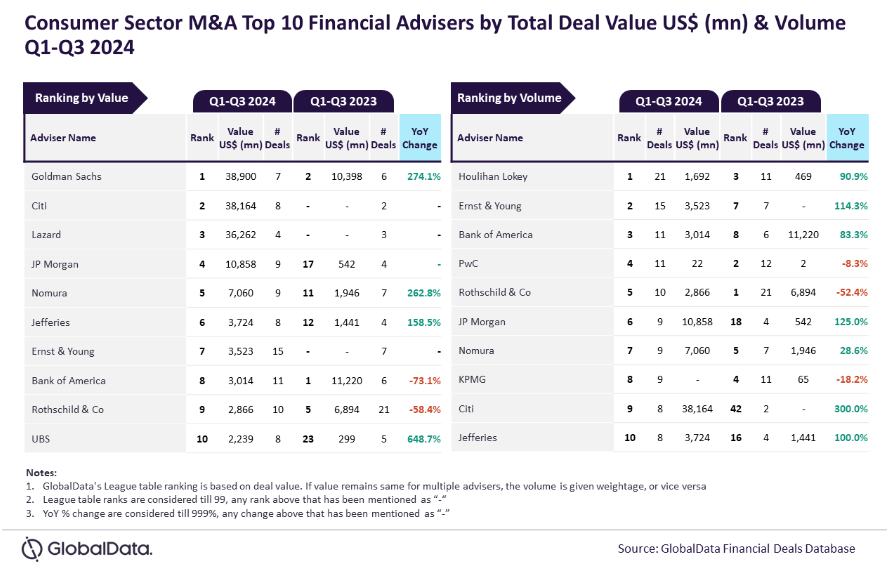

According to the deals database of GlobalData, Just Food’s parent, Goldman Sachs headed the charts when measuring the value of transactions over the first nine months of 2024. The group did not feature in the top ten after the opening half of the year.

Houlihan Lokey advised on the most M&A transactions in the consumer sector, GlobalData said.

“Goldman Sachs registered a massive jump in the value of deals advised by it during the Q1 to Q3 2024 period, compared to the corresponding period a year earlier,” Aurojyoti Bose, lead analyst at GlobalData, said. “The involvement in the $35.9bn acquisition of Kellanova by Mars played a pivotal role for Goldman Sachs to register a three-fold jump in terms of value and top the chart.”

Bose highlighted the gap between Houlihan Lokey and its rivals on deal volumes. “Houlihan Lokey saw an improvement in the number of deals advised by it during Q1 to Q3 2024. In fact, it was the only adviser to advise on more than 20 deals during the review period,” he said.

Access the most comprehensive Company Profiles

on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Company Profile – free

sample

Your download email will arrive shortly

We are confident about the

unique

quality of our Company Profiles. However, we want you to make the most

beneficial

decision for your business, so we offer a free sample that you can download by

submitting the below form

By GlobalData

Cerealto’s move for UK snacks maker Hill Biscuits was among the consumer M&A deals Houlihan Lokey worked on during the period.

When looking at the value of consumer M&A during the first nine months of the year, Citi – which advised Mars on its decision to buy Kellanova – was ranked second.

Lazard, J.P. Morgan and Nomura round out the top five.

EY was second when measuring the volume of transactions, followed by Bank of America and PwC in joint third. Rothschild & Co. was fifth.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.

[ad_2]