A senior Biden administration official says the U.S. Department of Education did not plan to begin forgiving up to $147 billion in student debt for as many as 25 million Americans before publishing a final rule on the program — despite claims to the contrary by seven Republican state attorneys general.

Those AGs last week convinced a judge in Georgia to temporarily block President Joe Biden‘s new forgiveness plan for federal student loans by claiming the Department of Education was trying to secretly implement the plan before the final rule was issued in October.

The AGs in a lawsuit challenging the legality of the program alleged that Education Secretary Miguel Cardona “quietly sent orders to loan servicing companies to start mass canceling loans as soon as this week,” which would violate regulations requiring the final rule to be issued first.

But the Biden administration official told CNBC that the Department of Education had only instructed loan servicers to get ready for the debt cancellation.

“We would not implement a rule before it’s final,” the official said.

A person close to the loan industry confirmed that account to CNBC, saying the DOE only told the servicers to prepare for the debt relief program.

Those preparations included briefing customer service agents on how to explain the aid to borrowers when it became available and drafting new website information.

“It’s the preparatory work that is required and necessary,” the source said. “It’s similar to any kind of product launch.”

“Servicers have not been given files to forgive,” the source said.

But a spokesman for the Missouri Attorney General’s Office, one of the plaintiffs in the suit, in an email to CNBC when asked about the Biden official’s and source’s comments, said, “We have evidence to the contrary, which we filed under seal.”

“It remains under seal until the Department agrees to unseal it,” the spokesman said. “It’s telling that the Department has so far refused to consent to this proof being made public.”

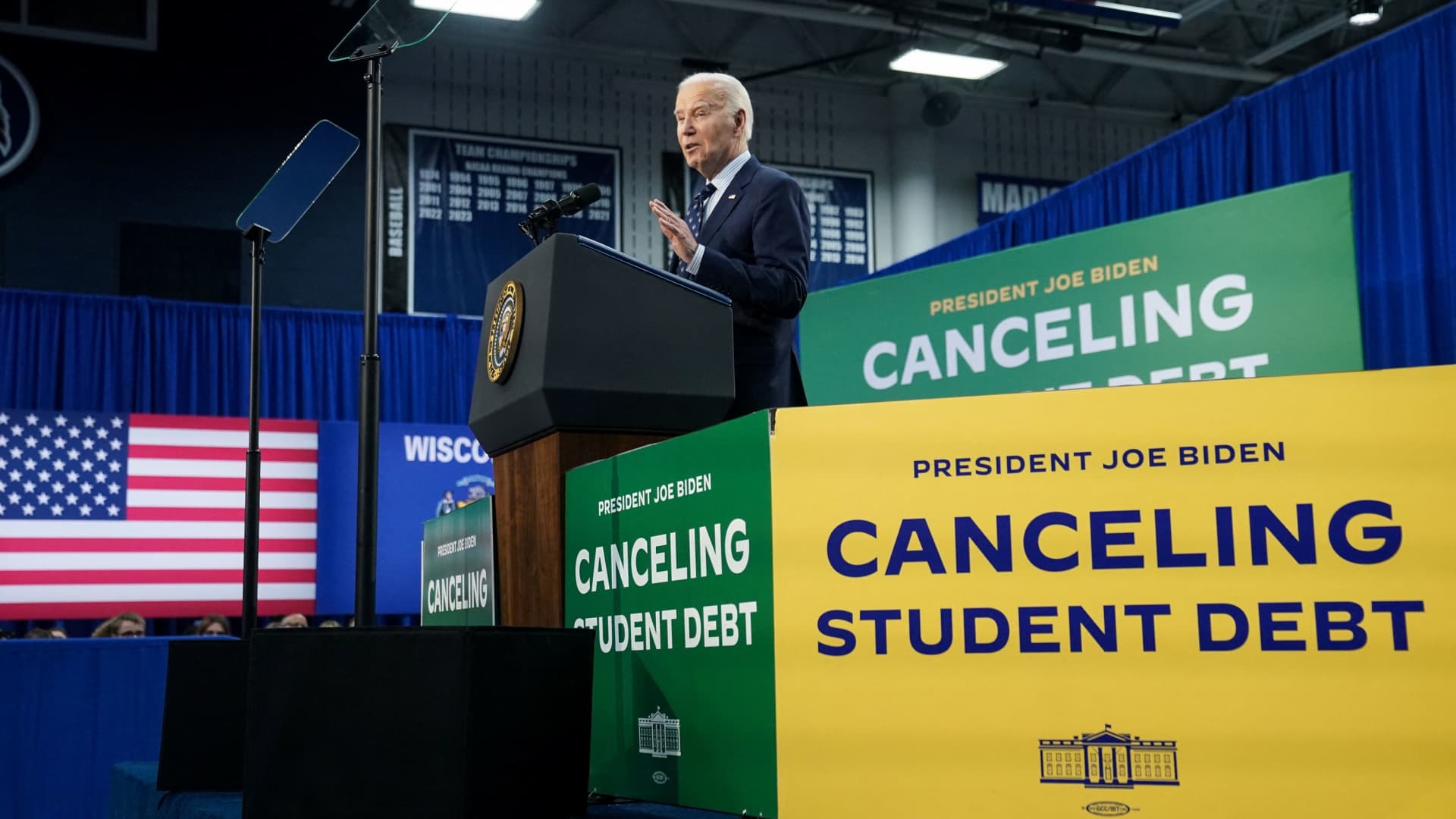

The program is the third Biden administration effort to forgive student debt to end up blocked by Republican-led legal challenges.

In June 2023, the Supreme Court ruled that the administration’s first attempt to cancel up to $400 billion in student debt without prior authorization from Congress was unconstitutional.

Two months ago, a federal appeals court temporarily halted Biden’s new affordable repayment plan for student loan borrowers, known as SAVE. Some Republican-led states argued that the Department of Education with SAVE was essentially trying to find a roundabout way to forgive student debt after the Supreme Court’s decision.

In their new lawsuit challenging the third relief program, which was filed in U.S. District Court in Augusta, Georgia, the seven states argue that the Biden administration’s loan forgiveness plan violates the U.S. Constitution’s separation of powers by seeking to cancel billions of dollars in debt without congressional approval.

In addition to Missouri, the states that filed the suit are Alabama, Arkansas, Florida, Georgia, North Dakota and Ohio.

On Thursday, when he issued a temporary restraining order blocking the new program from taking effect, U.S. District Judge Randal Hall wrote that the AGs “have obtained documents revealing the Secretary is implementing this forgiveness plan … without publication and has been set on doing so since May.”

Hall wrote that the states “show a substantial likelihood of success” in their lawsuit given “the Secretary’s attempt to implement a rule contrary to normal procedures.”

Hall scheduled a hearing next week on the lawsuit.

Mark Kantrowitz, a higher education expert, told CNBC that it is normal for executive branch agencies to take steps to prepare for a new regulation.

“Preparatory work does not violate the law,” Kantrowitz said. He also said, “Forgiveness cannot occur before the rule is final.”

Hall could still strike down the debt relief plan as unconstitutional or on other grounds, even if he finds that the Biden administration did not violate the regulatory process timeline.

But consumer and legal advocates were concerned at how quickly Hall accepted the states’ claim that the Biden administration was improperly rushing the plan.

“There’s an increased permission structure for conservative judges to just make stuff up without even having to ground it in sound principles or precedent,” said Luke Herrine, an assistant professor of law at the University of Alabama.