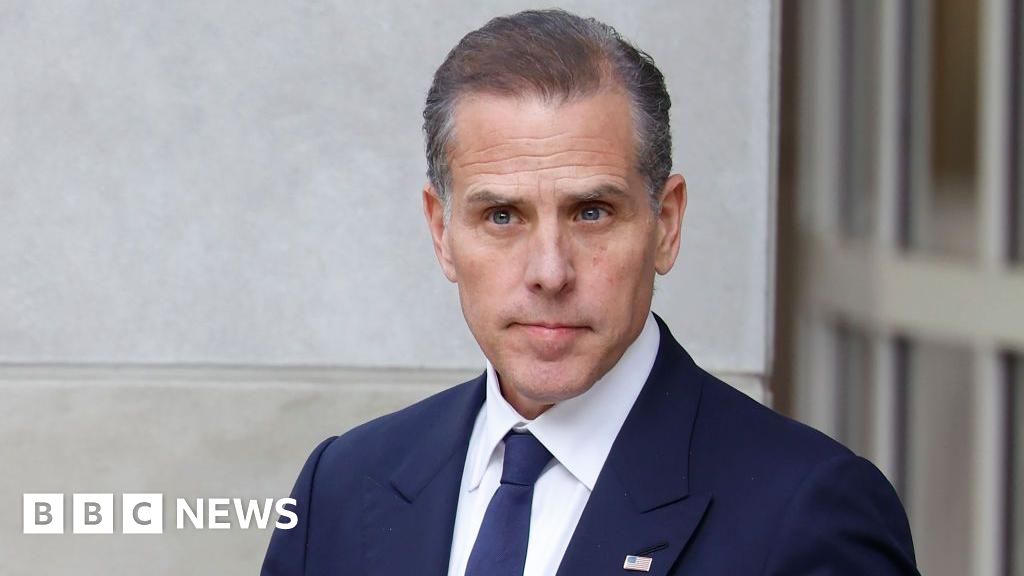

Hunter Biden has agreed to plead guilty in his federal tax evasion case, appearing to surprise federal prosecutors who had shown up to court on Thursday prepared to begin his trial.

Biden had previously denied prosecutors’ accusations that he intentionally avoided paying $1.4m (£1m) in income tax from 2016 to 2019.

His last-minute reversal, first announced in a Los Angeles courtroom as jury selection was about to start, could lead to his second criminal conviction this year.

When Judge Mark Scarsi asked Biden if understands that the maximum penalty he could face is 15 years in prison, the president’s son said: “I do.”

Inside a federal courtroom in Los Angeles, the judge also warned Biden that fines could range from $500,000 to $1m.

President Joe Biden has previously said he would not his executive power to pardon his son.

Biden’s attorney Abbe Lowell said his client wanted the trial to end on Thursday “for the sake of private interest”, to spare his friends and family from testifying about something that happened “when he was addicted to drugs”.

He had earlier asked to use a rare legal manoeuvre called an Alford plea, where he could accept the charges while maintaining his innocence. But after prosecutors objected and the judge brought up the possible filings of briefs, he changed his mind.

The prosecution – representing President Biden’s Justice Department – said they were “shocked” by the suggested Alford plea and reluctant to agree to the deal if it allowed Hunter Biden to maintain his innocence.

“Hunter Biden is not innocent. Hunter Biden is guilty,” lead prosecutor Leo Wise said in court.

“We came to court today to try this case.”

After the prosecutors read all 56 pages of the indictment against him, Biden is expected to formally plead guilty.

Biden had previously sought to toss out the case, arguing that the justice department’s investigation was motivated by politics and he was selectively targeted because Republican lawmakers are working to impeach his father.

He also argued that the special counsel on the case, David Weiss, was appointed unlawfully.

These arguments were dismissed by Judge Scarsi, who is overseeing the case and is weighing whether to accept Biden’s new plea.

The president’s son was charged with three felony tax offences and six misdemeanour offences in December. These include failure to file and pay his taxes, tax evasion and filing a false return.

According to the indictment, Biden earned $7m in income from his foreign business dealings between 2016 and 2019.

The indictment also said he spent nearly $5m during that time period on “everything but his taxes”.

Those purchases included drugs, escorts, lavish hotels, luxury cars and clothing, according to the indictment, which Biden allegedly falsely labelled as business expenses.

Prosecutors said Biden’s actions amounted to “a four-year scheme”.

“In each year in which he failed to pay his taxes, the defendant had sufficient funds available to him to pay some or all of his outstanding taxes when they were due,” the indictment said. “But he chose not to pay them.”

His tax evasion trial marks the second federal criminal proceeding for Biden this year.

In June, he was found guilty of charges related to gun possession and drug use, becoming the first criminally convicted son of a sitting US president.

Specifically, Biden was convicted on three felony charges connected to his purchase of a revolver, in 2018, while battling a drug addiction, and lying about his drug use on a federal form to buy the gun.