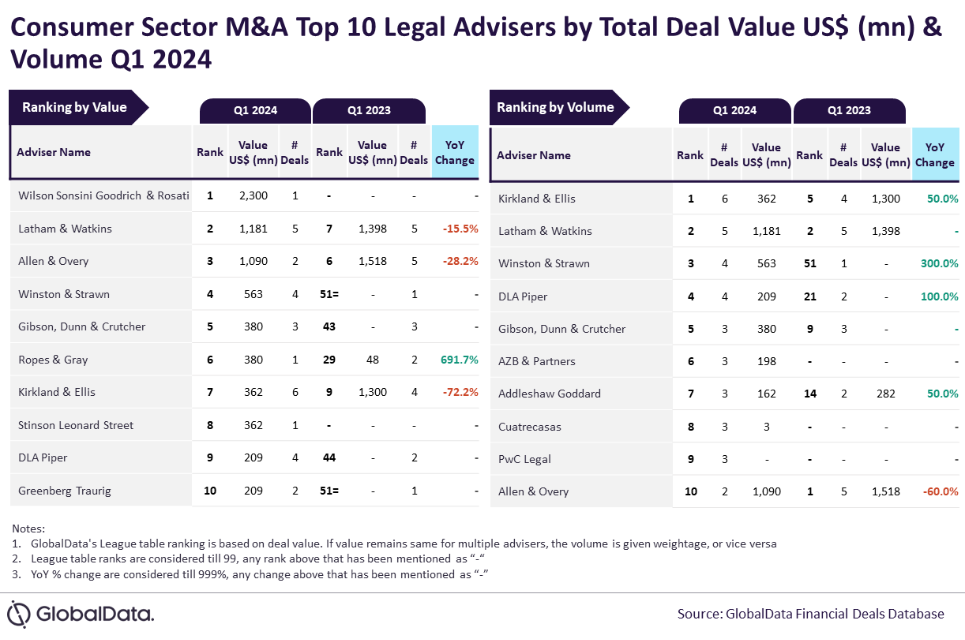

Wilson Sonsini Goodrich & Rosati and Kirkland & Ellis were the top law firms advising on M&A in the consumer sector in the first quarter of the year, analysis of deal data suggests.

According to GlobalData, Just Drinks’ parent, Wilson Sonsini led the way when measuring the value of deals, while Kirkland & Ellis advised on the most transactions.

GlobalData figures show Wilson Sonsini Goodrich & Rosati achieved its leading position in terms of value by advising on a single deal worth $2.3bn. Meanwhile, Kirkland & Ellis led in terms of volume by advising on a total of six deals.

Aurojyoti Bose, lead analyst at GlobalData, said: “The total value of deals advised by Latham & Watkins in second position by value in Q1 2024 was almost half when compared to Wilson Sonsini Goodrich & Rosati.

“Meanwhile, Kirkland & Ellis registered improvement in deals volume and its ranking by this metric in Q1 2024 compared to Q1 2023. It went from occupying the fifth position in Q1 2023 to top the chart in Q1 2024.”

In terms of value, Allen & Overy came in third after working on two deals worth a combined $1.1bn. Winston & Strawn was next after advising on transactions worth a total of $562.5m and Gibson, Dunn & Crutcher was next at $380m.

Access the most comprehensive Company Profiles

on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Company Profile – free

sample

Your download email will arrive shortly

We are confident about the

unique

quality of our Company Profiles. However, we want you to make the most

beneficial

decision for your business, so we offer a free sample that you can download by

submitting the below form

By GlobalData

Meanwhile, Latham & Watkins occupied the second position in terms of volume with five deals, followed by Winston & Strawn with four and DLA Piper with four transactions each and Gibson, Dunn & Crutcher with three.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.