[ad_1]

Want to step into the world of investing but feeling a little lost? We’ve got you covered. We’ll talk about investment essentials and how to choose a good business to invest in.

Whether you’re an old hand at this or just taking your first steps, stick around as we navigate the exciting (and sometimes bumpy) road of business ventures.

Understanding Investment Basics

Think of investing as planting seeds for your future wealth. You’re putting your money into an asset, like stocks, bonds, or real estate, hoping it’ll grow over time. But, it’s not a get-rich-quick scheme. It requires patience and discipline.

Understanding the risk and reward balance is critical. Higher potential returns often come with higher risks. So, you have to decide how much risk you’re comfortable taking on.

It’s also important to diversify your investments, spreading your money across different assets. This way, if one investment doesn’t perform well, others might pick up the slack.

That’s investment basics in a nutshell.

Evaluating Business Ventures

Evaluating potential business ventures is more than just casually browsing through “businesses for sale Calgary” or researching the “M&A market in Portland” online. You have to ensure the business asset you’re eyeing is worth the investment.

First, you must assess the financial health of the company. Look at its profit margins, revenue growth, and debt levels. Next, consider the business model. Is it sustainable? Can it withstand market fluctuations?

Then, scrutinize the management team. Do they have a track record of success? Are they innovative, adaptable, and driven?

Lastly, don’t forget the product or service itself. Is it unique? Does it solve a problem or fill a need in the market?

Market Trend Analysis

Market trend analysis involves examining different factors like historical data, current market conditions, and potential future developments.

You’re looking for patterns that indicate where the market might be headed. Is it trending upwards, suggesting growth, or downwards, implying potential loss? Also, consider if the market is volatile or stable.

This process will help you understand whether the business venture aligns with these trends. Remember, just because a market is currently thriving doesn’t guarantee it will in the future. An accurate market trend analysis aids in making informed investment decisions.

Risk Assessment Strategies

It’s not enough to just spot opportunities; you must also understand the risks involved. When looking at risk assessment strategies, consider both internal and external factors.

- Internally, you’ll examine your company’s financial stability, operational efficiency, and workforce competency.

- Externally, you’ll scrutinize market volatility, regulatory changes, and competitive landscape.

- You’ll also need to analyze potential disruptions like technological advances or political unrest.

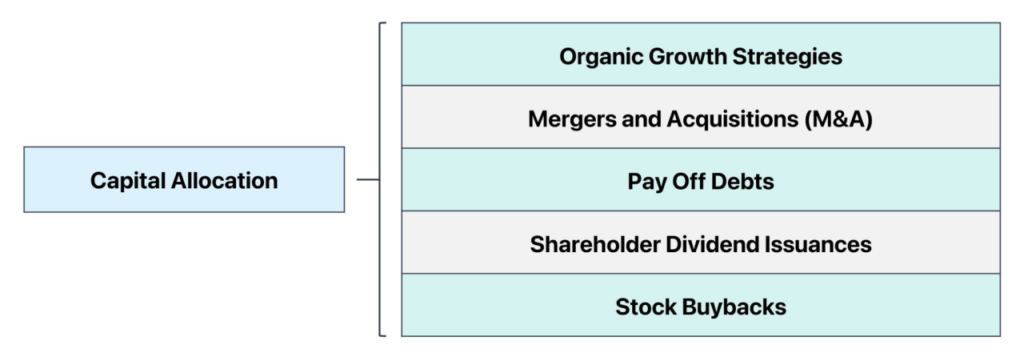

Capital Allocation Techniques

Allocation techniques help you determine where to place your financial resources to achieve the highest return.

It’s crucial to know about opportunity cost, the potential gain missed when one alternative is chosen over another. It’s also important to understand the concept of diversification, spreading your resources across various investments to reduce risk.

You need to balance your long-term and short-term goals, considering both growth opportunities and immediate needs.

Finally, using financial indicators like return on investment (ROI) can guide your decision-making. Don’t forget, it’s not about how much you invest, but where you invest.

Investors Behavioral Finance

Behavioral finance, a field that combines psychology and economics, provides insight into why investors make the decisions they do. It’s not just about the numbers; emotions, biases, and mental shortcuts often play a role.

For instance, due to loss aversion, investors may hold onto losing investments too long, hoping they’ll rebound. Understanding these behaviors can help you make better financial decisions.

You’ll know when to push back against your instincts or adapt your strategy to take advantage of others’ biases.

Navigating Global Investment Opportunities

Venturing beyond your local market can expose you to diverse economies, sectors, and companies, all offering different growth potentials. But keep in mind, it’s not without challenges.

Exchange rate fluctuations, political instability, and cultural differences can impact your investment’s performance. Therefore, it’s crucial to understand the economic indicators and market trends of the countries you’re investing in.

Research is key – look into the stability of the local currency, GDP growth rate, and the political climate. Also, diversify your investments to manage risk.

Global investing allows you to capitalize on worldwide growth while broadening your investment horizons.

Continual Learning and Development

You must commit to continual learning and development to stay ahead of the business game. You can’t afford to rest on your laurels; the competition is fierce and only getting fiercer.

- Embrace opportunities to learn new skills.

- Deepen your understanding of your chosen field.

- Broaden your knowledge base.

- Attend seminars, join online courses, and read up on the latest industry trends.

This isn’t just about professional growth, it’s about personal development. You’ll be surprised at how much you can accomplish when constantly learning and expanding your horizons.

Remember, in the world of business, standing still is the same as moving backwards. So keep pushing, keep learning, and keep growing.

[ad_2]