Meat-alternative suppliers doing business in France and South Africa have been given a boost in recent days in their battles over how to market their products.

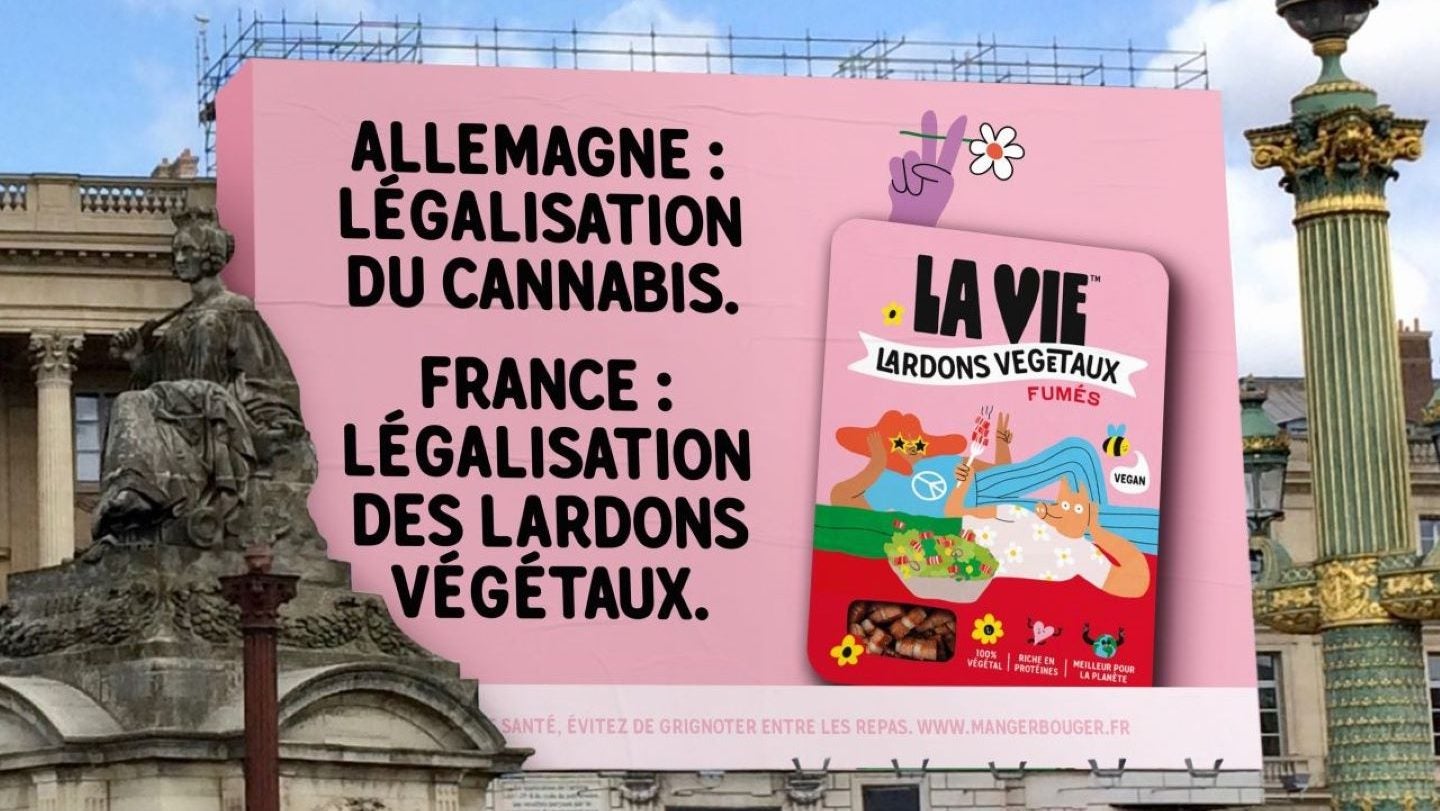

In France, the country’s Conseil d’État has suspended a government decree proposing to stop brands from using plant-based meat descriptors. The supreme administrative court, reflecting on EU law covering food information, said it had “serious doubts about the legality” of the ban, which was intended to come into force on 1 May.

And, in South Africa, the country’s High Court has overturned a planned seizure of all plant-based products that use “meat-like” terms.

However, while the brands doing business in those markets (and those further afield) will rightly be pleased about the developments in what, frankly, have been rather spurious efforts to limit how plant-based meat products can be sold (what consumer is really confused between a meat-based and a plant-based burger?) there are more fundamental issues weighing on the alt-meat category – and there have been for some time.

Demand for alt-meat products has eased in a number of markets, not least in the US and the UK, two countries seen as being at the forefront of the development of the sector in recent years. The pressures facing suppliers can be seen in the number of businesses that have gone to the wall on both sides of the Atlantic, or the deals that have seen distressed assets bought out of administration.

And, in the same week as the sector was given a little bit of a shot in the arm in France and South Africa, news elsewhere in the industry underlined the challenges the category is facing.

Access the most comprehensive Company Profiles

on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Company Profile – free

sample

Your download email will arrive shortly

We are confident about the

unique

quality of our Company Profiles. However, we want you to make the most

beneficial

decision for your business, so we offer a free sample that you can download by

submitting the below form

By GlobalData

In New Zealand, Sunfed Meats, a plant-based business selling on both sides of the Tasman Sea, confirmed it plans to shut up shop after investors decided not to fund the business further.

And there was more concerning news coming out of Monde Nissin, the Philippines food group that owns one of the better-known alt-meat brands, Quorn. Reporting its 2023 financial results last week, Monde Nissin logged another impairment charge on its meat-free business, with CEO Henry Soesanto warning the category continues to “face headwinds”.

Now, it would be wrong to say that the entire category is suffering. There are businesses still attracting funding and able to carve out – and sustain – positions on supermarket shelves.

UK company This is one example, with listings across the country’s major supermarkets and ambitions to grow further. That said, even This acknowledges it has yet to make a profit, though it is “in our sights”, co-founder Andy Shovel said in February.

Beyond Meat, perhaps the poster child for plant-based meat in North America, booked an 18% drop in sales in 2023 and warned in February sales were likely to be lower again in 2024 as its US business continues to be hit by “weak” demand.

However, Beyond Meat did see its (smaller) business outside the US grow sales by 19% last year, driven by foodservice contracts. It’s not all bad – but it’s certainly less rosy than some of the more fervent advocates in the sector forecast a few years ago.

Announcing the closure of Sunfed Meats last week, founder and CEO Shama Sukul Lee, who set up the business to offer products different from the “vegan junk food” in the market, stood by the company’s efforts but said its “existing VC investors were no longer interested in supporting the business” after the pandemic.

“Essentially, a lot of VC investors had jumped into the plant-based gold rush, thinking they could get fast valuation returns, similar to what they’re used to in the virtual world,” she said. “Manufacturing and FMCG are in the physical world with a lot more complexity and moving parts and is generally a longer-term play as you have to build real things.

“Despite Sunfed’s self-evident competence in unique products and manufacturing and FMCG, Sunfed’s VC investors did not see value in that and that is of course their prerogative as they can put their money elsewhere where they can get biggest faster easier valuation returns.”

Lee added Sunfed’s VC investors “chose not to clear the way for Sunfed but instead held onto their preferential claims, which complicated new capital options for the company”. However, her comments on the wider category caught the eye.

“Regardless, it is a fact that the plant-based bubble burst and the category has been undergoing a reality check and rightly so. Fuelled by easy VC money, the category became saturated with junk food masked as healthy and people now see through that.”

Meanwhile, over at Monde Nissin, the company outlined some gains Quorn had made, pointing to progress in the foodservice sector. However, the group suggested there had been some reassessment of the position in which the company and the al-meat category find themselves.

“We’ve worked very hard through that exercise to come to a realistic valuation that’s neither pessimistic nor optimistic,” Quorn CFO Nick Cooper said. “One that’s grounded in the challenging reality that we find ourselves in today.

“That valuation does have a more modest growth rate than has been used in valuations previously but the valuation and the projection do assume that the market stabilises and returns to growth.”

However, Quorn CEO Marco Bertacca had a note of caution all in the sector would do well to take heed of. “It is clear that unfortunately both the UK and the US market, and in general the global market for meat alternatives, is still very tough.”