Airbnb arbitrage is an extremely profitable business venture in 2024. To learn more about how to get started with this rental strategy, just scroll down!

It’s got more than a million searches on Google, but readers are still not 100% certain about what Airbnb arbitrage is.

As vacation rentals and home-sharing become more popular among tourists and business travelers, real estate investors are looking for efficient ways to take advantage of this opportunity.

But what if you cannot afford to buy a house or apartment?

Airbnb arbitrage is the answer to all your troubles.

This business venture is highly profitable, but most real estate investors making their way into the housing market have yet to learn how to go about this and make the most of their rental strategy. So, let’s start by defining what is short term rental arbitrage and continue with how to get into this lucrative endeavor.

Table of Contents

- What Is Airbnb Arbitrage?

- The Pros and Cons of Airbnb Rental Arbitrage

- 5 Best Cities for Airbnb Arbitrage Property

- How to Convince Your Landlord to Agree to Rental Arbitrage

- Steps to Run a Successful Airbnb Arbitrage

Watch our video below to find out how to get started with Airbnb rental arbitrage:

What Is Airbnb Arbitrage?

Airbnb arbitrage is the practice of leasing a long term rental property from a landlord and then subletting it to third-party guests on short rental platforms such as Airbnb, Vrbo, Booking.com, etc. Essentially, you’re leveraging the rental properties of other investors and the attractiveness of the Airbnb business to make money with minimum initial investment.

Airbnb rental arbitrage is a lucrative investment strategy that allows many to start investing in real estate and make money from rentals without owning a property. In terms of financial gains and affordable investments, Airbnb rental arbitrage makes a lot of sense.

Currently, the average home value in the US market stands at $347,716, according to real estate data from Zillow, which marks a major decrease of 44.4% year-on-year. Nevertheless, despite this significant drop in property prices, ownership remains unaffordable and unachievable for a lot of investors, especially beginners with limited financial resources.

At the moment, the 15-year fixed-rate mortgage rates amounts to 6.16%, while the 30-year fixed-mortgage rate is 6.88%, based on data from Freddie Mac. While these interest rates are comparable to the rates a year ago, they are considerably higher than the rates we witnessed two or three years ago. This further contributes to the inability of newcomers to join the real estate investment world.

Rental arbitrage allows this group of investors to start generating profit from rental properties.

How Does Airbnb Arbitrage Work?

The best way to grasp the concept of Airbnb arbitrage is to give an example.

Your first order of business would be to search for and rent a one-bedroom apartment.

Let’s say this apartment costs $1,000 a month in Honolulu, HI.

You then sublet that apartment unit on the Airbnb platform for one month at $140 per night. This would allow you to pay off your monthly rent in 8 days.

It seems tempting already, right?

Suppose you could have guests for 28 days that month; you would have already earned $3,920. After deducting your rent, you still have $2,920 in profit.

From the example we’ve illustrated, this may seem too good to be true. However, the key is just thorough research and a well-calculated decision.

Is Airbnb Arbitrage Legal?

Before you start envisioning huge profits, it’s important to go over the legal side of this real estate venture.

Is your Airbnb arbitrage strategy legal?

Well, it depends on where you plan to rent and sublet your Airbnb property.

Many local laws and HOA bylaws have strict short term rental regulations, so you have to ensure you can do this in your area before moving on to the next step.

So you don’t start an Airbnb arbitrage where it’s illegal, here is a list of US cities where it is either prohibited or restricted, according to the website Passive Airbnb:

- Charleston, SC

- Jersey City, NJ

- New York City, NY

- Miami Beach, FL

- Los Angeles, CA

Additionally, here are some US cities that impose strict laws on this type of short term rental strategy:

- San Francisco, CA

- Santa Monica, CA

- Jacksonville, FL

- Fort Worth, TX

- Atlanta, GA

After you’ve done your research and this rental strategy is legal in your area of interest, you must check if you have to apply for a special license or permit to operate. On top of that, you’ll still have to talk about this with your landlord – you don’t want to put anyone at risk of getting evicted.

The Pros and Cons of Airbnb Rental Arbitrage

Entering the Airbnb business, specifically choosing rental arbitrage as your next project, is a major step in your investing career. So, before you start, it’s crucial that you are aware of both the upsides and downsides of leading an Airbnb arbitrage.

The Pros of Short Term Rental Arbitrage

As far as property ownership goes, there is little risk for the investor who decides to sublet Airbnb. For instance, if the roof of the Airbnb property becomes damaged over time, it’s not your responsibility to have it fixed.

Moreover, because you’re subletting the Airbnb to tenants, you don’t have to deal with the enormous paperwork originally associated with hosts who own the Airbnb property in question. They have to deal with all the complexities of paying HOA fees, regular maintenance, utilities, mortgage payments, and so on.

The best part about getting into an Airbnb arbitrage business is that it does not require much upfront capital from you.

As a secondary host, you’re not expected to purchase the entire property. You’re just expected to pay for the first month of rent and, ideally, have some additional cash on you – just in case.

The Cons of Vacation Rental Arbitrage

Engaging in Airbnb arbitrage is not all fun and games. There are some potential problems on the horizon that could happen to you.

Regardless of whether your Airbnb property is booked for the entire month, the original landlord will expect the rent. That’s why we recommend having extra money prepared. Some hosts are not as friendly or collaborative as others.

With this type of host, it’s easy to get into disagreements, which may end your professional relationship.

Although you won’t have to pay the utilities and maintenance fees yourself, you won’t be able to completely avoid the legal side of Airbnb arbitrage. As we’ve hinted above, you’ll have to familiarize yourself with the location’s Airbnb laws, including permissions and limitations.

5 Best Cities for Airbnb Arbitrage Property

If you’re eager to expand your investment portfolio with Airbnb arbitrage, then you should start your research for the next best Airbnb property as soon as possible.

To your luck, we’re always one step ahead and ready to assist you. Using Mashvisor’s latest data report from May 2023, we’ve singled out the five best cities for Airbnb arbitrage based on potential profit and the local laws surrounding short-term rentals.

The following places have been ranked from highest to lowest cash on cash return. We only included markets that have:

- A median property value of no more than $1,000,000

- At least 100 active listings on the short-term rental market

- A minimum monthly rental income of $2,000

- Cash on cash return rate no lower than 2.00%

- An average Airbnb occupancy rate of 50% and above

That said, here are the best cities for Airbnb arbitrage:

1. Marrero, LA

- Median Property Price: $227,771

- Average Price per Square Foot: $120

- Days on Market: 97

- Number of Airbnb Listings: 1,874

- Monthly Airbnb Rental Income: $4,743

- Airbnb Cash on Cash Return: 8.40%

- Airbnb Cap Rate: 8.52%

- Airbnb Daily Rate: $206

- Airbnb Occupancy Rate: 91%

- Walk Score: 66

Marrero is a census-designated place on the south side of the Mississippi River and is part of the New Orleans-Metairie-Kenner metro statistical area. The area hosts forests, bayous, marshes, and swamps along with miles of hard trails and boardwalks accompanied by attractive marsh plant species. Moreover, Marrero benefits from the rich history of Louisiana. All these factors make Marrero an excellent location for vacation rental arbitrage.

2. Merriam Woods, MO

- Median Property Price: $245,260

- Average Price per Square Foot: $190

- Days on Market: 59

- Number of Airbnb Listings: 130

- Monthly Airbnb Rental Income: $3,051

- Airbnb Cash on Cash Return: 8.30%

- Airbnb Cap Rate: 8.48%

- Airbnb Daily Rate: $177

- Airbnb Occupancy Rate: 74%

- Walk Score: 1

Merriam Woods is a quiet suburb of Branson, Missouri, which is becoming an increasingly popular and desirable place to live in. In addition, the area is a busy tourist destination due to the many attractions that it offers. This turns Merriam Woods into the perfect spot for both corporate housing arbitrage and short term rental arbitrage.

3. Westwego, LA

- Median Property Price: $287,780

- Average Price per Square Foot: $149

- Days on Market: 66

- Number of Airbnb Listings: 1,700

- Monthly Airbnb Rental Income: $3,784

- Airbnb Cash on Cash Return: 8.21%

- Airbnb Cap Rate: 8.35%

- Airbnb Daily Rate: $201

- Airbnb Occupancy Rate: 65%

- Walk Score: 57

Westwego is located on the west bank of the Mississippi River and comprises a suburban community of New Orleans. The city offers swamp tours and bayou excursions as well as some of the best seafood nationwide, including fresh crabs, shrimp, fish, and others. The high Airbnb income make Westwego a great location to get into the arbitrage property business.

4. St. Bernard, OH

- Median Property Price: $243,587

- Average Price per Square Foot: $176

- Days on Market: 53

- Number of Airbnb Listings: 1,188

- Monthly Airbnb Rental Income: $3,285

- Airbnb Cash on Cash Return: 8.01%

- Airbnb Cap Rate: 8.19%

- Airbnb Daily Rate: $153

- Airbnb Occupancy Rate: 74%

- Walk Score: 72

St. Bernard is an enclave and suburb of Cincinnati, Ohio. The village is famous for its long history, distinct architecture, multiple tourist attractions (including a soap factory, a winery, and a distillery), and restaurants. All these points of interest make St. Bernard a place worth visiting. From hosts’ point of view, it can be the perfect location for applying the Airbnb rental arbitrage model.

5. Rileyville, VA

- Median Property Price: $335,213

- Average Price per Square Foot: $210

- Days on Market: 7

- Number of Airbnb Listings: 168

- Monthly Airbnb Rental Income: $3,818

- Airbnb Cash on Cash Return: 7.99%

- Airbnb Cap Rate: 8.12%

- Airbnb Daily Rate: $230

- Airbnb Occupancy Rate: 60%

- Walk Score: 10

For Airbnb guests who are on the lookout for new and exciting adventures, Rileyville might just be the perfect location for them. This city offers magnificent hiking trails and meadows, museums, and fine restaurants that serve only the finest specialties, which make it the perfect location to conclude our list of the best places to start your Airbnb arbitrage strategy.

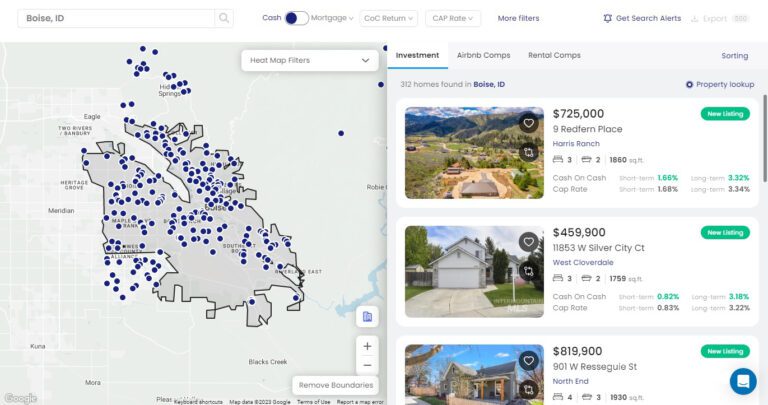

Finding the ideal Airbnb property that meets your needs and requirements is an effortless process with the help of specially designed investment tools. One of them happens to be Mashvisor’s Property Finder.

If you’ve got an idea where you’d like to kick off your Airbnb arbitrage strategy, make the most of this investment tool and access up-to-date and accurate information within minutes.

The hunt for the best property for Airbnb arbitrage that align with your investment goals and needs is made easier with Mashvisor’s Property Finder.

How to Convince Your Landlord to Agree to Rental Arbitrage

As we’ve already hinted, reaching a mutual agreement with your potential landlord might be challenging. They might not be as trusting or reliable as you initially thought.

However, if the opportunity in front of you is a profitable one, it would be useful to learn how to convince your landlord to agree to your deal.

Let’s look at one possible scenario.

Suppose you used Mashvisor’s tools to pinpoint where you want to start your Airbnb business. You’ve gone through the legal side, and you understand the requirements and laws of the city, and most importantly, it allows this type of investment strategy.

Your next order of business is to find a landlord who rents their property out to you and allows you to sublet it. Once you finish that, it’s time for the main part – reaching an agreement.

From experience, there are two main reasons why enterprising tenants are hesitant to talk to their landlord:

- They might say “no;” or

- They might steal their tenant’s idea and directly list it on Airbnb.

If you want to convince your landlord to let you launch your Airbnb arbitrage business and generate profit for both of you, you need to address their potential concerns accordingly.

Here are some helpful tips on how to achieve that:

You Will Keep the Unit in Pristine Condition

Maintaining the condition of the Airbnb property should be on your priority list. Even though you won’t be primarily responsible for repairs, it is best to treat and manage the property like it’s your own.

It’s absolutely vital to keep the property spotless and, possibly even Instagram-worthy if you want to get 5-star reviews and continue to attract more guests.

As for the landlord’s side, a well-kept unit will save them the hassle and cost of repairs and renovations.

You Will Pay on Time

You’re slowly beginning to connect the dots of what it takes to reach an agreement with your landlord.

Naturally, the landlord’s primary goal is to generate as much profit as possible. This means you should pay on time, as some landlords are unwilling to extend the deadline, even for a few days.

All in all, it’s that simple – you must ensure on-time payments to your landlord.

You Will Be Hands-On With the Business

Your landlord might be under the impression that subletting the Airbnb property is easy and won’t require too much effort on your part. They probably think listing their property directly on Airbnb would be a stress-free experience and guarantee higher incomes.

While this is true in most cases, you need to take a stand and convince your landlord of how much work it takes to manage at least one Airbnb property. To put it simply – it’s not an online-based business. You need to spend considerable time on the field as well.

If your landlord has been managing the property before, your chances are looking good. On the other hand, if they had a property manager take care of this for them, you might have to bring your A-game.

Once they agree to an arbitrage, you must amend your lease to include a contract. A rental arbitrage lease agreement template would include the following:

- Who takes the fall for any fines and penalties

- If liability insurance is needed and who will pay for it,

- How much of your profit will you share with your landlord

- Suppose you should give advance notice to your landlord about any guests and how you will communicate about it

- If you should pay an additional security deposit,

Steps to Run a Successful Airbnb Arbitrage

Now that you’ve researched and determined the perfect area for your Airbnb arbitrage with your landlord on board, it is time to set up your first rental.

Your goal is to generate as much profit as possible, so here are the next steps:

1. Get Your Finances in Order

The most important factor to consider before engaging in Airbnb arbitrage is to secure your finances.

Let’s be honest for a second – regardless of your rental strategy, all of them require upfront costs from the real estate investor.

With Airbnb arbitrage, even if you don’t have to buy a house or apartment you will rent out to tenants, you still need to factor in the following expenses.

This will make it much easier for you to keep track of how much you need to earn back to make a profit on your Airbnb arbitrage properties:

- Application fee for any permit or license required to operate

- Deposit (e.g., security deposit, first and last month’s rent, etc.)

- Insurance

- Legal fees

- Repairs on the property

- Furnishings and decoration

- Airbnb amenities

- Wi-Fi

- Entertainment subscriptions (e.g., Netflix, Amazon Prime, Disney+)

- Professional cleaning service

- Utilities

- Toiletries and kitchenware

We can’t stress this enough – Aside from calculating these costs, it’s vital to set aside emergency funds in case you get fewer bookings than expected in the first six months.

Mashvisor’s Rental Calculator: Assisting Real Estate Investors

To help you get your finances in order and do the hard part (math) for you, Mashvisor offers its Rental Calculator. This tool is specifically designed to assist investors in evaluating their anticipated profits.

Our calculator will thoroughly assess the relevant Airbnb data regarding your rental property and provide you with information that will accelerate the decision-making process.

The days of manually collecting information are officially over.

Our investment property calculator provides real estate investors with useful features such as neighborhood analysis, calculating cash on cash return, rental income, cash flow, and so on.

2. Prepare Your Airbnb Property for Tenants

Although you’re on the hunt for rent-ready Airbnb properties, this shouldn’t stop you from putting in much effort. With vacation rentals, having a clean apartment is not enough.

You will want to spice up the interior design of the apartment so that it’s even more attractive for future tenants. It would also be good to add amenities like a washer and dryer, TV, crib, dishwasher, coffee maker, and free parking – if they’re not available now.

Bear in mind that a majority of guests nowadays consider these must-haves.

3. List Your Property

Once you’re done with your finances and decorating, next comes advertising your Airbnb property.

You’ll need to research the best platform that fits your expectations and requirements. If you’re going to try a multi-channel distribution strategy, you will need an automation tool to boost your marketing and prevent double bookings.

4. Keep Optimizing Your Listing

The most important part of your strategy is to be attentive.

If you want your Airbnb to reach a wider audience, you must ensure it pops up in search results frequently. Simply speaking, this means that you’ll need to take some time out of your day and devote it to optimizing your Airbnb listing.

Make sure you take high-quality photos of the property and show off the Airbnb amenities that guests are looking for in your market. Improve the listing title and the listing description to highlight all the best features of your arbitrage property to boost your performance in the Airbnb SEO algorithm.

Apply an Airbnb dynamic pricing strategy to further enhance the ranking of your listing and to attract more bookings from guests choosing between your property and similar alternatives. Having competitive nightly rates is a must, especially for beginner investors. The Mashvisor Airbnb pricing tool can help you automate your vacation rental arbitrage pricing strategy to maximize revenue and ROI without sacrificing occupancy.

Try testing out one variable each week to know which part of your listing works.

Summing Up: Discover Your Airbnb Rental Arbitrage Opportunity With Mashvisor

An Airbnb arbitrage business is an excellent way for a real estate investor to kick off their career and extend their portfolio without actually buying a property. The process is quite simple – it involves pinning down a rental property and subletting it to your target tenants. Through this Airbnb leverage strategy, you benefit from someone else’s rental to make money in real estate without going through the troubles of purchasing and owning an investment property.

However, it’s essential to be fully aware of the advantages and disadvantages. Although it doesn’t require a large capital, you should be careful with the laws, regulations, and permissions regarding certain areas. Bear in mind that not all states view Airbnb arbitrage as legal.

Moreover, you’ll need to convince your landlord to let you proceed with this investment strategy. After that, it’s time to prepare for the main part: running your Airbnb property. Before you start, ensure that your finances are in order, that you’ve decorated the place, and that you’re optimizing your listing frequently.

It’s a no-brainer. Airbnb arbitrage is definitely a profitable investment venture in 2024. However, taking on this business opportunity solo is not the smartest move. To your luck, professionals at Mashvisor are here to assist you throughout your investment journey – from beginning to end.

To learn how Mashvisor can help you find the next profitable Airbnb arbitrage opportunity, sign up for a 7-day free trial now.