The consumer price index accelerated at a faster-than-expected pace in March, pushing inflation higher and likely dashing hopes that the Federal Reserve will be able to cut interest rates anytime soon.

The CPI, a broad measure of goods and services costs across the economy, rose 0.4% for the month, putting the 12-month inflation rate at 3.5%, or 0.3 percentage point higher than in February, the Labor Department’s Bureau of Labor Statistics reported Wednesday. Economists surveyed by Dow Jones had been looking for a 0.3% gain and a 3.4% year-over-year level.

Excluding volatile food and energy components, the core CPI also accelerated 0.4% on a monthly basis while rising 3.8% from a year ago, compared with respective estimates for 0.3% and 3.7%.

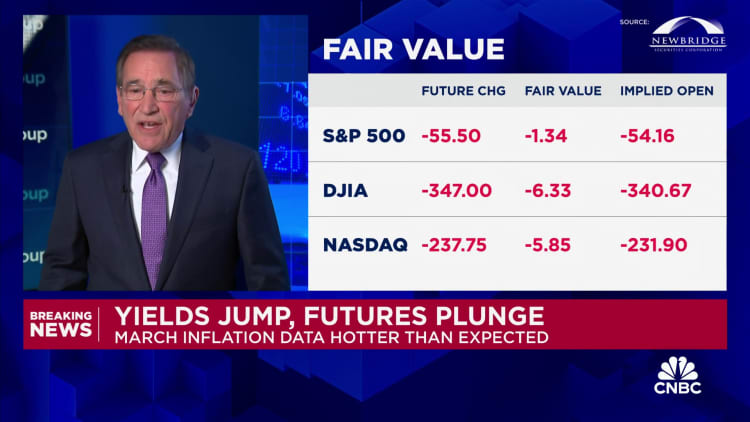

Stocks slumped after the report while Treasury yields spiked higher.

Shelter and energy costs drove the increase on the all-items index.

Energy rose 1.1% after climbing 2.3% in February, while shelter costs, which make up about one-third of the weighting in the CPI, were higher by 0.4% on the month and up 5.7% from a year ago. Expectations for shelter-related costs to decelerate through the year have been central to the Fed’s thesis that inflation will cool enough to allow for interest rate cuts.

Food prices increased just 0.1% on the month and were up 2.2% on a year-over-year basis. There were some big gains within the food category, however.

The measure for meat, fish, poultry and eggs climbed 0.9%, pushed by a 4.6% jump in egg prices. Butter fell 5% and cereal and bakery products declined by 0.9%. Food away from home increased 0.3%.

Elsewhere, used vehicle prices fell 1.1% and medical care services prices rose 0.6%.

Increasing inflation was also bad news for workers, as real average hourly earnings were flat on the month and increased just 0.6% over the past year, according to a separate BLS release.

The report comes with markets on edge and Fed officials expressing caution about the near-term direction for monetary policy. Central bank policymakers have repeatedly called for patience on cutting rates, saying they have not seen enough evidence that inflation is on a solid path back to their 2% annual goal. The March report likely confirmed worries that inflation is stickier than expected.

Markets had expected the Fed to start cutting interest rates in June with three reductions in total expected this year, but that shifted dramatically following the release. Traders in the fed funds futures market pushed expectations for the first cut out to September, according to CME Group calculations.

“There’s not much you can point to that this is going to result in a shift away from the hawkish bent” from Fed officials, said Liz Ann Sonders, chief investment strategist at Charles Schwab. “June to me is definitively off the table.”

The Fed also expects services inflation to ease through the year, but that has shown to be stubborn as well. Excluding energy, the services index increased 0.5% in March and was at a 5.4% annual rate, inconsistent with the Fed’s target.

“This marks the third consecutive strong reading and means that the stalled disinflationary narrative can no longer be called a blip,” said Seema Shah, chief global strategist at Principal Asset Management. “In fact, even if inflation were to cool next month to a more comfortable reading, there is likely sufficient caution within the Fed now to mean that a July cut may also be a stretch, by which point the US election will begin to intrude with Fed decision making.”

Later Wednesday, the Fed will release minutes from its March meeting, providing more insight into where officials stand on monetary policy.

Multiple Fed officials in recent days have expressed skepticism about lowering rates. Atlanta Fed President Raphael Bostic told CNBC that he expects just one cut this year, likely not coming until the fourth quarter. Governor Michelle Bowman said an increase may even be necessary if the data does not cooperate.