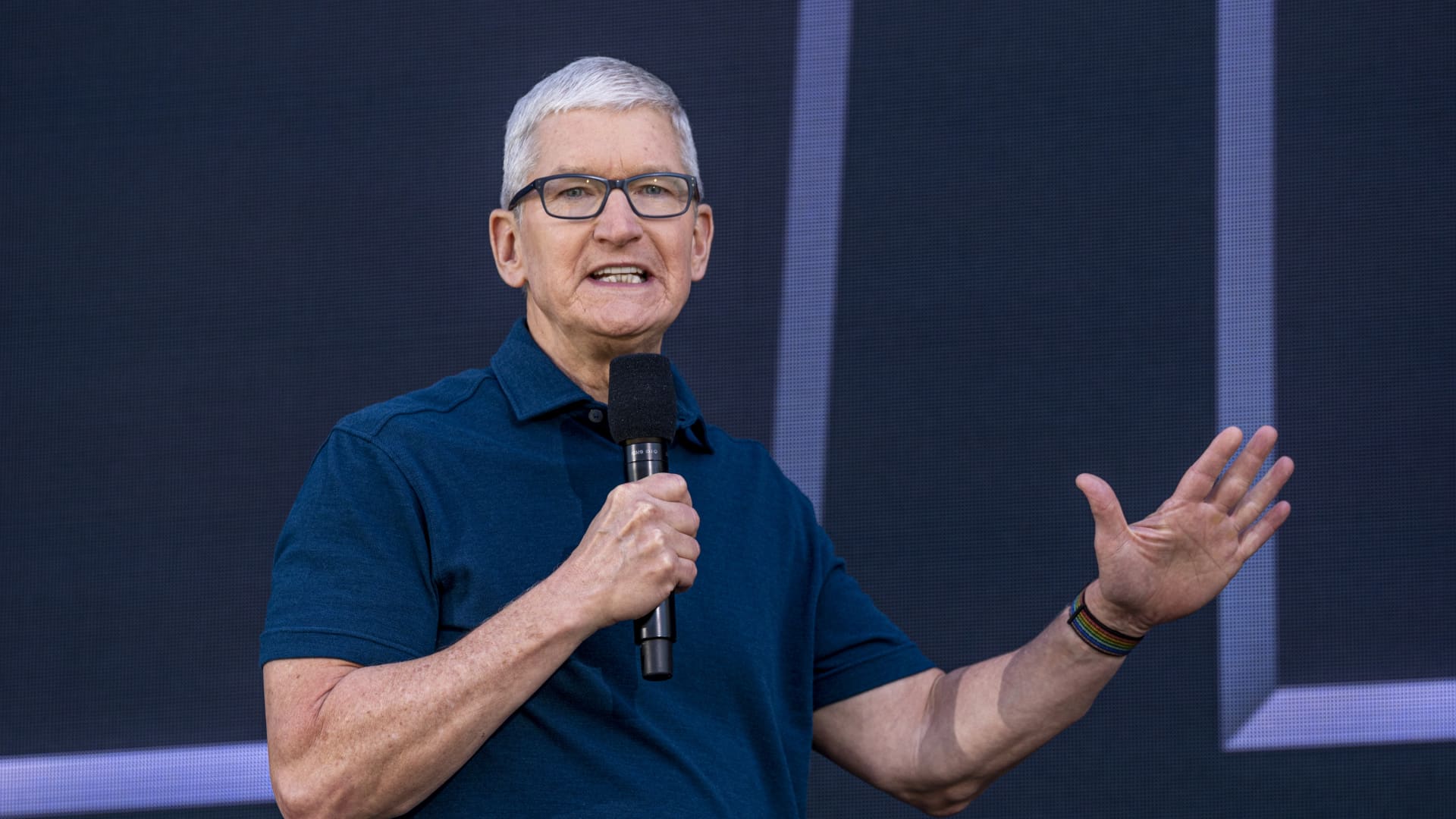

Tim Cook, chief executive officer of Apple Inc., speaks during the Apple Worldwide Developers Conference at Apple Park campus in Cupertino, California, US, on Monday, June 6, 2022.

David Paul Morris | Bloomberg | Getty Images

Apple has reached a $490 million settlement to resolve a class-action lawsuit that alleged Chief Executive Tim Cook defrauded shareholders by concealing falling demand for iPhones in China.

A preliminary settlement was filed on Friday with the U.S. District Court in Oakland, California, and requires approval by U.S. District Judge Yvonne Gonzalez Rogers.

It stemmed from Apple’s unexpected announcement on Jan. 2, 2019, that the iPhone maker would slash its quarterly revenue forecast by up to $9 billion, blaming U.S.-China trade tensions.

Cook had told investors on an Nov. 1, 2018, analyst call that although Apple faced sales pressure in markets such as Brazil, India, Russia and Turkey, where currencies had weakened, “I would not put China in that category.”

Apple told suppliers a few days later to curb production.

The lowered revenue forecast was Apple’s first since the iPhone’s launch in 2007. Shares of Apple fell 10% the next day, wiping out $74 billion of market value.

Apple and its lawyers did not immediately respond to requests for comment on the ruling.

The Cupertino, California-based company denied liability, but settled to avoid the cost and distraction of litigation, court papers show.

Shawn Williams, a lawyer for the shareholders, called the settlement an “outstanding result” for the class, which includes shareholders who bought Apple shares in the two months between Cook’s comments and the revenue forecast.

Apple posted $97 billion of net income in its latest fiscal year, and its payout equals a little under two days of profit.

Last June, Rogers refused to dismiss the lawsuit.

She found it plausible to believe Cook had been discussing Apple’s sales outlook and not currency changes, and said Apple knew China’s economy was slowing and demand could fall.

The lead plaintiff is the Norfolk County Council as Administering Authority of the Norfolk Pension Fund, located in Norwich, England.

Lawyers for the shareholders may seek fees of up to 25% of the settlement amount.

Apple’s share price has more than quadrupled since January 2019, giving the company a more than $2.6 trillion market value.

The case is In re Apple Inc Securities Litigation, U.S. District Court, Northern District of California, No. 19-02033.