We all enjoyed the ride up to 5,000 for the S&P 500 (SPY). But more and more it looks like this will be a near term top for the market. Gladly there are still ways to carve out stock market gains even in this less bullish environment. Investment expert Steve Reitmeister shares his updated trading and top picks for the weeks ahead.

The stock market seems to be stuck around the all time highs at 5,000 for the S&P 500 (SPY). And yet under the surface things are not so bullish.

Tech stocks are finally giving back some of their tremendous gains and defensive stocks are the market leaders. This is NOT a positive for those expecting immediate market upside.

Why is that?

And what is the trading plan from here?

That is what we will answer in this week’s Reitmeister Total Return commentary.

Market Commentary

Let’s get some perspective.

The S&P 500 (SPY) is up 43% from the bear market low in October 2022. Thus, there is no denying we are in a bull market…the main debate is when/how the next round of gains will come our way.

It is fair to say that this most recent 20% bull run that started the beginning of November has grown tired. This makes 5,000 a place of strong resistance especially when the expected catalyst of Fed rate cuts keep getting pushed further into the future.

Friday’s higher than expected PPI report, on top of last weeks far too hot CPI report, are showing that inflation is a bit too sticky. Add to that a still too hot US economy (around 3%) and it says that inflationary pressures will likely persist.

The Fed has already been more patient than most investors predicted. This latest data only gives them more reason for pause calling into question whether May or June will be the first rate cut. Right now I predict neither given the inflationary facts in hand coupled with the Fed’s clear preference to not act too soon lest the flames of inflation spark up once again.

Or to put it another way, they want the embers of inflation to be 100% put out before they lower rates to boost the economy. And without that boost to the economy…then earnings growth prospects are simply too low right now to promote markedly higher stock prices.

Add it all up and it says that 5,000 should form a top for quite a bit longer. Perhaps all the way until it is clear that the Fed will indeed finally lower rates.

It is possible that stocks cling to and consolidate around 5,000. Yet with this much time on our hands til the likely first rate cut, then any negative headline will serve as easy reason for stocks to go lower.

This lines things up for a fairly typical 3-5% pullback. Like to 4,800 which was the previous area of resistance that should serve well as support. This makes for a comfortable 4% range for stocks to move around in for the time being.

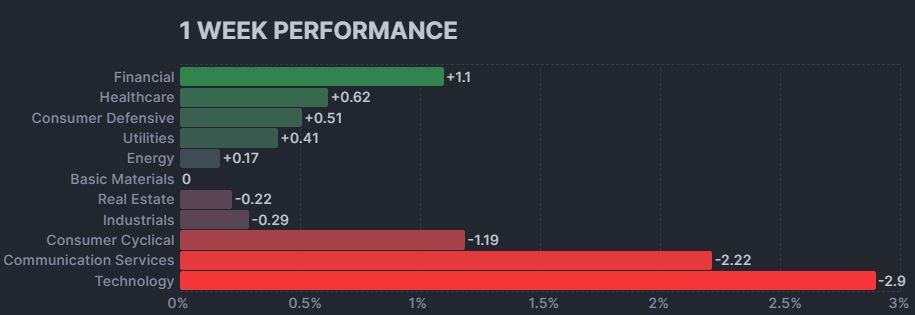

This also makes way for a bit of sector rotation that comes through loud and clear in this 1 week chart:

In essence you have the big winners of 2023, such as Tech and Communication Services, selling off with more conservative groups (Healthcare, Utilities and Consumer Defensive) in the plus column. The only surprise is Financials leading the way. But that is more about that group rebounding from recent weakness as there was whispers of more bank failures on the way which have not come to fruition.

Trading Plan

One could read the above and think its time to take some chips off the table. But with over 4 decades of investment experience under my belt I think it is unwise to fight the primary trend.

Meaning that we are no doubt in a bull market. And it can start running at any time for any reason. So to me this is not a time to take money off the table. Rather, it is a time to be reflective about what companies you own going forward as the overall market is near fully valued.

The simple answer is to unload overvalued stocks and seek to own more undervalued selections. This is partially about industry rotation where the aforementioned 2023 leaders of Tech and Communication services are getting very stretched. Especially the usual suspects of the Magnificent 7 that have spent too much time in the sun.

I am not saying to be focus solely on the defensive groups like Healthcare, Utilities and Consumer Defensive. Rather I think it is about opportunities with Industrials, Basic Materials and Consumer Cyclical that were middle of the pack last year giving them more room to rise.

On top of that is moving to smaller companies. Not saying micro caps. More like companies between $1 and $20 billion market cap that may be flying a bit more under the radar offering more upside potential.

Our POWR Ratings system does an excellent job scouting out precisely these kinds of companies with consistent growth prospects trading at attractive valuations. It is that combination that is always in fashion…but particularly for the rest of 2024 when the easy profits have been made on the “name brand” stocks.

Now it is time for them to take a back seat and let other worthy players take the lead. More on my favorite stock picks in the next section…

What To Do Next?

Discover my current portfolio of 12 stocks packed to the brim with the outperforming benefits found in our exclusive POWR Ratings model. (Nearly 4X better than the S&P 500 going back to 1999)

This includes 5 under the radar small caps recently added with tremendous upside potential.

Plus I have 1 special ETF that is incredibly well positioned to outpace the market in the weeks and months ahead.

This is all based on my 43 years of investing experience seeing bull markets…bear markets…and everything between.

If you are curious to learn more, and want to see these lucky 13 hand selected trades, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

SPY shares . Year-to-date, SPY has gained 4.51%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

The post Is 5,000 a Stop Sign for Stocks? appeared first on StockNews.com